EXAMPLE 7.4 Diversify or Be Sued

divrsfy

An investor with a stock portfolio worth several hundred thousand dollars sued his broker and brokerage firm because lack of diversification in his portfolio led to poor performance. The conflict was settled by an arbitration panel that gave “substantial damages” to the investor.2 Table 7.1 gives the rates of return for the 39 months that the account was managed by the broker. The arbitration panel compared these returns with the average of the Standard & Poor’s 500-stock index for the same period.

366

| −8.36 | 1.63 | −2.27 | −2.93 | −2.70 | −2.93 | −9.14 | −2.64 |

| 6.82 | −2.35 | −3.58 | 6.13 | 7.00 | −15.25 | −8.66 | −1.03 |

| −9.16 | −1.25 | −1.22 | −10.27 | −5.11 | −0.80 | −1.44 | 1.28 |

| −0.65 | 4.34 | 12.22 | −7.21 | −0.09 | 7.34 | 5.04 | −7.24 |

| −2.14 | −1.01 | −1.41 | 12.03 | −2.56 | 4.33 | 2.35 |

Consider the 39 monthly returns as a random sample from the population of monthly returns that the brokerage would generate if it managed the account forever. Are these returns compatible with a population mean of , the S&P 500 average? Our hypotheses are

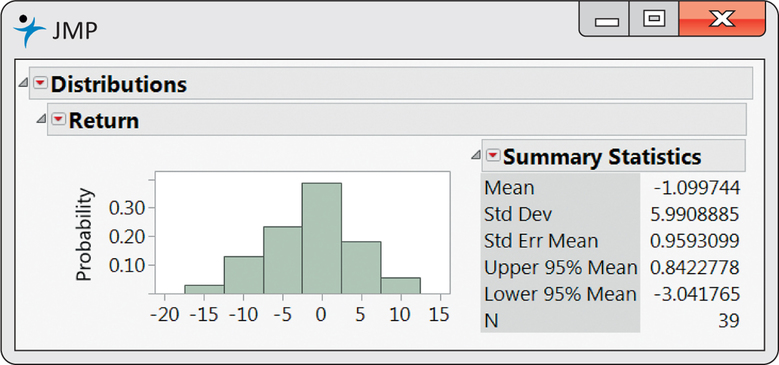

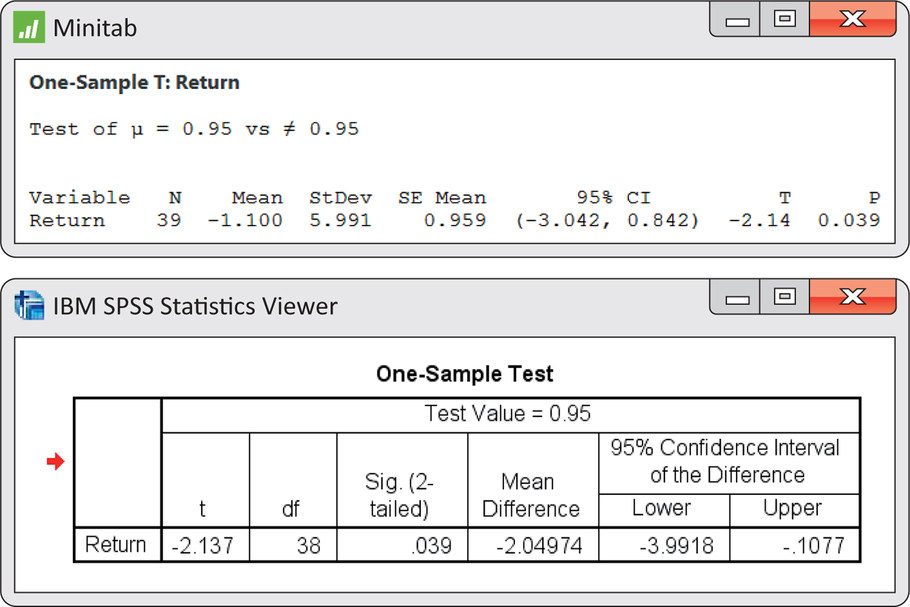

Figure 7.5 gives a histogram for these data. There are no outliers, and the distribution shows no strong skewness. We are reasonably confident that the distribution of is approximately Normal, and we proceed with our inference based on Normal theory. Minitab and SPSS outputs appear in Figure 7.6. Output from other software will look similar.

367

Here is one way to report the conclusion: the mean monthly return on investment for this client’s account was . This differs significantly from 0.95, the performance of the S&P 500 for the same period