Investment

The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future.

— John Maynard Keynes

While spending on consumption goods provides utility to households today, spending on investment goods is aimed at providing a higher standard of living at a later date. Investment is the component of GDP that links the present and the future.

Investment spending plays a key role not only in long-run growth but also in the short-run business cycle because it is the most volatile component of GDP. When expenditure on goods and services falls during a recession, much of the decline is usually due to a drop in investment spending. In the severe recession of 1982, for example, real GDP fell $14 billion whereas investment spending fell $11 billion, accounting for more than three-quarters of the fall in spending.

Economists study investment to better understand fluctuations in the economy’s output of goods and services. The models of GDP we saw in previous chapters, such as the IS–LM model in Chapters 10 and 11, were based on a simple investment function relating investment to the real interest rate: I = I(r). That function states that an increase in the real interest rate reduces investment. In this chapter we look more closely at the theory behind this investment function.

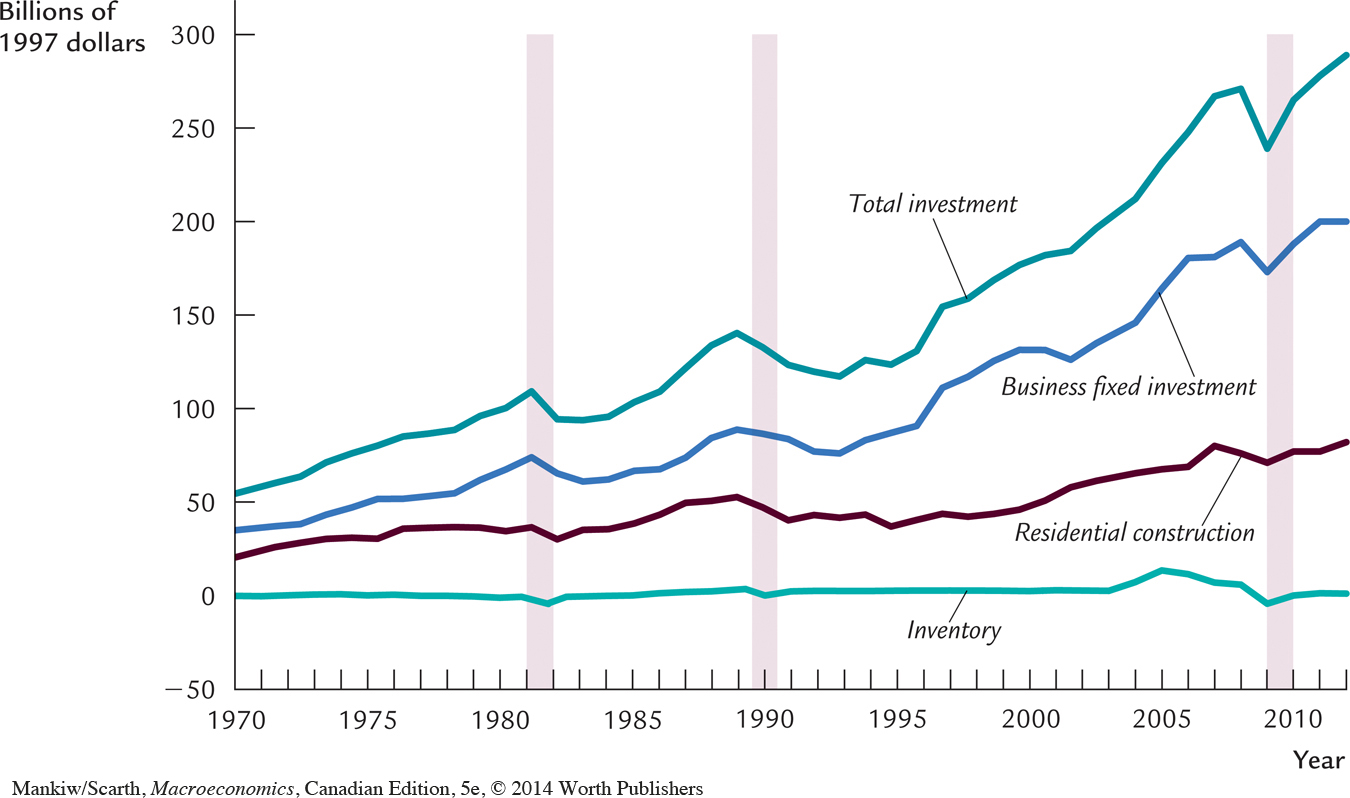

There are three types of investment spending. Business fixed investment includes the machinery, equipment, and structures that businesses buy to use in production. Residential investment includes the new housing that people buy to live in and that landlords buy to rent out. Inventory investment includes those goods that businesses put aside in storage, including materials and supplies, work in process, and finished goods. Figure 18-1 plots total investment and its three components in Canada from 1970 to 2012. You can see that all types of investment fall substantially during recessions, which are shown as shaded areas in the figure.

In this chapter we build models of each type of investment to explain these fluctuations. The models will shed light on the following questions:

Why is investment negatively related to the interest rate?

What causes the investment function to shift?

Why does investment rise during booms and fall during recessions?

At the end of the chapter, we return to these questions and summarize the answers that the models offer.