Ownership and Consolidation

Printed Page 254

To broaden their offerings, expand their market share, and lower expenses, many players in the TV and cable industry have consolidated. Others (such as the major broadcast networks) have been acquired by media conglomerates or large corporations. For example, Disney owns ABC; General Electric owns NBC; News Corp. owns Fox; Time Warner and CBS jointly own the newer CW network; and in 2009, Comcast struck a deal to buy 51 percent of NBC from GE.

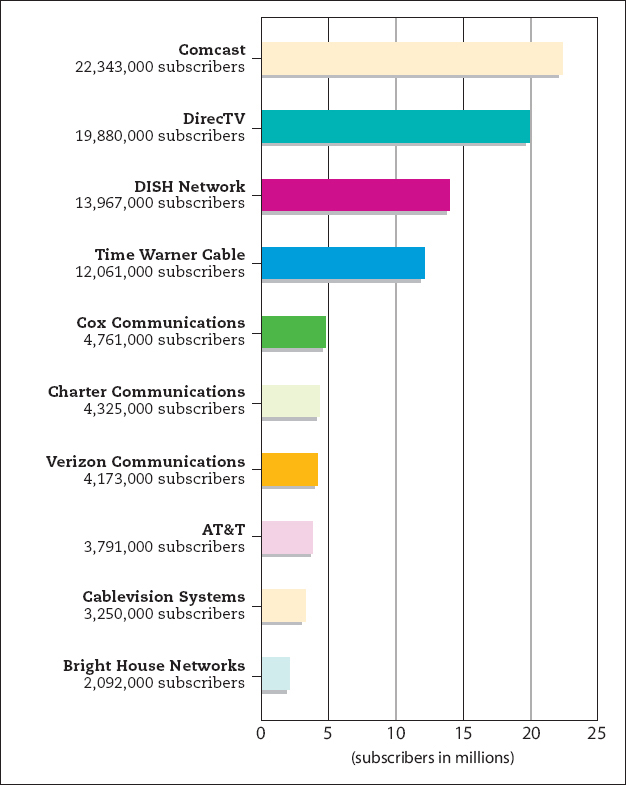

The world of cable has also seen extensive consolidation. In 2010, there were about 7,500 U.S. cable systems, down from 11,200 in 1994. Increasingly, these systems are being bought by multiple-system operators (MSOs), large corporations eager to cash in on the infrastructure of high-bandwidth wires connecting households across the country. In 1998, the twelve biggest MSOs controlled the lines into 70 percent of all households wired for cable. By 2009, the five top MSOs served more than 80 percent of all U.S. cable subscribers (see Figure 8.3). As with other media, this trend suggests a move toward oligopoly, in which a handful of media megafirms control cable and DBS programming.

AT&T, TCI, and Comcast

Facing increasing competition and declining long-distance revenues, AT&T, the nation’s leading long-distance phone company, purchased cable giant TCI (Tele-Communications, Inc.) in 1998. At that time, TCI was the leading cable MSO, boasting thirteen million households. AT&T renamed the cable division AT&T Broadband & Internet Services. In 2000, AT&T acquired MediaOne, the third-largest cable firm, a move that boosted its direct subscriber base to sixteen million.

Ultimately, AT&T’s appetite for acquisitions gave it a bad case of debt. In late 2001, only three years after it had ventured into the cable and broadband industry, AT&T got out of the business by merging its cable division in a $72 billion deal with Comcast. The new Comcast instantly became the cable industry behemoth. Ironically, AT&T later returned to the business by delivering video service through its telephone lines.

Time Warner, AOL, and Turner

Time Warner Cable is a division of the world’s largest media company, Time Warner. In 1995, Time Warner bought Cablevision Systems—the eighth-largest MSO—and by 2011, Time Warner had around twelve million cable subscribers.

Beyond its cable-subscriber base, Time Warner is also a major provider of programming services. In 1995, it secured its position as the world’s largest media corporation by offering $6.5 billion to acquire Ted Turner’s Turner Broadcasting, which included superstation WTBS, CNN, Headline News, TNT, and CNN Radio.

DirecTV and DISH Network

In the 2000s, the two rival DBS companies DirecTV and DISH Network vaulted onto the list of major players in what the industry calls the multi-channel video programming distributor (MVPD) market (see Figure 8.3). DirecTV was established in 1977, and its DBS system debuted in 1994. News Corp., owner of several media properties (including the first DBS service in Europe, Sky Television), acquired DirecTV in 2003. In 2008, the FCC approved a deal to transfer the controlling interest in DirecTV from News Corp. to cable service provider Liberty Media, which also owns the Starz Entertainment movie channel.

The independently owned DISH Network was founded as EchoStar Communications in 1980. Originally a distributor of big-dish television systems, the company later refocused on the emerging DBS market and launched its DISH Network service in 1995. Each of the two DBS companies operates between eight and ten satellites.