PROBLEMS AND APPLICATIONS

For any problem marked with  , there is a Work It Out online tutorial available for a similar problem. To access these interactive, step-by-step tutorials and other resources, visit LaunchPad for Macroeconomics, 9e at www.macmillanhighered.com/launchpad/mankiw9e

, there is a Work It Out online tutorial available for a similar problem. To access these interactive, step-by-step tutorials and other resources, visit LaunchPad for Macroeconomics, 9e at www.macmillanhighered.com/launchpad/mankiw9e

Question 13.6

1. Use the Mundell–Fleming model to predict what would happen to aggregate income, the exchange rate, and the trade balance under both floating and fixed exchange rates in response to each of the following shocks. Be sure to include an appropriate graph in your answer.

A fall in consumer confidence about the future induces consumers to spend less and save more.

The introduction of a stylish line of Toyotas makes some consumers prefer foreign cars over domestic cars.

The introduction of automatic teller machines reduces the demand for money.

Question 13.7

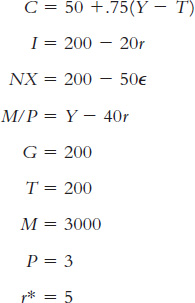

2.  • A small open economy is described by the following equations:

• A small open economy is described by the following equations:

Derive and graph the IS* and LM* curves.

Calculate the equilibrium exchange rate, level of income, and net exports.

Assume a floating exchange rate. Calculate what happens to the exchange rate, the level of income, net exports, and the money supply if the government increases its spending by 50. Use a graph to explain what you find.

Now assume a fixed exchange rate. Calculate what happens to the exchange rate, the level of income, net exports, and the money supply if the government increases its spending by 50. Use a graph to explain what you find.

Question 13.8

3. A small open economy with a floating exchange rate is in recession with balanced trade. If policy-makers want to reach full employment while maintaining balanced trade, what combination of monetary and fiscal policy should they choose? Use a graph, and be sure to identify the effects of each policy.

Question 13.9

4. The Mundell–Fleming model takes the world interest rate r* as an exogenous variable. Let’s consider what happens when this variable changes.

What might cause the world interest rate to rise? (Hint: The world is a closed economy.)

If the economy has a floating exchange rate, what happens to aggregate income, the exchange rate, and the trade balance when the world interest rate rises?

If the economy has a fixed exchange rate, what happens to aggregate income, the exchange rate, and the trade balance when the world interest rate rises?

Question 13.10

5. Business executives and policymakers are often concerned about the competitiveness of American industry (the ability of U.S. industries to sell their goods profitably in world markets).

How would a change in the nominal exchange rate affect competitiveness in the short run when prices are sticky?

Suppose you wanted to make domestic industries more competitive but did not want to alter aggregate income. According to the Mundell–Fleming model, what combination of monetary and fiscal policies should you pursue? Use a graph, and be sure to identify the effects of each policy.

Question 13.11

6. Suppose that higher income implies higher imports and thus lower net exports. That is, the net-exports function is

NX = NX(e, Y).

Examine the effects in a small open economy of a fiscal expansion on income and the trade balance under the following exchange-rate regimes.

A floating exchange rate

A fixed exchange rate

How does your answer compare to the results in Table 13-1?

401

Question 13.12

7. Suppose that money demand depends on disposable income, so that the equation for the money market becomes

M/P = L(r, Y − T).

Analyze the short-run impact of a tax cut in a small open economy on the exchange rate and income under both floating and fixed exchange rates.

Question 13.13

8. Suppose that the price level relevant for money demand includes the price of imported goods and that the price of imported goods depends on the exchange rate. That is, the money market is described by

M/P = L(r, Y),

where

P = λPd + (1 − λ)Pf/e.

Here, Pd is the price of domestic goods, Pf is the price of foreign goods measured in the foreign currency, and e is the exchange rate. Thus, Pf/e is the price of foreign goods measured in the domestic currency. The parameter λ is the share of domestic goods in the price index P. Assume that the price of domestic goods Pd and the price of foreign goods measured in foreign currency Pf are sticky in the short run.

Suppose that we graph the LM* curve for given values of Pd and Pf (instead of the usual P). Is this LM* curve still vertical? Explain.

What is the effect of expansionary fiscal policy under floating exchange rates in this model? Explain. Contrast with the standard Mundell–Fleming model.

Suppose that political instability increases the country risk premium and, thereby, the interest rate. What is the effect on the exchange rate, the price level, and aggregate income in this model? Contrast with the standard Mundell–Fleming model.

Question 13.14

9. Use the Mundell–Fleming model to answer the following questions about the state of California (a small open economy).

What kind of exchange-rate system does California have with its major trading partners (Alabama, Alaska, Arizona, …)?

If California suffers from a recession, should the state government use monetary or fiscal policy to stimulate employment? Explain. (Note: For this question, assume that the state government can print dollar bills.)

If California prohibited the import of wines from the state of Washington, what would happen to income, the exchange rate, and the trade balance? Consider both the short-run and the long-run impacts.

Can you think of any important features of the Californian economy that are different from, say, the Canadian economy and that might make the Mundell–Fleming model less useful when applied to California than to Canada?

402