The Lesson of the Post-Crisis Slump

Almost all major economies had great difficulty dealing with the aftermath of the 2008 financial crisis—

Clearly, then, the best way to avoid the terrible problems that arise after a financial crisis is not to have a crisis in the first place. How can you do that? In part, one might hope, through better regulation of financial institutions. We turn next to attempts at regulatory reform.

!worldview! ECONOMICS in Action: If Only It Were the 1930s

If Only It Were the 1930s

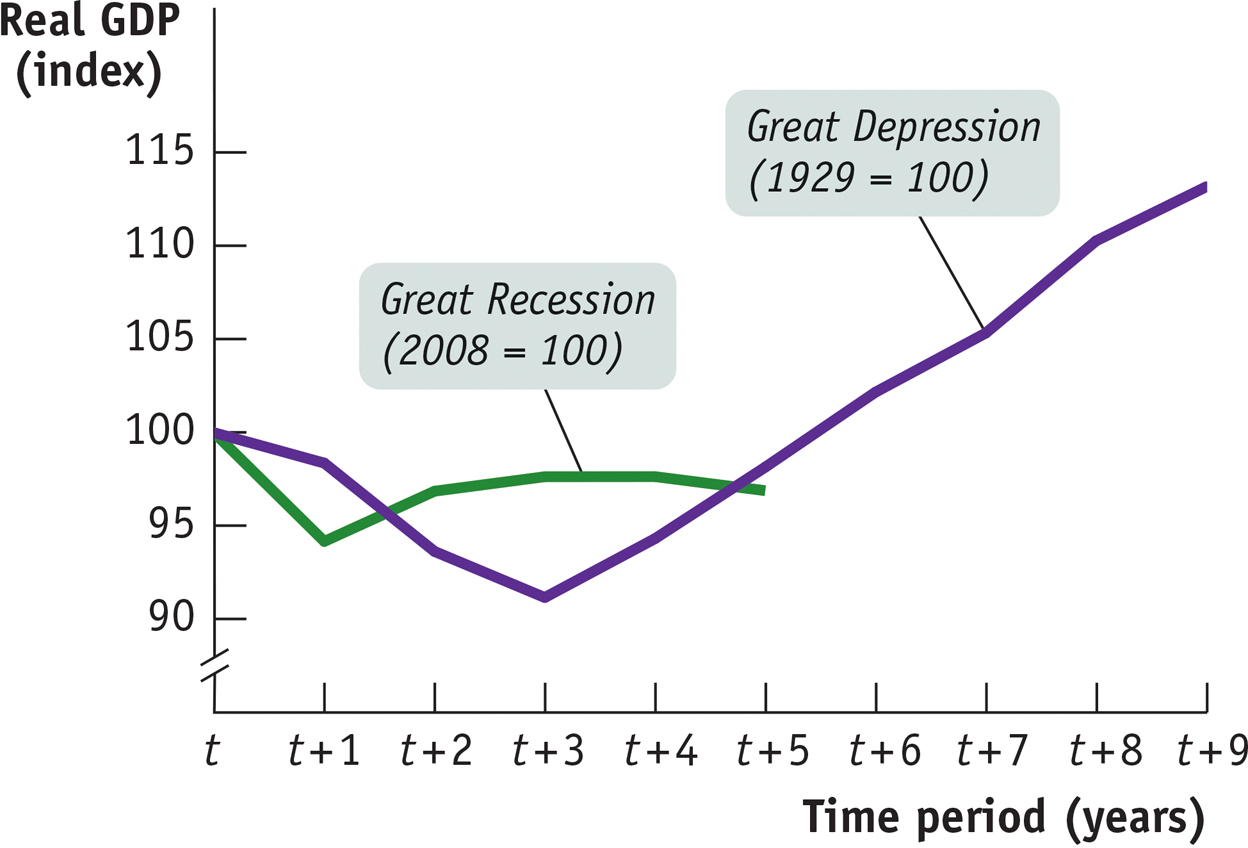

In the United States, the aftermath of the 2008 financial crisis was terrible, but at least you can say that it was a lot better than what happened during the Great Depression, when real GDP fell by a third. In Europe, however, you can’t even say that. Partly that’s because the Great Depression wasn’t as severe in Europe as it was in the United States. But it’s also due to the fact that Europe has failed to stage a convincing recovery from the 2008 crisis, sliding back into recession in 2011. As a result, while the initial slump wasn’t as deep as in the 1930s, by the time of writing Europe was actually doing worse than it did in the 1930s.

Figure 17-9 shows the painful comparison. The purple line shows real GDP in Western Europe from 1929 onwards, while the green line shows real GDP in the eurozone starting in 2008; in each case the pre-

As a result, by late 2014 Europe was, incredibly, significantly behind where it was at this point in the 1930s, prompting the British economic historian Nicholas Crafts to publish a widely cited article with the title “The Eurozone: If Only It Were the 1930s.”

We can attribute Europe’s terrible performance since 2008 in part to policy mistakes and in part to the straitjacket created by the euro itself. However one apportions the blame, Europe’s woes demonstrate the awesome damage financial crises can do.

Quick Review

Economic damage from the financial crisis of 2008 was both large and prolonged. Aftershocks from the crisis continue to shake the world economy.

The world’s two largest economies, the United States and the European Union, suffered severe downturns, shrinking more than 5%, followed by relatively slow recoveries. The severe slump and the slow recovery were very bad news for workers.

The persistence of economic difficulties after the 2008 financial crisis led to severe solvency concerns for several European countries. A fierce debate erupted over whether fiscal stimulus or fiscal austerity was the right policy prescription, which the stimulus advocates appear to be winning.

17-4

Question 17.6

In November 2011, the government of France announced that it was reducing its forecast for economic growth in 2012. It was also reducing its estimates of tax revenue for 2012, since a weaker economy would mean smaller tax receipts. To offset the effect of lower revenue on the budget deficit, the government also announced a new package of tax increases and spending cuts. Which side of the stimulus–

austerity debate was France taking?

Solutions appear at back of book.