Expectations and Uncertainty

The Lee family doesn’t know how big its medical bills will be next year. If all goes well, it won’t have any medical expenses at all. Let’s assume that there’s a 50% chance of that happening. But if family members require hospitalization or expensive drugs, they will face medical expenses of $10,000. Let’s assume that there’s also a 50% chance that these high medical expenses will materialize.

A random variable is a variable with an uncertain future value.

In this example—

The expected value of a random variable is the weighted average of all possible values, where the weights on each possible value correspond to the probability of that value occurring.

A state of the world is a possible future event.

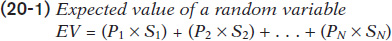

To derive the general formula for the expected value of a random variable, we imagine that there are a number of different states of the world, possible future events. Each state is associated with a different realized value—

Let’s assume that P1 is the probability of state 1, P2 the probability of state 2, and so on. And you know the realized value of the random value in each state of the world: S1 in state 1, S2 in state 2, and so on. Let’s also assume that there are N possible states. Then the expected value of a random variable is:

In the case of the Lee family, there are only two possible states of the world, each with a probability of 0.5.

Notice, however, that the Lee family doesn’t actually expect to pay $5,000 in medical bills next year. That’s because in this example there is no state of the world in which the family pays exactly $5,000. Either the family pays nothing, or it pays $10,000. So the Lees face considerable uncertainty about their future medical expenses.

But what if the Lee family can buy health insurance that will cover its medical expenses, whatever they turn out to be? Suppose, in particular, that the family can pay $5,000 up front in return for full coverage of whatever medical expenses actually arise during the coming year. Then the Lees’ future medical expenses are no longer uncertain for them: in return for $5,000—

Risk is uncertainty about future outcomes. When the uncertainty is about monetary outcomes, it becomes financial risk.

Yes, it would—

But before we study the market for insurance, we need to understand why people feel that risk is a bad thing, an attitude that economists call risk aversion. The source of risk aversion lies in a concept we first encountered in our analysis of consumer demand, back in Chapter 10: diminishing marginal utility.