Problems

1.Given the following information about the closed economy of Brittania, what is the level of investment spending and private savings, and what is the budget balance? What is the relationship among the three? Is national savings equal to investment spending? There are no government transfers.

GDP = $1,000 million

C = $850 million

T = $50 million

G = $100 million

2.Explain how a well-

3.Boris Borrower and Lynn Lender agree that Lynn will lend Boris $10,000 and that Boris will repay the $10,000 with interest in one year. They agree to a nominal interest rate of 8%, reflecting a real interest rate of 3% on the loan and a commonly shared expected inflation rate of 5% over the next year.

If the inflation rate is actually 4% over the next year, how does that lower-

than- expected inflation rate affect Boris and Lynn? Who is better off? If the actual inflation rate is 7% over the next year, how does that affect Boris and Lynn? Who is better off?

4.Explain why equilibrium in the loanable funds market maximizes efficiency.

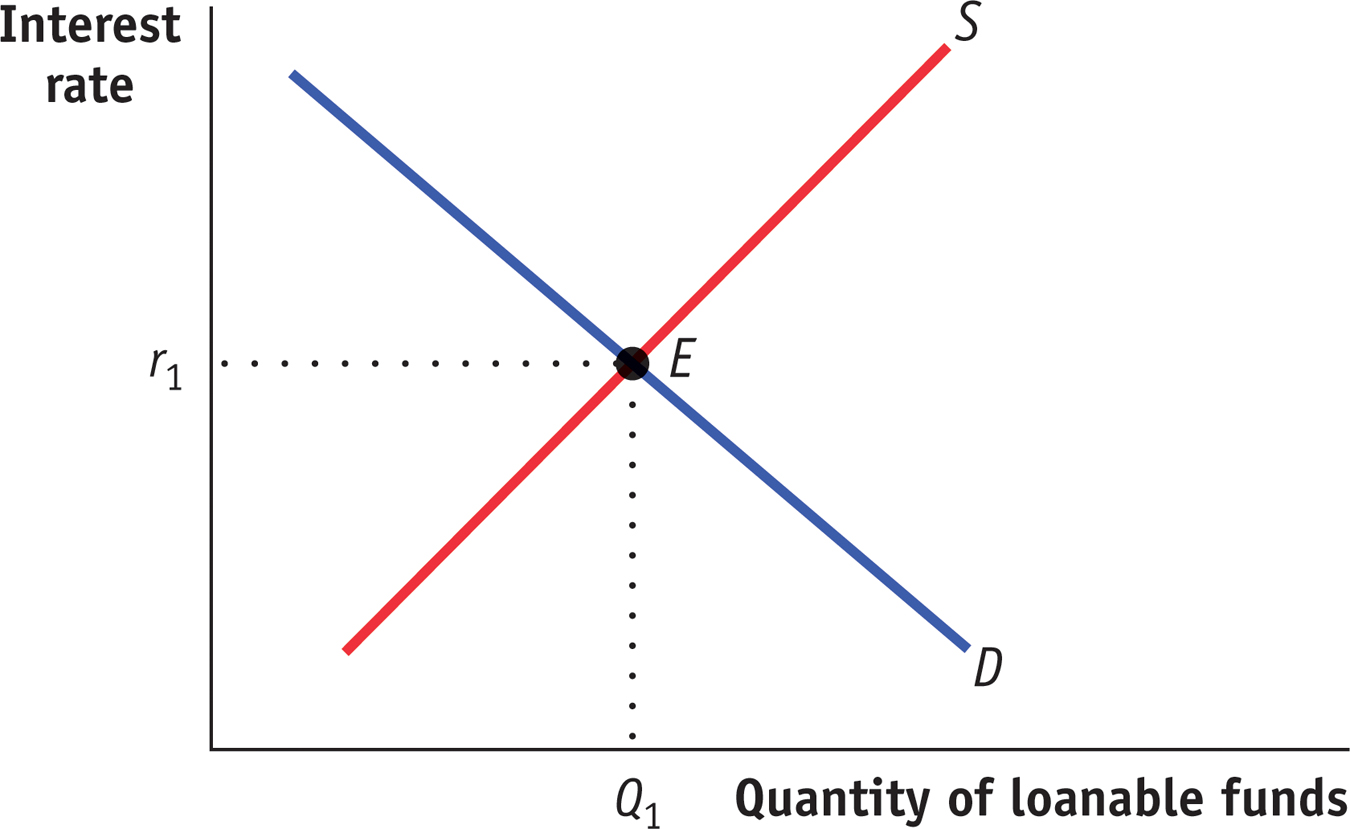

5.Use the market for loanable funds shown in the accompanying diagram to explain what happens to private savings, private investment spending, and the interest rate if each of the following events occur. Assume that there are no capital inflows or outflows.

The government reduces the size of its deficit to zero.

At any given interest rate, consumers decide to save more. Assume the budget balance is zero.

At any given interest rate, businesses become very optimistic about the future profitability of investment spending. Assume the budget balance is zero.

6.In 2010, Congress estimated that the cost of increasing the U.S. presence in Afghanistan by 30,000 troops was approximately $36 billion. The U.S. government was running a budget deficit at the time, so assume that the surge in troop levels was financed by government borrowing, which increases the demand for loanable funds without affecting supply. This question considers the likely effect of this government expenditure on the interest rate.

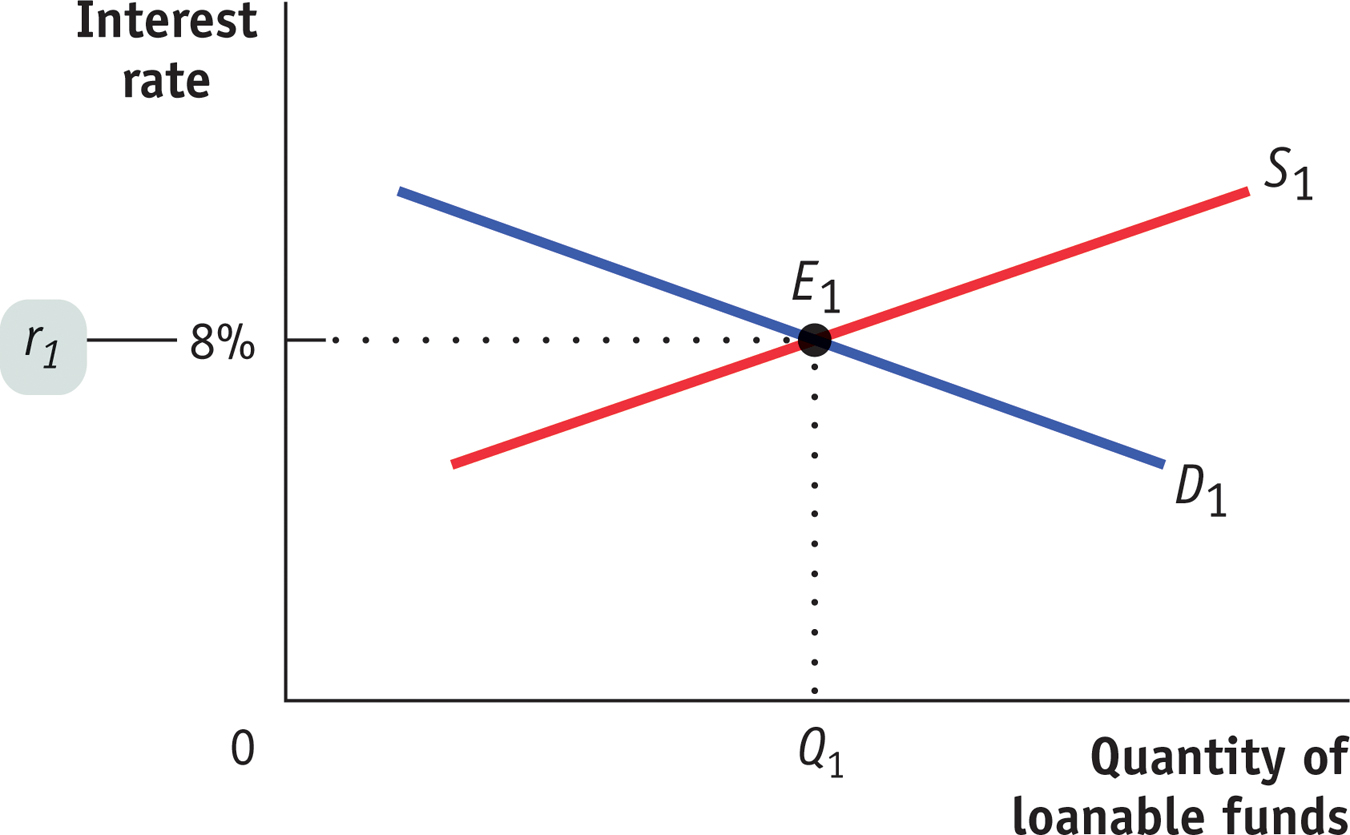

Draw typical demand (D1) and supply (S1) curves for loanable funds without the cost of the surge in troop levels accounted for. Label the vertical axis “Interest rate” and the horizontal axis “Quantity of loanable funds.” Label the equilibrium point (E1) and the equilibrium interest rate (r1).

Now draw a new diagram with the cost of the surge in troop levels included in the analysis. Shift the demand curve in the appropriate direction. Label the new equilibrium point (E2) and the new equilibrium interest rate (r2).

How does the equilibrium interest rate change in response to government expenditure on the troop surge? Explain.

7.How would you respond to a friend who claims that the government should eliminate all purchases that are financed by borrowing because such borrowing crowds out private investment spending?

8.Using the accompanying diagram, explain what will happen to the market for loanable funds when there is a fall of 2 percentage points in the expected future inflation rate. How will the change in the expected future inflation rate affect the equilibrium quantity of loanable funds?

9.You have won the state lottery. There are two ways in which you can receive your prize. You can either have $1 million in cash now, or you can have $1.2 million that is paid out as follows: $300,000 now, $300,000 in one year’s time, $300,000 in two years’ time, and $300,000 in three years’ time. The interest rate is 20%. How would you prefer to receive your prize?

10.The drug company Pfizer is considering whether to invest in the development of a new cancer drug. Development will require an initial investment of $10 million now; beginning one year from now, the drug will generate annual profits of $4 million for three years.

If the interest rate is 12%, should Pfizer invest in the development of the new drug? Why or why not?

If the interest rate is 8%, should Pfizer invest in the development of the new drug? Why or why not?

11.What are the important types of financial intermediaries in the U.S. economy? What are the primary assets of these intermediaries, and how do they facilitate investment spending and saving?

12.Sallie Mae is a quasi-

What is this process called? What effect will it have on investors compared to situations in which they could only buy and sell individual student loans?

What effect do you think Sallie Mae’s actions will have on the ability of students to get loans?

Suppose that a very severe recession hits and, as a consequence, many graduating students cannot get jobs and default on their student loans. What effect will this have on Sallie Mae bonds? Why is it likely that investors now believe Sallie Mae bonds to be riskier than expected? What will be the effect on the availability of student loans?

13.For each of the following, is it an example of investment spending, investing in financial assets, or investing in physical assets?

Rupert Moneybucks buys 100 shares of existing Coca-

Cola stock. Rhonda Moviestar spends $10 million to buy a mansion built in the 1970s.

Ronald Basketballstar spends $10 million to build a new mansion with a view of the Pacific Ocean.

Rawlings builds a new plant to make catcher’s mitts.

Russia buys $100 million in U.S. government bonds.