1.3 11Gross Domestic Product (GDP)

WHAT YOU WILL LEARN

An exact definition for gross domestic product, or GDP

An exact definition for gross domestic product, or GDP

Three different ways to calculate GDP

Three different ways to calculate GDP

In the previous module we used the circular-

In this module we will formally define gross domestic product, or GDP, and then look at how it is calculated.

Gross Domestic Product Defined

Final goods and services are goods and services sold to the final, or end, user.

Intermediate goods and services are goods and services bought from one firm by another firm to be used as inputs into the production of final goods and services.

A consumer’s purchase of a new car from a dealer is one example of a sale of final goods and services: goods and services sold to the final, or end, user. But an automobile manufacturer’s purchase of steel from a steel foundry or glass from a glassmaker is an example of a sale of intermediate goods and services: goods and services that are inputs into the production of final goods and services. In the case of intermediate goods and services, the purchaser—

Gross domestic product, or GDP, is the total value of all final goods and services produced in the economy during a given year.

Gross domestic product, or GDP, is the total value of all final goods and services produced in an economy during a given period, usually a year. In 2013 the GDP of the United States was $16,803 billion, or about $53,086 per person.

Calculating GDP

Government statisticians use three methods to calculate GDP:

- Survey and add up the total value of the production of final goods and services.

- Add up aggregate spending on domestically produced final goods and services in the economy—

the sum of consumer spending, investment spending, government purchases of goods and services, and exports minus imports. Aggregate spending—the total spending on domestically produced final goods and services in the economy—

is the sum of consumer spending (C), investment spending (I), government purchases of goods and services (G), and exports minus imports (X − IM). - Sum the total factor income earned by households from firms in the economy.

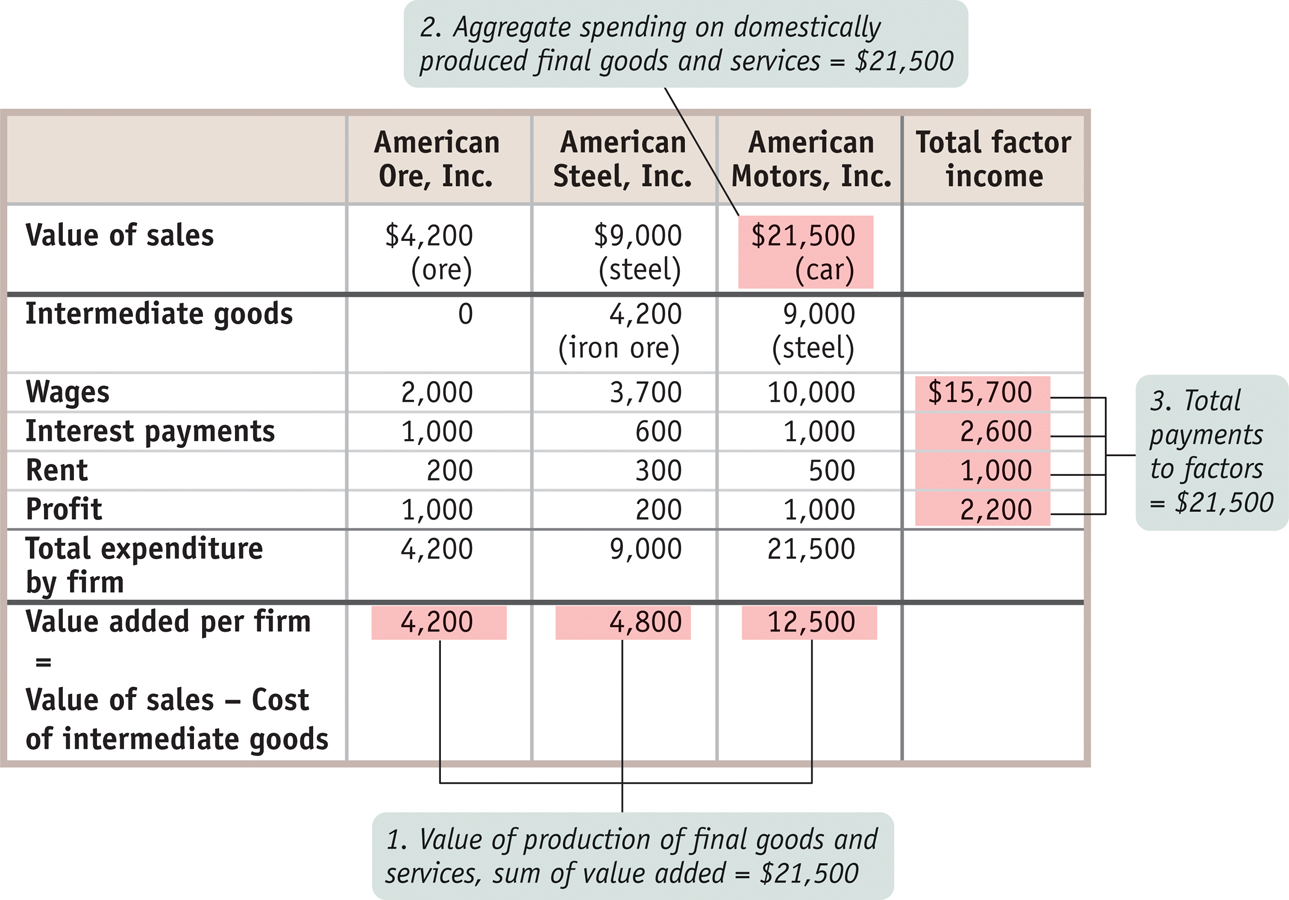

To illustrate how the methods of calculating GDP work, we will consider a hypothetical economy, shown in Figure 11-1. This economy consists of three firms—

Measuring GDP as the Value Of Production Of Final Goods and ServicesThe first method for calculating GDP is to add up the value of all the final goods and services produced in the economy—

To understand why only final goods and services are included in GDP, look at the simplified economy described in Figure 11-1. Should we measure the GDP of this economy by adding up the total sales of the iron ore producer, the steel producer, and the auto producer?

If we did, we would in effect be counting the value of the steel twice—

The value added of a producer is the value of its sales minus the value of its purchases of inputs.

In Figure 11-1, the total value of all sales, intermediate and final, is $34,700: $21,500 from the sale of the car, plus $9,000 from the sale of the steel, plus $4,200 from the sale of the iron ore. Yet we know that GDP—

To avoid double-

Only the ore producer, who we have assumed doesn’t buy any inputs, has value added equal to its total sales, $4,200. The sum of the three producers’ value added is $21,500, equal to GDP.

Measuring GDP As Spending On Domestically Produced Final Goods And ServicesAnother way to calculate GDP is by adding up aggregate spending on domestically produced final goods and services. That is, GDP can be measured by the flow of funds into firms. Like the method that estimates GDP as the value of domestic production of final goods and services, this measurement must be carried out in a way that avoids double-

In terms of our steel and auto example, we don’t want to count both consumer spending on a car (represented in Figure 11-1 by the sales price of the car) and the auto producer’s spending on steel (represented in Figure 11-1 by the price of a car’s worth of steel). If we counted both, we would be counting the steel embodied in the car twice.

We solve this problem by counting only the value of sales to final buyers, such as consumers, firms that purchase investment goods, the government, or foreign buyers. In other words, in order to avoid the double-

As we’ve already pointed out, the national accounts do include investment spending by firms as a part of final spending. That is, an auto company’s purchase of steel to make a car isn’t considered a part of final spending, but the company’s purchase of new machinery for its factory is considered a part of final spending. What’s the difference? Steel is an input that is used up in production; machinery will last for a number of years. Since purchases of capital goods that will last for a considerable time aren’t closely tied to current production, the national accounts consider such purchases a form of final sales.

What types of spending make up GDP? Look again at Figure 10-2 of the circular-

In reality, not all of this final spending goes toward domestically produced goods and services. We must take account of spending on imports, which we will denote by IM. Income spent on imports is income not spent on domestic goods and services—

Net exports are the difference between the value of exports and the value of imports (X − IM).

where C = consumer spending, I = investment spending, G = government purchases of goods and services, X = sales to foreigners, or exports, and IM = spending on imports. Note that the value of X − IM—the difference between the value of exports and the value of imports—

Measuring GDP As Factor Income Earned From Firms In The EconomyA final way to calculate GDP is to add up all the income earned by factors of production in the economy—

Figure 11-1 shows how this calculation works for our simplified economy. The shaded column at the far right shows the total wages, interest, and rent paid by all these firms as well as their total profit. Summing up all of these yields a total factor income of $21,500—

We won’t emphasize the income method as much as the other two methods of calculating GDP. It’s important to keep in mind, however, that all the money spent on domestically produced goods and services generates factor income to households—

The Components of GDP

Now that we know how GDP is calculated in principle, let’s see what it looks like in practice.

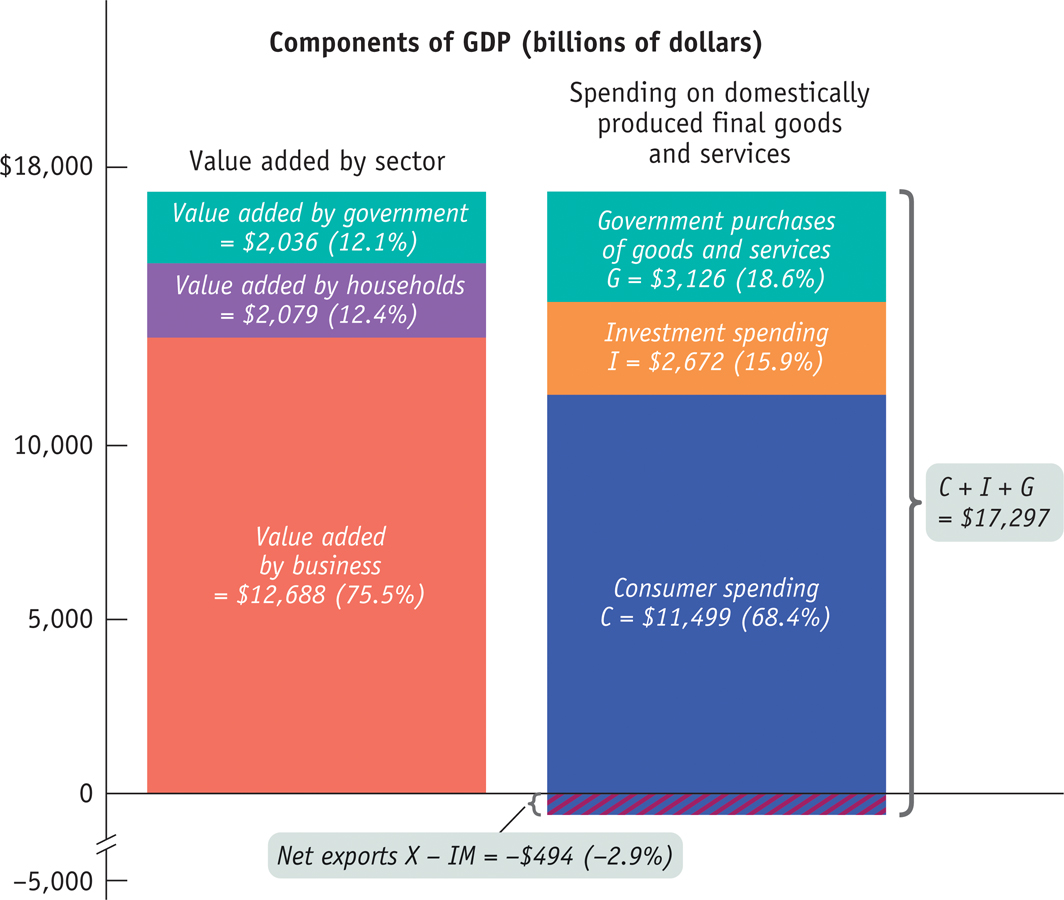

Figure 11-2 shows the first two methods of calculating GDP side by side. The height of each bar above the horizontal axis represents the GDP of the U.S. economy in 2013: $16,803 billion. Each bar is divided to show the breakdown of that total in terms of where the value was added and how the money was spent.

In the left bar in Figure 11-2, we see the breakdown of GDP by value added according to sector, the first method of calculating GDP. Of the $16,803 billion, $12,688 billion consisted of value added by businesses. Another $2,036 billion consisted of value added by government, in the form of military, education, and other government services. Finally, $2,079 billion of value added was added by households and institutions. For example, the value added by households includes the value of work performed in homes by professional gardeners, maids, and cooks.

The right bar in Figure 11-2 corresponds to the second method of calculating GDP, showing the breakdown by the four types of aggregate spending. The total length of the right bar is longer than the total length of the left bar, a difference of $494 billion (which, as you can see, extends below the horizontal axis). That’s because the total length of the right bar represents total spending in the economy, spending on both domestically produced and foreign-

Within the bar at right, consumer spending (C), which is 68.4% of GDP, dominates the picture. But some of that spending was absorbed by foreign-

GDP: What’s In and What’s Out?

It’s easy to confuse what is included and what isn’t included in GDP. So let’s stop here and make sure the distinction is clear.

Be sure not to confuse investment spending with spending on inputs. Investment spending—

Recall the distinction between resources that are used up and those that are not used up in production. An input, like steel, is used up in production. A metal-

Used goods are not included in GDP because, as with inputs, to include them would be to double-

Also, financial assets such as stocks and bonds are not included in GDP because they don’t represent either the production or the sale of final goods and services. Rather, a bond represents a promise to repay with interest, and a stock represents a proof of ownership. And for obvious reasons, foreign-

Here is a summary of what’s included and not included in GDP:

Included

- Domestically produced final goods and services, including capital goods, new construction of structures, and changes to inventories

Not Included

- Intermediate goods and services

- Inputs

- Used goods

- Financial assets such as stocks and bonds

- Foreign-

produced goods and services

OUR IMPUTED LIVES

An old line says that when a person marries the household cook, GDP falls. And it’s true: when someone provides services for pay, those services are counted as a part of GDP. But the services family members provide to each other are not. Some economists have produced alternative measures that try to “impute” the value of household work—

GDP estimates do, however, include an imputation for the value of “owner-

If you think about it, this makes a lot of sense. In a homeowning country like the United States, the pleasure we derive from our houses is an important part of the standard of living. So to be accurate, estimates of GDP must take into account the value of housing that is occupied by owners as well as the value of rental housing.

11

Solutions appear at the back of the book.

Check Your Understanding

Explain why the three methods of calculating GDP produce the same estimate of GDP.

Let’s start by considering the relationship between the total value added of all domestically produced final goods and services, and aggregate spending on domestically produced final goods and services. These two quantities are equal because every final good and service produced in the economy is either purchased by someone or added to inventories, and additions to inventories are counted as spending by firms. Next, consider the relationship between aggregate spending on domestically produced final goods and services and total factor income. These two quantities are equal because all spending that is channeled to firms to pay for purchases of domestically produced final goods and services is revenue for firms. Those revenues must be paid out by firms to their factors of production in the form of wages, profit, interest, and rent. Taken together, this means that all three methods of calculating GDP are equivalent.What does the investment spending category of GDP measure?

The investment spending category of GDP measures purchases of new capital by firms, changes to the stock of firm’s inventories, and residential investment (the value of new houses constructed during the given time period).Consider Figure 11-1. Explain why it would be incorrect to calculate total value added as $30,500, the sum of the sales price of a car and a car’s worth of steel.

You would be counting the value of the steel twice—once as it was sold by American Steel to American Motors and once as part of the car sold by American Motors.

Multiple-

Question

GDP is equal to

A. B. C. D. E. Question

Which of the following is included in GDP?

A. B. C. D. E. Question

Value added is best defined as

A. B. C. D. E. Question

Which of the following is not included in GDP?

A. B. C. D. E. Question

Which of the following components make up the largest percentage of GDP measured by aggregate spending?

A. B. C. D. E.

Critical-

Explain why the government cannot simply add up the total value of new goods and services produced in the economy during a given time period to come up with an estimate of GDP.

Some of the new goods and services produced are intermediate goods. We do not want to count intermediate goods separately because they are part of the value of the final goods.How does the concept of value added help the government obtain a more accurate measure of GDP?

The concept of value added allows the government to measure GDP by counting only the value added by each firm as opposed to the total value of the firm’s output. Value added by definition is the value of the firm’s output minus the value of any purchased intermediate goods used in production.