The Organization and Economics of Magazines

Given the great diversity in magazine content and ownership, it is hard to offer a common profile of a successful magazine. However, large or small, online or in print, most magazines deal with the same basic functions: production, content, ads, and sales. In this section, we discuss how magazines operate, the ownership structure behind major magazines, and how smaller publications fulfill niche areas that even specialized magazines do not reach.

Magazine Departments and Duties

Unlike a broadcast station or a daily newspaper, a small newsletter or magazine can begin cheaply via computer-

Editorial and Production

The lifeblood of a magazine is the editorial department, which produces its content, excluding advertisements. Like newspapers, most magazines have a chain of command that begins with a publisher and extends to the editor in chief, the managing editor, and a variety of subeditors. These subeditors oversee such editorial functions as photography, illustrations, reporting and writing, copyediting, layout, and print and multimedia design. Magazine writers generally include contributing staff writers, who are specialists in certain fields, and freelance writers: nonstaff professionals who are assigned to cover particular stories or a region of the country. Many magazines, especially those with small budgets, also rely on well-

Despite the rise of inexpensive desktop publishing, most large commercial magazines still operate several departments, which employ hundreds of people. The production and technology department maintains the computer and printing hardware necessary for mass market production. Because magazines are printed weekly, monthly, or bimonthly, it is not economically practical for most magazine publishers to maintain expensive print facilities. As with USA Today, many national magazines digitally transport magazine copy to various regional printing sites for the insertion of local ads and for faster distribution.

Advertising and Sales

The advertising and sales department of a magazine secures clients, arranges promotions, and places ads. Like radio stations, network television stations, and basic cable television stations, consumer magazines are heavily reliant on advertising revenue. The more successful the magazine, the more it can charge for advertisement space. Magazines provide their advertisers with rate cards, which indicate how much they charge for a certain amount of advertising space on a page. A top-

The traditional display ad has been the staple of magazine advertising for more than a century. As magazines move to tablet editions, the options for ad formats have grown immensely. For example, Condé Nast magazines offer static display ads with a link for their editions on the iPad, Kindle Fire, Nexus 7, and Next Issue app. But they offer almost thirty other premium ad types, which can include audio, video, tap and reveal, and panoramic views. A single-

A few contemporary magazines, such as Highlights for Children, have decided not to carry ads and rely solely on subscriptions and newsstand sales instead. To protect the integrity of their various tests and product comparisons, Consumer Reports and Cook’s Illustrated carry no advertising. To strengthen its editorial independence, Ms. magazine abandoned ads in 1990 after years of pressure from the food, cosmetics, and fashion industries to feature recipes and more complementary copy.

Some advertisers and companies have canceled ads when a magazine featured an unflattering or critical article about a company or an industry.12 In some instances, this practice has put enormous pressure on editors not to offend advertisers. The cozy relationships between some advertisers and magazines have led to a dramatic decline in investigative reporting, once central to popular magazines during the muckraking era.

As television advertising siphoned off national ad revenues in the 1950s, publishers began introducing different editions of their magazines to attract advertisers. Regional editions are national magazines whose content is tailored to the interests of different geographic areas. For example, Sports Illustrated often prints five different regional versions of its College Football Preview and March Madness Preview editions, picturing regional stars on each of the five covers. In split-

Circulation and Distribution

TIME ON THE IPADTime, like many print publications, has an app with which users can purchase each weekly issue in digital form. The magazine also offers combination digital/print subscriptions.

The circulation and distribution department of a magazine monitors single-

Other strategies include evergreen subscriptions—those that automatically renew on a credit card account unless subscribers request that the automatic renewal be stopped—

The biggest strategy for reviving magazine sales is the migration to digital distribution (which also promises savings over the printing and physical distribution of glossy paper magazines). The number of magazines with iPad apps (which enable users to click on the app and launch the magazine) has grown rapidly. Although the iPad still reigns supreme in the world of tablets, other touchscreen color tablets, like the Amazon Kindle Fire, the Google Nexus 7, and the Samsung Galaxy Tab, have offered competition in the expanding market. Other models, such as the Next Issue app, offer unlimited access to 133 titles ($9.99 a month) or 143 titles ($14.99)—a Netflix-

Major Magazine Chains

In terms of ownership, the commercial magazine industry most closely resembles the cable television business, which patterned its specialized channels on the consumer magazine market (see Figure 9.2). Even though more than two hundred new commercial magazine titles appear each year—

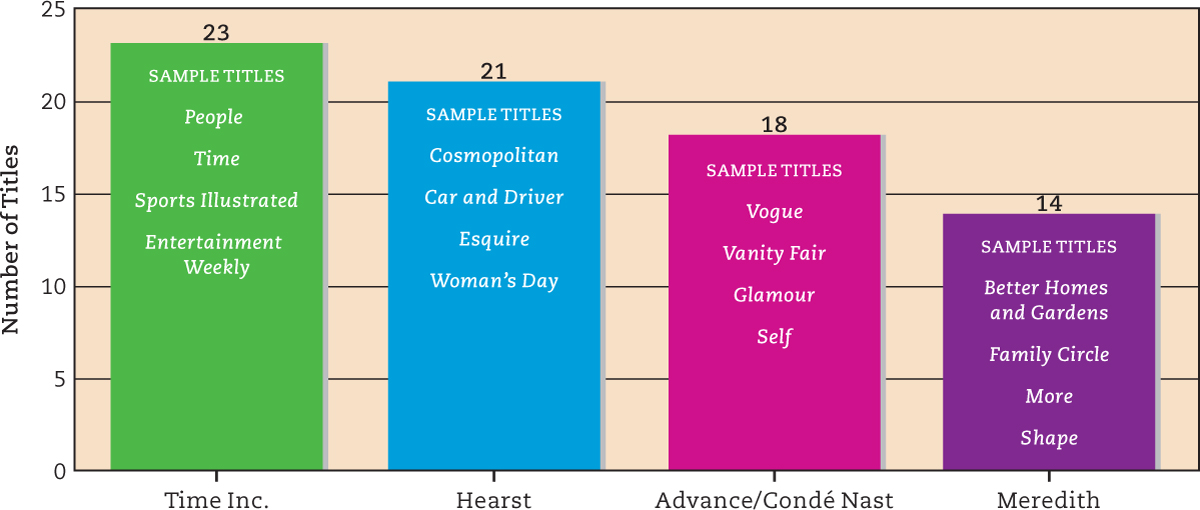

FIGURE 9.2TOP U.S. CONSUMER MAGAZINE COMPANIESData from: Corporate reports of each publisher.

Time Inc. is the largest U.S. magazine chain (by circulation), with twenty-

The Hearst Corporation, the leading magazine (and newspaper) chain early in the twentieth century, still remains a formidable publisher, with titles like Cosmopolitan, Esquire, Elle, and O: The Oprah Magazine. Long a force in upscale consumer magazines, Condé Nast is a division of Advance Publications, which operates the Newhouse newspaper chain. The Condé Nast group controls several key magazines, including Vanity Fair, GQ, and Vogue. The Meredith Corporation, based in Des Moines, Iowa, specializes in women’s and home-

In addition, a number of American magazines have carved out market niches worldwide. Reader’s Digest, Cosmopolitan, National Geographic, and Time, for example, all produce international editions in several languages. In general, though, most American magazines are local, regional, or specialized and therefore less exportable than movies and television. Of the twenty thousand titles, only about two hundred magazines from the United States circulate routinely in the world market. Such magazines, however—

Many major publishers, including Hearst, Meredith, Time Inc., and Rodale, generate additional revenue through custom publishing divisions, producing limited-

Alternative Voices

Only eighty-

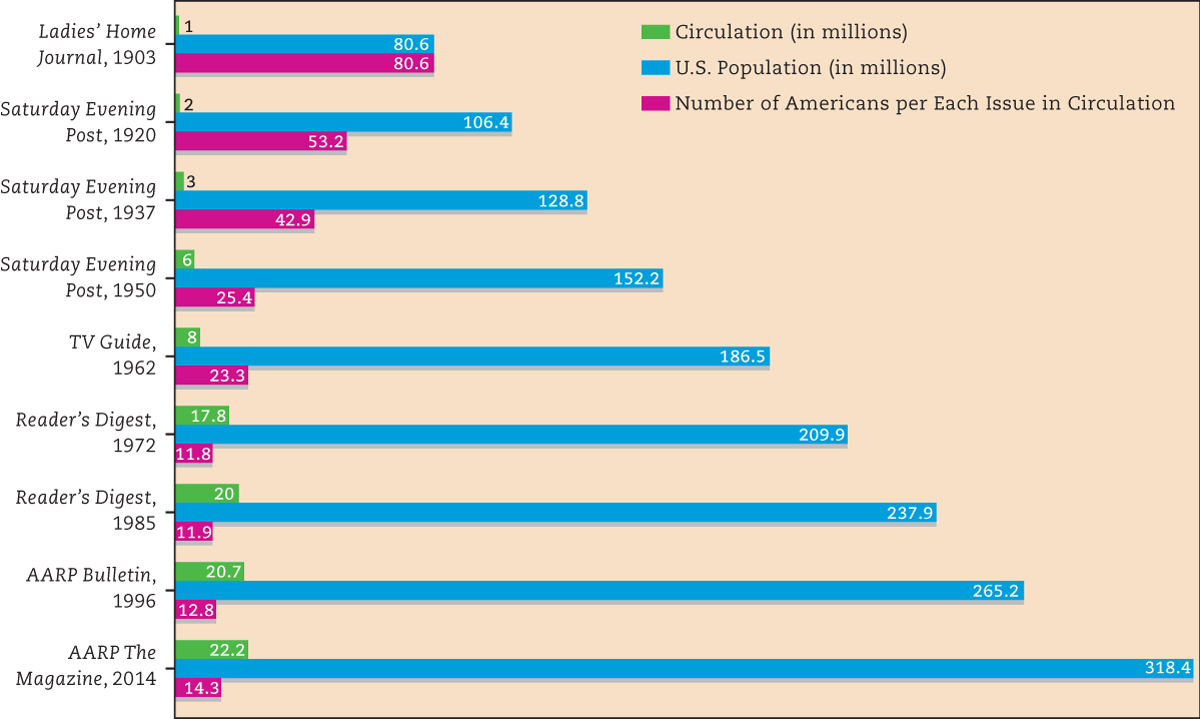

FIGURE 9.3THE CIRCULATION REACH OF LEADING AMERICAN MAGAZINESU.S. population data from U.S. Census Bureau, www.census.gov.

Alternative magazines have historically defined themselves in terms of politics—

Occasionally, alternative magazines have become marginally mainstream. For example, during the conservative Reagan era in the 1980s, William F. Buckley’s National Review saw its circulation swell to more than 100,000—

Most alternative magazines, however, are content to swim outside the mainstream. These are the small magazines that typically include diverse political, cultural, religious, international, and environmental subject matter, such as Against the Current, Y’all, Buddhadharma, Home Education Magazine, Jewish Currents, Small Farmer’s Journal, and Humor Times.