3.3 What Determines the Demand for Goods and Services?

We have seen what determines the level of production and how the income from production is distributed to workers and owners of capital. We now continue our tour of the circular flow diagram, Figure 3-1, and examine how the output from production is used.

In Chapter 2 we identified the four components of GDP:

Consumption (C)

Investment (I)

Government purchases (G)

Net exports (NX).

The circular flow diagram contains only the first three components. For now, to simplify the analysis, we assume a closed economy—a country that does not trade with other countries. Thus, net exports are always zero. (We examine the macroeconomics of open economies in Chapter 5.)

A closed economy has three uses for the goods and services it produces. These three components of GDP are expressed in the national accounts identity:

Y = C + I + G.

Households consume some of the economy’s output; firms and households use some of the output for investment; and the government buys some of the output for public purposes. We want to see how GDP is allocated among these three uses.

Consumption

When we eat food, wear clothing, or go to a movie, we are consuming some of the output of the economy. All forms of consumption together make up almost 56 percent of GDP. Because consumption is so large, macroeconomists have devoted much energy to studying how households decide how much to consume. Chapter 17 examines this work in detail. Here we consider the simplest description of the aggregate consumption behaviour of all households.

Households receive income from their labour and their ownership of capital, pay taxes to the government, and then decide how much of their after-tax income to consume and how much to save. As we discussed in Section 3-2, the income that households receive equals the output of the economy Y. The government then taxes households an amount T. (Although the government imposes many kinds of taxes, such as personal and corporate income taxes and sales taxes, for our purposes in this introductory analysis we can lump all these taxes together.) We define income after the payment of all taxes, Y – T, as disposable income. Households divide their disposable income between consumption and saving.

We assume that the level of consumption depends directly on the level of disposable income. The higher is disposable income, the greater is consumption. Thus,

C = C(Y – T).

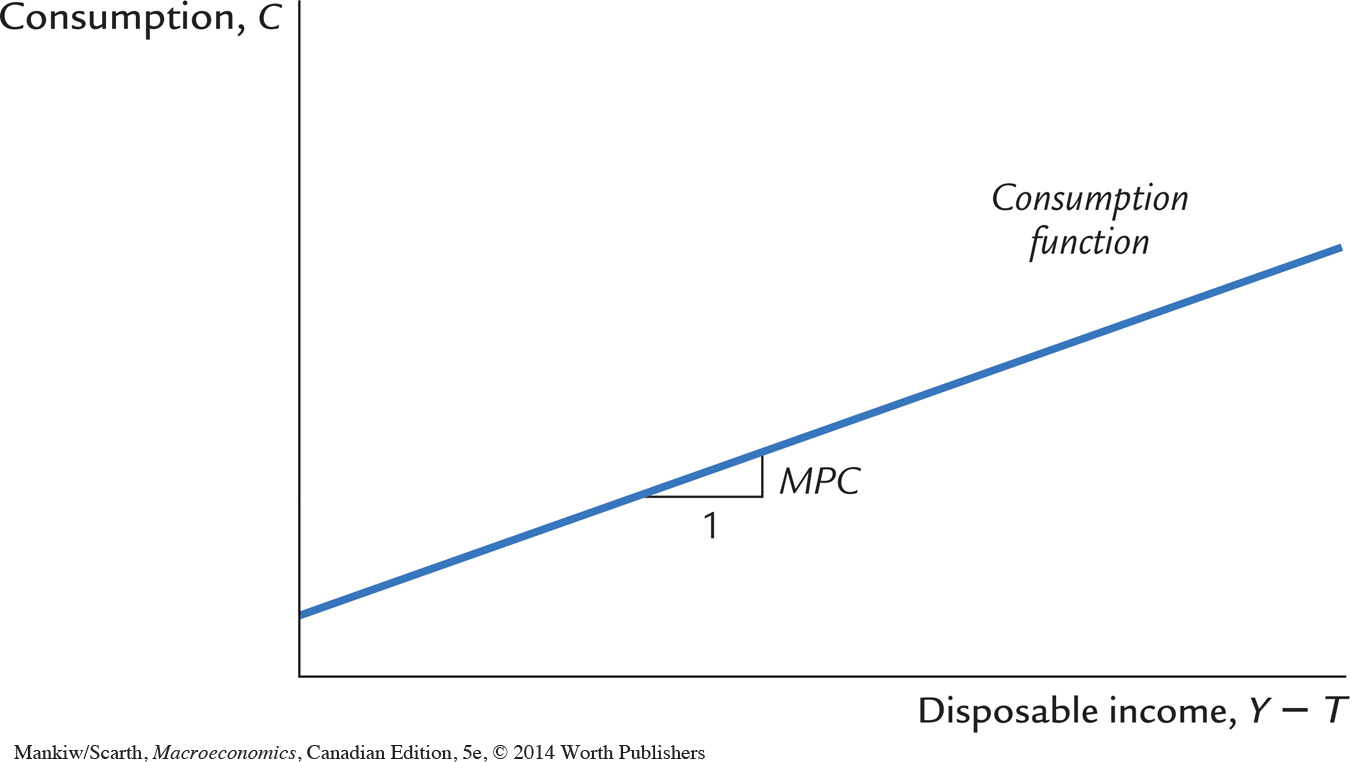

This equation states that consumption is a function of disposable income. The relationship between consumption and disposable income is called the consumption function.

The marginal propensity to consume (MPC) is the amount by which consumption changes when disposable income increases by one dollar. The MPC is between zero and one: an extra dollar of income increases consumption, but by less than one dollar. Thus, if households obtain an extra dollar of income, they save a portion of it. For example, if the MPC is 0.7, then households spend 70 cents of each additional dollar of disposable income on consumer goods and services and save 30 cents.

Figure 3-6 illustrates the consumption function. The slope of the consumption function tells us how much consumption increases when disposable income increases by one dollar. That is, the slope of the consumption function is the MPC.

Investment

Both firms and households purchase investment goods. Firms buy investment goods to add to their stock of capital and to replace existing capital as it wears out. Households buy new houses, which are also part of investment. Total investment in Canada averages about 18 percent of GDP.

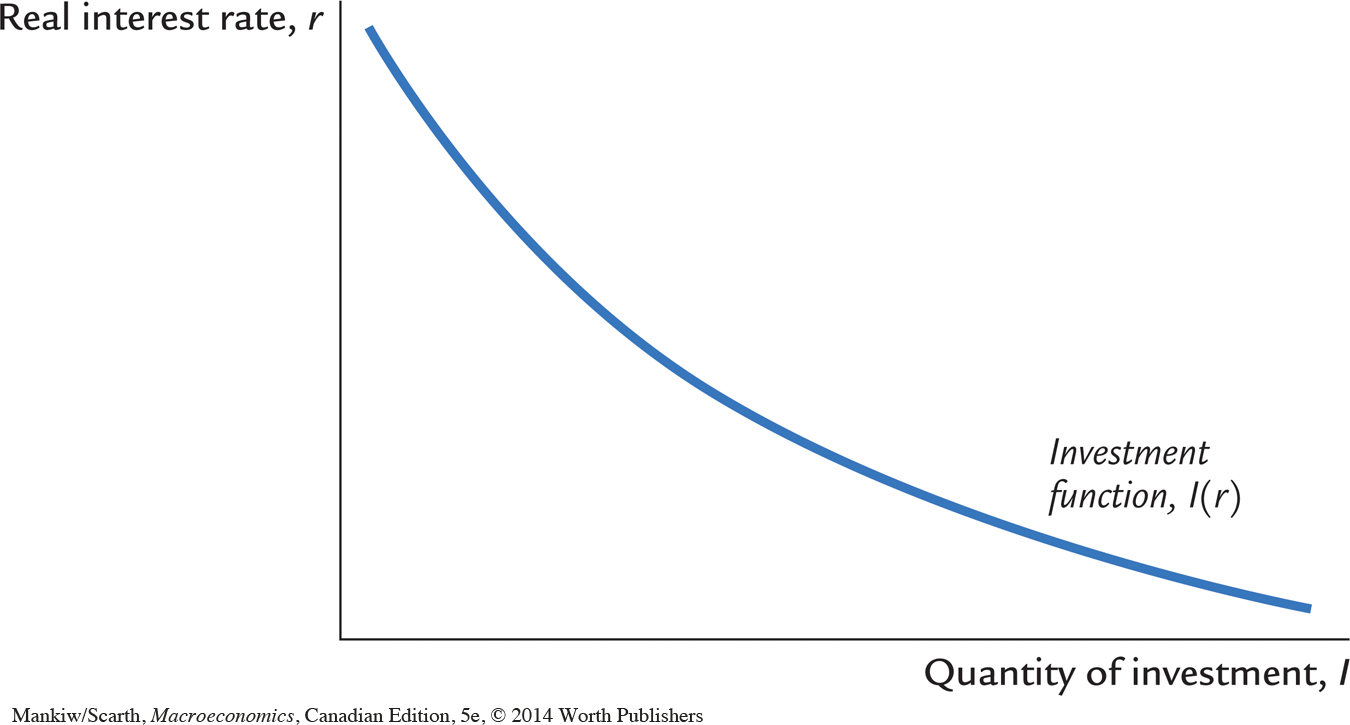

The quantity of investment goods demanded depends on many things such as the rate of increase in new knowledge, the expectations firms have about the likelihood that households are ready to spend, the level of taxes and the interest rate. The interest rate matters since it measures the cost of the funds used to finance investment. For an investment project to be profitable, its return (the revenue from increased future production of goods and services) must exceed its cost (the payments for borrowed funds). If the interest rate rises, fewer investment projects are profitable, and the quantity of investment goods demanded falls.

For example, suppose that a firm is considering whether it should build a $1 million factory that would yield a return of $100,000 per year, or 10 percent. The firm compares this return to the cost of borrowing the $1 million. If the interest rate is below 10 percent, the firm borrows the money in financial markets and makes the investment. If the interest rate is above 10 percent, the firm forgoes the investment opportunity and does not build the factory.

FYI

The Many Different Interest Rates

If you look in the business section of a newspaper, you will find many different interest rates reported. By contrast, throughout this book, we will talk about “the” interest rate, as if there were only one interest rate in the economy. The only distinction we will make is between the nominal interest rate (which is not corrected for inflation) and the real interest rate (which is corrected for inflation). Almost all of the interest rates reported in the newspaper are nominal.

Why does the newspaper report so many interest rates? The various interest rates differ in three ways:

Term. Some loans in the economy are for short periods of time, even as short as overnight. Other loans are for thirty years or even longer. The interest rate on a loan depends on its term. Long-term interest rates are usually, but not always, higher than short-term interest rates.

Credit risk. In deciding whether to make a loan, a lender must take into account the probability that the borrower will repay. The law allows borrowers to default on their loans by declaring bankruptcy. The higher the perceived probability of default, the higher the interest rate. The safest credit risk is the government, and so government bonds tend to pay a low interest rate. At the other extreme, financially shaky corporations can raise funds only by issuing junk bonds, which pay a high interest rate to compensate for the high risk of default.

Currency denomination. A lender must be concerned about possible changes in international exchange rates. For example, an American who lends money to a provincial government by buying a bond denominated in Canadian dollars will form expectations concerning the likely change in the value of the Canadian dollar over the period she is making this loan. If the Canadian dollar is expected to fall in value, perhaps due to uncertainty concerning Quebec separation, Canadian borrowers have to pay a higher interest rate than do borrowers in the United States. Thus, the spread between Canadian and American interest rates widens whenever the Canadian dollar is perceived as “weak.”

When you see two different interest rates in the newspaper, you can almost always explain the difference by considering the term, credit risk, and currency denomination of the loan.

Although there are many different domestic interest rates, macroeconomists can usually ignore these distinctions. The various interest rates tend to move up and down together. For many purposes, it is acceptable to assume that there is only one interest rate. When focusing on the financial crisis of 2008 in Chapters 11 and 20, we do consider differences between various forms of loans (for example, stocks, bonds, and mortgages).

The firm makes the same investment decision even if it does not have to borrow the $1 million but rather uses its own funds. The firm can always deposit this money in a bank or a money market fund and earn interest on it. Building the factory is more profitable than the deposit if and only if the interest rate is less than the 10 percent return on the factory.

A person wanting to buy a new house faces a similar decision. The higher the interest rate, the greater the cost of carrying a mortgage. A $100,000 mortgage costs $8,000 per year if the interest rate is 8 percent and $10,000 per year if the interest rate is 10 percent. As the interest rate rises, the cost of owning a home rises, and the demand for new homes falls.

When studying the role of interest rates in the economy, economists distinguish between the nominal interest rate and the real interest rate. This distinction is relevant when the overall level of prices is changing. The nominal interest rate is the interest rate as usually reported: it is the rate of interest that investors pay to borrow money. The real interest rate is the nominal interest rate corrected for the effects of inflation. If the nominal interest rate is 8 percent and the inflation rate is 3 percent, then the real interest rate is 5 percent. In Chapter 4 we discuss the relation between nominal and real interest rates in detail. Here it is sufficient to note that the real interest rate measures the true cost of borrowing and, thus, determines the quantity of investment.

We can summarize this discussion with an equation relating investment I to the real interest rate r:

I = I(r).

Figure 3-7 shows this investment function. It slopes downward, because as the interest rate rises, the quantity of investment demanded falls. The position of this investment function shifts if there is any significant change in the other determinants of investment spending (which we have assumed to be constant when drawing Figure 3-7).

Government Purchases

Government purchases are the third component of the demand for goods and services. The federal government buys helicopters, computers, and the services of government employees. Provincial and municipal governments buy library books, build schools and hospitals, and hire teachers and doctors. Governments at all levels build roads and other public works. All these transactions make up government purchases of goods and services, which account for about 22 percent of GDP in Canada.

These purchases are only one type of government spending. The other type is transfer payments to households, such as welfare for the poor and Canada Pension payments for the elderly. Unlike government purchases, transfer payments are not made in exchange for some of the economy’s output of goods and services. Therefore, they are not included in the variable G.

Transfer payments do affect the demand for goods and services indirectly. Transfer payments are the opposite of taxes: they increase households’ disposable income, just as taxes reduce disposable income. Thus, an increase in transfer payments financed by an increase in taxes leaves disposable income unchanged. We can now revise our definition of T to equal taxes minus transfer payments. Disposable income, Y – T, includes both the negative impact of taxes and the positive impact of transfer payments.

If government purchases equal taxes minus transfers, then G = T, and the government has a balanced budget. If G exceeds T, the government runs a budget deficit, which it funds by issuing government debt—that is, by borrowing in the financial markets. If G is less than T, the government runs a budget surplus, which it can use to repay some of its outstanding debt.

Here we do not try to explain the political process that leads to a particular fiscal policy—that is, to the level of government purchases and taxes. Instead, we take government purchases and taxes as exogenous variables. To denote that these variables are fixed outside of our model of national income, (that is, determined by events that we are not trying to explain in this model—such as a natural disaster that would prompt government to take action) we write

We do, however, want to examine the impact of fiscal policy on the variables determined within the model, the endogenous variables. The endogenous variables here are consumption, investment, and the interest rate.

To see how the exogenous variables affect the endogenous variables, we must complete the model. This is the subject of the next section.