6-1 The International Flows of Capital and Goods

The key macroeconomic difference between open and closed economies is that, in an open economy, a country’s spending in any given year need not equal its output of goods and services. A country can spend more than it produces by borrowing from abroad, or it can spend less than it produces and lend the difference to foreigners. To understand this more fully, let’s take another look at national income accounting, which we first discussed in Chapter 2.

141

The Role of Net Exports

Consider the expenditure on an economy’s output of goods and services. In a closed economy, all output is sold domestically, and expenditure is divided into three components: consumption, investment, and government purchases. In an open economy, some output is sold domestically and some is exported to be sold abroad. We can divide expenditure on an open economy’s output Y into four components:

Cd, consumption of domestic goods and services,

Id, investment in domestic goods and services,

Gd, government purchases of domestic goods and services,

X, exports of domestic goods and services.

The division of expenditure into these components is expressed in the identity

Y = Cd + Id + Gd + X.

The sum of the first three terms, Cd + Id + Gd, is domestic spending on domestic goods and services. The fourth term, X, is foreign spending on domestic goods and services.

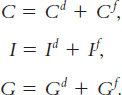

A bit of manipulation can make this identity more useful. Note that domestic spending on all goods and services equals domestic spending on domestic goods and services plus domestic spending on foreign goods and services. Hence, total consumption C equals consumption of domestic goods and services Cd plus consumption of foreign goods and services Cf; total investment I equals investment in domestic goods and services Id plus investment in foreign goods and services If; and total government purchases G equals government purchases of domestic goods and services Gd plus government purchases of foreign goods and services Gf. Thus,

We substitute these three equations into the identity above:

Y = (C – Cf) + (I – If) + (G – Gf) + X.

We can rearrange to obtain

Y = C + I + G + X – (Cf + If + Gf).

The sum of domestic spending on foreign goods and services (Cf + If + Gf) is expenditure on imports (IM). We can thus write the national income accounts identity as

Y = C + I + G + X – IM.

Because spending on imports is included in domestic spending (C + I + G), and because goods and services imported from abroad are not part of a country’s output, this equation subtracts spending on imports. Defining net exports to be exports minus imports (NX = X – IM), the identity becomes

142

Y = C + I + G + NX.

This equation states that expenditure on domestic output is the sum of consumption, investment, government purchases, and net exports. This is the most common form of the national income accounts identity; it should be familiar from Chapter 2.

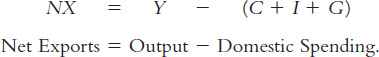

The national income accounts identity shows how domestic output, domestic spending, and net exports are related. In particular,

This equation shows that in an open economy, domestic spending need not equal the output of goods and services. If output exceeds domestic spending, we export the difference: net exports are positive. If output falls short of domestic spending, we import the difference: net exports are negative.

International Capital Flows and the Trade Balance

In an open economy, as in the closed economy we discussed in Chapter 3, financial markets and goods markets are closely related. To see the relationship, we must rewrite the national income accounts identity in terms of saving and investment. Begin with the identity

Y = C + I + G + NX.

Subtract C and G from both sides to obtain

Y – C – G = I + NX.

Recall from Chapter 3 that Y – C – G is national saving S, which equals the sum of private saving, Y – T – C, and public saving, T – G, where T stands for taxes. Therefore,

S = I + NX.

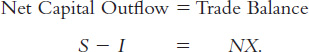

Subtracting I from both sides of the equation, we can write the national income accounts identity as

S – I = NX.

This form of the national income accounts identity shows that an economy’s net exports must always equal the difference between its saving and its investment.

Let’s look more closely at each part of this identity. The easy part is the right-

143

The left-

The national income accounts identity shows that net capital outflow always equals the trade balance. That is,

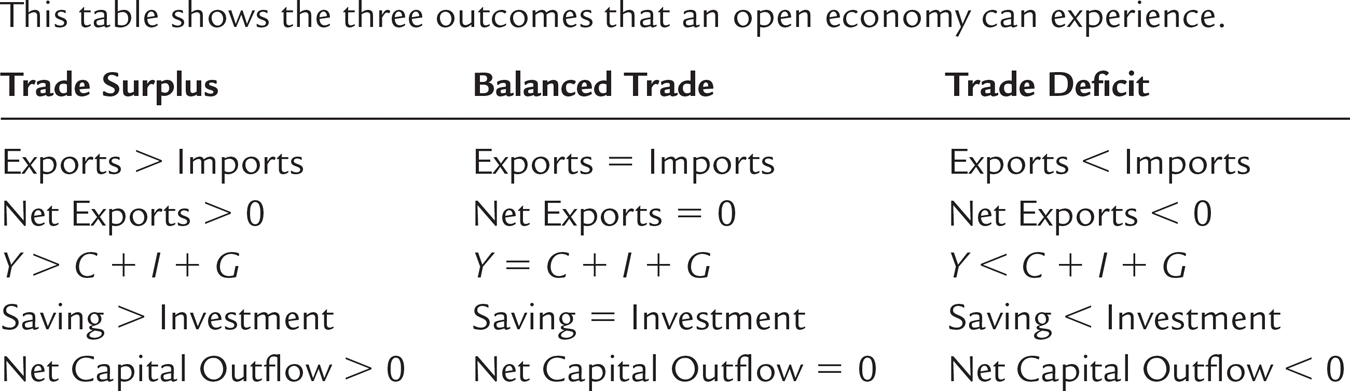

If S – I and NX are positive, we have a trade surplus. In this case, we are net lenders in world financial markets, and we are exporting more goods than we are importing. If S – I and NX are negative, we have a trade deficit. In this case, we are net borrowers in world financial markets, and we are importing more goods than we are exporting. If S – I and NX are exactly zero, we are said to have balanced trade because the value of imports equals the value of exports.

The national income accounts identity shows that the international flow of funds to finance capital accumulation and the international flow of goods and services are two sides of the same coin. If domestic saving exceeds domestic investment, the surplus saving is used to make loans to foreigners. Foreigners require these loans because we are providing them with more goods and services than they are providing us. That is, we are running a trade surplus. If investment exceeds saving, the extra investment must be financed by borrowing from abroad. These foreign loans enable us to import more goods and services than we export. That is, we are running a trade deficit. Table 6-1 summarizes these lessons.

TABLE 6-1

TABLE 6-

Note that the international flow of capital can take many forms. It is easiest to assume—

144

International Flows of Goods and Capital: An Example

The equality of net exports and net capital outflow is an identity: it must hold because of how the variables are defined and the numbers are added up. But it is easy to miss the intuition behind this important relationship. The best way to understand it is to consider an example.

Imagine that Bill Gates sells a copy of the Windows operating system to a Japanese consumer for 10,000 yen. Because Mr. Gates is a U.S. resident, the sale represents an export of the United States. Other things equal, U.S. net exports rise. What else happens to make the identity hold? It depends on what Mr. Gates does with the 10,000 yen.

Suppose Mr. Gates decides to stuff the 10,000 yen in his mattress. In this case, Mr. Gates has allocated some of his saving to an investment in the Japanese economy (in the form of the Japanese currency) rather than to an investment in the U.S. economy. Thus, U.S. saving exceeds U.S. investment. The rise in U.S. net exports is matched by a rise in the U.S. net capital outflow.

If Mr. Gates wants to invest in Japan, however, he is unlikely to make currency his asset of choice. He might use the 10,000 yen to buy some stock in, say, the Japanese firm Sony, or he might buy a bond issued by the Japanese government. In either case, some of U.S. saving flows abroad. Once again, the U.S. net capital outflow exactly balances U.S. net exports.

The opposite situation occurs in Japan. When the Japanese consumer buys a copy of the Windows operating system, Japan’s purchases of goods and services (C + I + G) rise, but there is no change in what Japan has produced (Y). Japan’s imports increase, and its net exports decrease. In addition, the transaction reduces Japan’s saving (S = Y – C – G) for a given level of investment (I). While the United States experiences a net capital outflow, Japan experiences a net capital inflow.

Now let’s change the example. Suppose that instead of investing his 10,000 yen in a Japanese asset, Mr. Gates uses it to buy something made in Japan, such as a supersize box of Pokémon cards. In this case, imports into the United State rise. Together, the Windows export and the Pokémon import represent balanced trade between Japan and the United States. Because exports and imports rise equally, net exports and net capital outflow are both unchanged.

A final possibility is that Mr. Gates exchanges his 10,000 yen for U.S. dollars at a local bank. But this doesn’t change the situation: the bank now has to do something with the 10,000 yen. It can buy Japanese assets (a U.S. net capital outflow); it can buy a Japanese good (a U.S. import); or it can sell the yen to another American who wants to make such a transaction. If you follow the money, you can see that, in the end, U.S. net exports must equal U.S. net capital outflow.

145

The Irrelevance of Bilateral Trade Balances

The trade balance we have been discussing measures the difference between a nation’s exports and its imports with the rest of the world. Sometimes you might hear a media report on a nation’s trade balance with a specific other nation. This is called a bilateral trade balance. For example, the U.S. bilateral trade balance with China equals exports that the United States sells to China minus imports that the United States buys from China.

The overall trade balance is, as we have seen, inextricably linked to a nation’s saving and investment. That is not true of a bilateral trade balance. Indeed, a nation can have large trade deficits and surpluses with specific trading partners while having balanced trade overall.

For example, suppose the world has three countries: the United States, China, and Australia. The United States sells $100 billion in machine tools to Australia, Australia sells $100 billion in wheat to China, and China sells $100 billion in toys to the United States. In this case, the United States has a bilateral trade deficit with China, China has a bilateral trade deficit with Australia, and Australia has a bilateral trade deficit with the United States. But each of the three nations has balanced trade overall because it has exported and imported $100 billion in goods.

Bilateral trade deficits receive more attention in the political arena than they deserve. This is in part because international relations are conducted country to country, so politicians and diplomats are naturally drawn to statistics measuring country-

The same lesson applies to individuals as it does to nations. Your own personal trade balance is the difference between your income and your spending, and you may be concerned if these two variables are out of line. But you should not be concerned with the difference between your income and spending with a particular person or firm. Economist Robert Solow once explained the irrelevance of bilateral trade balances as follows: “I have a chronic deficit with my barber, who doesn’t buy a darned thing from me.” But that doesn’t stop Mr. Solow from living within his means—