Chapter 8 Macro (19 Econ)

Screen 1 of 1

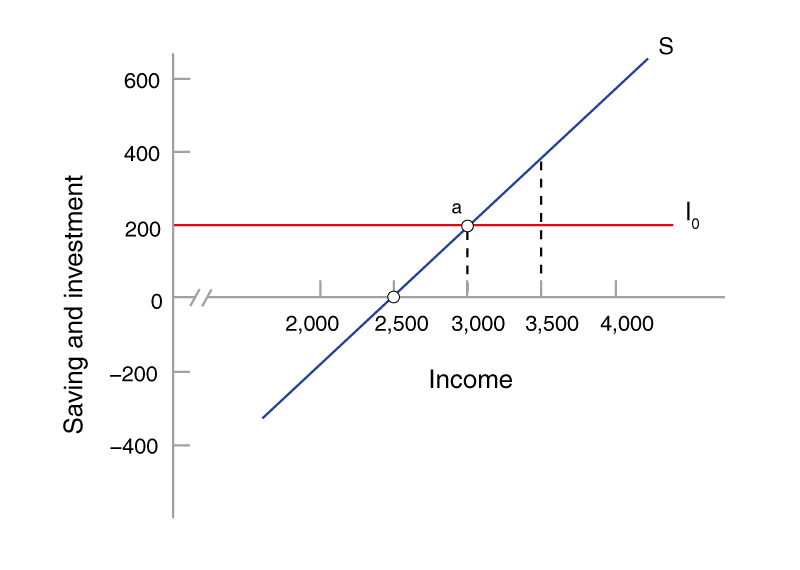

Use the figure below to answer the following questions.

The numerical value of the MPC is .

The numerical value of the multiplier is .

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

- English Captions

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

- English Captions

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.

- Chapters

- descriptions off, selected

- captions settings, opens captions settings dialog

- captions off, selected

- English Captions

This is a modal window.

Beginning of dialog window. Escape will cancel and close the window.

End of dialog window.

This is a modal window. This modal can be closed by pressing the Escape key or activating the close button.

This is a modal window.