The Logic of Risk Aversion

To understand how diminishing marginal utility gives rise to risk aversion, we need to look not only at the Lees’ medical costs but also at how those costs affect the income the family has left after medical expenses. Let’s assume the family knows that it will have an income of $30,000 next year. If the family has no medical expenses, it will be left with all of that income. If its medical expenses are $10,000, its income after medical expenses will be only $20,000. Since we have assumed that there is an equal chance of these two outcomes, the expected value of the Lees’ income after medical expenses is (0.5 × $30,000) + (0.5 × $20,000) = $25,000. At times we will simply refer to this as expected income.

Expected utility is the expected value of an individual’s total utility given uncertainty about future outcomes.

But as we’ll now see, if the family’s utility function has the shape typical of most families’, its expected utility—the expected value of its total utility given uncertainty about future outcomes—

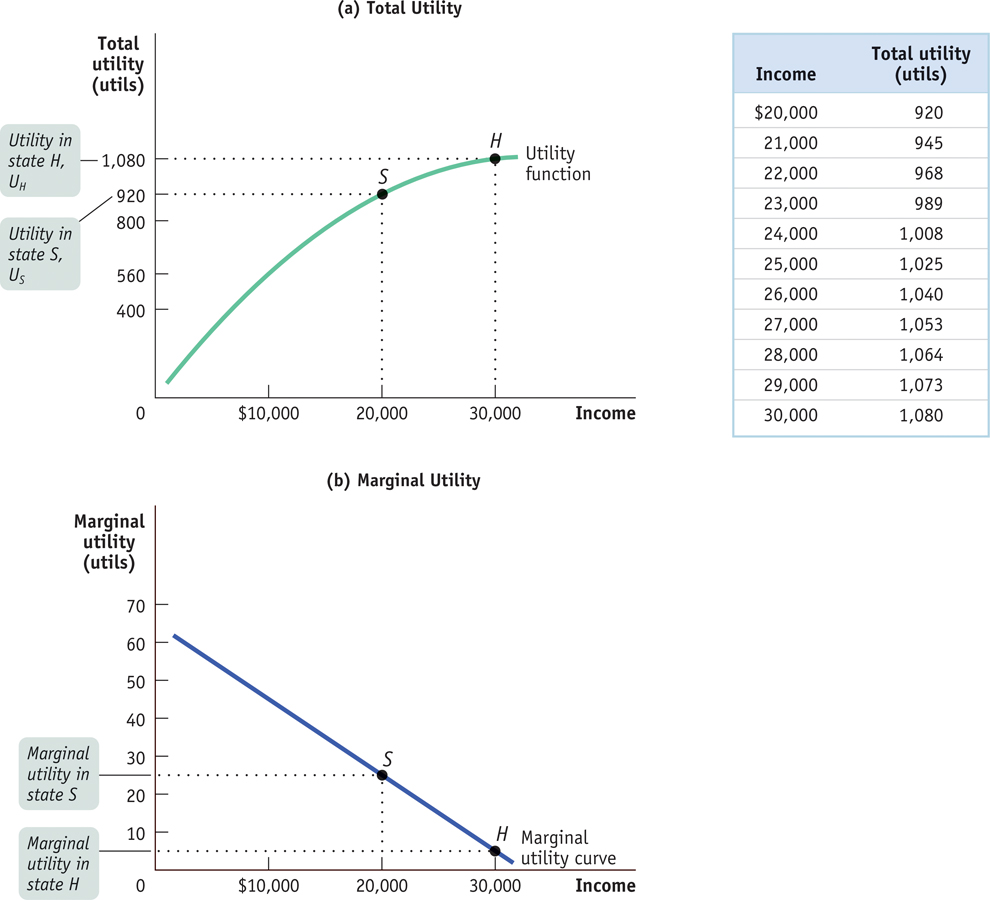

To see why, we need to look at how total utility depends on income. Panel (a) of Figure 20-1 shows a hypothetical utility function for the Lee family, where total utility depends on income—

20-1

The Utility Function and Marginal Utility Curve of a Risk-

In Chapter 10 we applied the principle of diminishing marginal utility to individual goods and services: each successive unit of a good or service that a consumer purchases adds less to his or her total utility. The same principle applies to income used for consumption: each successive dollar of income adds less to total utility than the previous dollar. Panel (b) shows how marginal utility varies with income, confirming that marginal utility of income falls as income rises. As we’ll see in a moment, diminishing marginal utility is the key to understanding the desire of individuals to reduce risk.

To analyze how a person’s utility is affected by risk, economists start from the assumption that individuals facing uncertainty maximize their expected utility. We can use the data in Figure 20-1 to calculate the Lee family’s expected utility. We’ll first do the calculation assuming that the Lees have no insurance, and then we’ll recalculate it assuming that they have purchased insurance.

Without insurance, if the Lees are lucky and don’t incur any medical expenses, they will have an income of $30,000, generating total utility of 1,080 utils. But if they have no insurance and are unlucky, incurring $10,000 in medical expenses, they will have just $20,000 of their income to spend on consumption and total utility of only 920 utils. So without insurance, the family’s expected utility is (0.5 × 1,080) + (0.5 × 920) = 1,000 utils.

A premium is a payment to an insurance company in return for the insurance company’s promise to pay a claim in certain states of the world.

Now let’s suppose that an insurance company offers to pay whatever medical expenses the family incurs during the next year in return for a premium—a payment to the insurance company—

A fair insurance policy is an insurance policy for which the premium is equal to the expected value of the claim.

If the family purchases this fair insurance policy, the expected value of its income available for consumption is the same as it would be without insurance: $25,000—

Reading from the table in Figure 20-1, we see that this utility level is 1,025 utils. Or to put it a slightly different way, their expected utility with insurance is 1 × 1,025 = 1,025 utils, because with insurance they will receive a utility of 1,025 utils with a probability of 1. And this is higher than the level of expected utility without insurance—

Risk-

The calculations for this example are summarized in Table 20-1. This example shows that the Lees, like most people in real life, are risk-

20-1

The Effect of Fair Insurance on the Lee Family’s Income Available for Consumption and Expected Utility

|

Income in different states of the world |

||||

|---|---|---|---|---|

|

$0 in medical expenses (0.5 probability) |

$10,000 in medical expenses (0.5 probability) |

Expected value of income available for consumption |

Expected utility |

|

|

Without insurance |

$30,000 |

$20,000 |

(0.5 × $30,000) + (0.5 × $20,000) = $25,000 |

(0.5 × 1,080 utils) + (0.5 × 920 utils) = 1,000 utils |

|

With fair insurance |

$25,000 |

$25,000 |

(0.5 × $25,000) + (0.5 × $25,000) = $25,000 |

(0.5 × 1,025 utils) + (0.5 × 1,025 utils) = 1,025 utils |

TABLE 20-

You might think that this result depends on the specific numbers we have chosen. In fact, however, the proposition that purchase of a fair insurance policy increases expected utility depends on only one assumption: diminishing marginal utility. The reason is that with diminishing marginal utility, a dollar gained when income is low adds more to utility than a dollar gained when income is high.

That is, having an additional dollar matters more when you are facing hard times than when you are facing good times. And as we will shortly see, a fair insurance policy is desirable because it transfers a dollar from high-

But first, let’s see how diminishing marginal utility leads to risk aversion by examining expected utility more closely. In the case of the Lee family, there are two states of the world; let’s call them H and S, for healthy and sick. In state H the family has no medical expenses; in state S it has $10,000 in medical expenses. Let’s use the symbols UH and US to represent the Lee family’s total utility in each state. Then the family’s expected utility is:

The fair insurance policy reduces the family’s income available for consumption in state H by $5,000, but it increases it in state S by the same amount. As we’ve just seen, we can use the utility function to directly calculate the effects of these changes on expected utility. But as we have also seen in many other contexts, we gain more insight into individual choice by focusing on marginal utility.

To use marginal utility to analyze the effects of fair insurance, let’s imagine introducing the insurance a bit at a time, say in 5,000 small steps. At each of these steps, we reduce income in state H by $1 and simultaneously increase income in state S by $1. At each of these steps, total utility in state H falls by the marginal utility of income in that state but total utility in state S rises by the marginal utility of income in that state.

Now look again at panel (b) of Figure 20-1, which shows how marginal utility varies with income. Point S shows marginal utility when the Lee family’s income is $20,000; point H shows marginal utility when income is $30,000. Clearly, marginal utility is higher when income after medical expenses is low. Because of diminishing marginal utility, an additional dollar of income adds more to total utility when the family has low income (point S) than when it has high income (point H).

This tells us that the gain in expected utility from increasing income in state S is larger than the loss in expected utility from reducing income in state H by the same amount. So at each step of the process of reducing risk, by transferring $1 of income from state H to state S, expected utility increases. This is the same as saying that the family is risk-

Almost everyone is risk-

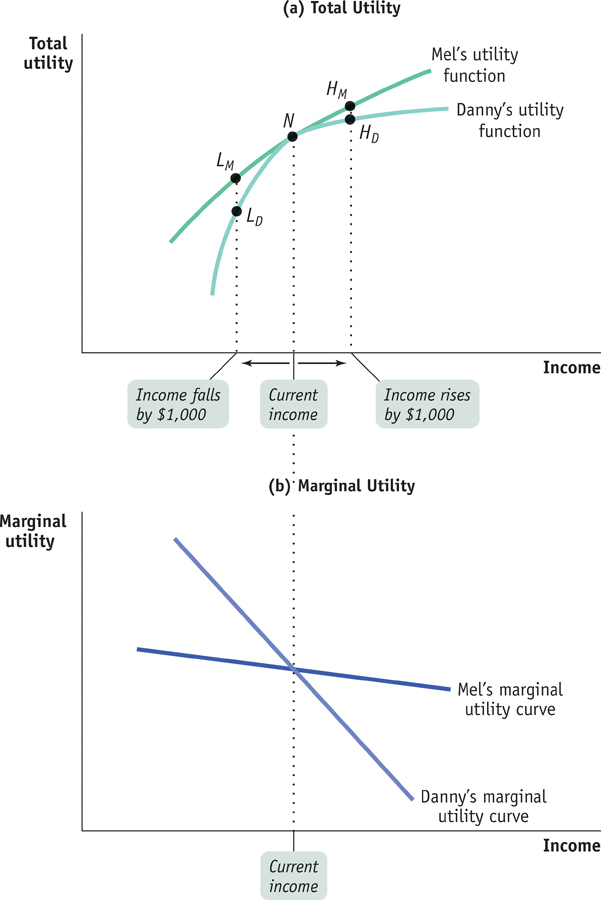

Panel (a) of Figure 20-2 shows how each individual’s total utility would be affected by the change in income. Danny would gain very few utils from a rise in income, which moves him from N to HD, but lose a large number of utils from a fall in income, which moves him from N to LD. That is, he is highly risk-

20-2

Differences in Risk Aversion

A risk-

Mel, though, as shown in panel (a), would gain almost as many utils from higher income, which moves him from N to HM, as he would lose from lower income, which moves him from N to LM. He is barely risk-

The Paradox of Gambling

If most people are risk-

After all, a casino doesn’t even offer gamblers a fair gamble: all the games in any gambling facility are designed so that, on average, the casino makes money. So why would anyone play their games?

You might argue that the gambling industry caters to the minority of people who are actually the opposite of risk-

Instead, most of them are ordinary people who have health and life insurance and who wear seat belts. In other words, they are risk-

So why do people gamble? Presumably because they enjoy the experience.

Also, gambling may be one of those areas where the assumption of rational behavior goes awry. Psychologists have concluded that gambling can be addictive in ways that are not that different from the addictive effects of drugs. Taking dangerous drugs is irrational; so is excessive gambling. Alas, both happen all the same.

Individuals differ in risk aversion for two main reasons: differences in preferences and differences in initial income or wealth.

Differences in preferences. Other things equal, people simply differ in how much their marginal utility is affected by their level of income. Someone whose marginal utility is relatively unresponsive to changes in income will be much less sensitive to risk. In contrast, someone whose marginal utility depends greatly on changes in income will be much more risk-

averse. Differences in initial income or wealth. The possible loss of $1,000 makes a big difference to a family living below the poverty threshold; it makes very little difference to someone who earns $1 million a year. In general, people with whigh incomes or high wealth will be less risk-

averse.

Differences in risk aversion have an important consequence: they affect how much an individual is willing to pay to avoid risk.