A Cautionary Note: Lags in Fiscal Policy

Looking back at Figures 13-4 and 13-5, it may seem obvious that the government should actively use fiscal policy—

We’ll leave discussion of the warnings associated with monetary policy to Chapter 15. In the case of fiscal policy, one key reason for caution is that there are important time lags between when the policy is decided upon and when it is implemented. To understand the nature of these lags, think about what has to happen before the government increases spending to fight a recessionary gap. First, the government has to realize that the recessionary gap exists: economic data take time to collect and analyze, and recessions are often recognized only months after they have begun. Second, the government has to develop a spending plan, which can itself take months, particularly if politicians take time debating how the money should be spent and passing legislation. Finally, it takes time to spend money. For example, a road construction project begins with activities such as surveying that don’t involve spending large sums. It may be quite some time before the big spending begins.

Because of these lags, an attempt to increase spending to fight a recessionary gap may take so long to get going that the economy has already recovered on its own. In fact, the recessionary gap may have turned into an inflationary gap by the time the fiscal policy takes effect. In that case, the fiscal policy will make things worse instead of better.

This doesn’t mean that fiscal policy should never be actively used. In early 2009 there was good reason to believe that the slump facing the U.S. economy would be both deep and long and that a fiscal stimulus designed to arrive over the next year or two would almost surely push aggregate demand in the right direction. In fact, as we’ll see later in this chapter, the 2009 stimulus arguably faded out too soon, leaving the economy still deeply depressed. But the problem of lags makes the actual use of both fiscal and monetary policy harder than you might think from a simple analysis like the one we have just given.

ECONOMICS in Action: What Was in the Recovery Act?

What Was in the Recovery Act?

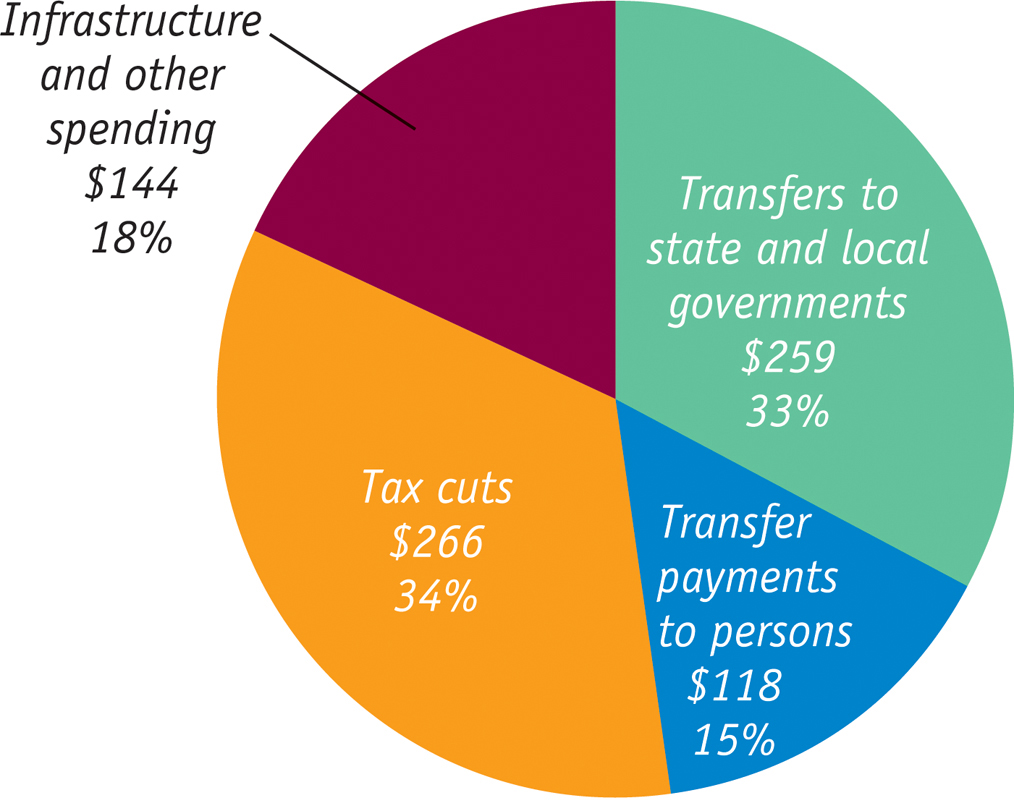

As we’ve just learned, fiscal stimulus can take three forms: increased government purchases of goods and services, increased transfer payments, and tax cuts. So what form did the Recovery Act take? The answer is that it’s a bit complicated.

Figure 13-6 shows the composition of the budget impact of the Recovery Act, a measure that adds up the dollar value of tax cuts, transfer payments, and government spending. Here, the numbers are broken down into four categories, not three. “Infrastructure and other spending” means spending on roads, bridges, and schools as well as “nontraditional” infrastructure like research and development, all of which fall under government purchases of goods and services. “Tax cuts” are self-

Because America has multiple levels of government. The authors live in Princeton Township, which has its own budget, which is part of Mercer County, which has its own budget, which is part of the state of New Jersey, which has its own budget, which is part of the United States. One effect of the recession was a sharp drop in revenues at the state and local levels, which in turn forced these lower levels of government to cut spending. Federal aid—

Perhaps the most surprising aspect of the Recovery Act was how little direct federal spending on goods and services was involved. The great bulk of the program involved giving money to other people, one way or another, in the hope that they would spend it.

Quick Review

The main channels of fiscal policy are taxes and government spending. Government spending takes the form of purchases of goods and services as well as transfers.

In the United States, most government transfers are accounted for by social insurance programs designed to alleviate economic hardship—

principally Social Security, Medicare, and Medicaid. The government controls G directly and influences C and I through taxes and transfers.

Expansionary fiscal policy is implemented by an increase in government spending, a cut in taxes, or an increase in government transfers. Contractionary fiscal policy is implemented by a reduction in government spending, an increase in taxes, or a reduction in government transfers.

Arguments against the effectiveness of expansionary fiscal policy based upon crowding out are valid only when the economy is at full employment. The argument that expansionary fiscal policy won’t work because of Ricardian equivalence—

that consumers will cut back spending today to offset expected future tax increases— appears to be untrue in practice. What is clearly true is that time lags can reduce the effectiveness of fiscal policy, and potentially render it counterproductive.

13-1

Question 13.1

In each of the following cases, determine whether the policy is an expansionary or contractionary fiscal policy.

Several military bases around the country, which together employ tens of thousands of people, are closed.

The number of weeks an unemployed person is eligible for unemployment benefits is increased.

The federal tax on gasoline is increased.

Question 13.2

Explain why federal disaster relief, which quickly disburses funds to victims of natural disasters such as hurricanes, floods, and large-

scale crop failures, will stabilize the economy more effectively after a disaster than relief that must be legislated. Question 13.3

Is the following statement true or false? Explain. “When the government expands, the private sector shrinks; when the government shrinks, the private sector expands.”

Solutions appear at back of book.