PROBLEMS AND APPLICATIONS

For any problem marked with  , there is a Work It Out online tutorial available for a similar problem. To access these interactive, step-

, there is a Work It Out online tutorial available for a similar problem. To access these interactive, step-

Question 6.6

1. Use the model of the small open economy to predict what would happen to the trade balance, the real exchange rate, and the nominal exchange rate in response to each of the following events.

A fall in consumer confidence about the future induces consumers to spend less and save more.

A tax reform increases the incentive for businesses to build new factories.

The introduction of a stylish line of Toyotas makes some consumers prefer foreign cars over domestic cars.

The central bank doubles the money supply.

New regulations restricting the use of credit cards increase the demand for money.

Question 6.7

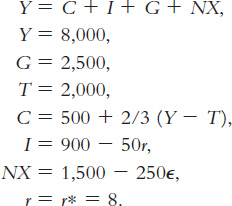

2.  • Consider an economy described by the following equations:

• Consider an economy described by the following equations:

In this economy, solve for private saving, public saving, national saving, investment, the trade balance, and the equilibrium exchange rate.

Suppose now that G is cut to 2,000. Solve for private saving, public saving, national saving, investment, the trade balance, and the equilibrium exchange rate. Explain what you find.

Now suppose that the world interest rate falls from 8 to 3 percent. (G is again 2,500.) Solve for private saving, public saving, national saving, investment, the trade balance, and the equilibrium exchange rate. Explain what you find.

Question 6.8

3. The country of Leverett is a small open economy. Suddenly, a change in world fashions makes the exports of Leverett unpopular.

What happens in Leverett to saving, investment, net exports, the interest rate, and the exchange rate?

The citizens of Leverett like to travel abroad. How will this change in the exchange rate affect them?

The fiscal policymakers of Leverett want to adjust taxes to maintain the exchange rate at its previous level. What should they do? If they do this, what are the overall effects on saving, investment, net exports, and the interest rate?

171

Question 6.9

4. What will happen to the trade balance and the real exchange rate of a small open economy when government purchases increase, such as during a war? Does your answer depend on whether this is a local war or a world war?

Question 6.10

5. A Case Study in this chapter concludes that if poor nations offered better production efficiency and legal protections, the trade balance in rich nations such as the United States would move toward surplus. Let’s consider why this might be the case.

If the world’s poor nations offer better production efficiency and legal protection, what would happen to the investment demand function in those countries?

How would the change you describe in part (1) affect the demand for loanable funds in world financial markets?

How would the change you describe in part (2) affect the world interest rate?

How would the change you describe in part (3) affect the trade balance in rich nations?

Question 6.11

6. The president is considering placing a tariff on the import of Japanese luxury cars. Using the model presented in this chapter, discuss the economics and politics of such a policy. In particular, how would the policy affect the U.S. trade deficit? How would it affect the exchange rate? Who would be hurt by such a policy? Who would benefit?

Question 6.12

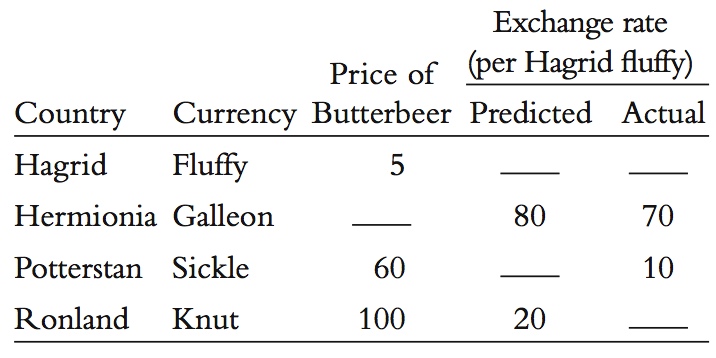

7.  • Here is a table similar to Table 6-2 (but in alphabetical order) for the currencies of four imaginary nations. Use the theory of purchasing-

• Here is a table similar to Table 6-2 (but in alphabetical order) for the currencies of four imaginary nations. Use the theory of purchasing-

Question 6.13

8. Suppose China exports TVs and uses the yuan as its currency, whereas Russia exports vodka and uses the ruble. China has a stable money supply and slow, steady technological progress in TV production, while Russia has very rapid growth in the money supply and no technological progress in vodka production. On the basis of this information, what would you predict for the real exchange rate (measured as bottles of vodka per TV) and the nominal exchange rate (measured as rubles per yuan)? Explain your reasoning. (Hint: For the real exchange rate, think about the link between scarcity and relative prices.)

Question 6.14

9. Oceania is a small open economy. Suppose that a large number of foreign countries begin to subsidize investment by instituting an investment tax credit (while adjusting other taxes to hold their tax revenue constant), but Oceania does not institute such an investment subsidy.

What happens to world investment demand as a function of the world interest rate?

What happens to the world interest rate?

What happens to investment in Oceania?

What happens to Oceania’s trade balance?

What happens to Oceania’s real exchange rate?

Question 6.15

10. “Traveling in Mexico is much cheaper now than it was ten years ago,” says a friend. “Ten years ago, a dollar bought 10 pesos; this year, a dollar buys 15 pesos.” Is your friend right or wrong? Given that total inflation over this period was 25 percent in the United States and 100 percent in Mexico, has it become more or less expensive to travel in Mexico? Write your answer using a concrete example—

172

Question 6.16

11. You read on a financial Web site that the nominal interest rate is 12 percent per year in Canada and 8 percent per year in the United States. Suppose that international capital flows equalize the real interest rates in the two countries and that purchasing-

Using the Fisher equation (discussed in Chapter 5), what can you infer about expected inflation in Canada and in the United States?

What can you infer about the expected change in the exchange rate between the Canadian dollar and the U.S. dollar?

A friend proposes a get-

rich- quick scheme: borrow from a U.S. bank at 8 percent, deposit the money in a Canadian bank at 12 percent, and make a 4 percent profit. What’s wrong with this scheme?

173