Modeling a Price Ceiling

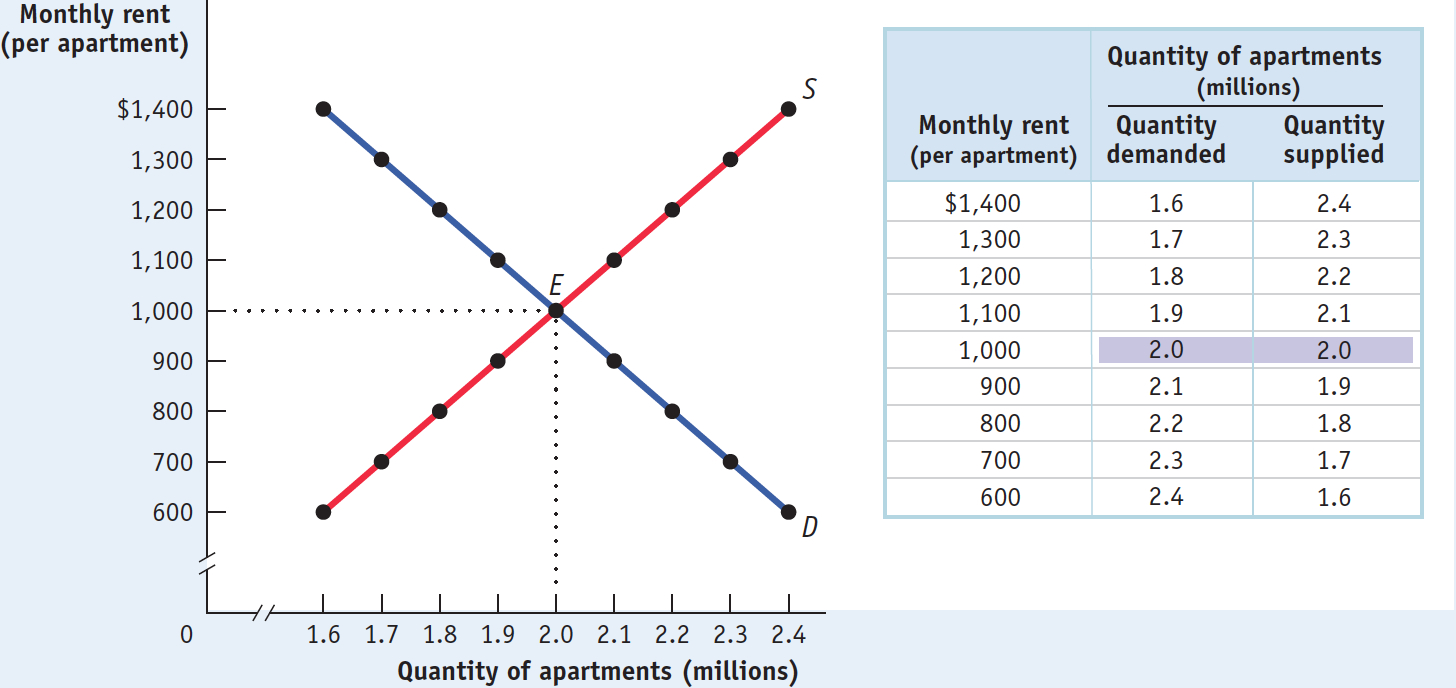

To see what can go wrong when a government imposes a price ceiling on an efficient market, consider Figure 5-1, which shows a simplified model of the market for apartments in New York. For the sake of simplicity, we imagine that all apartments are exactly the same and so would rent for the same price in an unregulated market.

5-1

The Market for Apartments in the Absence of Price Controls

The table in Figure 5-1 shows the demand and supply schedules; the demand and supply curves are shown on the left. We show the quantity of apartments on the horizontal axis and the monthly rent per apartment on the vertical axis. You can see that in an unregulated market the equilibrium would be at point E: 2 million apartments would be rented for $1,000 each per month.

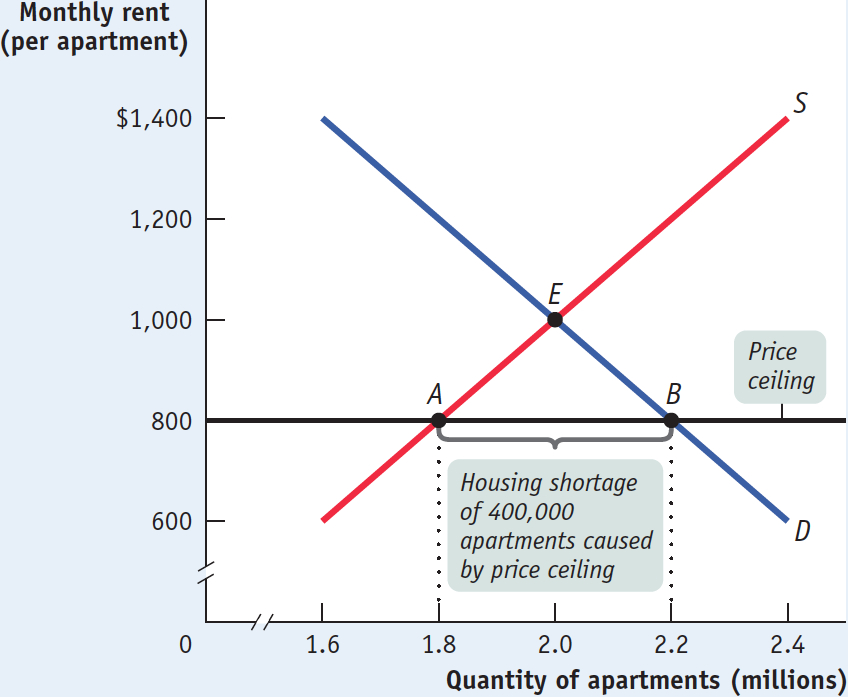

Now suppose that the government imposes a price ceiling, limiting rents to a price below the equilibrium price—

Figure 5-2 shows the effect of the price ceiling, represented by the line at $800. At the enforced rental rate of $800, landlords have less incentive to offer apartments, so they won’t be willing to supply as many as they would at the equilibrium rate of $1,000. They will choose point A on the supply curve, offering only 1.8 million apartments for rent, 200,000 fewer than in the unregulated market.

5-2

The Effects of a Price Ceiling

At the same time, more people will want to rent apartments at a price of $800 than at the equilibrium price of $1,000; as shown at point B on the demand curve, at a monthly rent of $800 the quantity of apartments demanded rises to 2.2 million, 200,000 more than in the unregulated market and 400,000 more than are actually available at the price of $800. So there is now a persistent shortage of rental housing: at that price, 400,000 more people want to rent than are able to find apartments.

Do price ceilings always cause shortages? No. If a price ceiling is set above the equilibrium price, it won’t have any effect. Suppose that the equilibrium rental rate on apartments is $1,000 per month and the city government sets a ceiling of $1,200. Who cares? In this case, the price ceiling won’t be binding—it won’t actually constrain market behavior—