15.1 Should Policy Be Active or Passive?

Policymakers in the federal government view economic stabilization as one of their primary responsibilities. The analysis of macroeconomic policy is a regular duty of the Department of Finance and the Bank of Canada. When the government is considering a major change in either fiscal or monetary policy, foremost in the discussion are how the change will influence inflation and unemployment and whether aggregate demand needs to be stimulated or restrained.

Although the government has long conducted monetary and fiscal policy, the view that it should use these policy instruments to try to stabilize the economy is more recent. The federal White Paper of 1945 was the landmark document in which the government first held itself accountable for macroeconomic performance. The White Paper states that the “government will be prepared, in periods when unemployment is threatening, to incur deficits and increases in the national debt resulting from its employment and income policy.” This policy commitment was written when the memory of the Great Depression was still fresh. The lawmakers who wrote it believed, as many economists do, that in the absence of an active government role in the economy, events like the Great Depression could occur regularly.

To many economists the case for active government policy is clear and simple. Recessions are periods of high unemployment, low incomes, and increased economic hardship. The model of aggregate demand and aggregate supply shows how shocks to the economy can cause recessions. It also shows how monetary and fiscal policy can limit recessions by responding to these shocks. These economists consider it wasteful not to use these policy instruments to stabilize the economy.

Other economists are critical of the government’s attempts to stabilize the economy. These critics argue that the government should take a hands-off approach to macroeconomic policy. At first, this view might seem surprising. If our model shows how to prevent or reduce the severity of recessions, why do these critics want the government to refrain from using monetary and fiscal policy for economic stabilization? To find out, let’s consider some of their arguments.

Lags in the Implementation and Effects of Policies

Economic stabilization would be easy if the effects of policy were immediate. Making policy would be like driving a car: policymakers would simply adjust their instruments to keep the economy on the desired path.

Making economic policy, however, is less like driving a car than it is like piloting a large ship. A car changes direction almost immediately after the steering wheel is turned. By contrast, a ship changes course long after the pilot adjusts the rudder, and once the ship starts to turn, it continues turning long after the rudder is set back to normal. A novice pilot is likely to oversteer and, after noticing the mistake, overreact by steering too much in the opposite direction. The ship’s path could become unstable, as the novice responds to previous mistakes by making larger and larger corrections.

Like a ship’s pilot, economic policymakers face the problem of long lags. Indeed, the problem for policymakers is even more difficult, because the lengths of the lags are hard to predict. These long and variable lags greatly complicate the conduct of monetary and fiscal policy.

Economists distinguish between two lags that are relevant to the conduct of stabilization policy: the inside lag and the outside lag. The inside lag is the time between a shock to the economy and the policy action responding to that shock. This lag arises because it takes time for policymakers first to recognize that a shock has occurred and then to put appropriate policies into effect. The outside lag is the time between a policy action and its influence on the economy. This lag arises because policies do not immediately influence spending, income, and employment.

Fiscal policy can have a long inside lag, since changes in spending or taxes must be voted through both the House of Commons and the Senate. The process of parliamentary committee hearings can be slow and cumbersome. An additional problem concerning fiscal policy is that provincial governments sometimes want to push the economy in the opposite direction from what is intended by the federal government. (This coordination problem was discussed more fully in Chapter 12.)

Monetary policy has a much shorter inside lag than fiscal policy, for a central bank can decide on and implement a policy change in less than a day, but monetary policy has a substantial outside lag. Monetary policy works by changing the money supply and thereby interest rates and the exchange rate, which in turn influence the investment and net-exports components of aggregate demand. But many firms make investment, import, and export plans far in advance. Therefore, a change in monetary policy is thought not to affect economic activity until about six months after it is made.

The long and variable lags associated with monetary and fiscal policy certainly make stabilizing the economy more difficult. Advocates of passive policy argue that, because of these lags, successful stabilization policy is almost impossible. Indeed, attempts to stabilize the economy can be destabilizing. Suppose that the economy’s condition changes between the beginning of a policy action and its impact on the economy. In this case, active policy may end up stimulating the economy when it is heating up or depressing the economy when it is cooling off. Advocates of active policy admit that such lags do require policymakers to be cautious. But, they argue, these lags do not necessarily mean that policy should be completely passive, especially in the face of a severe and protracted economic downturn, such as the recession that began in 2008.

Some policies, called automatic stabilizers, are designed to reduce the lags associated with stabilization policy. Automatic stabilizers are policies that stimulate or depress the economy when necessary without any deliberate policy change. For example, the system of income taxes automatically reduces taxes when the economy goes into a recession, without any change in the tax laws, because individuals and corporations pay less tax when their incomes fall. Similarly, the employment-insurance and welfare systems automatically raise transfer payments when the economy moves into a recession, because more people apply for benefits. One can view these automatic stabilizers as a type of fiscal policy without any inside lag.

CASE STUDY

Profit Sharing as an Automatic Stabilizer

Economists often propose policies to improve the automatic-stabilizing powers of the economy. The economist Martin Weitzman has made one of the most intriguing suggestions: profit sharing. Today, most labour contracts specify a fixed wage. For example, a manufacturing firm might pay assembly-line workers $30 an hour. Weitzman recommends that the workers’ total pay should depend on their firm’s profits. A profit-sharing contract for this firm might pay workers $15 for each hour of work, but in addition the workers would divide among themselves a share of the firm’s profit.

Weitzman argues that profit sharing would act as an automatic stabilizer. Under the current wage system, a fall in demand for a firm’s product causes the firm to lay off workers: it is no longer profitable to employ them at the old wage. The firm will rehire these workers only if the wage falls or if demand recovers. Under a profit-sharing system, Weitzman argues, firms would be more likely to maintain employment after a fall in demand. Under the profit-sharing contract for our hypothetical manufacturing firm, for example, each additional hour of work would cost the firm only $15; the rest of the compensation for additional workers would come from the workers’ share of profits. Because the marginal cost of labour would be so much lower under profit sharing, a fall in demand would not normally cause a firm to lay off workers.

To provide evidence for the advantages of profit sharing, Weitzman points to Japan. Most Japanese workers receive a large fraction of their compensation in the form of year-end bonuses. Weitzman argues that, because of these bonuses, Japanese workers “think of themselves more as permanently employed partners than as hired hands.”

The New York Times dubbed Weitzman’s proposal “the best idea since Keynes.” Advocates of his theory want the government to provide tax incentives to encourage firms to adopt profit-sharing plans. Others, however, have expressed skepticism. They wonder why, if profit sharing is such a good idea, firms and workers don’t sign such contracts without prodding from the government. Whether profit sharing would help stabilize the economy, as Weitzman suggests, remains an open question.1

The Difficult Job of Economic Forecasting

Because policy influences the economy only after a substantial lag, successful stabilization policy requires the ability to predict accurately future economic conditions. If we cannot predict whether the economy will be in a boom or a recession in six months or a year, we cannot evaluate whether monetary and fiscal policy should now be trying to expand or contract aggregate demand. Unfortunately, economic developments are often unpredictable, at least given our current understanding of the economy.

One way forecasters try to look ahead is with the index of leading indicators. This index, called the composite index, is composed of 10 data series—such as stock prices, the number of housing starts, firms’ inventories, the U.S. leading indicator, the value of orders for new plants and equipment, and the money supply—that often fluctuate in advance of the economy. A large fall in a leading indicator signals that a recession is more likely.

Another way forecasters look ahead is with macroeconometric models, which have been developed both by government agencies and by private firms for forecasting and policy analysis. As we discussed in Chapter 11, these large-scale computer models are made up of many equations, each representing a part of the economy. After making assumptions about the path of the exogenous variables, such as monetary policy, fiscal policy, and foreign variables such as oil prices and trade restrictions, these models yield predictions about unemployment, inflation, and other endogenous variables. Keep in mind, however, that the validity of these predictions is only as good as the model and the forecasters’ assumptions about the exogenous variables.

CASE STUDY

Two Episodes in Economic Forecasting

“Light showers, bright intervals, and moderate winds.” This was the forecast offered by the renowned British national weather service on October 14, 1987. The next day Britain was hit by the worst storm in over two centuries.

Like weather forecasts, economic forecasts are a crucial input to private and public decisionmaking. Business executives rely on economic forecasts when deciding how much to produce and how much to invest in plant and equipment. Government policymakers also rely on them when developing economic policies. Yet also like weather forecasts, economic forecasts are far from precise.

Even the most severe economic downturn, the Great Depression of the 1930s, caught economic forecasters completely by surprise. Even after the stock market crash of 1929, they remained confident that the economy would not suffer a substantial setback. In late 1931, when the economy was clearly in bad shape, the eminent economist Irving Fisher predicted that it would recover quickly. Subsequent events showed that these forecasts were much too optimistic.2

Forecasting success is still an elusive goal, as the recession of the early 1990s illustrates. On average, during the first three years of the decade, Canada’s real GDP fell by 0.4 percentage points each year. Throughout this period, the federal government surveyed private forecasters to ensure that their own projections of GDP growth agreed with the existing consensus. One of the reasons the government’s budget deficit increased so much during the 1990–1992 period is that Finance Department officials (and other forecasters) overestimated GDP growth by over 3 percentage points per year! (With lower levels of income being earned, the existing set of tax rates did not generate the amount of revenue that the government expected.)

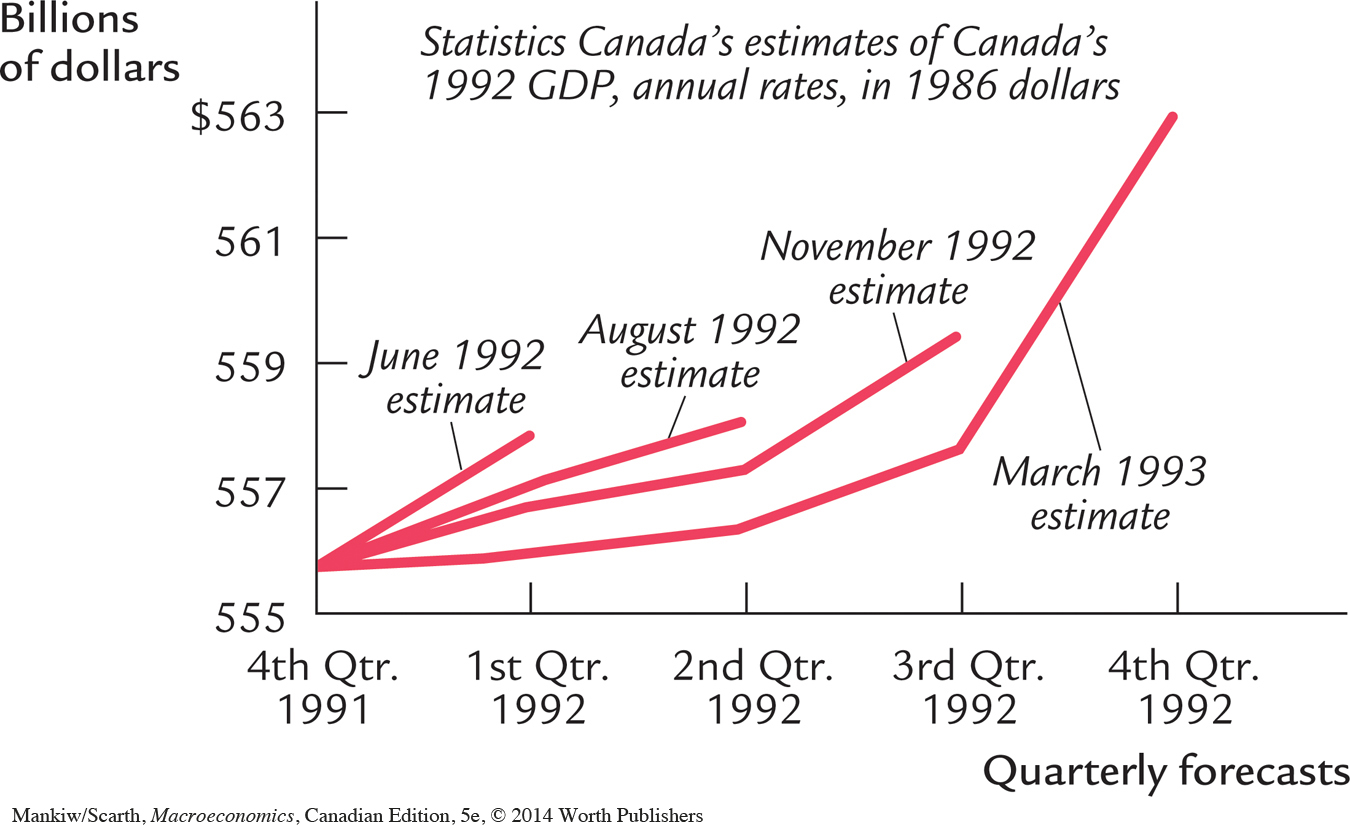

This low level of forecasting accuracy is discouraging for those who favour an active stabilization policy. Furthermore, there is significant disparity among the various forecasters’ estimates. For example, in the federal budget of 1994 (delivered in February of that year), it was noted that the private forecasts for real GDP growth in that year ranged from 2.9 percent to 4.3 percent. More important, Statistics Canada (one of the most respected statistical agencies in the world) finds that it must revise its estimates of real GDP several times—even after the period in question has become a matter of history. Journalist Bruce Little used the graph shown in Figure 15-1 to indicate how much data revision goes on. For example, in just the nine months between June 1992 and March 1993, the estimate for GDP growth during the first quarter of 1992 was revised downward four times, with the final estimate’s being a growth rate that is only one-sixth of the initial measurement. And this is just getting recorded history straight—this is not forecasting at all. Although less well documented, the recession of 2008–2009 was underestimated initially as well. More specifically, in October 2008, most professional forecasters predicted that Canadian GDP growth in 2009 would be 1 percent. Just six months later, in March 2009, those same forecasters predicted the 2009 growth rate at minus 2 percent. Thus, while economic forecasts are an essential input to private and public decision-making, they have been, and continue to be, very uncertain.

Ignorance, Expectations, and the Lucas Critique

The prominent economist Robert Lucas once wrote, “As an advice-giving profession we are in way over our heads.” Even many of those who advise policymakers would agree with this assessment. Economics is a young science, and there is still much that we do not know. Economists cannot be completely confident when they assess the effects of alternative policies. This ignorance suggests that economists should be cautious when offering policy advice.

In his writing on macroeconomic policymaking, Lucas has emphasized that economists need to pay more attention to the issue of how people form expectations of the future. Expectations play a crucial role in the economy because they influence all sorts of behaviour. For instance, households decide how much to consume based on how much they expect to earn in the future, and firms decide how much to invest based on their expectations of future profitability. These expectations depend on many things, but one factor, according to Lucas, is especially important: the economic policies being pursued by the government. When policymakers estimate the effect of any policy change, therefore, they need to know how people’s expectations will respond to the policy change. Lucas has argued that traditional methods of policy evaluation—such as those that rely on standard macroeconometric models—do not adequately take into account this impact of policy on expectations. This criticism of traditional policy evaluation is known as the Lucas critique. 3

An important example of the Lucas critique arises in the analysis of disinflation. As you may recall from Chapter 13, the cost of reducing inflation is often measured by the sacrifice ratio, which is the number of percentage points of GDP that must be forgone to reduce inflation by 1 percentage point. Because estimates of the sacrifice ratio are often large, they have led some economists to argue that policymakers should learn to live with inflation, rather than incurring the large cost of reducing it.

According to advocates of the rational-expectations approach, however, these estimates of the sacrifice ratio are unreliable because they are subject to the Lucas critique. Traditional estimates of the sacrifice ratio are based on adaptive expectations, that is, on the assumption that expected inflation depends on past inflation. Adaptive expectations may be a reasonable premise in some circumstances, but if the policymakers make a credible change in policy, workers and firms setting wages and prices will rationally respond by adjusting their expectations of inflation appropriately. This change in inflation expectations will quickly alter the short-run tradeoff between inflation and unemployment. As a result, reducing inflation can potentially be much less costly than is suggested by traditional estimates of the sacrifice ratio.

We encounter two other examples of the Lucas critique in this book. First, in the appendix to Chapter 12, we examine whether the central bank should smooth the exchange rate or not. We find that the answer to this question depends fundamentally on whether individuals adjust their forecasts of the exchange rate to reflect this intervention by the authorities. Second, in Chapter 17, we study the household consumption function. We learn that economists have sometimes made very inaccurate predictions concerning how consumers respond to changes in personal-income tax rates. This is because analysts have ignored the effect of the government’s policies on consumers’ expectations. In Chapter 17, we see how economists have learned to respect the Lucas critique by modifying their theory of consumer behaviour.

The Lucas critique leaves us with two lessons. The more narrow lesson is that economists evaluating alternative policies need to consider how policy affects expectations and, thereby, behaviour. The broader lesson is that policy evaluation is hard, so economists engaged in this task should be sure to show the requisite humility.

The Historical Record

In judging whether government policy should play an active or passive role in the economy, we must give some weight to the historical record. If the economy has experienced many large shocks to aggregate supply and aggregate demand, and if policy has successfully insulated the economy from these shocks, then the case for active policy should be clear. Conversely, if the economy has experienced few large shocks, and if the fluctuations we have observed can be traced to inept economic policy, then the case for passive policy should be clear. In other words, our view of stabilization policy should be influenced by whether policy has historically been stabilizing or destabilizing. For this reason, the debate over macro-economic policy frequently turns into a debate over macroeconomic history.

Yet history does not settle the debate over stabilization policy. Disagreements over history arise because it is not easy to identify the sources of economic fluctuations. The historical record often permits more than one interpretation.

The Great Depression is a case in point. Economists’ views on macroeconomic policy are often related to their views on the cause of the Depression. Some economists believe that a large contractionary shock to private spending caused the Depression. They assert that policymakers should have responded by using the tools of monetary and fiscal policy to stimulate aggregate demand. Other economists believe that the large fall in the money supply in the United States caused the Depression. They assert that the Depression would have been avoided if the U.S. central bank, the Fed, had been pursuing a passive monetary policy of increasing the money supply at a steady rate. Hence, depending on one’s beliefs about its cause, the Great Depression can be viewed either as an example of why active monetary and fiscal policy is necessary or as an example of why it is dangerous.

CASE STUDY

Is the Stabilization of the Economy a Figment of the Data?

Keynes wrote The General Theory in the 1930s, and in the wake of the Keynesian revolution, governments around the world began to view economic stabilization as a primary responsibility. Some economists believe that the development of Keynesian theory has had a profound influence on the behaviour of the economy. Comparing data from before World War I and after World War II, they find that real GDP and unemployment have become much more stable. This, some Keynesians claim, is the best argument for active stabilization policy: it has worked.

In a series of provocative and influential papers, economist Christina Romer has challenged this assessment of the historical record. She argues that the measured reduction in volatility reflects not an improvement in economic policy and performance but rather an improvement in the economic data. The older data are much less accurate than the newer data. Romer claims that the higher volatility of unemployment and real GDP reported for the period before World War I is largely a figment of the data.

Romer uses various techniques to make her case. One is to construct more accurate data for the earlier period. This task is difficult because data sources are not readily available. A second way is to construct less accurate data for the recent period—that is, data that are comparable to the older data and thus suffer from the same imperfections. After constructing new “bad” data, Romer finds that the recent period appears almost as volatile as the early period, suggesting that the volatility of the early period may be largely an artifact of how the data were assembled.

Romer’s work is an important part of the continuing debate over whether macroeconomic policy has improved the performance of the economy. Although her work remains controversial, most economists now believe that the economy in the immediate aftermath of the Keynesian revolution was only slightly more stable than it had been before.4