1.2 31Fiscal Policy and the Multiplier

Dmitriy Shironosov/Alamy

WHAT YOU WILL LEARN

Why fiscal policy has a multiplier effect

Why fiscal policy has a multiplier effect

How the multiplier effect is influenced by automatic stabilizers

How the multiplier effect is influenced by automatic stabilizers

Multiplier Effects of Fiscal Policy

An expansionary fiscal policy, like the 2009 U.S. stimulus, pushes the aggregate demand curve to the right. A contractionary fiscal policy, like Lyndon Johnson’s tax surcharge, pushes the aggregate demand curve to the left. For policy makers, however, knowing the direction of the shift isn’t enough: they need estimates of how much a given policy will shift the aggregate demand curve. To get these estimates, they use the concept of the multiplier, which we learned about in Module 24.

Multiplier Effects of an Increase in Government Purchases of Goods and Services

Suppose that a government decides to spend $50 billion building bridges and roads. The government’s purchases of goods and services will directly increase total spending on final goods and services by $50 billion.

But as we learned, there will also be an indirect effect: the government’s purchases will start a chain reaction throughout the economy. The firms that produce the goods and services purchased by the government earn revenues that flow to households in the form of wages, profits, interest, and rent. This increase in disposable income leads to a rise in consumer spending. The rise in consumer spending, in turn, induces firms to increase output, leading to a further rise in disposable income, which leads to another round of consumer spending increases, and so on.

As we know, the multiplier is the ratio of the change in real GDP caused by an autonomous change in aggregate spending to the size of that autonomous change. An increase in government purchases of goods and services is a prime example of such an autonomous increase in aggregate spending.

In Module 24 we considered a simple case in which there are no taxes or international trade, so that any change in GDP accrues entirely to households. We also assumed that the aggregate price level is fixed, so that any increase in nominal GDP is also a rise in real GDP, and that the interest rate is fixed. In that case the multiplier is 1/(1 − MPC). Recall that MPC is the marginal propensity to consume, the fraction of an additional dollar in disposable income that is spent.

For example, if the marginal propensity to consume is 0.5, the multiplier is 1/(1 − 0.5) = 1/0.5 = 2. Given a multiplier of 2, a $50 billion increase in government purchases of goods and services would increase real GDP by $100 billion. Of that $100 billion, $50 billion is the initial effect from the increase in G, and the remaining $50 billion is the subsequent effect arising from the increase in consumer spending.

What happens if government purchases of goods and services are reduced instead? The math is exactly the same, except that there’s a minus sign in front: if government purchases of goods and services fall by $50 billion and the marginal propensity to consume is 0.5, real GDP falls by $100 billion.

Multiplier Effects of Changes in Government Transfers and Taxes

Expansionary or contractionary fiscal policy need not take the form of changes in government purchases of goods and services. Governments can also change transfer payments or taxes. In general, however, a change in government transfers or taxes shifts the aggregate demand curve by less than an equal-

To see why, imagine that instead of spending $50 billion on building bridges, the government simply hands out $50 billion in the form of government transfers. In this case, there is no direct effect on aggregate demand, as there was with government purchases of goods and services. Real GDP goes up only because households spend some of that $50 billion—

31-1

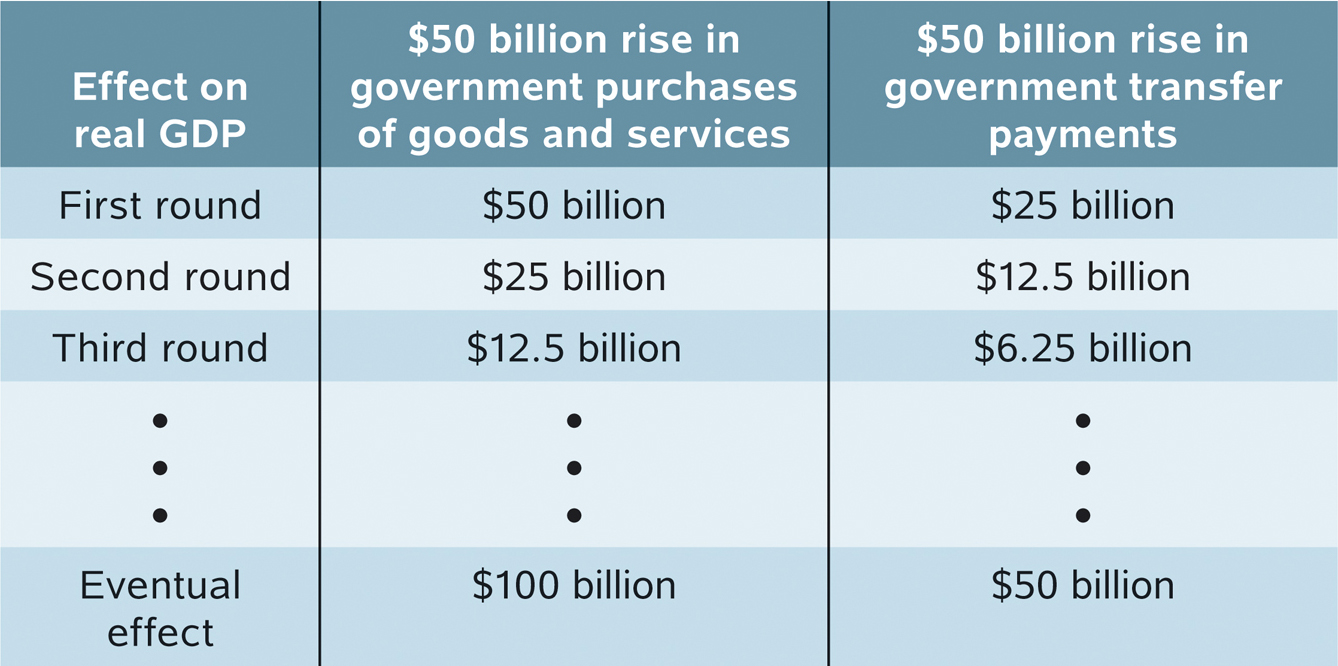

Hypothetical Effects of a Fiscal Policy with Multiplier of 2

Table 31-1 shows a hypothetical comparison of two expansionary fiscal policies assuming an MPC equal to 0.5 and a multiplier equal to 2: one in which the government directly purchases $50 billion in goods and services and one in which the government makes transfer payments instead, sending out $50 billion in checks to consumers. In each case there is a first-

However, the first-

Overall, when expansionary fiscal policy takes the form of a rise in transfer payments, real GDP may rise by either more or less than the initial government outlay—

A tax cut has an effect similar to the effect of a transfer. It increases disposable income, leading to a series of increases in consumer spending. But the overall effect is smaller than that of an equal-

In practice, economists often argue that the size of the multiplier determines who among the population should get tax cuts or increases in government transfers. For example, compare the effects of an increase in unemployment benefits with a cut in taxes on profits distributed to shareholders as dividends.

Consumer surveys suggest that the average unemployed worker will spend a higher share of any increase in his or her disposable income than would the average recipient of dividend income. That is, people who are unemployed tend to have a higher MPC than people who own a lot of stocks because the latter tend to be wealthier and tend to save more of any increase in disposable income. If that’s true, a dollar spent on unemployment benefits increases aggregate demand more than a dollar’s worth of dividend tax cuts.

How Taxes Affect the Multiplier

When we introduced the analysis of the multiplier, we simplified matters by assuming that a $1 increase in real GDP raises disposable income by $1. In fact, however, government taxes capture some part of the increase in real GDP that occurs in each round of the multiplier process, since most government taxes depend positively on real GDP. As a result, disposable income increases by considerably less than $1 once we include taxes in the model.

The increase in government tax revenue when real GDP rises isn’t the result of a deliberate decision or action by the government. It’s a consequence of the way the tax laws are written, which causes most sources of government revenue to increase automatically when real GDP goes up.

Lump-

The income taxes individuals pay to the government are a percentage of their income. Therefore, when real GDP rises, this increase in aggregate income leads to an increase in government tax revenue. In the real world, governments rarely impose lump-

In addition, sales tax receipts increase when real GDP rises because people with more income spend more on goods and services. And corporate profit tax receipts increase when real GDP rises because profits increase when the economy expands.

The effect of these automatic increases in tax revenue is to reduce the size of the multiplier. Remember, the multiplier is the result of a chain reaction in which higher real GDP leads to higher disposable income, which leads to higher consumer spending, which leads to further increases in real GDP. The fact that the government siphons off some of any increase in real GDP means that at each stage of this process, the increase in consumer spending is smaller than it would be if taxes weren’t part of the picture. The result is to reduce the multiplier.

Many macroeconomists believe it’s a good thing that in real life taxes reduce the multiplier. Earlier we argued that most, though not all, recessions are the result of negative demand shocks. The same mechanism that causes tax revenue to increase when the economy expands causes it to decrease when the economy contracts. Since tax receipts decrease when real GDP falls, the effects of these negative demand shocks are smaller than they would be if there were no taxes. The decrease in tax revenue reduces the adverse effect of the initial fall in aggregate demand.

The automatic decrease in government tax revenue generated by a fall in real GDP—

Automatic stabilizers are government spending and taxation rules that cause fiscal policy to be automatically expansionary when the economy contracts and automatically contractionary when the economy expands.

Similarly, when the economy expands, the government finds itself automatically pursuing a contractionary fiscal policy—

The rules that govern tax collection aren’t the only automatic stabilizers, although they are the most important ones. Some types of government transfers also play a stabilizing role. For example, more people receive unemployment insurance when the economy is depressed than when it is booming. The same is true of Medicaid and food stamps, or SNAP.

So transfer payments tend to rise when the economy is contracting and fall when the economy is expanding. Like changes in tax revenue, these automatic changes in transfers tend to reduce the size of the multiplier because the total change in disposable income that results from a given rise or fall in real GDP is smaller.

Discretionary fiscal policy is fiscal policy that is the result of deliberate actions by policy makers rather than automatic adjustments.

As in the case of government tax revenue, many macroeconomists believe that it’s a good thing that government transfers reduce the multiplier. Expansionary and contractionary fiscal policies that are the result of automatic stabilizers are widely considered helpful to macroeconomic stabilization because they blunt the extremes of the business cycle.

But what about fiscal policy that isn’t the result of automatic stabilizers? Discretionary fiscal policy is fiscal policy that is the direct result of deliberate actions by policy makers rather than automatic adjustment. For example, during a recession, the government may pass legislation that cuts taxes and increases government spending in order to stimulate the economy. In general, economists tend to support the use of discretionary fiscal policy only in special circumstances, such as an especially severe recession.

MULTIPLIERS AND THE OBAMA STIMULUS

The American Recovery and Reinvestment Act, also known as the Obama stimulus, was the largest example of discretionary fiscal expansion in U.S. history. The total stimulus was $787 billion, although not all of that was spent at once: only about half, or roughly $400 billion, of the stimulus arrived in 2010, the year of peak impact. Still, even that was a lot—

The first description of the planned stimulus and its expected effects came in early January 2009, from two of the incoming administration’s top economists. They were explicit about the assumed multipliers: based on models developed at the Federal Reserve and elsewhere, they assumed that government spending would have a multiplier of 1.57 and that tax cuts would have a multiplier of 0.99.

These assumptions yielded an overall multiplier for the stimulus of almost 1.4, implying that the stimulus would, at its peak in 2010, add about 3.7% to real GDP. It would also, they estimated, reduce unemployment by about 1.8 percentage points relative to what it would otherwise have been.

But here’s the problem: the slump the Obama stimulus was intended to fight was brought on by a major financial crisis—

Compared with the economy’s problems, then, the Obama stimulus was actually small: it cut only 1.8 points off the unemployment rate in 2010 and faded out rapidly thereafter. And given its small size relative to the problem, the failure of the stimulus to avert persistently high unemployment should not have come as a surprise.

31

Solutions appear at the back of the book.

Check Your Understanding

Explain why a $500 million increase in government purchases of goods and services will generate a larger rise in real GDP than a $500 million increase in government transfers.

A $500 million increase in government purchases of goods and services directly increases aggregate spending by $500 million, which then starts the multiplier in motion. It will increase real GDP by $500 million × 1/(1 − MPC). A $500 million increase in government transfers increases aggregate spending only to the extent that it leads to an increase in consumer spending. Consumer spending rises by MPC × $1 for every $1 increase in disposable income, where MPC is less than 1. So a $500 million increase in government transfers will cause a rise in real GDP only MPC times as much as a $500 million increase in government purchases of goods and services. It will increase real GDP by $500 million × MPC/(1 − MPC).Explain why a $500 million reduction in government purchases of goods and services will generate a larger fall in real GDP than a $500 million reduction in government transfers.

If government purchases of goods and services fall by $500 million, the initial fall in aggregate spending is $500 million. If there is a $500 million tax increase, the initial fall in aggregate spending is MPC × $500 million, which is less than $500 million because some of the tax payments are made with money that would otherwise have been saved rather than spent.The country of Boldovia has no unemployment insurance benefits and a tax system using only lump-

sum taxes. The neighboring country of Moldovia has generous unemployment benefits and a tax system in which residents must pay a percentage of their income. Which country will experience greater variation in real GDP in response to demand shocks, positive and negative? Explain. Boldovia will experience greater variation in its real GDP than Moldovia because Moldovia has automatic stabilizers while Boldovia does not. In Moldovia the effects of slumps will be lessened by unemployment insurance benefits, which will support residents’ incomes, while the effects of booms will be diminished because tax revenues will go up. In contrast, incomes will not be supported in Boldovia during slumps because there is no unemployment insurance. In addition, because Boldovia has lump-sum taxes, its booms will not be diminished by increases in tax revenue.

Multiple-

Question

The marginal propensity to consume

I. is inversely related to the multiplier.

II. is equal to 1.

III. represents the proportion of consumers’ disposable income that is spent.A. B. C. D. E. Question

Assume that taxes and interest rates remain unchanged when government spending increases, and that both savings and consumer spending increase when income increases. The ultimate effect on real GDP of a $100 million increase in government purchases of goods and services will be

A. B. C. D. E. Question

Taxes have what effect on the multiplier? They

A. B. C. D. E. Question

A lump-

sum tax is A. B. C. D. E. Question

Which of the following is NOT an automatic stabilizer?

A. B. C. D. E.

Critical-

A change in government purchases of goods and services results in a change in real GDP equal to $200 million. Assuming the absence of taxes, international trade, and changes in the aggregate price level, answer the following.

Suppose that the MPC is equal to 0.75. What was the size of the change in government purchases of goods and services that resulted in the increase in real GDP of $200 million?

$50 million

multiplier = 1/(1 − MPC) = 1/(1 − 0.75) = 1/0.25 = 4

change in G × 4 = $200 million

change in G = $50 millionNow suppose that the change in government purchases of goods and services was $20 million. What value of the multiplier would result in an increase in real GDP of $200 million?

10

$20 million × multiplier = $200 million

multiplier = 200/20 = 10Given the value of the multiplier you calculated in the preceding question, what marginal propensity to save would have led to that value of the multiplier?

0.1

1/(1 − MPC) = 1/MPS = 10

MPS = 0.1