13.8 PROBLEMS

Question 13.14

Each of the following firms possesses market power. Explain its source.

Merck, the producer of the patented cholesterol-

lowering drug Zetia WaterWorks, a provider of piped water

Chiquita, a supplier of bananas and owner of most banana plantations

The Walt Disney Company, the creators of Mickey Mouse

Question 13.15

Skyscraper City has a subway system, for which a one-

Question 13.16

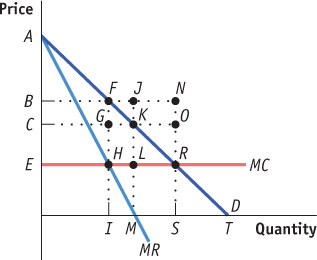

Consider an industry with the demand curve (D) and marginal cost curve (MC) shown in the accompanying diagram. There is no fixed cost. If the industry is a single-

If the industry is perfectly competitive, what will be the total quantity produced? At what price?

Which area reflects consumer surplus under perfect competition?

If the industry is a single-

price monopoly, what quantity will the monopolist produce? Which price will it charge? Which area reflects the single-

price monopolist’s profit? Which area reflects consumer surplus under single-

price monopoly? Which area reflects the deadweight loss to society from single-

price monopoly? If the monopolist can price-

discriminate perfectly, what quantity will the perfectly price- discriminating monopolist produce?

Question 13.17

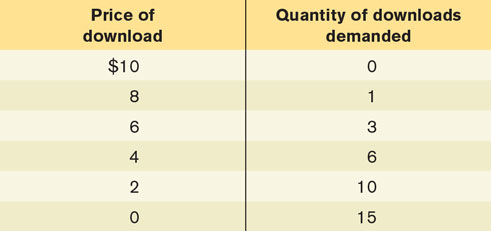

Bob, Bill, Ben, and Brad Baxter have just made a documentary movie about their basketball team. They are thinking about making the movie available for download on the Internet, and they can act as a single-

Calculate the total revenue and the marginal revenue per download.

Bob is proud of the film and wants as many people as possible to download it. Which price would he choose? How many downloads would be sold?

Bill wants as much total revenue as possible. Which price would he choose? How many downloads would be sold?

Ben wants to maximize profit. Which price would he choose? How many downloads would be sold?

Brad wants to charge the efficient price. Which price would he choose? How many downloads would be sold?

Question 13.18

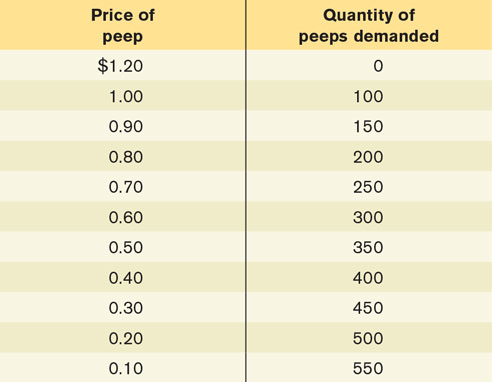

Jimmy has a room that overlooks, from some distance, a CFL football stadium. He decides to rent a telescope for $50.00 a week and charge his friends and classmates to use it to peep at the game for 30 seconds. He can act as a single-

For each price in the table, calculate the total revenue from selling peeps and the marginal revenue per peep.

At what quantity will Jimmy’s profit be maximized? What price will he charge? What will his total profit be?

Jimmy’s landlady complains about all the visitors coming into the building and tells Jimmy to stop selling peeps. Jimmy discovers, however, that if he gives the landlady $0.20 for every peep he sells, she will stop complaining. What effect does the $0.20-per-

peep bribe have on Jimmy’s marginal cost per peep? What is the new profit- maximizing quantity of peeps? What effect does the $0.20-per- peep bribe have on Jimmy’s total profit?

Question 13.19

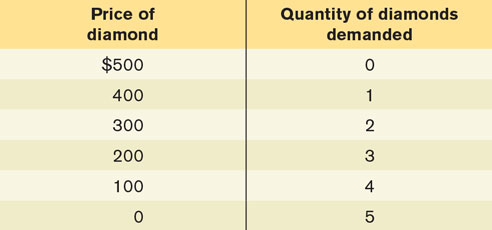

Suppose that De Beers is a single-

Calculate De Beers’s total revenue and its marginal revenue. From your calculation, draw the demand curve and the marginal revenue curve.

Explain why De Beers faces a downward-

sloping demand curve. Explain why the marginal revenue from an additional diamond sale is less than the price of the diamond.

Suppose De Beers currently charges $200 for its diamonds. If it lowers the price to $100, how large is the price effect? How large is the quantity effect?

Add the marginal cost curve to your diagram from part (a) and determine which quantity maximizes De Beers’s profit and which price it will charge.

Question 13.20

Use the demand schedule for diamonds given in Problem 6. The marginal cost of producing diamonds is constant at $100. There is no fixed cost.

If De Beers charges the monopoly price, how large is the individual consumer surplus that each buyer experiences? Calculate total consumer surplus by summing the individual consumer surpluses. How large is producer surplus?

Suppose that upstart Russian and Asian producers enter the market and the market becomes perfectly competitive.

What is the perfectly competitive price? What quantity will be sold in this perfectly competitive market?

At the competitive price and quantity, how large is the consumer surplus that each buyer experiences? How large is total consumer surplus? How large is producer surplus?

Compare your answer to part (c) to your answer to part (a). How large is the deadweight loss associated with monopoly in this case?

Question 13.21

Use the demand schedule for diamonds given in Problem 6. De Beers is a monopolist, but it can now price-

If De Beers can price-

discriminate perfectly, to which customers will it sell diamonds and at what prices? How large is each individual consumer surplus? How large is total consumer surplus? Calculate producer surplus by summing the producer surplus generated by each sale.

Question 13.22

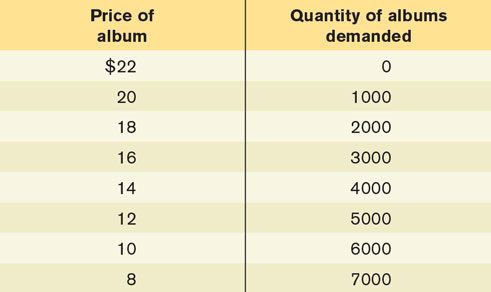

Download Records decides to release an album by the group Mary and the Little Lamb. It produces the album with no fixed cost, but the total cost of downloading an album to a CD and paying Mary her royalty is $6 per album. Download Records can act as a single-

Calculate the total revenue and the marginal revenue per album.

The marginal cost of producing each album is constant at $6. To maximize profit, what level of output should Download Records choose, and which price should it charge for each album?

Mary renegotiates her contract and now needs to be paid a higher royalty per album. So the marginal cost rises to be constant at $14. To maximize profit, what level of output should Download Records now choose, and which price should it charge for each album?

Question 13.23

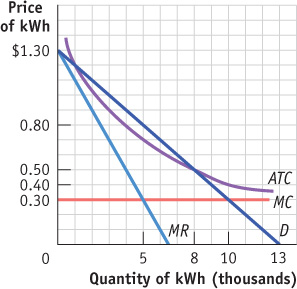

The accompanying diagram illustrates your local electricity company’s natural monopoly. The diagram shows the demand curve for kilowatt-

If the government does not regulate this monopolist, which price will it charge? Illustrate the inefficiency this creates by shading the deadweight loss from monopoly.

If the government imposes a price ceiling equal to the marginal cost, $0.30, will the monopolist make profits or lose money? Shade the area of profit (or loss) for the monopolist. If the government does impose this price ceiling, do you think the firm will continue to produce in the long run?

If the government imposes a price ceiling of $0.50, will the monopolist make a profit, lose money, or break even?

Question 13.24

The movie theatre in Lafacville serves two kinds of customers: students and professors. There are 900 students and 100 professors in Lafacville. Each student’s willingness to pay for a movie ticket is $5. Each professor’s willingness to pay for a movie ticket is $10. Each will buy at most one ticket. The movie theatre’s marginal cost per ticket is constant at $3, and there is no fixed cost.

Suppose the movie theatre cannot price-

discriminate and needs to charge students and professors the same price per ticket. If the theatre charges $5, who will buy tickets and what will the theatre’s profit be? How large is the consumer surplus? If the movie theatre charges $10, who will buy movie tickets and what will the movie theatre’s profit be? How large is consumer surplus?

Now suppose that, if it chooses to, the movie theatre can price-

discriminate between students and professors by requiring students to show their student ID. If the movie theatre charges students $5 and professors $10, how much profit will the movie theatre make? How large is consumer surplus?

Question 13.25

A monopolist knows that in order to expand the quantity of output it produces from 8 to 9 units it must lower the price of its output from $2 to $1. Calculate the quantity effect and the price effect. Use these results to calculate the monopolist’s marginal revenue of producing the 9th unit. The marginal cost of producing the 9th unit is positive. Is it a good idea for the monopolist to produce the 9th unit?

Question 13.26

In the United States, the Federal Trade Commission (FTC) is charged with promoting competition and challenging mergers that would likely lead to higher prices. Several years ago, Staples and Office Depot, two of the largest office supply superstores, announced their agreement to merge.

Some critics of the merger argued that, in many parts of the country, a merger between the two companies would create a monopoly in the office supply superstore market. Based on the FTC’s argument and its mission to challenge mergers that would likely lead to higher prices, do you think it should have allowed the merger?

Staples and Office Depot argued that, while they might create a monopoly in the office supply superstore market, the FTC should consider the larger market for all office supplies, which includes many smaller stores that sell office supplies (such as grocery stores and other retailers). In that market, Staples and Office Depot would face competition from many other, smaller stores. If the market for all office supplies is the relevant market that the FTC should consider, would it make the FTC more or less likely to allow the merger?

Question 13.27

Prior to 1999, the same company that generated electricity in Ontario also distributed it over high-

Assume that the market for electricity distribution was and remains a natural monopoly. Use a graph to illustrate the market for electricity distribution if the government sets price equal to average total cost.

Assume that deregulation of electricity generation creates a perfectly competitive market. Also assume that electricity generation does not exhibit the characteristics of a natural monopoly. Use a graph to illustrate the cost curves in the long-

run equilibrium for an individual firm in this industry.

Question 13.28

Explain the following situations.

Many cellphone service providers give away for free what would otherwise be very expensive cellphones when a service contract is purchased. Why might a company want to do that?

In the United Kingdom, the country’s competition authority banned the cellphone service provider Vodaphone from offering a plan that gave customers free calls to other Vodaphone customers. Why might Vodaphone have wanted to offer these calls for free? Why might a government want to step in and ban this practice? Why might it not be a good idea for a government to interfere in this way?

Question 13.29

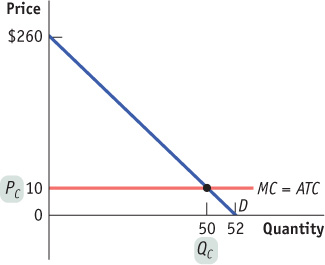

The market demand for recorders (a simple musical instrument) in Hamelin is given by the following graph. Currently, Pied Piping is the single seller in Hamelin.

Note: Be sure to show your work and do not round your answers.

At what level of output and price does Pied Piping maximize its profit? What is the deadweight loss in the market for recorders?

In attempt to increase output, the government decides to regulate the industry through an average cost pricing. What are the price charged and quantity sold by the monopolist after the regulation?

What is the deadweight loss after the regulation? What is the change in consumer surplus?

Question 13.30

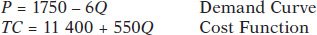

This question uses the algebraic method to solve problems from Appendix 3A and Appendix 6A. The market of widgets is characterized by a single seller. The market demand and the firm’s total cost are given by:

where P is the price per widgets and Q is the number of widgets. The firm has fixed costs of $475, and a constant variable cost of production equal to $50 per unit made. The marginal cost is always $50 for another widget.

Determine the profit maximizing price and quantity. What are the firm’s profit, the consumer surplus, and the deadweight loss?

Suppose the government decides to regulate the firm through price regulation. The government is considering either marginal cost pricing or average cost pricing. Calculate the following items under each proposal:

Price charged

Quantity produced

Firm’s profit

Consumer surplus

Deadweight loss

You are asked to make a recommendation on which proposal—

marginal cost pricing or average cost pricing— the government should adopt. What kind of recommendation would you give? Explain.

Question 13.31

This question uses the algebraic method to solve problems from Appendix 3A and Appendix 6A. Suppose the Potash Corporation of Saskatchewan (PotashCorp) is the sole producer of the fertilizer potash in the Canadian market. The market demand and PotashCorp’s total cost are given by:

where P is the price per tonne of potash and Q is the quantity in tonnes.

Note: Round your answer to two decimal places where needed. Be sure to show your work.

Determine the quantity produced and price charged by PotashCrop if it is an unregulated monopoly.

Determine the deadweight loss in the market if PotashCorp is an unregulated monopoly.

Suppose the federal government decides to regulate the industry to decrease the deadweight loss associated with this monopoly. The new regulation requires PotashCorp to adopt average cost pricing. What will be the price charged by PotashCorp? What is the change in total surplus?