Preserved Farmland: An External Benefit

Preserved farmland yields both benefits and costs to society. In the absence of government intervention, the farmer who wants to sell his land incurs all the costs of preservation—

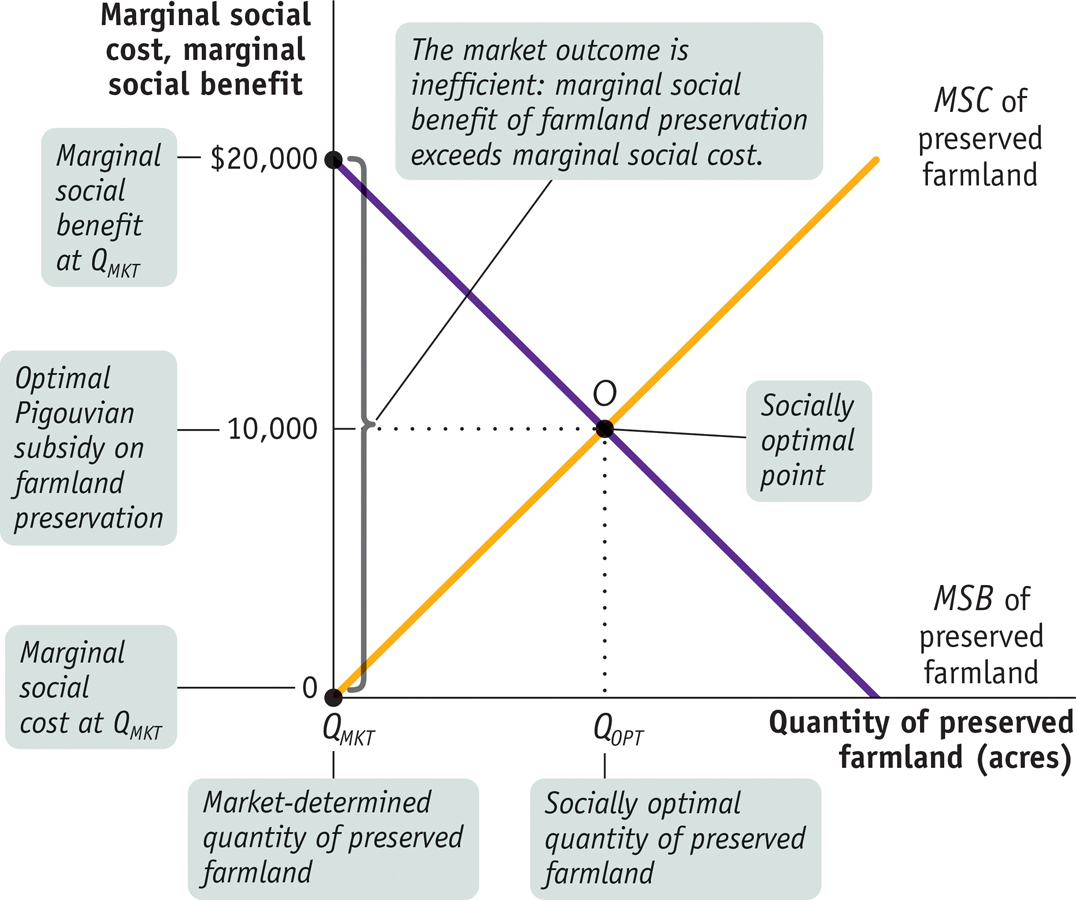

Figure 16-4 illustrates society’s problem. The marginal social cost of preserved farmland, shown by the MSC curve, is the additional cost imposed on society by an additional acre of such farmland. This represents the forgone profits that would have accrued to farmers if they had sold their land to developers. The line is upward sloping because when very few acres are preserved and there is plenty of land available for development, the profit that could be made from selling an acre to a developer is small. But as the number of preserved acres increases and few are left for development, the amount a developer is willing to pay for them, and therefore the forgone profit, increases as well.

16-4

Why a Market Economy Preserves Too Little Farmland

The MSB curve represents the marginal social benefit of preserved farmland. It is the additional benefit that accrues to society—

As Figure 16-4 shows, the socially optimal point, O, occurs when the marginal social cost and the marginal social benefit are equalized—

The market alone will not provide QOPT acres of preserved farmland. Instead, in the market outcome no acres will be preserved; the level of preserved farmland, QMKT, is equal to zero. That’s because farmers will set the marginal social cost of preservation—

Because farmers bear the entire cost of preservation but gain none of the benefits, an inefficiently low quantity of acres will be preserved in the market outcome.

A Pigouvian subsidy is a payment designed to encourage activities that yield external benefits.

This is clearly inefficient because at zero acres preserved, the marginal social benefit of preserving an acre of farmland is $20,000. So how can the economy be induced to produce QOPT acres of preserved farmland, the socially optimal level? The answer is a Pigouvian subsidy: a payment designed to encourage activities that yield external benefits. The optimal Pigouvian subsidy, as shown in Figure 16-4, is equal to the marginal social benefit of preserved farmland at the socially optimal level, QOPT —that is, $10,000 per acre.

So New Jersey voters are indeed implementing the right policy to raise their social welfare—