12.6 PROBLEMS

Question 12.9

For each of the following, is the business a price-

A cappuccino café in a university town where there are dozens of very similar cappuccino cafés

The makers of Pepsi-

Cola One of many sellers of zucchini at a local farmers’ market

Question 12.10

For each of the following, is the industry perfectly competitive? Referring to market share, standardization of the product, and/or free entry and exit, explain your answers.

the painkiller ibuprofen

Alicia Keys concerts

Sport utility vehicles (SUVs)

Question 12.11

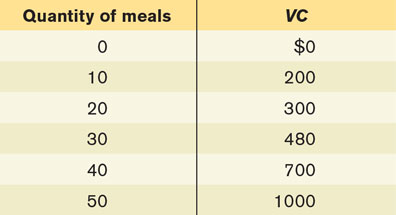

Kate’s Katering provides catered meals, and the catered meals industry is perfectly competitive. Kate’s machinery costs $100 per day and is the only fixed input. Her variable cost consists of the wages paid to the cooks and the food ingredients. The variable cost per day associated with each level of output is given in the accompanying table.

Calculate the total cost, the average variable cost, the average total cost, and the marginal cost for each quantity of output.

What is the break-

even price? What is the shut- down price? Suppose that the price at which Kate can sell catered meals is $21 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

Suppose that the price at which Kate can sell catered meals is $17 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

Suppose that the price at which Kate can sell catered meals is $13 per meal. In the short run, will Kate earn a profit? In the short run, should she produce or shut down?

Question 12.12

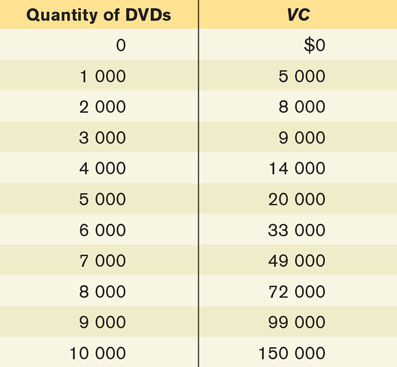

Bob produces DVD movies for sale, which requires a building and a machine that copies the original movie onto a DVD. Bob rents a building for $30 000 per month and rents a machine for $20 000 a month. Those are his fixed costs. His variable cost per month is given in the accompanying table.

Calculate Bob’s average variable cost, average total cost, and marginal cost for each quantity of output.

There is free entry into the industry, and anyone who enters will face the same costs as Bob. Suppose that currently the price of a DVD is $25. What will Bob’s profit be? Is this a long-

run equilibrium? If not, what will the price of DVD movies be in the long run?

Question 12.13

Consider Bob’s DVD company described in Problem 4. Assume that DVD production is a perfectly competitive industry. For each of the following questions, explain your answers.

What is Bob’s break-

even price? What is his shut- down price? Suppose the price of a DVD is $2. What should Bob do in the short run?

Suppose the price of a DVD is $7. What is the profit-

maximizing quantity of DVDs that Bob should produce? What will his total profit be? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run? Suppose instead that the price of DVDs is $20. Now what is the profit-

maximizing quantity of DVDs that Bob should produce? What will his total profit be now? Will he produce or shut down in the short run? Will he stay in the industry or exit in the long run?

Question 12.14

Consider again Bob’s DVD company described in Problem 4.

Draw Bob’s marginal cost curve.

Over what range of prices will Bob produce no DVDs in the short run?

Draw Bob’s individual supply curve.

Question 12.15

A profit-

maximizing business incurs an economic loss of $10 000 per year. Its fixed cost is $15 000 per year. Should it produce or shut down in the short run? Should it stay in the industry or exit in the long run? Suppose instead that this business has a fixed cost of $6000 per year. Should it produce or shut down in the short run? Should it stay in the industry or exit in the long run?

Question 12.16

The first sushi restaurant opens in town. Initially people are very cautious about eating tiny portions of raw fish, as this is a town where large portions of grilled meat have always been popular. Soon, however, an influential health report warns consumers against grilled meat and suggests that they increase their consumption of fish, especially raw fish. The sushi restaurant becomes very popular and the demand for it increases.

What will happen to the short-

run profit of the sushi restaurant? What will happen to the number of sushi restaurants in town in the long run? Will the first sushi restaurant be able to sustain its short- run profit over the long run? Explain your answers. Local steakhouses suffer from the popularity of sushi and start incurring losses. What will happen to the number of steakhouses in town in the long run? Explain your answer.

Question 12.17

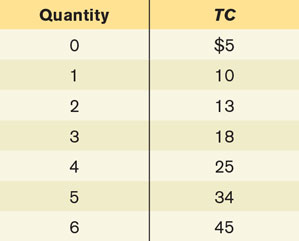

A perfectly competitive firm has the following short-

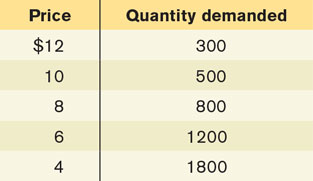

Market demand for the firm’s product is given by the following market demand schedule:

Calculate this firm’s marginal cost and, for all output levels except zero, the firm’s average variable cost and average total cost.

There are 100 firms in this industry that all have costs identical to those of this firm. Draw the short-

run industry supply curve. In the same diagram, draw the market demand curve. What is the market price, and how much profit will each firm make?

Question 12.18

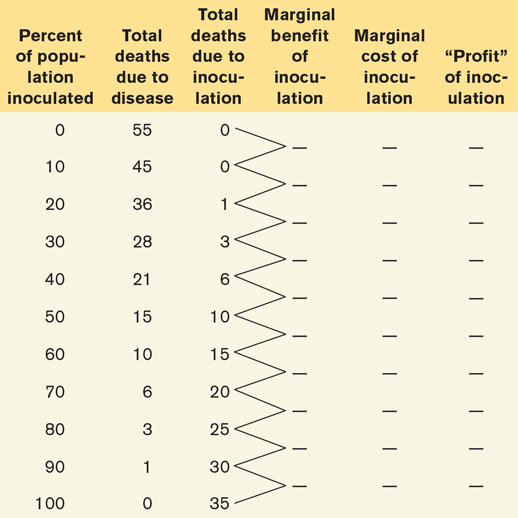

A new vaccine against a deadly disease has just been discovered. Presently, 55 people die from the disease each year. The new vaccine will save lives, but it is not completely safe. Some recipients of the shots will die from adverse reactions. The projected effects of the inoculation are given in the accompanying table:

What are the interpretations of “marginal benefit” and “marginal cost” here? Calculate marginal benefit and marginal cost per each 10% increase in the rate of inoculation. Write your answers in the table.

What proportion of the population should optimally be inoculated?

What is the interpretation of “profit” here? Calculate the profit for all levels of inoculation.

Question 12.19

Evaluate each of the following statements. If a statement is true, explain why; if it is false, identify the mistake and try to correct it.

A profit-

maximizing firm in a perfectly competitive industry should select the output level at which the difference between the market price and marginal cost is greatest. An increase in fixed cost lowers the profit-

maximizing quantity of output produced in the short run.

Question 12.20

The production of agricultural products like wheat is one of the few examples of a perfectly competitive industry. In this question, we analyze results from a study released by the Saskatchewan Ministry of Agriculture about crop production in the province in 2013.

The average variable cost per hectare planted with durum wheat was $376.54 (in the dark brown soil zone). Assuming an expected yield of 101 bushels per hectare, calculate the average variable cost per bushel of durum wheat.

Suppose prior to the 2013 growing season the expected average price of durum wheat in Saskatchewan was $7.20 per bushel. Do you think the average farm would have exited the durum wheat industry in the short run? Explain. Below what price would farms exit the durum wheat industry?

In fact, the average price of durum wheat received by a farmer in Saskatchewan in October 2013 was $6.20 per bushel. At this price would farmers be pleased they did not exit or regret not exiting? Explain.

According to Ministry of Agriculture estimates, a farm with dark brown soil, with an estimated yield of 101 bushels per hectare, would have total costs of production of $530.34 per hectare. Using these figures determine the average cost of production and determine whether the typical farm would be profitable or not.

Suppose you were told that new data from Statistics Canada just arrived and the average durum wheat yield of Saskatchewan farmers was actually 117 bushels per hectare. How does this impact the average variable cost and average total cost figures (both per bushel)? Would the average farmer regret not exiting the industry or be pleased that he or she had remained to produce durum wheat?

The harvested land for durum wheat in Saskatchewan rose from 1 100 000 hectares in 2010 to 1 750 000 hectares in 2013. Using the information on prices and costs here and in parts (a) and (b), explain why this might have happened.

Using the above information, do you think the prices of durum wheat were higher or lower prior to 2013? Why?

(Note: Every year the Saskatchewan Ministry of Agriculture prepares cost estimates for various crops for the province’s three major soil zones. To access these estimates go to agriculture.gov.sk.ca, and search for “crop planning guide.”)

Question 12.21

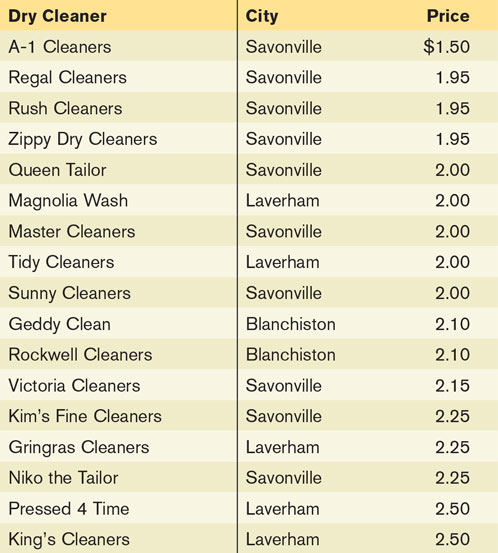

The accompanying table presents prices for washing and ironing a man’s shirt taken from a survey of dry cleaners in three neighbouring towns.

What is the average price per shirt washed and ironed in Laverham? In Savonville?

Draw typical marginal cost and average total cost curves for Gingras Cleaners in Laverham, assuming it is a perfectly competitive firm but is making a profit on each shirt in the short run. Mark the short-

run equilibrium point and shade the area that corresponds to the profit made by the dry cleaner. Assume $2.25 is the short-

run equilibrium price in Laverham. Draw a typical short- run demand and supply curve for the market. Label the equilibrium point. Observing profits in the Laverham area, another dry cleaning service, Diamond Cleaners, enters the market. It charges $1.95 per shirt. What is the new average price of washing and ironing a shirt in Laverham? Illustrate the effect of entry on the average Laverham price by a shift of the short-

run supply curve, the demand curve, or both. Assume that Gingras Cleaners now charges the new average price and just breaks even (that is, makes zero economic profit) at this price. Show the likely effect of the entry on your diagram in part (b).

If the dry cleaning industry is perfectly competitive, what does the average difference in price between Laverham and Savonville imply about costs in the two areas?

Question 12.22

Besides assuming there is a large number of consumers and producers in a perfectly competitive industry, we often also assume:

Consumers and producers in the market have perfect information about the characteristics of the good sold by every producer and the price charged by each producer.

A potential producer has access to any necessary resources, to best-

practice technology, and to product designs. So there are no barriers to firms wishing to enter this market. All producers have the same technology, which results in them all having the same costs of production.

For a perfectly competitive industry with all the usual assumptions, plus the three additional assumptions above, is each of the following statements true, false, or uncertain? Explain why or why not. Highlight which assumptions are key to making your answer what it is.

Producers will make goods that are identical in all regards (perfect substitutes).

In equilibrium, consumers who are good negotiators are able to buy the product at a lower price than other consumers can.

At every point in time, all firms will earn the same level of economic profit.

In order to build customer loyalty to their brand, some producers in this market will carefully design their product to serve the needs of their chosen market segment.

Prices charged by all producers in the market will be identical.

At some points in time, some firms will be more profitable than others. This allows their senior executives to be paid a much high salary than the executives at competing firms.

In equilibrium, no producer will be able to sell lower quality goods at the same price, or charge a higher price for goods of the same quality as those being sold by other producers.

All firms selling in this market have the power to set their own price independent of what other firms are charging.

Question 12.23

The extent to which a firm or a person can influence the price of an item by exercising control of its demand, supply, or both is known as market power. Under perfect competition all firms and consumers are assumed to have zero market power. Therefore, all market participants must accept the current market price without being able to exercise any control over it. Explain the role played by the following assumptions on the degree of market power possessed by market participants in a perfectly competitive market.

There are many producers.

There are many consumers.

The producers have a standardized product.

All producers and consumers possess perfect information.

This industry has free entry and exit.

Question 12.24

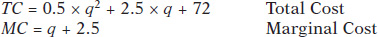

This question uses the algebraic method of determining average variable cost from Appendix 11A and the algebraic method of determining equilibrium from Appendix 3A. A firm in a perfectly competitive constant cost industry has total and marginal costs in the short-

where q is the output per day and TC is the total cost in dollars. The firm has fixed costs of $40 (which is already included in the TC equation above). This TC equation generates minimum average total cost of $14.50 at q = 12. This firm generates minimum long run average costs (also at q = 12, LRAC = $14.50). (Hint: The average total cost curve is at a minimum where it intersects the marginal cost curve (that is, ATC = MC). Similarly, the average variable cost curve is at a minimum where AVC = MC.)

Determine the average variable cost. At what price will the firm shut down in the short run?

In the short run, if the firm faces a price of $11.50, how much will the firm produce?

In the short run, if the firm faces a price of $20.50, how much profit will the firm earn?

In the short run, there are 200 identical firms in the industry. Demand for the output of firms in this industry is given by:

where Q is the total amount sold to consumers. What are the equilibrium price and quantity?

Given the demand curve described in part (d), how many firms will there be in this industry in the long run?

Suppose in the long run, there is technological change that reduces the long-

run minimum average cost of the typical business firm to $8.50 at q = 8. Now, how many firms will there be in the industry in the long run?