Factor Incomes and the Distribution of Income

Most American families get most of their income in the form of wages and salaries—

The Factor Distribution of Income and Social Change in the Industrial Revolution

Have you read any novels by Jane Austen? How about Charles Dickens? If you’ve read both, you probably noticed that they seem to be describing quite different societies. Austen’s novels, set in England around 1800, describe a world in which the leaders of society are landowning aristocrats. Dickens, writing about 50 years later, describes an England in which businessmen, especially factory owners, are in control.

This literary shift reflects a dramatic transformation in the factor distribution of income in England at the time. The Industrial Revolution, which took place between the late eighteenth century and the middle of the nineteenth century, changed England from a mainly agricultural country, in which land earned a fairly substantial share of income, to an urbanized and industrial one, in which land rents were dwarfed by capital income. Estimates by the economist Nancy Stokey show that between 1780 and 1850 the share of national income represented by land fell from 20% to 9%, but the share represented by capital rose from 35% to 44%. That shift changed everything—

The factor distribution of income is the division of total income among labor, land, and capital.

Obviously, then, the prices of factors of production have a major impact on how the economic “pie” is sliced among different groups. For example, a higher wage rate, other things equal, means that a larger proportion of the total income in the economy goes to people who derive their income from labor, and less goes to those who derive their income from capital or land. Economists refer to how the economic pie is sliced as the “distribution of income.” Specifically, factor prices determine the factor distribution of income—how the total income of the economy is divided among labor, land, and capital.

As the following Economics in Action explains, the factor distribution of income in the United States has been quite stable over the past few decades. In other times and places, however, large changes have taken place in the factor distribution. One notable example: during the Industrial Revolution, the share of total income earned by English landowners fell sharply, while the share earned by English capital owners rose. As we just learned in the For Inquiring Minds, this shift had a profound effect on society.

!worldview! ECONOMICS in Action: The Factor Distribution of Income in the United States

The Factor Distribution of Income in the United States

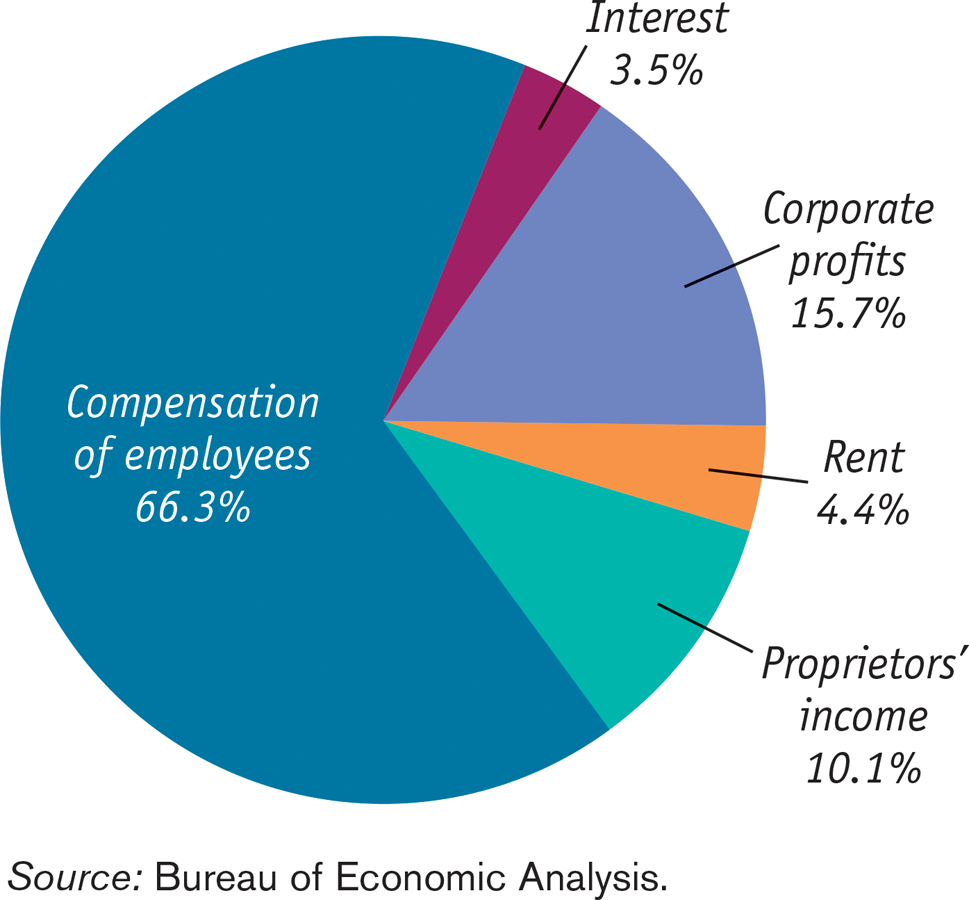

When we talk about the factor distribution of income, what are we talking about in practice? In the United States, as in all advanced economies, payments to labor account for most of the economy’s total income. Figure 19-1 shows the factor distribution of income in the United States in 2013: in that year, 66.3% of total income in the economy took the form of “compensation of employees”—a number that includes both wages and benefits such as health insurance. This number is somewhat low by historical standards (it was 72.1% in 1972 and 70.2% in 2007). It reflects the slow recovery after the Great Recession where unemployment and wages rates have yet to return to pre-

19-1

Factor Distribution of Income in the United States in 2013

However, measured wages and benefits don’t capture the full income of “labor” because a significant fraction of total income in the United States (usually 7 to 10%) is “proprietors’ income”—the earnings of people who own their own businesses. Part of that income should be considered wages these business owners pay themselves. So the true share of labor in the economy is probably a few percentage points higher than the reported “compensation of employees” share.

But much of what we call compensation of employees is really a return on human capital. A surgeon isn’t just supplying the services of a pair of ordinary hands (at least the patient hopes not!): that individual is also supplying the result of many years and hundreds of thousands of dollars invested in training and experience. We can’t directly measure what fraction of wages is really a payment for education and training, but many economists believe that human capital has become the most important factor of production in modern economies.

Quick Review

Economists usually divide the economy’s factors of production into four principal categories: labor, land, physical capital, and human capital.

The demand for a factor is a derived demand. Factor prices, which are set in factor markets, determine the factor distribution of income. Labor receives the bulk—

66% in 2013— of the income in the modern U.S. economy. Although the exact share is not directly measurable, much of what is called compensation of employees is a return to human capital.

19-1

Check Your Understanding

Question 19.1

Suppose that the government places price controls on the market for college professors, imposing a wage that is lower than the market wage. Describe the effect of this policy on the production of college degrees. What sectors of the economy do you think will be adversely affected by this policy? What sectors of the economy might benefit?

Solutions appear at back of book.