1.1 40Factor Markets

WHAT YOU WILL LEARN

How factors of production are traded in factor markets

How factors of production are traded in factor markets

How factor markets determine the factor distribution of income

How factor markets determine the factor distribution of income

How the demand for a factor of production is determined

How the demand for a factor of production is determined

The Economy’s Factors of Production

You may recall that we have already defined a factor of production in the context of the circular-

What are these factors of production, and why do factor prices matter?

The Factors of Production

Economists divide factors of production into four principal classes. The first is labor, the work done by human beings. The second is land, which encompasses resources provided by nature. The third is physical capital—often referred to simply as “capital”—which consists of manufactured resources such as equipment, buildings, tools, and machines. The fourth and final factor of production is human capital, the improvement in labor created by education and knowledge, and embodied in the workforce.

Technological progress has boosted the importance of human capital and made technical sophistication essential to many jobs, thus helping to create the premium for workers with advanced degrees.

Why Factor Prices Matter: The Allocation of Resources

The factor prices determined in factor markets play a vital role in the important process of allocating resources among firms.

Consider the example of Mississippi and Louisiana in the aftermath of Hurricane Katrina, the costliest hurricane ever to hit the U.S. mainland. The states had an urgent need for workers in the building trades—

What ensured that those needed workers actually came? The factor market: the high demand for workers drove up wages. During 2005, the average U.S. wage grew at a rate of around 6%. But in areas heavily affected by Katrina, the average wage during the fall of 2005 grew by 30% more than the national rate, and some areas saw twice that rate of increase. Over time, these higher wages led large numbers of workers with the right skills to move temporarily to these states to do the work.

In other words, the market for a factor of production—

The demand for a factor is a derived demand. It results from (that is, it is derived from) the demand for the output being produced.

In this sense factor markets are similar to goods markets, which allocate goods among consumers. But there are two features that make factor markets special. Unlike in a goods market, demand in a factor market is what we call derived demand. That is, demand for the factor is derived from demand for the firm’s output. The second feature is that factor markets are where most of us get the largest shares of our income (government transfers being the next largest source of income in the economy).

Factor Incomes and the Distribution of Income

Most American families get most of their income in the form of wages and salaries—

The factor distribution of income is the division of total income among land, labor, physical capital, and human capital.

Obviously, then, the prices of factors of production have a major impact on how the economic “pie” is sliced among different groups. For example, a higher wage rate, other things equal, means that a larger proportion of the total income in the economy goes to people who derive their income from labor and less goes to those who derive their income from physical capital, land, or human capital. Economists refer to how the economic pie is sliced as the “distribution of income.” Specifically, factor prices determine the factor distribution of income—how the total income of the economy is divided among labor, land, physical capital, and human capital.

As the following Economics in Action explains, the factor distribution of income in the United States has been quite stable over the past few decades. In other times and places, however, large changes have taken place in the factor distribution. One notable example: during the Industrial Revolution, the share of total income earned by landowners fell sharply, while the share earned by physical capital owners rose.

THE FACTOR DISTRIBUTION OF INCOME IN THE UNITED STATES

When we talk about the factor distribution of income, what are we talking about in practice?

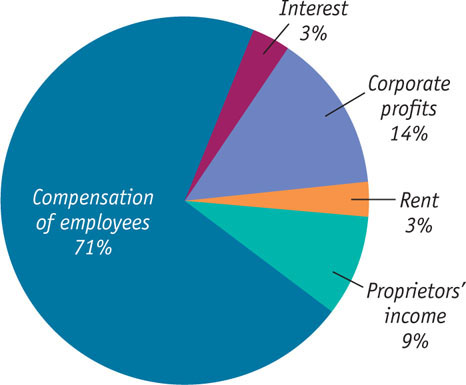

In the United States, as in all advanced economies, payments to labor account for most of the economy’s total income. Figure 40-1 shows the factor distribution of income in the United States in 2012: in that year, 71% of total income in the economy took the form of “compensation of employees”—a number that includes both wages and benefits such as health insurance. This number is in line with historical standards (it was 72.2% in 1972 and 70.4% in 2007), and reflects the fact that the economy has begun to rebound from the high unemployment and reduced wages for many American employees in the recent recession.

FIGURE40-1Factor Distribution of Income in the United States in 2012

However, measured wages and benefits don’t capture the full income of “labor” because a significant fraction of total income in the United States (usually 7 to 10%) is “proprietors’ income”—the earnings of people who own their own businesses. Part of that income should be considered wages these business owners pay themselves. So the true share of labor in the economy is probably a few percentage points higher than the reported “compensation of employees” share.

But much of what we call compensation of employees is really a return on human capital. A surgeon isn’t just supplying the services of a pair of ordinary hands (at least the patient hopes not!): that individual is also supplying the result of many years and hundreds of thousands of dollars invested in training and experience. We can’t directly measure what fraction of wages is really a payment for education and training, but many economists believe that human capital has become the most important factor of production in modern economies.

Marginal Productivity and Factor Demand

All economic decisions are about comparing costs and benefits—

Although there are some important exceptions, most factor markets in the modern American economy are perfectly competitive. This means that most buyers and sellers of factors are price-

Value of the Marginal Product

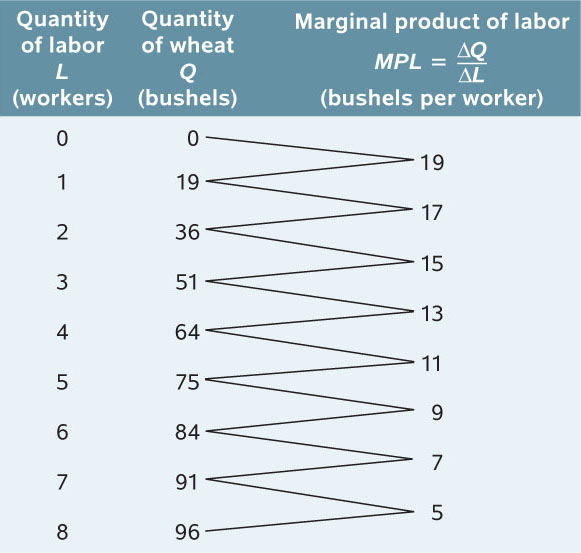

Figure 40-2 reproduces Figures 21-1 and 21-2, which show the production function for wheat on George and Martha’s farm. Panel (a) of Figure 40-2 uses the total product curve to show how total wheat production depends on the number of workers employed on the farm; panel (b) shows how the marginal product of labor, the increase in output from employing one more worker, depends on the number of workers employed. Table 40-1 shows the numbers behind the figure. Note: sometimes the marginal product (MP) is called the marginal product of labor, or MPL.

FIGURE40-2The Production Function for George and Martha’s Farm

40-1

Employment and Output for George and Martha∈s Farm

If workers are paid $200 each and wheat sells for $20 per bushel, how many workers should George and Martha employ to maximize profit?

Earlier we showed how to answer this question in several steps. First, we used information from the production function to derive the firm’s total cost and its marginal cost. Then we used the price-

As you might have guessed, marginal analysis provides a more direct way to find the number of workers that maximizes a firm’s profit. This alternative approach is just a different way of looking at the same thing. But it gives us more insight into the demand for factors as opposed to the supply of goods.

To see how this alternative approach works, suppose that George and Martha are deciding whether to employ another worker. The increase in cost from employing another worker is the wage rate, W. The benefit to George and Martha from employing another worker is the value of the extra output that worker can produce. What is this value? It is the marginal product of labor, MPL, multiplied by the price per unit of output, P. This amount—

The value of the marginal product of a factor is the value of the additional output generated by employing one more unit of that factor.

So should George and Martha hire another worker? Yes, if the value of the extra output is more than the cost of the additional worker—

The hiring decision is made using marginal analysis, by comparing the marginal benefit from hiring another worker (VMPL) with the marginal cost (W). And as with any decision that is made on the margin, the optimal choice is made by equating marginal benefit with marginal cost (or if they’re never equal, by continuing to hire until the marginal cost of one more unit would exceed the marginal benefit). That is, to maximize profit, George and Martha will employ workers up to the point at which, for the last worker employed,

This rule doesn’t apply only to labor; it applies to any factor of production. The value of the marginal product of any factor is its marginal product times the price of the good it produces. The general rule is that a profit-

This rule is consistent with our previous analysis. We saw that a profit-

Now let’s look more closely at why choosing the level of employment to equate VMPL and W works, and at how it helps us understand factor demand.

Value of the Marginal Product and Factor Demand

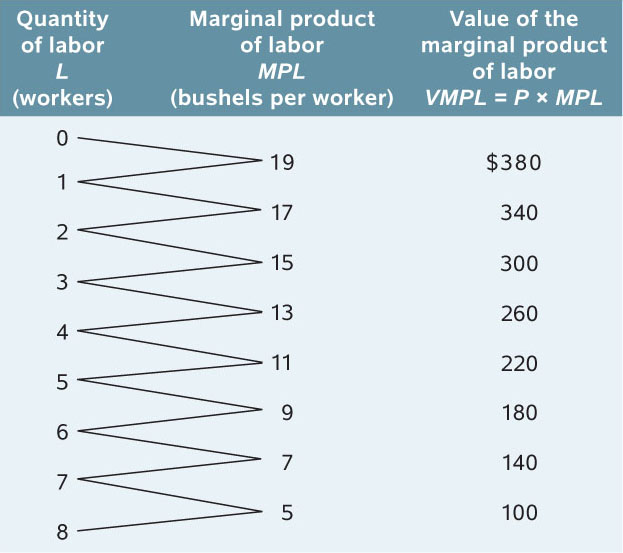

Table 40-2 shows the value of the marginal product of labor on George and Martha’s farm when the price of wheat is $20 per bushel. In Figure 40-3, the horizontal axis shows the number of workers employed; the vertical axis measures the value of the marginal product of labor and the wage rate. The curve shown is the value of the marginal product curve of labor. This curve, like the marginal product of labor curve, slopes downward because of diminishing returns to labor in production. That is, the value of the marginal product of each worker is less than that of the preceding worker because the marginal product of each worker is less than that of the preceding worker.

40-2

Value of the Marginal Product of Labor for George and Martha's Farm

FIGURE40-3The Value of the Marginal Product Curve

The value of the marginal product curve of a factor shows how the value of the marginal product of that factor depends on the quantity of the factor employed.

We have just seen that to maximize profit, George and Martha hire workers until the wage rate is equal to the value of the marginal product of the last worker employed. Let’s use the example to see how this principle really works. Assume that George and Martha currently employ 3 workers and that these workers must be paid the market wage rate of $200. Should they employ an additional worker?

Looking at Table 40-2, we see that if George and Martha currently employ 3 workers, the value of the marginal product of an additional worker is $260. So if they employ an additional worker, they will increase the value of their production by $260 but increase their cost by only $200, yielding an increased profit of $60. In fact, a firm can always increase profit by employing one more unit of a factor of production as long as the value of the marginal product produced by that unit exceeds the factor price.

Alternatively, suppose that George and Martha employ 8 workers. By reducing the number of workers to 7, they can save $200 in wages. In addition, the value of the marginal product of the 8th worker is only $100. So, by reducing employment by one worker, they can increase profit by $200 − $100 = $100. In other words, a firm can always increase profit by employing one less unit of a factor of production as long as the value of the marginal product produced by that unit is less than the factor price.

Using this method, we can see from Table 40-2 that the profit-

But George and Martha should not hire more than 5 workers: the value of the marginal product of the 6th worker is only $180, $20 less than the cost of that worker. So, to maximize profit, George and Martha should employ workers up to but not beyond the point at which the value of the marginal product of the last worker employed is equal to the wage rate.

Now look again at the value of the marginal product curve in Figure 40-3. To determine the profit-

In this example, George and Martha have a small farm in which the potential employment level varies from 0 to 8 workers, and they hire workers up to the point at which the value of the marginal product of another worker would fall below the wage rate.

For a larger farm with many employees, the value of the marginal product of labor falls only slightly when an additional worker is employed. As a result, there will be some worker whose value of the marginal product almost exactly equals the wage rate. (In keeping with the George and Martha example, this means that some worker generates a value of the marginal product of approximately $200.) In this case, the firm maximizes profit by choosing a level of employment at which the value of the marginal product of the last worker hired equals (to a very good approximation) the wage rate.

In the interest of simplicity, we will assume from now on that firms use this rule to determine the profit-

Shifts of the Factor Demand Curve

As in the case of ordinary demand curves, it is important to distinguish between movements along the factor demand curve and shifts of the factor demand curve. What causes factor demand curves to shift? There are three main causes:

- Changes in the prices of goods

- Changes in the supply of other factors

- Changes in technology

1. Changes in the Prices of GoodsRemember that factor demand is derived demand: if the price of the good that is produced with a factor changes, so will the value of the marginal product of the factor. That is, in the case of labor demand, if P changes, VMPL = P × MPL will change at any given level of employment.

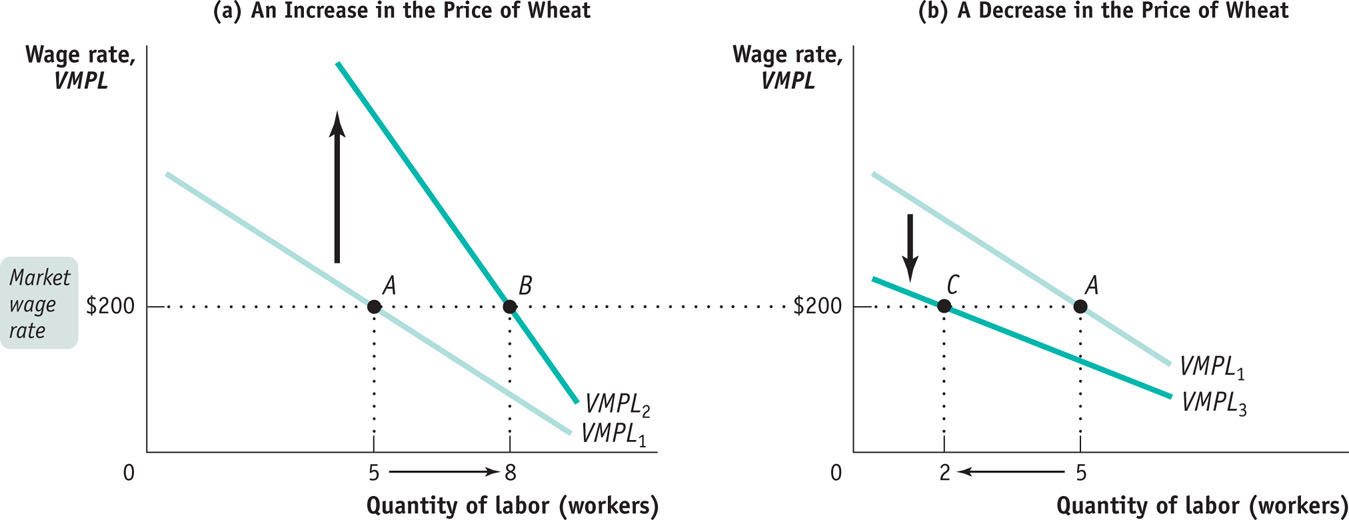

Figure 40-4 illustrates the effects of changes in the price of wheat, assuming that $200 is the current wage rate. Panel (a) shows the effect of an increase in the price of wheat. This shifts the value of the marginal product of labor curve upward because VMPL rises at any given level of employment. If the wage rate remains unchanged at $200, the optimal point moves from point A to point B: the profit-

FIGURE40-4Shifts of the Value of the Marginal Product Curve

Panel (b) shows the effect of a decrease in the price of wheat. This shifts the value of the marginal product of labor curve downward. If the wage rate remains unchanged at $200, the optimal point moves from point A to point C: the profit-

2. Changes in the Supply of Other FactorsSuppose that George and Martha acquire more land to cultivate—

3. Changes in TechnologyIn general, the effect of technological progress on the demand for any given factor can go either way: improved technology can either increase or decrease the demand for a given factor of production.

How can technological progress decrease factor demand? Consider horses, which were once an important factor of production. The development of substitutes for horse power, such as automobiles and tractors, greatly reduced the demand for horses.

The usual effect of technological progress, however, is to increase the demand for a given factor, often because it raises the marginal product of the factor. In particular, although there have been persistent fears that machinery would reduce the demand for labor, over the long run the U.S. economy has seen both large wage increases and large increases in employment, suggesting that technological progress has greatly increased labor demand.

40

Solutions appear at the back of the book.

Check Your Understanding

1. Suppose that the government places price controls on the market for college professors, imposing a wage that is lower than the market wage. Describe the effect of this policy on the production of college degrees. What sectors of the economy do you think would be adversely affected by this policy? What sectors of the economy might benefit?

-

2 a. Suppose service industries, such as retailing and banking, experience an increase in demand. These industries use relatively more labor than nonservice industries. Does the demand curve for labor shift to the right, shift to the left, or remain unchanged?

The demand curve for labor shifts to the right. -

b. Suppose diminishing fish populations off the coast of Maine lead to policies restricting the use of the most productive types of nets in that area. The result is a decrease in the number of fish caught per day by commercial fishers in Maine. The price of fish is unaffected. Does the demand curve for fishers in Maine shift to the right, shift to the left, or remain unchanged?

The demand curve for labor shifts to the left.

Multiple-

Question

1. Which of the following is an example of physical capital?

| A. |

| B. |

| C. |

| D. |

| E. |

Question

2. Which of the following can shift the factor demand curve to the right?

I. an increase in the price of the good being produced

II. an increase in the factor’s marginal productivity

III. a technological advance

| A. |

| B. |

| C. |

| D. |

| E. |

Question

3. Factor market demand is called a derived demand because it

| A. |

| B. |

| C. |

| D. |

| E. |

Question

4. Which factor of production receives the largest portion of income in the United States?

| A. |

| B. |

| C. |

| D. |

| E. |

Question

5. The individual firm’s demand curve for labor is

| A. |

| B. |

| C. |

| D. |

| E. |

Critical-

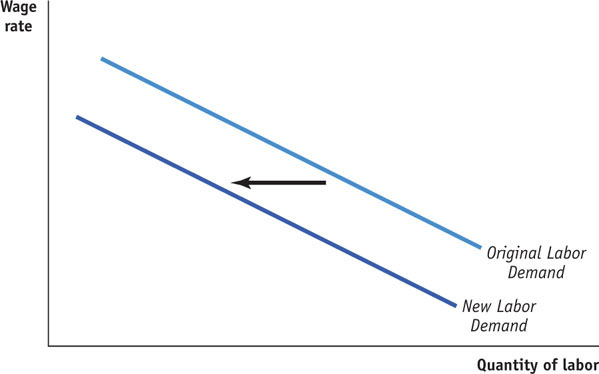

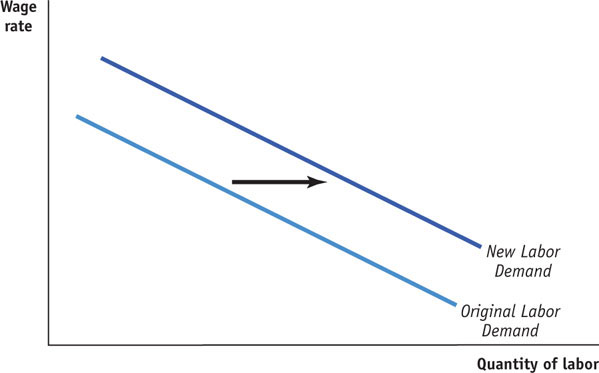

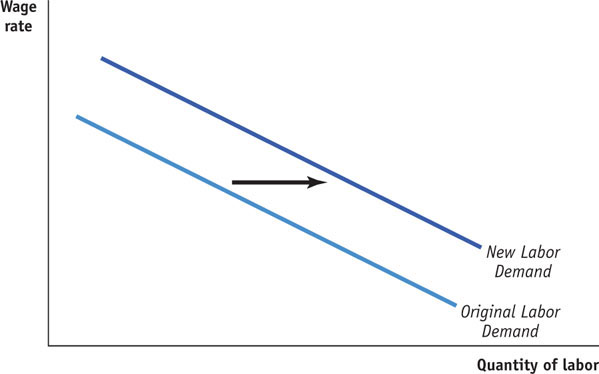

Draw three separate, correctly labeled graphs illustrating the effect of each of the following changes on the demand for labor. Adopt the usual ceteris paribus assumption that all else remains unchanged in each case.

- a. The price of the product being produced decreases.

- b. Worker productivity increases.

- c. Firms invest in more capital to be used by workers.

1.

2.

3.

WHAT IS A FACTOR, ANYWAY?

Imagine a business that produces shirts. The business will make use of workers and machines—

Imagine a business that produces shirts. The business will make use of workers and machines—

No: labor and physical capital are factors of production, but cloth and electricity are not. The key distinction is that a factor of production earns income from the selling of its services over and over again but an input cannot. For example, a worker earns income over time from repeatedly selling his or her efforts; the owner of a machine earns income over time from repeatedly selling the use of that machine. So a factor of production, such as labor and physical capital, represents an enduring source of income. An input like electricity or cloth, however, is used up in the production process. Once exhausted, it cannot be a source of future income for its owner.

No: labor and physical capital are factors of production, but cloth and electricity are not. The key distinction is that a factor of production earns income from the selling of its services over and over again but an input cannot. For example, a worker earns income over time from repeatedly selling his or her efforts; the owner of a machine earns income over time from repeatedly selling the use of that machine. So a factor of production, such as labor and physical capital, represents an enduring source of income. An input like electricity or cloth, however, is used up in the production process. Once exhausted, it cannot be a source of future income for its owner.

To learn more, see the discussion on pages 424–