The American Promise:

Printed Page 296

The American Promise Value

Edition: Printed Page 285

The Bank War and Economic Boom

Along with the tariff and nullification, President Jackson fought another political battle, over the Bank of the United States. With twenty-

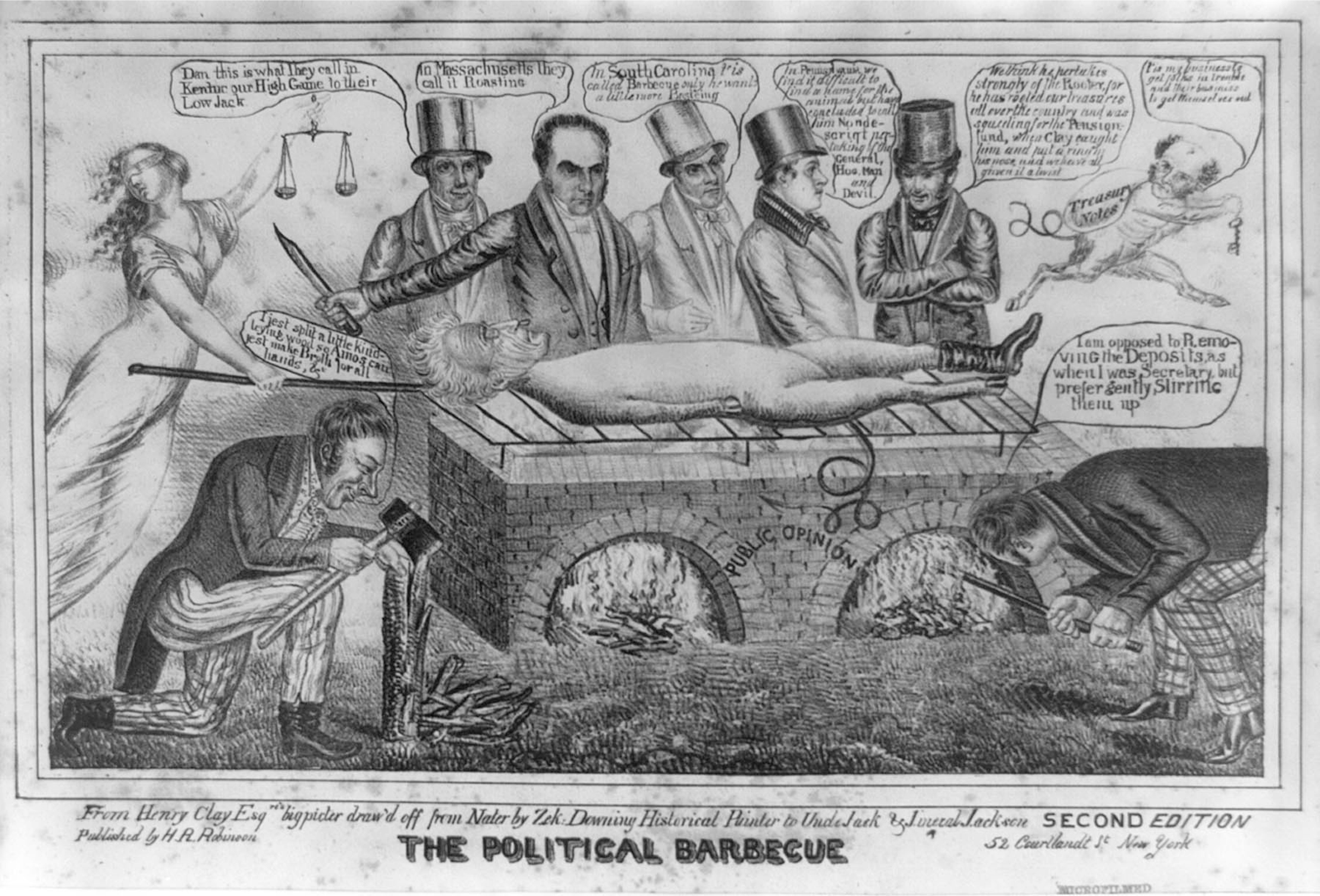

National Republican (Whig) senators Daniel Webster and Henry Clay decided to force the issue. They convinced the bank to apply for charter renewal in 1832, well before the fall election, even though the existing charter ran until 1836. They fully expected that Congress’s renewal would force Jackson to follow through on his rhetoric with a veto, that the unpopular veto would cause Jackson to lose the election, and that the bank would survive on an override vote by a new Congress swept into power on the anti-

At first, the plan seemed to work. The bank applied for rechartering, Congress voted to renew, and Jackson, angry over being manipulated, issued his veto. But it was a brilliantly written veto, positioning Jackson as the champion of the democratic masses. “Many of our rich men have not been content with equal protection and equal benefits, but have besought us to make them richer by act of Congress,” Jackson wrote.

Clay and his supporters found Jackson’s economic ideas and his rhetoric of class antagonism so absurd that they distributed thousands of copies of the bank veto as campaign material for their own party. A confident Henry Clay headed his party’s ticket for the presidency. But the plan backfired. Jackson’s framing of the bank controversy in the language of class conflict resonated with many Americans. Jackson won the election easily, gaining 55 percent of the popular vote and 219 electoral votes to Clay’s 49. Jackson’s party still controlled Congress, so no override was possible. The second Bank of the United States would cease to exist after 1836.

Jackson wanted to destroy the bank sooner. Calling it a “monster,” he ordered the sizable federal deposits to be removed from its vaults and redeposited into Democratic-

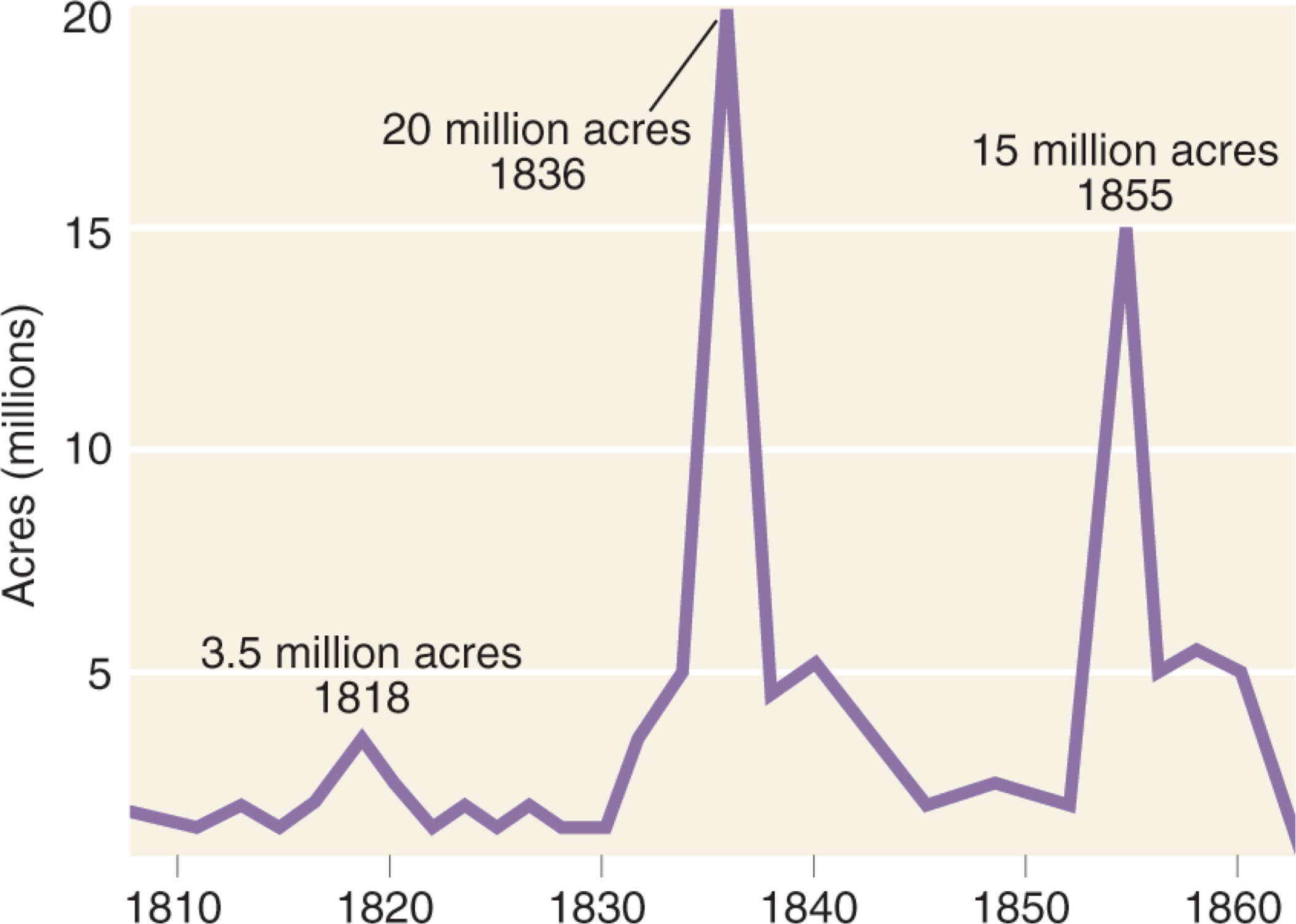

Unleashed and unregulated, the economy went into high gear in 1834. Just at this moment, an excess of silver from Mexican mines made its way into American banks, giving bankers license to print ever more banknotes. From 1834 to 1837, inflation soared; prices of basic goods rose more than 50 percent. States quickly chartered hundreds of new private banks, each issuing its own banknotes. Entrepreneurs borrowed and invested money, and the webs of credit and debt relationships that were the hallmark of the American economy grew denser yet. The market in western land sales also heated up. In 1834, about 4.5 million acres of the public domain had been sold, the highest annual volume since 1818. By 1836, the total reached an astonishing 20 million acres (Figure 11.1).

In one respect, the economy attained an admirable goal: The national debt disappeared, and from 1835 to 1837, for the only time in American history, the government had a monetary surplus. But much of that surplus consisted of questionable bank currencies—

REVIEW What were the most significant policies of Andrew Jackson’s presidency?