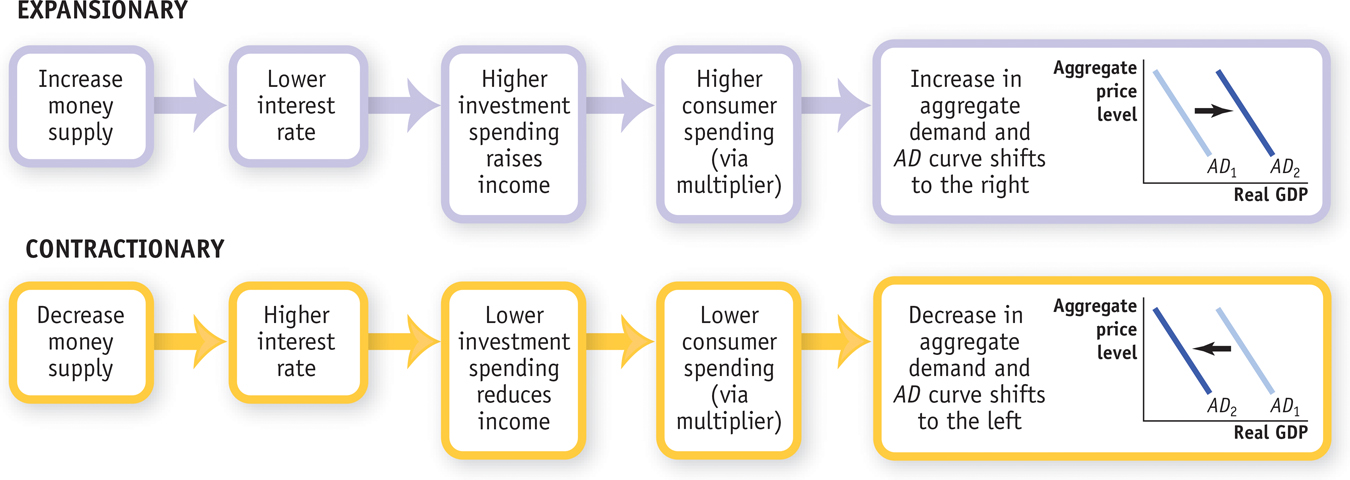

Expansionary and Contractionary Monetary Policy

In Chapter 12 we learned that monetary policy shifts the aggregate demand curve. We can now explain how that works: through the effect of monetary policy on the interest rate.

Figure 15-7 illustrates the process. Suppose, first, that the Federal Reserve wants to reduce interest rates, so it expands the money supply. As you can see in the top portion of the figure, a lower interest rate, in turn, will lead, other things equal, to more investment spending. This will in turn lead to higher consumer spending, through the multiplier process, and to an increase in aggregate output demanded. In the end, the total quantity of goods and services demanded at any given aggregate price level rises when the quantity of money increases, and the AD curve shifts to the right. Monetary policy that increases the demand for goods and services is known as expansionary monetary policy.

Expansionary monetary policy is monetary policy that increases aggregate demand.

Contractionary monetary policy is monetary policy that decreases aggregate demand.

Suppose, alternatively, that the Federal Reserve wants to increase interest rates, so it contracts the money supply. You can see this process illustrated in the bottom portion of the diagram. Contraction of the money supply leads to a higher interest rate. The higher interest rate leads to lower investment spending, then to lower consumer spending, and then to a decrease in aggregate output demanded. So the total quantity of goods and services demanded falls when the money supply is reduced, and the AD curve shifts to the left. Monetary policy that decreases the demand for goods and services is called contractionary monetary policy.