14.7 PROBLEMS

Question 14.10

The accompanying table presents recent market share data for the world breakfast cereal market.

Use the data provided to calculate the Herfindahl–

Hirschman Index (HHI) for the market. Based on this HHI, what type of market structure is the world breakfast cereal market?

Question 14.11

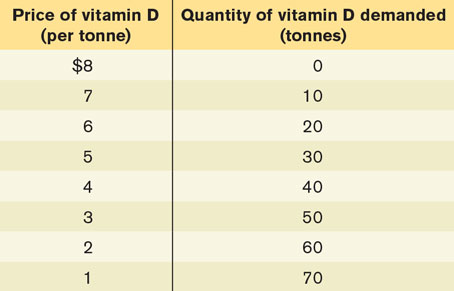

The accompanying table shows the demand schedule for vitamin D. Suppose that the marginal cost of producing vitamin D is zero.

Assume that BASF is the only producer of vitamin D and acts as a monopolist. It currently produces 40 tonnes of vitamin D at $4 per tonne. If BASF were to produce 10 more tonnes, what would be the price effect for BASF? What would be the quantity effect? Would BASF have an incentive to produce those 10 additional tonnes?

Now assume that Roche enters the market by also producing vitamin D and the market is now a duopoly. BASF and Roche agree to produce 40 tonnes of vitamin D in total, 20 tonnes each. BASF cannot be punished for deviating from the agreement with Roche. If BASF, on its own, were to deviate from that agreement and produce 10 more tonnes, what would be the price effect for BASF? What would be the quantity effect for BASF? Would BASF have an incentive to produce those 10 additional tonnes?

Question 14.12

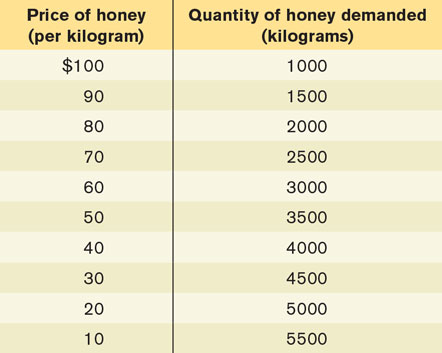

The market for honey in Winnipeg is controlled by two companies, Busy Bees and Honey Hive. Both companies will ruthlessly eliminate any other company that attempts to enter the Winnipeg honey market. The marginal cost of producing honey is constant and equal to $40 per kilogram. There is no fixed cost. The accompanying table gives the market demand schedule for honey.

Suppose Busy Bees and Honey Hive form a cartel. For each of the quantities given in the table, calculate the total revenue for their cartel and the marginal revenue for each additional kilogram. How many kilograms of honey would the cartel sell in total and at what price? The two companies share the market equally (each produces half of the total output of the cartel). How much profit does each company make?

Beatrice Buzz, the CEO of Busy Bees, breaks the agreement and sells 500 more kilograms of honey than under the cartel agreement. Assuming Honey Hive maintain the agreement, how does this affect the price for honey and the profit earned by each company?

Quincy Queen, the CEO of Honey Hive, decides to punish Busy Bees by increasing his sales by 500 kilograms as well. How much profit does each company earn now?

Question 14.13

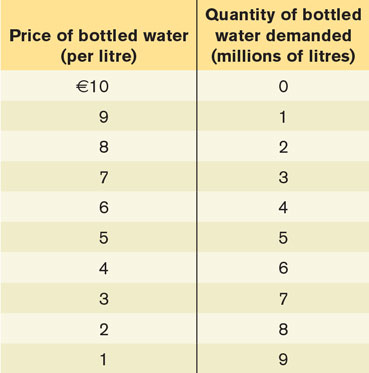

In France, the market for bottled water is controlled by two large firms, Perrier and Evian. Each firm has a fixed cost of €1 million and a constant marginal cost of €2 per litre of bottled water (€1 = 1 euro). The following table gives the market demand schedule for bottled water in France.

Suppose the two firms form a cartel and act as a monopolist. Calculate marginal revenue for the cartel. What will the monopoly price and output be? Assuming the firms divide the output evenly, how much will each produce and what will each firm’s profit be?

Now suppose Perrier decides to increase production by 1 million litres. Evian doesn’t change its production. What will the new market price and output be? What is Perrier’s profit? What is Evian’s profit?

What if Perrier increases production by 3 million litres? Evian doesn’t change its production. What would its output and profit be relative to those in part (b)?

What do your results tell you about the likelihood of cheating on such agreements?

Question 14.14

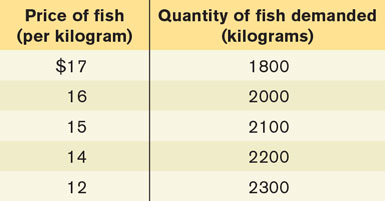

To preserve the North Atlantic fish stocks, it is decided that only two fishing fleets, one from North America (Canada and the United States) and the other from the European Union (EU), can fish in those waters. The accompanying table shows the market demand schedule per week for fish from these waters. The only costs are fixed costs, so fishing fleets maximize profit by maximizing revenue.

If both fishing fleets collude, what is the revenue-

maximizing output for the North Atlantic fishery? What price will a kilogram of fish sell for? If both fishing fleets collude and share the output equally, what is the revenue to the EU fleet? To the North American fleet?

Suppose the EU fleet cheats by expanding its own catch by 100 kilograms per week. The North American fleet doesn’t change its catch. What is the revenue to the North American fleet? To the EU fleet?

In retaliation for the cheating by the EU fleet, the North American fleet also expands its catch by 100 kilograms per week. What is the revenue to the North American fleet? To the EU fleet?

Question 14.15

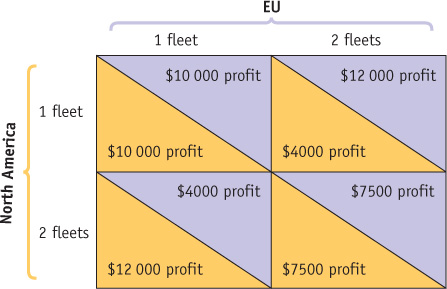

Suppose that the fisheries agreement in Problem 5 breaks down, so that the fleets behave noncooperatively. Assume that North America and the EU each can send out either one or two fleets. The more fleets in the area, the more fish they catch in total but the catch of each fleet decreases. The accompanying matrix shows the profit (in dollars) per week earned by each side.

What is the Nash equilibrium? Will each side choose to send out one or two fleets?

Suppose that the fish stocks are being depleted. Each region considers the future and comes to a tit-

for- tat agreement whereby each side will send only one fleet out as long as the other does the same. If either of them breaks the agreement and sends out a second fleet, the other will also send out two and will continue to do so until its competitor sends out only one fleet. If both play this tit- for- tat strategy, how much profit will each make every week?

Question 14.16

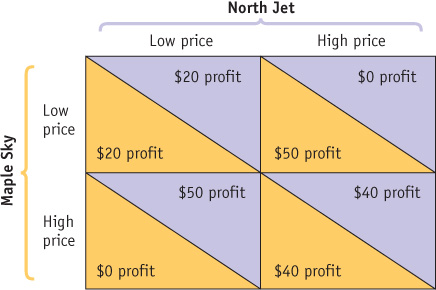

Maple Sky and North Jet are the only two airlines operating flights between Petiteville and Bigtown. That is, they operate in a duopoly. Each airline can charge either a high price or a low price for a ticket. The accompanying matrix shows their payoffs, in profits per seat (in dollars), for any choice that the two airlines can make.

Suppose the two airlines play a one-

shot game— that is, they interact only once and never again. What will be the Nash equilibrium in this one- shot game? Now suppose the two airlines play this game twice. And suppose each airline can play one of two strategies: it can play either always charge the low price or tit for tat—

that is, it starts off charging the high price in the first period, and then in the second period it does whatever the other airline did in the previous period. Write down the payoffs to Maple Sky from the following four possibilities: Maple Sky plays always charge the low price when North Jet also plays always charge the low price.

Maple Sky plays always charge the low price when North Jet plays tit for tat.

Maple Sky plays tit for tat when North Jet plays always charge the low price.

Maple Sky plays tit for tat when North Jet also plays tit for tat.

Question 14.17

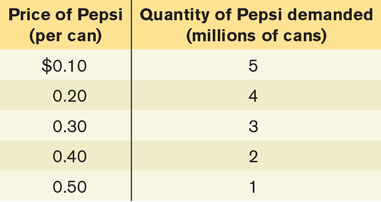

Suppose that Coke and Pepsi are the only two producers of cola drinks, making them duopolists. Both companies have zero marginal cost and a fixed cost of $100 000.

Assume first that consumers regard Coke and Pepsi as perfect substitutes. Currently both are sold for $0.20 per can, and at that price each company sells 4 million cans per day.

How large is Pepsi’s profit?

If Pepsi were to raise its price to $0.30 per can, and Coke does not respond, what would happen to Pepsi’s profit?

Now suppose that each company advertises to differentiate its product from the other company’s. As a result of advertising, Pepsi realizes that if it raises or lowers its price, it will sell less or more of its product, as shown by the demand schedule in the accompanying table.

If Pepsi now were to raise its price to $0.30 per can, what would happen to its profit?

Comparing your answers from parts (a) and (b), what is the maximum amount Pepsi would be willing to spend on advertising?

Question 14.18

Second Cup and Starbucks spend huge sums of money each year to advertise their coffee products in an attempt to steal customers from each other. Suppose each year Second Cup and Starbucks have to decide whether or not they want to spend money on advertising. If neither firm advertises, each will earn a profit of $2 million. If they both advertise, each will earn a profit of $1.5 million. If one firm advertises and the other does not, the firm that advertises will earn a profit of $2.8 million and the other firm will earn $1 million.

Use a payoff matrix to depict this problem.

Suppose Second Cup and Starbucks can write an enforceable contract about what they will do. What is the cooperative solution to this game?

What is the Nash equilibrium without an enforceable contract? Explain why this is the likely outcome.

Question 14.19

Over the last 40 years the Organization of Petroleum Exporting Countries (OPEC) has had varied success in forming and maintaining its cartel agreements. Explain how the following factors may contribute to the difficulty of forming and/or maintaining its price and output agreements.

New oil fields are discovered and increased drilling is undertaken in the Gulf of Mexico and the North Sea by nonmembers of OPEC.

Crude oil is a product that is differentiated by sulphur content: it costs less to refine low-

sulphur crude oil into gasoline. Different OPEC countries possess oil reserves of different sulfur content. Cars powered by hydrogen are developed.

Question 14.20

Suppose you are an economist working for the Competition Bureau. In each of the following cases you are given the task of determining whether the behaviour warrants an investigation for possible illegal acts or is just an example of tacit collusion. Explain your reasoning.

Two companies dominate the industry for industrial lasers. Several people sit on the boards of directors of both companies.

Three banks dominate the market for banking in a given country. Their profits have been going up recently as they add new fees for customer transactions. Advertising among the banks is fierce, and new branches are springing up in many locations.

The two oil companies that produce most of the petroleum for western Canada have decided to forgo building their own pipelines and to share a common pipeline, the only means of transporting petroleum products to that market.

The two major companies that dominate the market for herbal supplements have each created a subsidiary that sells the same product as the parent company in large quantities but with a generic name.

The two largest credit card companies, Passport and OmniCard, have required all retailers who accept their cards to agree to limit their use of rival credit cards.

Question 14.21

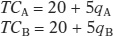

Note: This is a challenging question that uses the algebraic method to solve problems from Appendix 3A and Appendix 6A.

The market for widgets is characterized by many buyers but only two producers, A and B. The market demand for widgets is given by:

P = 200 − 5Qd

where Qd = total demand for widgets and Qd = qA + qB.

Both producers face the same production cost, which is $20 in fixed cost and a constant variable cost of $5 per widget. In other words, the cost functions for A and B are

Determine the best response functions for producers A and B.

Determine the profit-

maximizing levels of output by producers A and B if they both choose the quantity of widgets produced simultaneously. What is the profit for each producer? If both producers collude, what is the equilibrium price and quantity? Determine the industry profit under the collusive outcome.

Compare your answers to parts (b) and (c). Which outcome (collusive or noncollusive) would the producers prefer? Explain.

Which outcome (collusive or noncollusive) is a more stable outcome? Explain.