The American Promise: Printed Page 310

EXPERIENCING THE AMERICAN PROMISE

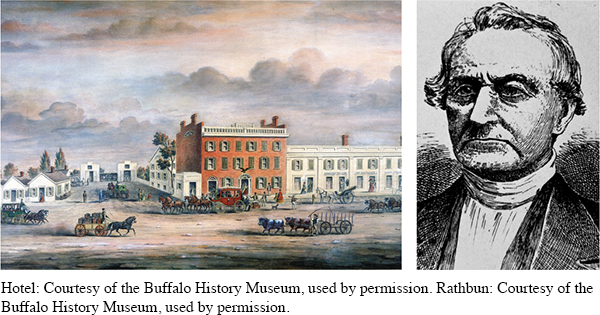

Going Ahead or Gone to Smash: An Entrepreneur Struggles in the 1830s

The spectacular boom of the 1830s gave life to the dream of get-

Benjamin Rathbun epitomized both go-

The success of the Eagle Hotel enabled Rathbun to become Buffalo’s biggest self-

Collapse came suddenly in 1836. Rathbun learned that his creditors in New York City had lost faith in him and were selling his IOUs to brokers at a steep discount, a process known as “note shaving.” To cover the much higher interest rates charged by the new note holders, the Rathbuns negotiated more loans, supposedly backed by a dozen cosigners from the Buffalo business community guaranteeing payment if the brothers failed. When Rathbun applied for a $500,000 loan in an attempt to consolidate his debt, the dozen endorsements were revealed to be forgeries. Benjamin Rathbun was convicted of fraud and sentenced to five years’ hard labor in state prison; brother Lyman disappeared with trunks full of money—

Rathbun’s spectacular failure plunged Buffalo into a severe depression eight months in advance of the panic of 1837. Although deliberate fraud brought him down, his wipeout highlighted the inherent difficulties in an economy of note shaving and discounting, where loans of millions of dollars were granted on the basis of a few signatures. Historians calculate that something like one-

Massive failures in the five years after 1837 led to two striking innovations in business law and loan practices. First, the federal government passed the U.S. Bankruptcy Act of 1841, a controversial and short-

Second, the credit rating industry was born in 1841 when a failed businessman opened the Mercantile Agency in New York City. For a $50 subscription fee, lenders could tap into large books containing confidential information gathered by hundreds of agents around the country who assessed the creditworthiness of local businessmen. Church (and saloon) attendance, family stability, and punctuality were often factors in grading businessmen’s reputations for prudence and reliability.

Had it been in existence in 1836, the Mercantile Agency might have unmasked Rathbun’s fraud through semiannual checks on his reputation. The Bankruptcy Act no doubt helped the many debt-

When Rathbun left prison in 1843, he rejoined his wife, now running a lowly boardinghouse in Buffalo. Soon the Rathbuns moved to New York City, where the onetime proprietor of Buffalo’s Eagle Hotel returned to his first occupation. With financial help from cousins, he leased a building for the first in a series of increasingly seedy hotels that he ran until his death.

Questions for Analysis

Summarize the Argument: What factors led to the Rathbuns’ downfall?

Analyze the Evidence: How did the new credit rating agency, established in reaction to the panic of 1837, intend to prevent economic crises?

Consider the Context: What were the causes of the panic of 1837? Did Jackson’s war against the Bank of the United States have any connection to the panic?