1.3 23Long-Run Costs and Economies of Scale

WHAT YOU WILL LEARN

Why a firm’s costs may differ in the short run versus the long run

Why a firm’s costs may differ in the short run versus the long run

How the firm’s technology of production can generate increasing returns to scale

How the firm’s technology of production can generate increasing returns to scale

Up to this point, we have treated fixed cost as completely outside the control of a firm because we have focused on the short run. But all inputs are variable in the long run: this means that in the long run, even “fixed cost” may change. In the long run, in other words, a firm’s fixed cost becomes a variable it can choose. For example, given time, Selena’s Gourmet Salsas can acquire additional food-

Short-Run versus Long-Run Costs

Let’s begin by supposing that Selena’s Gourmet Salsas is considering whether to acquire additional food-

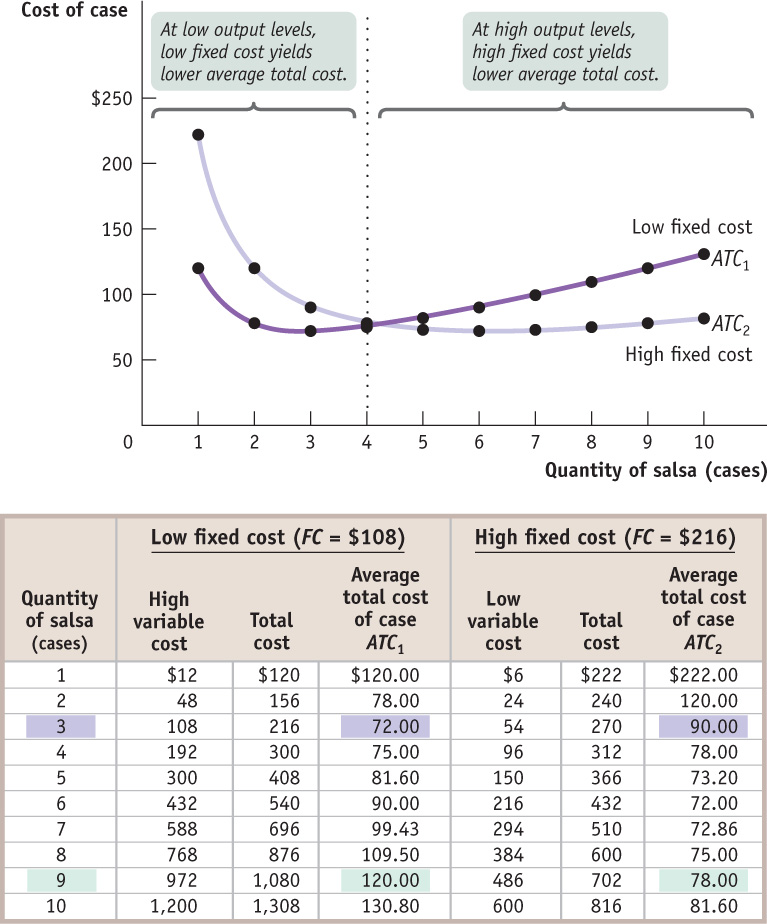

The table in Figure 23-1 shows how acquiring an additional machine affects costs. In our original example, we assumed that Selena’s Gourmet Salsas had a fixed cost of $108. The left half of the table shows variable cost as well as total cost and average total cost assuming a fixed cost of $108. The average total cost curve for this level of fixed cost is given by ATC1 in Figure 23-1. Let’s compare that to a situation in which the firm buys additional food-

FIGURE23-1Choosing the Level of Fixed Cost for Selena’s Gourmet Salsas

From the figure you can see that when output is small, 4 cases of salsa per day or fewer, average total cost is smaller when Selena forgoes the additional equipment and maintains the lower fixed cost of $108: ATC1 lies below ATC2. For example, at 3 cases per day, average total cost is $72 without the additional machinery and $90 with the additional machinery. But as output increases beyond 4 cases per day, the firm’s average total cost is lower if it acquires the additional equipment, raising its fixed cost to $216. For example, at 9 cases of salsa per day, average total cost is $120 when fixed cost is $108 but only $78 when fixed cost is $216.

Why does average total cost change like this when fixed cost increases? When output is low, the increase in fixed cost from the additional equipment outweighs the reduction in variable cost from higher worker productivity—

In general, for each output level there is some choice of fixed cost that minimizes the firm’s average total cost for that output level. So when the firm has a desired output level that it expects to maintain over time, it should choose the optimal fixed cost for that level—

Now that we are studying a situation in which fixed cost can change, we need to take time into account when discussing average total cost. All of the average total cost curves we have considered until now are defined for a given level of fixed cost—

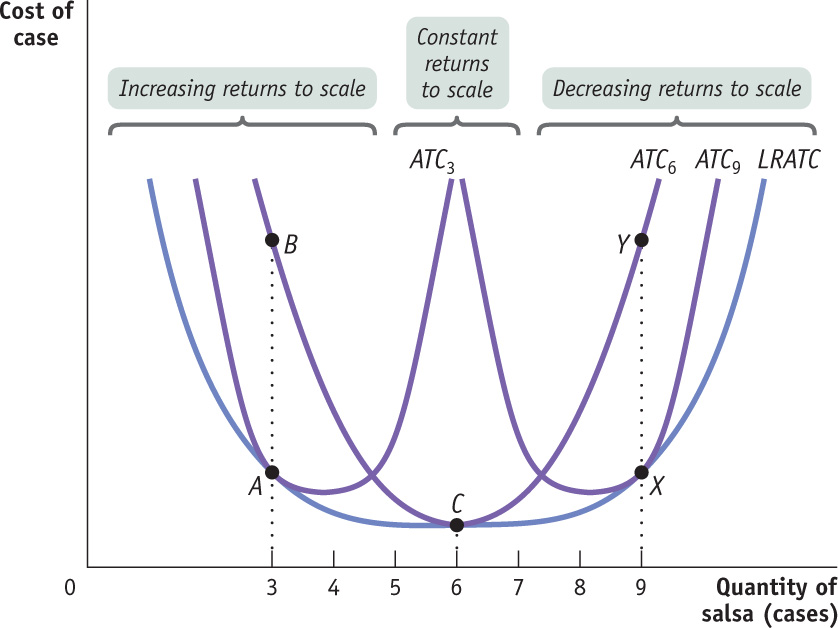

For most firms, it is realistic to assume that there are many possible choices of fixed cost, not just two. The implication: for such a firm, many possible short-

At any given time, a firm will find itself on one of its short-

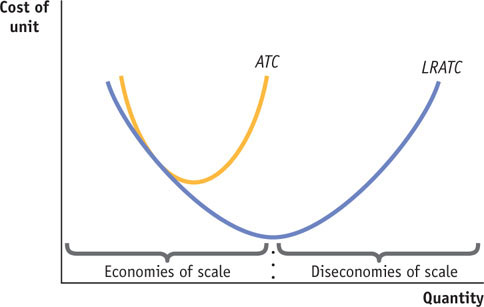

The long-

Suppose we do a thought experiment and calculate the lowest possible average total cost that can be achieved for each output level if the firm were to choose its fixed cost for each output level. Economists have given this thought experiment a name: the long-

FIGURE23-2Short-Run and Long-Run Average Total Cost Curves

We can now draw the distinction between the short run and the long run more fully. In the long run, when a producer has had time to choose the fixed cost appropriate for its desired level of output, that producer will be at some point on the long-

Figure 23-2 illustrates this point. The curve ATC3 shows short-

Suppose that Selena initially chose to be on ATC6. If she actually produces 6 cases of salsa per day, her firm will be at point C on both its short-

Suppose, conversely, that Selena ends up producing 9 cases per day even though she initially chose to be on ATC6. In the short run her average total cost is indicated by point Y on ATC6. But she would be better off purchasing more equipment and incurring a higher fixed cost in order to reduce her variable cost and move to ATC9. This would allow her to reach point X on the long-

The distinction between short-

Returns to Scale

What determines the shape of the long-

There are increasing returns to scale when long-

There are decreasing returns to scale when long-

There are increasing returns to scale (also known as economies of scale) when long-

There are constant returns to scale when long-

For Selena’s Gourmet Salsas, decreasing returns to scale occur at output levels greater than 7 cases, the output levels over which its long-

What explains these scale effects in production? The answer ultimately lies in the firm’s technology of production. Economies of scale often arise from the increased specialization that larger output levels allow—

THERE’S NO BUSINESS LIKE SNOW BUSINESS

Anyone who has lived both in a snowy city, like Chicago, and in a city that only occasionally experiences significant snowfall, like Washington, D.C., is aware of the differences in total cost that arise from making different choices about fixed cost.

In Washington, even a minor snowfall—

In this sense Washington and Chicago are like two producers who expect to produce different levels of output, where the “output” is snow removal. Washington, which rarely has significant snow, has chosen a low level of fixed cost in the form of snow-

Diseconomies of scale—

And when there are constant returns to scale, scale has no effect on a firm’s long-

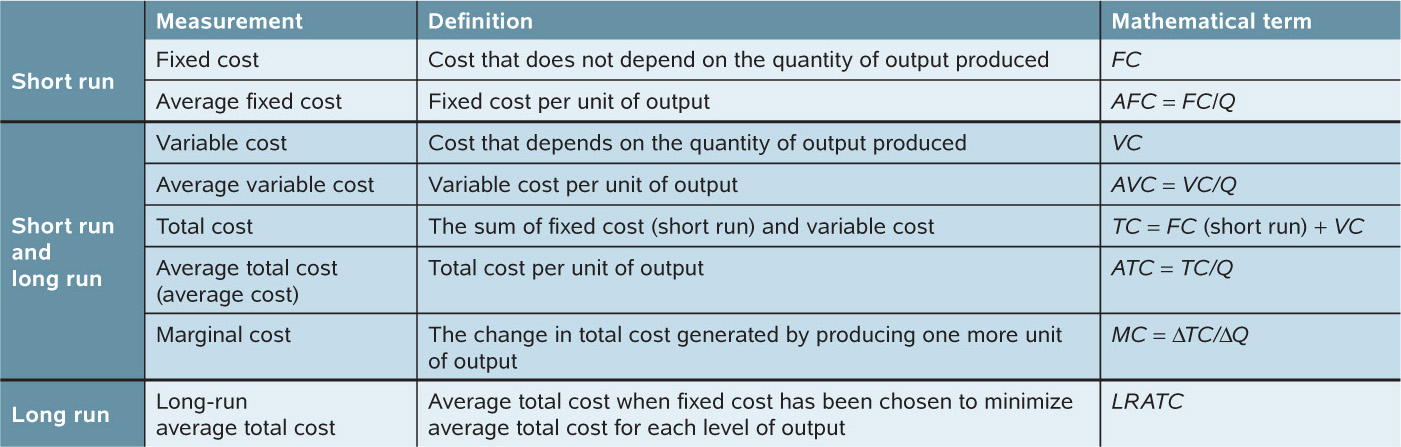

Summing Up Costs: The Short and Long of It

If a firm is to make the best decisions about how much to produce, it has to understand how its costs relate to the quantity of output it chooses to produce. Table 23-1 provides a quick summary of the concepts and measures of cost you have learned about.

23-1

Concepts and Measures of Cost

23

Solutions appear at the back of the book.

Check Your Understanding

1. The accompanying table shows three possible combinations of fixed cost and average variable cost. Average variable cost is constant in this example. (It does not vary with the quantity of output produced.)

| Choice | Fixed cost | Average variable cost |

|---|---|---|

| 1 | $8,000 | $1.00 |

| 2 | 12,000 | 0.75 |

| 3 | 24,000 | 0.25 |

-

a. For each of the three choices, calculate the average total cost of producing 12,000, 22,000, and 30,000 units. For each of these quantities, which choice results in the lowest average total cost?

The accompanying table shows the average total cost of producing 12,000, 22,000, and 30,000 units for each of the three choices of fixed cost. For example, if the firm makes choice 1, the total cost of producing 12,000 units of output is $8,000 + 12,000 × $1.00 = $20,000. The average total cost of producing 12,000 units of output is therefore $20,000/12,000 = $1.67. The other average total costs are calculated similarly.12,000 units 22,000 units 30,000 units Average total cost from choice 1 $1.67 $1.36 $1.27 Average total cost from choice 2 1.75 1.30 1.15 Average total cost from choice 3 2. 25 1.34 1.05

So if the firm wanted to produce 12,000 units, it would make choice 1 because this gives it the lowest average total cost. If it wanted to produce 22,000 units, it would make choice 2. If it wanted to produce 30,000 units, it would make choice 3. -

b. Suppose that the firm, which has historically produced 12,000 units, experiences a sharp, permanent increase in demand that leads it to produce 22,000 units. Explain how its average total cost will change in the short run and in the long run.

Having historically produced 12,000 units, the firm would have adopted choice 1. When producing 12,000 units, the firm would have had an average total cost of $1.67. When output jumps to 22,000 units, the firm cannot alter its choice of fixed cost in the short run, so its average total cost in the short run will be $1.36. In the long run, however, it will adopt choice 2, making its average total cost fall to $1.30. -

c. Explain what the firm should do instead if it believes the change in demand is temporary.

If the firm believes that the increase in demand is temporary, it should not alter its fixed cost from choice 1 because choice 2 generates higher average total cost as soon as output falls back to its original quantity of 12,000 units: $1.75 versus $1.67.

2. In each of the following cases, explain whether the firm is likely to experience economies of scale or diseconomies of scale and why.

-

a. an interior design firm in which design projects are based on the expertise of the firm’s owner

This firm is likely to experience diseconomies of scale. As the firm takes on more projects, the costs of communication and coordination required to implement the exper tise of the firm’s owner are likely to increase. -

b. a diamond-

mining company This firm is likely to experience economies of scale. Because diamond mining requires a large initial setup cost for excavation equipment, long-run average total cost will fall as output increases.

Multiple-

Question

1. In the long run,

| A. |

| B. |

| C. |

| D. |

| E. |

Question

2. Which of the following is always considered the long run?

| A. |

| B. |

| C. |

| D. |

| E. |

Question

3. Which of the following statements is generally correct?

I. The long-

II. The short-

III. Firms tend to experience economies of scale at low levels of production and diseconomies of scale at high levels of production.

| A. |

| B. |

| C. |

| D. |

| E. |

Question

4. A firm is at the minimum of its short run average cost curve, but also experiencing diseconomies of scale. A permanent increase in output will:

| A. |

| B. |

| C. |

| D. |

| E. |

Question

5. Economies of scale will allow which of the following types of cities to lower their average total cost of clearing snow by investing in larger snow plow fleets? Cities with

| A. |

| B. |

| C. |

| D. |

| E. |

Critical-

Draw a correctly labeled graph showing a short-