Problems

1.Skyscraper City has a subway system for which a one-

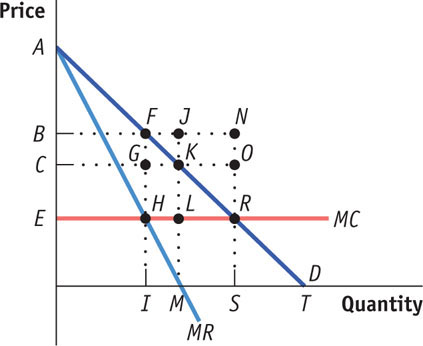

2.Consider an industry with the demand curve (D) and marginal cost curve (MC) shown in the accompanying diagram. There is no fixed cost. If the industry is a single-

- a. If the industry is perfectly competitive, what will be the total quantity produced? At what price?

- b. Which area reflects consumer surplus under perfect competition?

- c. If the industry is a single-

price monopoly, what quantity will the monopolist produce? Which price will it charge? - d. Which area reflects the single-

price monopolist’s profit? - e. Which area reflects consumer surplus under single-

price monopoly? - f. Which area reflects the deadweight loss to society from single-

price monopoly? - g. If the monopolist can price-

discriminate perfectly, what quantity will the perfectly price- discriminating monopolist produce?

3.Bob, Bill, Ben, and Brad Baxter have just made a documentary movie about their basketball team. They are thinking about making the movie available for download on the Internet, and they can act as a single-

| Price of download | Quantity of downloads demanded |

|---|---|

| $10 | 0 |

| 8 | 1 |

| 6 | 3 |

| 4 | 6 |

| 2 | 10 |

| 0 | 15 |

- a. Calculate the total revenue and the marginal revenue per download.

- b. Bob is proud of the film and wants as many people as possible to download it. Which price would he choose? How many downloads would be sold?

- c. Bill wants as much total revenue as possible. Which price would he choose? How many downloads would be sold?

- d. Ben wants to maximize profit. Which price would he choose? How many downloads would be sold?

- e. Brad wants to charge the efficient price. Which price would he choose? How many downloads would be sold?

4.Suppose that De Beers is a single-

| Price of diamond | Quantity of diamonds demanded |

|---|---|

| $500 | 0 |

| 400 | 1 |

| 300 | 2 |

| 200 | 3 |

| 100 | 4 |

| 0 | 5 |

- a. Calculate De Beers’s total revenue and its marginal revenue. From your calculation, draw the demand curve and the marginal revenue curve.

- b. Explain why De Beers faces a downward-

sloping demand curve. - c. Explain why the marginal revenue from an additional diamond sale is less than the price of the diamond.

- d. Suppose De Beers currently charges $200 for its diamonds. If it lowers the price to $100, how large is the price effect? How large is the quantity effect?

- e. Add the marginal cost curve to your diagram from part a, and determine which quantity maximizes the company’s profit and which price De Beers will charge.

5.Use the demand schedule for diamonds given in Problem 4. The marginal cost of producing diamonds is constant at $100. There is no fixed cost.

- a. If De Beers charges the monopoly price, how large is the individual consumer surplus that each buyer experiences? Calculate total consumer surplus by summing the individual consumer surpluses. How large is producer surplus?

- b. Suppose that upstart Russian and Asian producers enter the market and the market becomes perfectly competitive. What is the perfectly competitive price? What quantity will be sold in this perfectly competitive market?

- c. At the competitive price and quantity, how large is the consumer surplus that each buyer experiences? How large is total consumer surplus? How large is producer surplus?

- d. Compare your answer to part c to your answer to part a. How large is the deadweight loss associated with monopoly in this case?

6.Use the demand schedule for diamonds given in Problem 4. De Beers is a monopolist, but it can now price-

- a. If De Beers can price-

discriminate perfectly, to which customers will it sell diamonds and at what prices? - b. How large is each individual consumer surplus? How large is total consumer surplus? Calculate producer surplus by summing the producer surplus generated by each sale.

7.Download Records decides to release an album by the group Mary and the Little Lamb. It produces the album with no fixed cost, but the total cost of downloading an album to a CD and paying Mary her royalty is $6 per album. Download Records can act as a single-

| Price of album | Quantity of albums demanded |

|---|---|

| $22 | 0 |

| 20 | 1,000 |

| 18 | 2,000 |

| 16 | 3,000 |

| 14 | 4,000 |

| 12 | 5,000 |

| 10 | 6,000 |

| 8 | 7,000 |

- a. Calculate the total revenue and the marginal revenue per album.

- b. The marginal cost of producing each album is constant at $6. To maximize profit, what level of output should Download Records choose, and which price should it charge for each album?

- c. Mary renegotiates her contract and now needs to be paid a higher royalty per album. So the marginal cost rises to be constant at $14. To maximize profit, what level of output should Download Records now choose, and which price should it charge for each album?

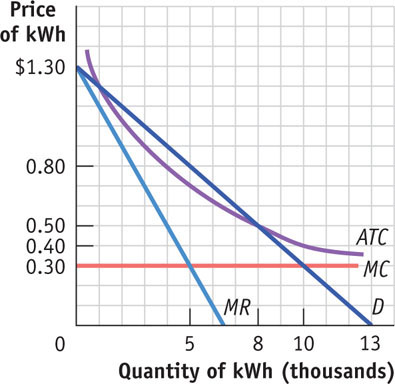

8.The accompanying diagram illustrates your local electricity company’s natural monopoly. The diagram shows the demand curve for kilowatt-

- a. If the government does not regulate this monopolist, which price will the monopolist charge? Illustrate the inefficiency this creates by shading the deadweight loss from monopoly.

- b. If the government imposes a price ceiling equal to the marginal cost, $0.30, will the monopolist make a profit or lose money? Shade the area of profit (or loss) for the monopolist. If the government does impose this price ceiling, do you think the firm will continue to produce in the long run?

- c. If the government imposes a price ceiling of $0.50, will the monopolist make a profit, lose money, or break even?

9.The movie theater in Collegetown serves two kinds of customers: students and professors. There are 900 students and 100 professors in Collegetown. Each student’s willingness to pay for a movie ticket is $5. Each professor’s willingness to pay for a movie ticket is $10. Each will buy at most one ticket. The movie theater’s marginal cost per ticket is constant at $3, and there is no fixed cost.

- a. Suppose the movie theater cannot price-

discriminate and needs to charge both students and professors the same price per ticket. If the movie theater charges $5, who will buy tickets and what will the movie theater’s profit be? How large is consumer surplus? - b. If the movie theater charges $10, who will buy movie tickets and what will the movie theater’s profit be? How large is consumer surplus?

- c. Now suppose that, if it chooses to, the movie theater can price-

discriminate between students and professors by requiring students to show their student ID. If the movie theater charges students $5 and professors $10, how much profit will the movie theater make? How large is consumer surplus?

10.A monopolist knows that in order to expand the quantity of output it produces from 8 to 9 units, it must lower the price of its output from $2 to $1. Calculate the quantity effect and the price effect. Use these results to calculate the monopolist’s marginal revenue of producing the 9th unit. The marginal cost of producing the 9th unit is positive. Is it a good idea for the monopolist to produce the 9th unit?