9-4 Beyond the Solow Model: Endogenous Growth Theory

A chemist, a physicist, and an economist are all trapped on a desert island, trying to figure out how to open a can of food.

“Let’s heat the can over the fire until it explodes,” says the chemist.

“No, no,” says the physicist, “let’s drop the can onto the rocks from the top of a high tree.”

“I have an idea,” says the economist. “First, we assume a can opener …”

261

This old joke takes aim at how economists use assumptions to simplify—and sometimes oversimplify—the problems they face. It is particularly apt when evaluating the theory of economic growth. One goal of growth theory is to explain the persistent rise in living standards that we observe in most parts of the world. The Solow growth model shows that such persistent growth must come from technological progress. But where does technological progress come from? In the Solow model, it is just assumed!

To fully understand the process of economic growth, we need to go beyond the Solow model and develop models that explain technological advance. Models that do this often go by the label endogenous growth theory because they reject the Solow model’s assumption of exogenous technological change. Although the field of endogenous growth theory is large and sometimes complex, here we get a quick taste of this modern research.12

The Basic Model

To illustrate the idea behind endogenous growth theory, let’s start with a particularly simple production function:

Y = AK,

where Y is output, K is the capital stock, and A is a constant measuring the amount of output produced for each unit of capital. Notice that this production function does not exhibit the property of diminishing returns to capital. One extra unit of capital produces A extra units of output, regardless of how much capital there is. This absence of diminishing returns to capital is the key difference between this endogenous growth model and the Solow model.

Now let’s see what this production function says about economic growth. As before, we assume a fraction s of income is saved and invested. We therefore describe capital accumulation with an equation similar to those we used previously:

ΔK = sY − δK.

This equation states that the change in the capital stock (ΔK) equals investment (sY) minus depreciation (δK). Combining this equation with the Y = AK production function, we obtain, after a bit of manipulation,

ΔY/Y = ΔK/K = sA − δ.

This equation shows what determines the growth rate of output ΔY/Y. Notice that, as long as sA > δ, the economy’s income grows forever, even without the assumption of exogenous technological progress.

262

Thus, a simple change in the production function can dramatically alter the predictions about economic growth. In the Solow model, saving temporarily leads to growth, but diminishing returns to capital eventually force the economy to approach a steady state in which growth depends only on exogenous technological progress. By contrast, in this endogenous growth model, saving and investment can lead to persistent growth.

But is it reasonable to abandon the assumption of diminishing returns to capital? The answer depends on how we interpret the variable K in the production function Y = AK. If we take the traditional view that K includes only the economy’s stock of plants and equipment, then it is natural to assume diminishing returns. Giving 10 computers to a worker does not make that worker 10 times as productive as she is with one computer.

Advocates of endogenous growth theory, however, argue that the assumption of constant (rather than diminishing) returns to capital is more palatable if K is interpreted more broadly. Perhaps the best case can be made for the endogenous growth model by viewing knowledge as a type of capital. Clearly, knowledge is a key input into the economy’s production—both its production of goods and services and its production of new knowledge. Compared to other forms of capital, however, it is less natural to assume that knowledge exhibits the property of diminishing returns. (Indeed, the increasing pace of scientific and technological innovation over the past few centuries has led some economists to argue that there are increasing returns to knowledge.) If we accept the view that knowledge is a type of capital, then this endogenous growth model with its assumption of constant returns to capital becomes a more plausible description of long-run economic growth.

A Two-Sector Model

Although the Y = AK model is the simplest example of endogenous growth, the theory has gone well beyond this. One line of research has tried to develop models with more than one sector of production in order to offer a better description of the forces that govern technological progress. To see what we might learn from such models, let’s sketch out an example.

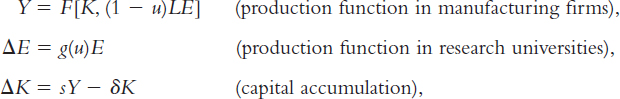

The economy has two sectors, which we can call manufacturing firms and research universities. Firms produce goods and services, which are used for consumption and investment in physical capital. Universities produce a factor of production called “knowledge,” which is then freely used in both sectors. The economy is described by the production function for firms, the production function for universities, and the capital-accumulation equation:

where u is the fraction of the labor force in universities (and 1 − u is the fraction in manufacturing), E is the stock of knowledge (which in turn determines the efficiency of labor), and g is a function that shows how the growth in knowledge depends on the fraction of the labor force in universities. The rest of the notation is standard. As usual, the production function for the manufacturing firms is assumed to have constant returns to scale: if we double both the amount of physical capital (K) and the effective number of workers in manufacturing [(1 − u)LE], we double the output of goods and services (Y).

263

This model is a cousin of the Y = AK model. Most important, this economy exhibits constant (rather than diminishing) returns to capital, as long as capital is broadly defined to include knowledge. In particular, if we double both physical capital K and knowledge E, then we double the output of both sectors in the economy. As a result, like the Y = AK model, this model can generate persistent growth without the assumption of exogenous shifts in the production function. Here persistent growth arises endogenously because the creation of knowledge in universities never slows down.

At the same time, however, this model is also a cousin of the Solow growth model. If u, the fraction of the labor force in universities, is held constant, then the efficiency of labor E grows at the constant rate g(u). This result of constant growth in the efficiency of labor at rate g is precisely the assumption made in the Solow model with technological progress. Moreover, the rest of the model—the manufacturing production function and the capital-accumulation equation—also resembles the rest of the Solow model. As a result, for any given value of u, this endogenous growth model works just like the Solow model.

There are two key decision variables in this model. As in the Solow model, the fraction of output used for saving and investment, s, determines the steady-state stock of physical capital. In addition, the fraction of labor in universities, u, determines the growth in the stock of knowledge. Both s and u affect the level of income, although only u affects the steady-state growth rate of income. Thus, this model of endogenous growth takes a small step in the direction of showing which societal decisions determine the rate of technological change.

The Microeconomics of Research and Development

The two-sector endogenous growth model just presented takes us closer to understanding technological progress, but it still tells only a rudimentary story about the creation of knowledge. If one thinks about the process of research and development for even a moment, three facts become apparent. First, although knowledge is largely a public good (that is, a good freely available to everyone), much research is done in firms that are driven by the profit motive. Second, research is profitable because innovations give firms temporary monopolies, either because of the patent system or because there is an advantage to being the first firm on the market with a new product. Third, when one firm innovates, other firms build on that innovation to produce the next generation of innovations. These (essentially microeconomic) facts are not easily connected with the (essentially macroeconomic) growth models we have discussed so far.

Some endogenous growth models try to incorporate these facts about research and development. Doing this requires modeling both the decisions that firms face as they engage in research and the interactions among firms that have some degree of monopoly power over their innovations. Going into more detail about these models is beyond the scope of this book, but it should be clear already that one virtue of these endogenous growth models is that they offer a more complete description of the process of technological innovation.

264

One question these models are designed to address is whether, from the standpoint of society as a whole, private profit-maximizing firms tend to engage in too little or too much research. In other words, is the social return to research (which is what society cares about) greater or smaller than the private return (which is what motivates individual firms)? It turns out that, as a theoretical matter, there are effects in both directions. On the one hand, when a firm creates a new technology, it makes other firms better off by giving them a base of knowledge on which to build in future research. As Isaac Newton famously remarked, “If I have seen further, it is by standing on the shoulders of giants.” On the other hand, when one firm invests in research, it can also make other firms worse off if it does little more than become the first to discover a technology that another firm would have invented in due course. This duplication of research effort has been called the “stepping on toes” effect. Whether firms left to their own devices do too little or too much research depends on whether the positive “standing on shoulders” externality or the negative “stepping on toes” externality is more prevalent.

Although theory alone is ambiguous about whether research effort is more or less than optimal, the empirical work in this area is usually less so. Many studies have suggested the “standing on shoulders” externality is important and, as a result, the social return to research is large—often in excess of 40 percent per year. This is an impressive rate of return, especially when compared to the return to physical capital, which we earlier estimated to be about 8 percent per year. In the judgment of some economists, this finding justifies substantial government subsidies to research.13

The Process of Creative Destruction

In his 1942 book Capitalism, Socialism, and Democracy, economist Joseph Schumpeter suggested that economic progress comes through a process of creative destruction. According to Schumpeter, the driving force behind progress is the entrepreneur with an idea for a new product, a new way to produce an old product, or some other innovation. When the entrepreneur’s firm enters the market, it has some degree of monopoly power over its innovation; indeed, it is the prospect of monopoly profits that motivates the entrepreneur. The entry of the new firm is good for consumers, who now have an expanded range of choices, but it is often bad for incumbent producers, who may find it hard to compete with the entrant. If the new product is sufficiently better than old ones, the incumbents may even be driven out of business. Over time, the process keeps renewing itself. The entrepreneur’s firm becomes an incumbent, enjoying high profitability until its product is displaced by another entrepreneur with the next generation of innovation.

265

History confirms Schumpeter’s thesis that there are winners and losers from technological progress. For example, in England in the early nineteenth century, an important innovation was the invention and spread of machines that could produce textiles with unskilled workers at low cost. This technological advance was good for consumers, who could clothe themselves more cheaply. Yet skilled textile artisans in England saw their jobs threatened by new technology, and they responded by organizing violent revolts. The rioting workers, called Luddites, smashed the weaving machines used in the wool and cotton mills and set the homes of the mill owners on fire (a less than creative form of destruction). Today, the term “Luddite” refers to anyone who opposes technological progress.

A more recent example of creative destruction involves the retailing giant Walmart. Although retailing may seem like a relatively static activity, in fact it is a sector that has seen sizable rates of technological progress over the past several decades. Through better inventory-control, marketing, and personnel-management techniques, for example, Walmart has found ways to bring goods to consumers at lower cost than traditional retailers. These changes benefit consumers, who can buy goods at lower prices, and the stockholders of Walmart, who share in its profitability. But they adversely affect small mom-and-pop stores, which find it hard to compete when a Walmart opens nearby.

Faced with the prospect of being the victims of creative destruction, incumbent producers often look to the political process to stop the entry of new, more efficient competitors. The original Luddites wanted the British government to save their jobs by restricting the spread of the new textile technology; instead, Parliament sent troops to suppress the Luddite riots. Similarly, in recent years, local retailers have sometimes tried to use local land-use regulations to stop Walmart from entering their market. The cost of such entry restrictions, however, is a slower pace of technological progress. In Europe, where entry regulations are stricter than they are in the United States, the economies have not seen the emergence of retailing giants like Walmart; as a result, productivity growth in retailing has been much lower.14

Schumpeter’s vision of how capitalist economies work has merit as a matter of economic history. Moreover, it has inspired some recent work in the theory of economic growth. One line of endogenous growth theory, pioneered by economists Philippe Aghion and Peter Howitt, builds on Schumpeter’s insights by modeling technological advance as a process of entrepreneurial innovation and creative destruction.15

266