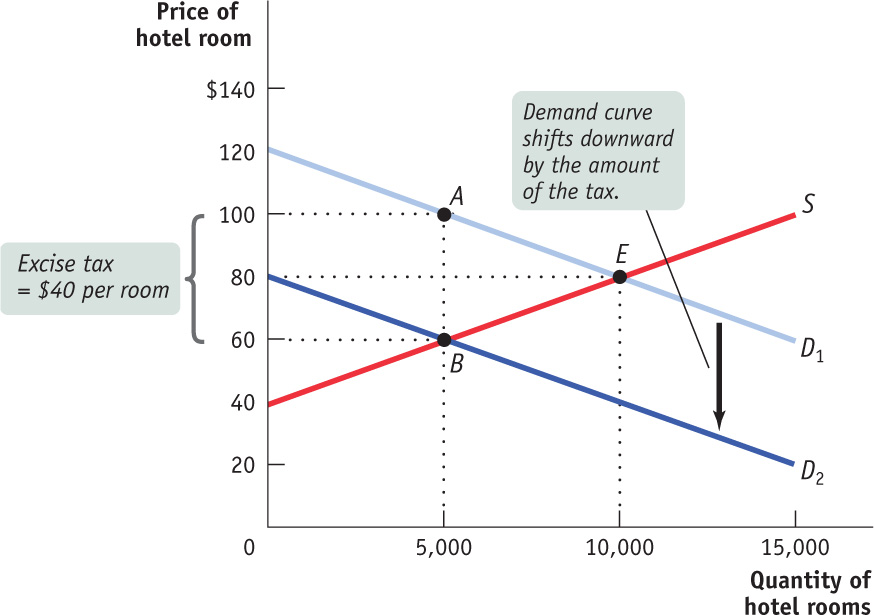

A $40 per room tax imposed on hotel guests shifts the demand curve from D1 to D2, a downward shift of $40. The equilibrium price of hotel rooms falls from $80 to $60 a night, and the quantity of rooms rented falls from 10,000 to 5,000. Although in this case the tax is officially paid by consumers, while in Figure 15-2 the tax was paid by producers, the outcome is the same: after taxes, hotel owners receive $60 per room but guests pay $100. This illustrates a general principle: The incidence of an excise tax doesn’t depend on whether consumers or producers officially pay the tax.