Paying to Avoid Risk

The risk-

Will the Lee family still want to purchase an “unfair” insurance policy—

It depends on the size of the premium. Look again at Table 20-1. We know that without insurance expected utility is 1,000 utils and that insurance costing $5,000 raises expected utility to 1,025 utils. If the premium were $6,000, the Lees would be left with an income of $24,000, which, as you can see from Figure 20-1, would give them a total utility of 1,008 utils—

PITFALLS: BEFORE THE FACT VERSUS AFTER THE FACT

BEFORE THE FACT VERSUS AFTER THE FACT

Why is an insurance policy different from a doughnut?

No, it’s not a riddle. Although the supply and demand for insurance behave like the supply and demand for any good or service, the payoff is very different. When you buy a doughnut, you know what you’re going to get; when you buy insurance, by definition you don’t know what you’re going to get. If you bought car insurance and then didn’t have an accident, you got nothing from the policy, except peace of mind, and might wish that you hadn’t bothered. But if you did have an accident, you probably would be glad that you bought insurance that covered the cost.

This means we have to be careful in assessing the rationality of insurance purchases (or, for that matter, any decision made in the face of uncertainty). After the fact-

One highly successful Wall Street investor told us that he never looks back-

This example shows that risk-

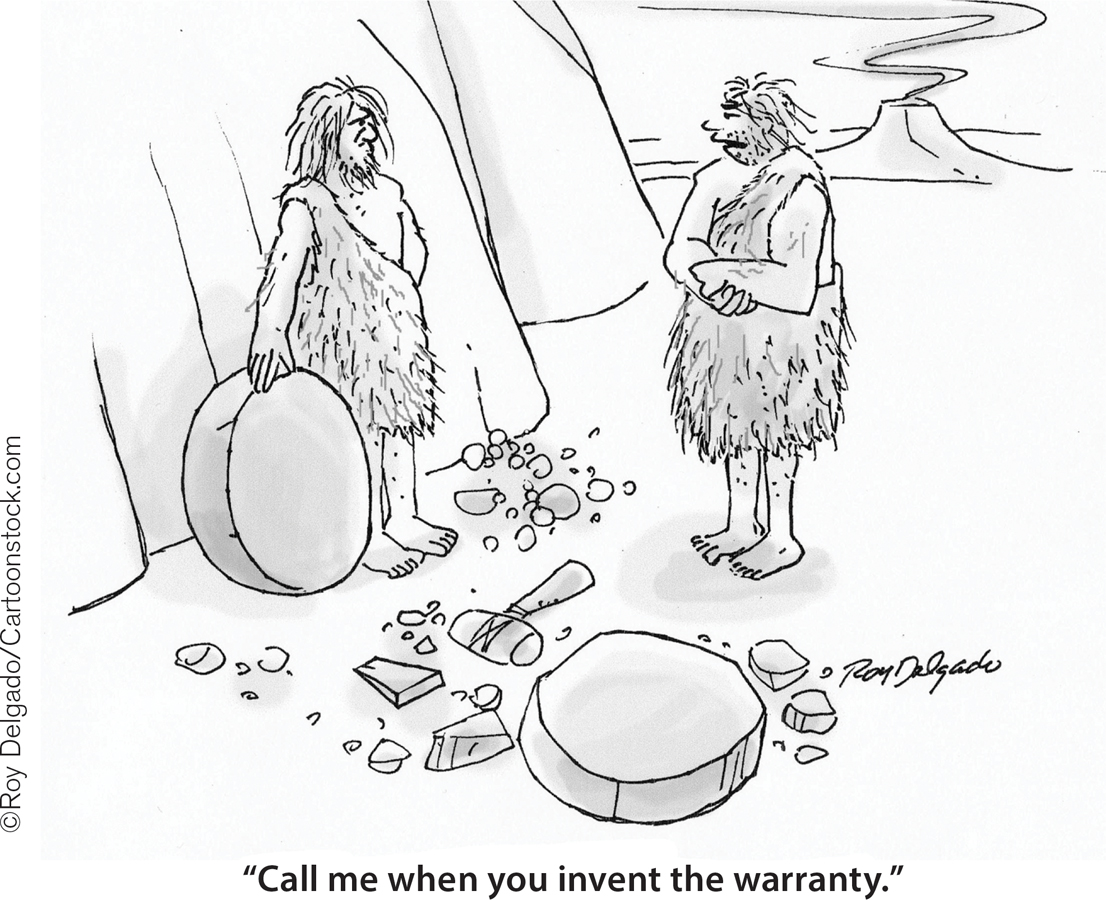

ECONOMICS in Action: Warranties

Warranties

Many expensive consumer goods—

Why do manufacturers offer warranties? Part of the answer is that warranties signal to consumers that the goods are of high quality. But mainly warranties are a form of consumer insurance. For many people, the cost of repairing or replacing an expensive item like a refrigerator—

So a warranty that covers the cost of repair or replacement increases the consumer’s expected utility, even if the cost of the warranty is greater than the expected future claim paid by the manufacturer.

Quick Review

The expected value of a random variable is the weighted average of all possible values, where the weight corresponds to the probability of a given value occurring.

Uncertainty about states of the world entails risk, or financial risk when there is an uncertain monetary outcome. When faced with uncertainty, consumers choose the option yielding the highest level of expected utility.

Most people are risk-

averse: they would be willing to purchase a fair insurance policy in which the premium is equal to the expected value of the claim.Risk aversion arises from diminishing marginal utility. Differences in preferences and in income or wealth lead to differences in risk aversion.

Depending on the size of the premium, a risk-

averse person may be willing to purchase an “unfair” insurance policy with a premium larger than the expected claim. The greater your risk aversion, the greater the premium you are willing to pay. A risk- neutral person is unwilling to pay any premium to avoid risk.

20-1

Question 20.1

Compare two families who own homes near the coast in Florida. Which family is likely to be more risk-

averse— (i) a family with income of $2 million per year or (ii) a family with income of $60,000 per year? Would either family be willing to buy an “unfair” insurance policy to cover losses to their Florida home? Income

Total utility (utils)

$22,000

850

25,000

1,014

26,000

1,056

35,000

1,260

Question 20.2

Karma’s income next year is uncertain: there is a 60% probability she will make $22,000 and a 40% probability she will make $35,000. The accompanying table shows some income and utility levels for Karma.

What is Karma’s expected income? Her expected utility?

What certain income level leaves her as well off as her uncertain income? What does this imply about Karma’s attitudes toward risk? Explain.

Would Karma be willing to pay some amount of money greater than zero for an insurance policy that guarantees her an income of $26,000? Explain.

Solutions appear at back of book.