The Prisoners’ Dilemma

The reward received by a player in a game, such as the profit earned by an oligopolist, is that player’s payoff.

Game theory deals with any situation in which the reward to any one player—

A payoff matrix shows how the payoff to each of the participants in a two-

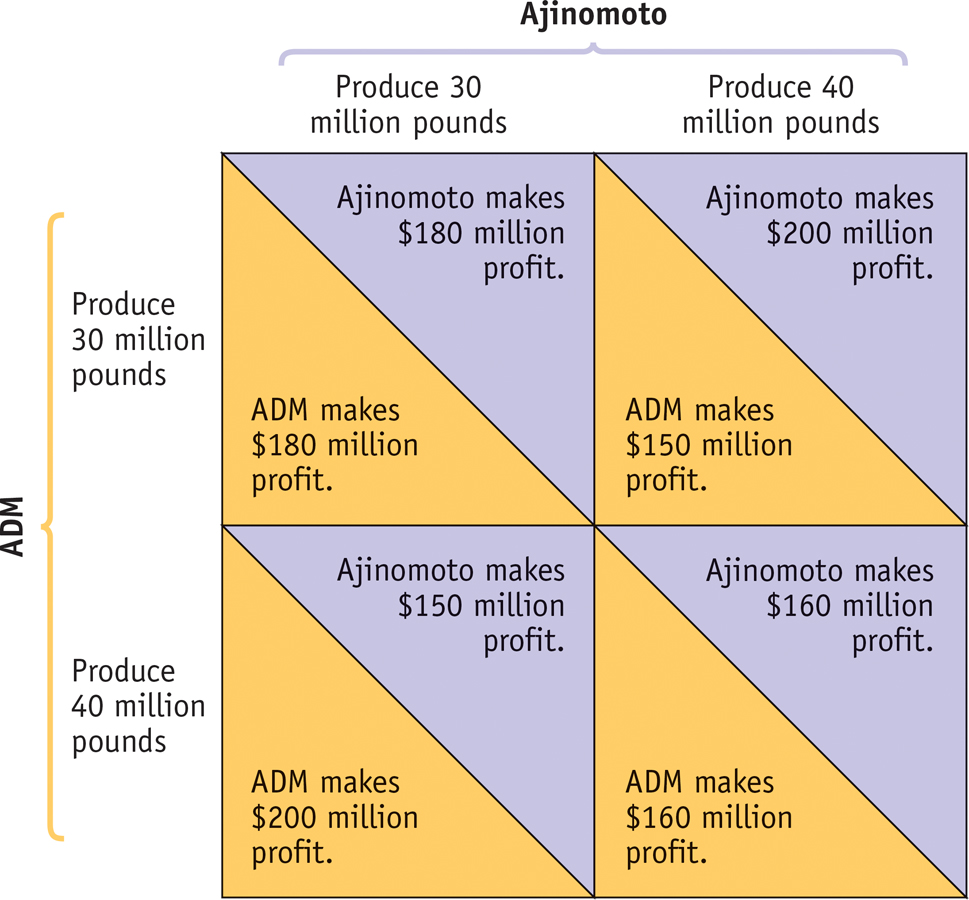

When there are only two players, as in a duopoly, the interdependence between the players can be represented with a payoff matrix like that shown in Figure 14-1. Each row corresponds to an action by one player (in this case, ADM); each column corresponds to an action by the other (in this case, Ajinomoto). For simplicity, let’s assume that ADM can pick only one of two alternatives: produce 30 million pounds of lysine or produce 40 million pounds. Ajinomoto has the same pair of choices.

14-1

A Payoff Matrix

The matrix contains four boxes, each divided by a diagonal line. Each box shows the payoff to the two firms that results from a pair of choices; the number below the diagonal shows ADM’s profits, the number above the diagonal shows Ajinomoto’s profits.

These payoffs show what we concluded from our earlier analysis: the combined profit of the two firms is maximized if they each produce 30 million pounds. Either firm can, however, increase its own profits by producing 40 million pounds while the other produces only 30 million pounds. But if both produce the larger quantity, both will have lower profits than if they had both held their output down.

Prisoners’ dilemma is a game based on two premises: (1) Each player has an incentive to choose an action that benefits itself at the other player’s expense (2) When both players act in this way, both are worse off than if they had acted cooperatively.

The particular situation shown here is a version of a famous—

Each player has an incentive, regardless of what the other player does, to cheat—

to take an action that benefits it at the other’s expense. When both players cheat, both are worse off than they would have been if neither had cheated.

The original illustration of the prisoners’ dilemma occurred in a fictional story about two accomplices in crime—

So the police put the miscreants in separate cells and say the following to each: “Here’s the deal: if neither of you confesses, you know that we’ll send you to jail for 5 years. If you confess and implicate your partner, and she doesn’t do the same, we’ll reduce your sentence from 5 years to 2. But if your partner confesses and you don’t, you’ll get the maximum 20 years. And if both of you confess, we’ll give you both 15 years.”

Figure 14-2 shows the payoffs that face the prisoners, depending on the decision of each to remain silent or to confess. (Usually the payoff matrix reflects the players’ payoffs, and higher payoffs are better than lower payoffs. This case is an exception: a higher number of years in prison is bad, not good!) Let’s assume that the prisoners have no way to communicate and that they have not sworn an oath not to harm each other or anything of that sort. So each acts in her own self-

14-2

The Prisoners’ Dilemma

An action is a dominant strategy when it is a player’s best action regardless of the action taken by the other player.

The answer is clear: both will confess. Look at it first from Thelma’s point of view: she is better off confessing, regardless of what Louise does. If Louise doesn’t confess, Thelma’s confession reduces her own sentence from 5 years to 2. If Louise does confess, Thelma’s confession reduces her sentence from 20 to 15 years. Either way, it’s clearly in Thelma’s interest to confess. And because she faces the same incentives, it’s clearly in Louise’s interest to confess, too. To confess in this situation is a type of action that economists call a dominant strategy. An action is a dominant strategy when it is the player’s best action regardless of the action taken by the other player.

It’s important to note that not all games have a dominant strategy—

PITFALLS: PLAYING FAIR IN THE PRISONERS’ DILEMMA

PLAYING FAIR IN THE PRISONERS’ DILEMMA

One common reaction to the prisoners’ dilemma is to assert that it isn’t really rational for either prisoner to confess. Thelma wouldn’t confess because she’d be afraid Louise would beat her up, or Thelma would feel guilty because Louise wouldn’t do that to her.

But this kind of answer is, well, cheating—

Luckily, when it comes to oligopoly, it’s a lot easier to believe that the firms care only about their profits. There is no indication that anyone at ADM felt either fear of or affection for Ajinomoto, or vice versa; it was strictly about business.

So if each prisoner acts rationally in her own interest, both will confess. Yet if neither of them had confessed, both would have received a much lighter sentence! In a prisoners’ dilemma, each player has a clear incentive to act in a way that hurts the other player—

A Nash equilibrium, also known as a noncooperative equilibrium, results when each player in a game chooses the action that maximizes his or her payoff given the actions of other players, ignoring the effects of his or her action on the payoffs received by those other players.

In game theory, this kind of equilibrium, in which each player takes the action that is best for her given the actions taken by other players, and vice versa, is known as a Nash equilibrium, after the mathematician and Nobel laureate John Nash. (Nash’s life was chronicled in the best-

Now look back at Figure 14-1: ADM and Ajinomoto are in the same situation as Thelma and Louise. Each firm is better off producing the higher output, regardless of what the other firm does. Yet if both produce 40 million pounds, both are worse off than if they had followed their agreement and produced only 30 million pounds. In both cases, then, the pursuit of individual self-

Prisoners’ dilemmas appear in many situations. The upcoming For Inquiring Minds describes an example from the days of the Cold War. Clearly, the players in any prisoners’ dilemma would be better off if they had some way of enforcing cooperative behavior—

Prisoners of the Arms Race

Between World War II and the late 1980s, the United States and the Soviet Union were locked in a seemingly endless struggle that never broke out into open war. During this Cold War, both countries spent huge sums on arms, sums that were a significant drain on the U.S. economy and eventually proved a crippling burden for the Soviet Union, whose underlying economic base was much weaker. Yet neither country was ever able to achieve a decisive military advantage.

As many have pointed out, both nations would have been better off if they had both spent less on arms. Yet the arms race continued for 40 years.

Why? As political scientists were quick to notice, one way to explain the arms race was to suppose that the two countries were locked in a classic prisoners’ dilemma. Each government would have liked to achieve decisive military superiority, and each feared military inferiority. But both would have preferred a stalemate with low military spending to one with high spending.

However, each government rationally chose to engage in high spending. If its rival did not spend heavily, its own high spending would lead to military superiority; not spending heavily would lead to inferiority if the other government continued its arms buildup. So the countries were trapped.

The answer to this trap could have been an agreement not to spend as much; indeed, the two sides tried repeatedly to negotiate limits on certain weapons. But these agreements weren’t very effective. In the end the issue was resolved as heavy military spending hastened the collapse of the Soviet Union in 1991.

Unfortunately, the logic of an arms race did not disappear. A nuclear arms race developed between Pakistan and India, two neighboring countries with a history of mutual antagonism. In 1998 both countries confirmed the unrelenting logic of the prisoners’ dilemma by publicly testing nuclear weapons in a tit-

However, by 2013 a glimmer of hope emerged, as the prime ministers of these South Asian nuclear rivals began a series of meetings aimed at making “a new beginning.”

But in the United States an agreement setting the output levels of two oligopolists isn’t just unenforceable, it’s illegal. So it seems that a noncooperative equilibrium is the only possible outcome. Or is it?