EXAMPLE 13.2 Runs Test and Stock Price Returns

disney

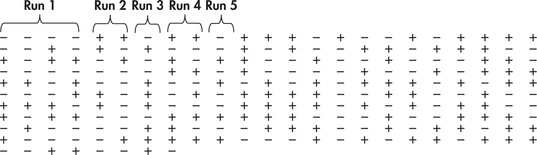

In Example 13.1, we observed weekly returns. To make the necessary counts for the runs test, it is convenient to subtract the sample mean from each of the observations. The focus can then be simply on whether the resulting observations are positive or negative. Figure 13.5 shows the sequence of pluses and minuses for the price change series with the first five runs identified. Going through the whole sequence, we find 131 runs, and we also find observations above the sample mean of 0.4846 and observations below or equal to the sample mean. Given these counts, the number of runs has mean

650

and standard deviation

The observed number of runs of 131 deviates by 11 runs from the expected number (mean) of runs, which is 120. The results can be summarized with a -value. The test statistic is given by

Because evidence against randomness is associated with either too many or too few runs, we have a two-sided test with a -value of

The -value indicates that there is not strong enough evidence to reject the hypothesis of a random process.