4.7 Hyperinflation

Hyperinflation is often defined as inflation that exceeds 50 percent per month, which is just over 1 percent per day. Compounded over many months, this rate of inflation leads to very large increases in the price level. An inflation rate of 50 percent per month implies a more than 100-fold increase in the price level over a year, and a more than 2-million-fold increase over three years. Here we consider the costs and causes of such extreme inflation.

FYI

Keynes (and Lenin) on the Cost of Inflation

The great economist John Maynard Keynes was no friend of inflation, as this chapter’s opening quotation indicates. Here is the more complete passage from his famous book, The Economic Consequences of the Peace, in which Keynes predicted (correctly) that the treaty imposed on Germany after World War I would lead to economic hardship and renewed international tensions:

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth. Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.11

History has given ample support to this assessment. A recent example occurred in Russia in 1998, where many citizens saw high rates of inflation wipe out their ruble-denominated savings. And, as Lenin would have predicted, this inflation put the country’s burgeoning capitalist system in serious jeopardy.

The Costs of Hyperinflation

Although economists debate whether the costs of moderate inflation are large or small, no one doubts that hyperinflation extracts a high toll on society. The costs are qualitatively the same as those we discussed earlier. When inflation reaches extreme levels, however, these costs are more apparent because they are so severe.

The shoeleather costs associated with reduced money holding, for instance, are serious under hyperinflation. Business executives devote much time and energy to cash management when cash loses its value quickly. By diverting this time and energy from more socially valuable activities, such as production and investment decisions, hyperinflation makes the economy run less efficiently.

Menu costs also become larger under hyperinflation. Firms have to change prices so often that normal business practices, such as printing and distributing catalogues with fixed prices, become impossible. In one restaurant during the German hyperinflation of the 1920s, a waiter would stand up on a table every 30 minutes to call out the new prices.

Similarly, relative prices do not do a good job of reflecting true scarcity during hyperinflations. When prices change frequently by large amounts, it is hard for customers to shop around for the best price. Highly volatile and rapidly rising prices can alter behaviour in many ways. According to one report, when patrons entered a pub during the German hyperinflation, they would often buy two pitchers of beer. Although the second pitcher would lose value by getting warm over time, it would lose value less rapidly than the money left sitting in the patron’s wallet.

Tax systems are also distorted by hyperinflation—but in ways that are different from the distortions of moderate inflation. In most tax systems there is a delay between the time when a tax is levied and the time when the tax is paid to the government. In Canada, for example, taxpayers are required to make estimated income tax payments every three months. This short delay does not matter much under low inflation. By contrast, during hyperinflation, even a short delay greatly reduces real tax revenue. By the time the government gets the money it is due, the money has fallen in value. As a result, once hyperinflations start, the real tax revenue of the government often falls substantially.

Finally, no one should underestimate the sheer inconvenience of living with hyperinflation. When carrying money to the grocery store is as burdensome as carrying the groceries back home, the monetary system is not doing its best to facilitate exchange. The government tries to overcome this problem by adding more and more zeros to the paper currency, but often it cannot keep up with the exploding price level.

Eventually, these costs of hyperinflation become intolerable. Over time, money loses its role as a store of value, unit of account, and medium of exchange. Barter becomes more common. And more stable unofficial monies—cigarettes or the U.S. dollar—naturally start to replace the official money.

CASE STUDY

Life During the Bolivian Hyperinflation

The following article from the Wall Street Journal shows what life was like during the Bolivian hyperinflation of 1985.12 What costs of inflation does this article emphasize?

Precarious Peso—Amid Wild Inflation, Bolivians Concentrate on Swapping Currency

LA PAZ, Bolivia When Edgar Miranda gets his monthly teacher’s pay of 25 million pesos, he hasn’t a moment to lose. Every hour, pesos drop in value. So, while his wife rushes to market to lay in a month’s supply of rice and noodles, he is off with the rest of the pesos to change them into black-market dollars.

Mr. Miranda is practicing the First Rule of Survival amid the most out-of-control inflation in the world today. Bolivia is a case study of how runaway inflation undermines a society. Price increases are so huge that the figures build up almost beyond comprehension. In one six-month period, for example, prices soared at an annual rate of 38,000%. By official count, however, last year’s inflation reached 2,000%, and this year’s is expected to hit 8,000%—though other estimates range many times higher. In any event, Bolivia’s rate dwarfs Israel’s 370% and Argentina’s 1,100%—two other cases of severe inflation.

It is easier to comprehend what happens to the 38-year-old Mr. Miranda’s pay if he doesn’t quickly change it into dollars. The day he was paid 25 million pesos, a dollar cost 500,000 pesos. So he received $50. Just days later, with the rate at 900,000 pesos, he would have received $27.

“We think only about today and converting every peso into dollars,” says Ronald MacLean, the manager of a gold-mining firm. “We have become myopic.”

And intent on survival. Civil servants won’t hand out a form without a bribe. Lawyers, accountants, hairdressers, even prostitutes have almost given up working to become money-changers in the streets. Workers stage repeated strikes and steal from their bosses. The bosses smuggle production abroad, take out phony loans, duck taxes—anything to get dollars for speculation.

The production at the state mines, for example, dropped to 12,000 tons last year from 18,000. The miners pad their wages by smuggling out the richest ore in their lunch pails, and the ore goes by a contraband network into neighboring Peru. Without a major tin mine, Peru now exports some 4,000 metric tons of tin a year.

“We don’t produce anything. We are all currency speculators,” a heavy-equipment dealer in La Paz says. “People don’t know what’s good and bad anymore. We have become an amoral society. . . .”

It is an open secret that practically all of the black-market dollars come from the illegal cocaine trade with the U.S. Cocaine traffickers earn an estimated $1 billion a year. . . .

But meanwhile the country is suffering from inflation largely because the government’s revenues cover a mere 15% of its expenditures and its deficit has widened to nearly 25% of the country’s total annual output. The revenues are hurt by a lag in tax payments, and taxes aren’t being collected largely because of widespread theft and bribery.

The Causes of Hyperinflation

Why do hyperinflations start, and how do they end? This question can be answered at different levels.

The most obvious answer is that hyperinflations are due to excessive growth in the supply of money. When the central bank prints money, the price level rises. When it prints money rapidly enough, the result is hyperinflation. To stop the hyperinflation, the central bank must simply reduce the rate of money growth.

This answer is incomplete, however, for it leaves open the question of why central banks in hyperinflating economies choose to print so much money. To address this deeper question, we must turn our attention from monetary to fiscal policy. Most hyperinflations begin when the government has inadequate tax revenue to pay for its spending. Although the government might prefer to finance this budget deficit by issuing debt, it may find itself unable to borrow, perhaps because lenders view the government as a bad credit risk. To cover the deficit, the government sells the bonds to the central bank, thereby turning to the only mechanism at its disposal—the printing press. The result is rapid money growth and hyperinflation.

Once the hyperinflation is under way, the fiscal problems become even more severe. Because of the delay in collecting tax payments, real tax revenue falls as inflation rises. Thus, the government’s need to rely on seigniorage is self-reinforcing. Rapid money creation leads to hyperinflation, which leads to a larger budget deficit, which leads to even more rapid money creation.

The ends of hyperinflations almost always coincide with fiscal reforms. Once the magnitude of the problem becomes apparent, the government finally musters the political will to reduce government spending and increase taxes. These fiscal reforms reduce the need for seigniorage, which allows a reduction in money growth. Hence, even if inflation is always and everywhere a monetary phenomenon, the end of hyperinflation is usually a fiscal phenomenon as well.13

CASE STUDY

Hyperinflation in Interwar Germany

After World War I, Germany experienced one of history’s most spectacular examples of hyperinflation. At the war’s end, the Allies demanded that Germany pay substantial reparations. These payments led to fiscal deficits in Germany, which the German government eventually financed by printing large quantities of money.

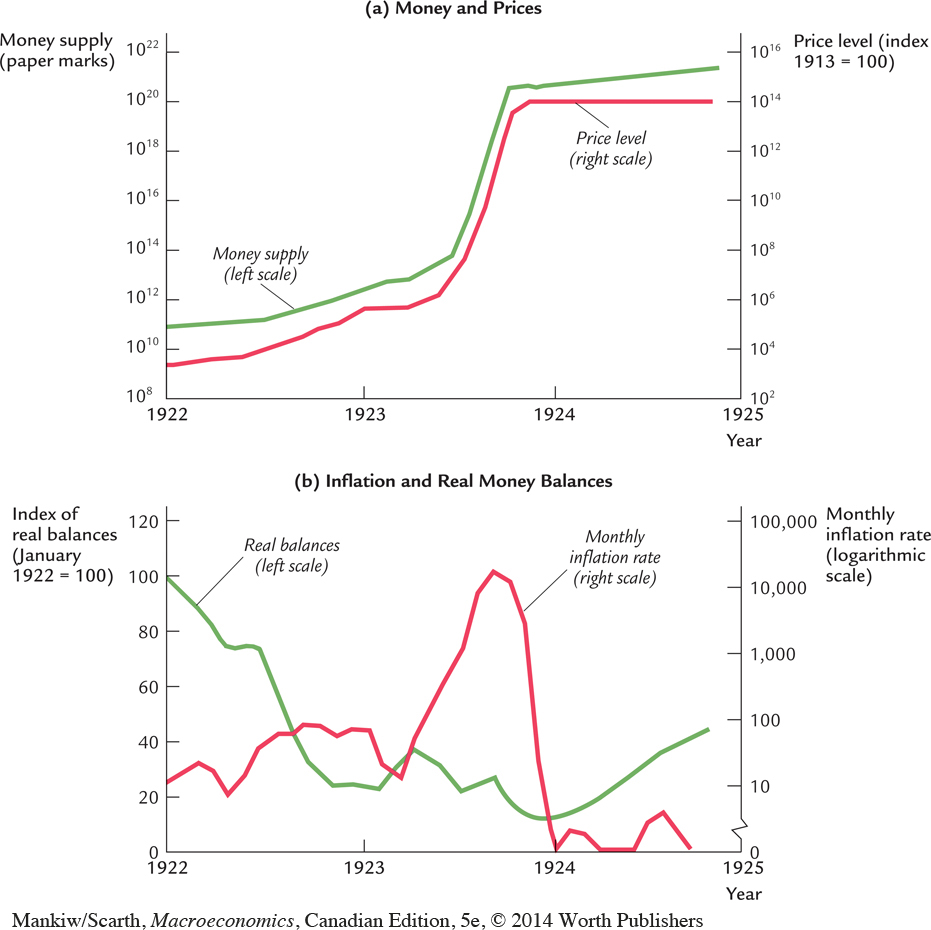

Panel (a) of Figure 4-6 shows the quantity of money and the general price level in Germany from January 1922 to December 1924. During this period both money and prices rose at an amazing rate. For example, the price of a daily newspaper rose from 0.30 mark in January 1921 to 1 mark in May 1922, to 8 marks in October 1922, to 100 marks in February 1923, and to 1,000 marks in September 1923. Then, in the fall of 1923, prices really took off: the newspaper sold for 2,000 marks on October 1, 20,000 marks on October 15, 1 million marks on October 29, 15 million marks on November 9, and 70 million marks on November 17. In December 1923 the money supply and prices abruptly stabilized.14

Just as fiscal problems caused the German hyperinflation, a fiscal reform ended it. At the end of 1923, the number of government employees was cut by one-third, and the reparations payments were temporarily suspended and eventually reduced. At the same time, a new central bank, the Rentenbank, replaced the old central bank, the Reichsbank. The Rentenbank was committed to not financing the government by printing money.

According to our theoretical analysis of money demand, an end to a hyperinflation should lead to an increase in real money balances as the cost of holding money falls. Panel (b) of Figure 4-6 shows that real money balances in Germany did fall as inflation increased, and then increased again as inflation fell. Yet the increase in real money balances was not immediate. Perhaps the adjustment of real money balances to the cost of holding money is a gradual process. Or perhaps it took time for people in Germany to believe that the inflation had really ended, so that expected inflation fell more gradually than actual inflation.

CASE STUDY

Hyperinflation in Zimbabwe

In 1980, after years of colonial rule, the old British colony of Rhodesia became the new African nation of Zimbabwe. A new currency, the Zimbabwe dollar, was introduced to replace the Rhodesian dollar. During Zimbabwe’s first decade of independence, inflation was modest—about 10 to 20 percent per year. However, this rate would soon change.

The hero of the Zimbabwe independence movement was Robert Mugabe. In general elections in 1980, he became the nation’s first prime minister and later, after a government reorganization, its president. Over the years, he continued to get reelected. In 2008, however, there were widespread claims of electoral fraud and threats against voters who supported rival candidates. Mugabe was no longer as popular as he once had been, but he appeared unwilling to relinquish power. In 2013, at the age of 89, he was elected again.

Throughout his tenure, Mugabe’s economic philosophy was Marxist, and one of his goals was to redistribute wealth. In the 1990s, his government instituted a series of land reforms with the ostensible purpose of redistributing land from the white minority, who had ruled Zimbabwe during the colonial era, to the historically disenfranchised black population. One result of these reforms was widespread corruption. Many abandoned and expropriated white farms ended up in the hands of cabinet ministers and senior government officials. Another result was a substantial decline in farm output. Productivity fell as many of the experienced white farmers fled the country.

The decline in the economy’s output led to a drop in the government’s tax revenue. The government responded to this revenue shortfall by printing money to pay the salaries of government employees. As textbook economic theory predicts, the monetary expansion led to higher inflation.

Mugabe tried to deal with inflation by imposing price controls. Once again, the results were predictable: a shortage of many goods and the growth of an underground economy in which price controls and tax collection were evaded. The government’s tax revenue declined further, inducing even more monetary expansion and yet higher inflation. In July 2008, the officially reported annual inflation rate was 231 million percent. Other observers put the inflation rate even higher.

The hyperinflation had widespread repercussions. In an article in the Washington Post, one Zimbabwean citizen described the situation: “If you don’t get a bill collected in 48 hours, it isn’t worth collecting, because it is worthless. Whenever we get money, we must immediately spend it, just go and buy what we can. Our pension was destroyed ages ago. None of us have any savings left.”

The end of this story is still to be told. As this book was going to press, Robert Mugabe was continuing to run the country, but violence was increasing, and there was no end in sight to Zimbabwe’s hyperinflation.