Problems

1.The accompanying table shows the demand schedule for vitamin D. Suppose that the marginal cost of producing vitamin D is zero.

| Price of vitamin D (per ton) | Quantity of vitamin D demanded (tons) |

|---|---|

| $8 | 0 |

| 7 | 10 |

| 6 | 20 |

| 5 | 30 |

| 4 | 40 |

| 3 | 50 |

| 2 | 60 |

| 1 | 70 |

- a. Assume that BASF is the only producer of vitamin D and acts as a monopolist. It currently produces 40 tons of vitamin D at $4 per ton. If BASF were to produce 10 more tons, what would be the price effect for BASF? What would be the quantity effect? Would BASF have an incentive to produce those 10 additional tons?

- b. Now assume that Roche enters the market by also producing vitamin D and the market is now a duopoly. BASF and Roche agree to produce 40 tons of vitamin D in total, 20 tons each. BASF cannot be punished for deviating from the agreement with Roche. If BASF, on its own, were to deviate from that agreement and produce 10 more tons, what would be the price effect for BASF? What would be the quantity effect for BASF? Would BASF have an incentive to produce those 10 additional tons?

2.The market for olive oil in New York City is controlled by two families, the Sopranos and the Contraltos. Both families will ruthlessly eliminate any other family that attempts to enter the New York City olive oil market. The marginal cost of producing olive oil is constant and equal to $40 per gallon. There is no fixed cost. The accompanying table gives the market demand schedule for olive oil.

| Price of olive oil (per gallon) | Quantity of olive oil demanded (gallons) |

|---|---|

| $100 | 1,000 |

| 90 | 1,500 |

| 80 | 2,000 |

| 70 | 2,500 |

| 60 | 3,000 |

| 50 | 3,500 |

| 40 | 4,000 |

| 30 | 4,500 |

| 20 | 5,000 |

| 10 | 5,500 |

- a. Suppose the Sopranos and the Contraltos form a cartel. For each of the quantities given in the table, calculate the total revenue for their cartel and the marginal revenue for each additional gallon. How many gallons of olive oil would the cartel sell in total and at what price? The two families share the market equally (each produces half of the total output of the cartel). How much profit does each family make?

- b. Uncle Junior, the head of the Soprano family, breaks the agreement and sells 500 more gallons of olive oil than under the cartel agreement. Assuming the Contraltos maintain the agreement, how does this affect the price for olive oil and the profits earned by each family?

- c. Anthony Contralto, the head of the Contralto family, decides to punish Uncle Junior by increasing his sales by 500 gallons as well. How much profit does each family earn now?

3.In France, the market for bottled water is controlled by two large firms, Perrier and Evian. Each firm has a fixed cost of €1 million and a constant marginal cost of €2 per liter of bottled water (€1 = 1 euro). The following table gives the market demand schedule for bottled water in France.

| Price of bottled water (per liter) | Quantity of bottled water demanded (millions of liters) |

|---|---|

| €10 | 0 |

| 9 | 1 |

| 8 | 2 |

| 7 | 3 |

| 6 | 4 |

| 5 | 5 |

| 4 | 6 |

| 3 | 7 |

| 2 | 8 |

| 1 | 9 |

- a. Suppose the two firms form a cartel and act as a monopolist. Calculate marginal revenue for the cartel. What will the monopoly price and output be? Assuming the firms divided the output evenly, how much will each produce and what will each firm’s profits be?

- b. Now suppose Perrier decides to increase production by 1 million liters. Evian doesn’t change its production. What will the new market price and output be? What is Perrier’s profit? What is Evian’s profit?

- c. What if Perrier increases production by 3 million liters? Evian doesn’t change its production. What would its output and profits be relative to those in part b?

- d. What do your results tell you about the likelihood of cheating on such agreements?

4.To preserve the North Atlantic fish stocks, it is decided that only two fishing fleets, one from the United States and the other from the European Union (EU), can fish in those waters. The accompanying table shows the market demand schedule per week for fish from these waters. The only costs are fixed costs, so fishing fleets maximize profit by maximizing revenue.

| Price of fish (per pound) | Quantity of fish demanded (pounds) |

|---|---|

| $17 | 1,800 |

| 16 | 2,000 |

| 15 | 2,100 |

| 14 | 2,200 |

| 12 | 2,300 |

- a. If both fishing fleets collude, what is the revenue-

maximizing output for the North Atlantic fishery? What price will a pound of fish sell for? - b. If both fishing fleets collude and share the output equally, what is the revenue to the EU fleet? To the U.S. fleet?

- c. Suppose the EU fleet cheats by expanding its own catch by 100 pounds per week. The U.S. fleet doesn’t change its catch. What is the revenue to the U.S. fleet? To the EU fleet?

- d. In retaliation for the cheating by the EU fleet, the U.S. fleet also expands its catch by 100 pounds per week. What is the revenue to the U.S. fleet? To the EU fleet?

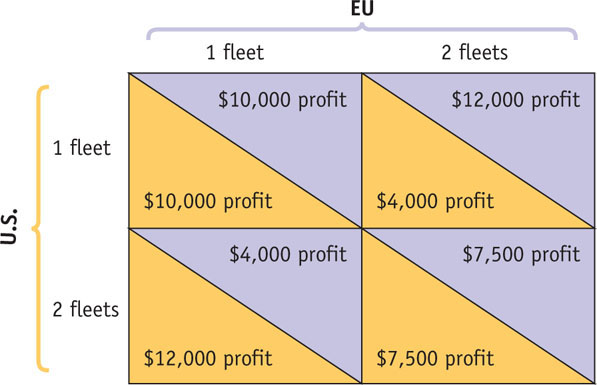

5.Suppose that the fisheries agreement in Problem 4 breaks down, so that the fleets behave noncooperatively. Assume that the United States and the EU each can send out either one or two fleets. The more fleets in the area, the more fish they catch in total but the lower the catch of each fleet. The accompanying matrix shows the profit (in dollars) per week earned by the two sides.

- a. What is the noncooperative Nash equilibrium? Will each side choose to send out one or two fleets?

- b. Suppose that the fish stocks are being depleted. Each region considers the future and comes to a tit-

for- tat agreement whereby each side will send only one fleet out as long as the other does the same. If either of them breaks the agreement and sends out a second fleet, the other will also send out two and will continue to do so until its competitor sends out only one fleet. If both play this tit- for- tat strategy, how much profit will each make every week?

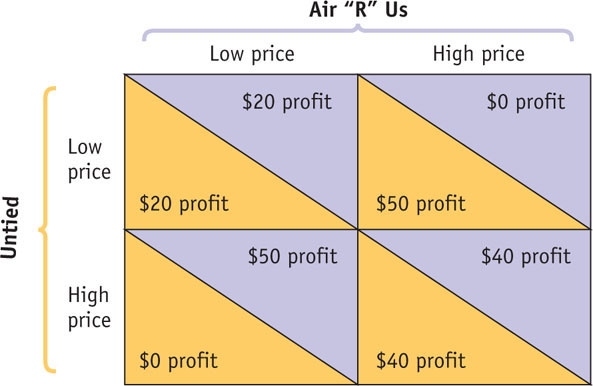

6.Untied and Air “R” Us are the only two airlines operating flights between Collegeville and Bigtown. That is, they operate in a duopoly. Each airline can charge either a high price or a low price for a ticket. The accompanying matrix shows their payoffs, in profits per seat (in dollars), for any choice that the two airlines can make.

- a. Suppose the two airlines play a one-

shot game— that is, they interact only once and never again. What will be the Nash equilibrium in this one- shot game? - b. Now suppose the two airlines play this game twice. And suppose each airline can play one of two strategies: it can play either “always charge the low price” or “tit for tat”—that is, start off charging the high price in the first period, and then in the second period do whatever the other airline did in the previous period. Write down the payoffs to Untied from the following four possibilities:

- i. Untied plays always charge the low price when Air “R” Us also plays always charge the low price.

- ii. Untied plays always charge the low price when Air “R” Us plays tit for tat.

- iii. Untied plays tit for tat when Air “R” Us plays always charge the low price.

- iv. Untied plays tit for tat when Air “R” Us also plays tit for tat.

7.Suppose that Coke and Pepsi are the only two producers of cola drinks, making them duopolists. Both companies have zero marginal cost and a fixed cost of $100,000.

- a. Assume first that consumers regard Coke and Pepsi as perfect substitutes. Currently both are sold for $0.20 per can, and at that price each company sells 4 million cans per day.

- i. How large is Pepsi’s profit?

- ii. If Pepsi were to raise its price to $0.30 cents per can, and Coke did not respond, what would happen to Pepsi’s profit?

- b. Now suppose that each company advertises to differentiate its product from the other company’s. As a result of advertising, Pepsi realizes that if it raises or lowers its price, it will sell less or more of its product, as shown by the demand schedule in the accompanying table.If Pepsi now were to raise its price to $0.30 per can, what would happen to its profit?

Price of Pepsi (per can) Quantity of Pepsi demanded (millions of cans) $0.10 5 0.20 4 0.30 3 0.40 2 0.50 1 - c. Comparing your answer to part a(i) and to part b, what is the maximum amount Pepsi would be willing to spend on advertising?

8.Philip Morris and R.J. Reynolds spend huge sums of money each year to advertise their tobacco products in an attempt to steal customers from each other. Suppose each year Philip Morris and R.J. Reynolds have to decide whether or not they want to spend money on advertising. If neither firm advertises, each will earn a profit of $2 million. If they both advertise, each will earn a profit of $1.5 million. If one firm advertises and the other does not, the firm that advertises will earn a profit of $2.8 million and the other firm will earn $1 million.

- a. Use a payoff matrix to depict this problem.

- b. Suppose Philip Morris and R.J. Reynolds can write an enforceable contract about what they will do. What is the cooperative solution to this game?

- c. What is the Nash equilibrium without an enforceable contract? Explain why this is the likely outcome.

9.Use the three conditions for monopolistic competition discussed in this section to decide which of the following firms are likely to be operating as monopolistic competitors. If they are not monopolistically competitive firms, are they monopolists, oligopolists, or perfectly competitive firms?

- a. a local band that plays for weddings, parties, and so on

- b. Minute Maid, a producer of individual-

serving juice boxes - c. a dry cleaner in a large metropolitan area

- d. a farmer who produces soybeans

10.You are thinking of setting up a coffee shop. The market structure for coffee shops is monopolistic competition. There are three Starbucks shops, and two other coffee shops very much like Starbucks, in your town already. In order for you to have some degree of market power, you may want to differentiate your coffee shop. Thinking about the three different ways in which products can be differentiated, explain how you would decide whether you should copy Starbucks or whether you should sell coffee in a completely different way.

11.The restaurant business in town is a monopolistically competitive industry in long-

12.The local hairdresser industry has the market structure of monopolistic competition. Your hairdresser boasts that he is making a profit and that if he continues to do so, he will be able to retire in five years. Use a diagram to illustrate your hairdresser’s current situation. Do you expect this to last? In a separate diagram, draw what you expect to happen in the long run. Explain your reasoning.

13.Magnificent Blooms is a florist in a monopolistically competitive industry. It is a successful operation, producing the quantity that minimizes its average total cost and making a profit. The owner also says that at its current level of output, its marginal cost is above marginal revenue. Illustrate the current situation of Magnificent Blooms in a diagram. Answer the following questions by illustrating with a diagram.

- a. In the short run, could Magnificent Blooms increase its profit?

- b. In the long run, could Magnificent Blooms increase its profit?

14.“In both the short run and in the long run, the typical firm in monopolistic competition and a monopolist each make a profit.” Do you agree with this statement? Explain your reasoning.

15.The market for clothes has the structure of monopolistic competition. What impact will fewer firms in this industry have on you as a consumer? Address the following issues:

- a. variety of clothes

- b. differences in quality of service

- c. price

16.For each of the following situations, decide whether advertising is directly informative about the product or simply an indirect signal of its quality. Explain your reasoning.

- a. Star quarterback Peyton Manning drives a Buick in a TV commercial and claims that he prefers it to any other car.

- b. A newspaper ad states, “For sale: 2006 Honda Civic, 160,000 miles, new transmission.”

- c. McDonald’s spends millions of dollars on an advertising campaign that proclaims: “I’m lovin’ it.”

- d. Subway advertises one of its sandwiches by claiming that it contains 6 grams of fat and fewer than 300 calories.

17.In each of the following cases, explain how the advertisement functions as a signal to a potential buyer. Explain what information the buyer lacks that is being supplied by the advertisement and how the information supplied by the advertisement is likely to affect the buyer’s willingness to buy the good.

- a. “Looking for work. Excellent references from previous employers available.”

- b. “Electronic equipment for sale. All merchandise carries a one-

year, no- questions- asked warranty.” - c. “Car for sale by original owner. All repair and maintenance records available.”