17.7 PROBLEMS

Question 17.10

The government is involved in providing many goods and services. For each of the goods or services listed, determine whether it is rival or nonrival in consumption and whether it is excludable or nonexcludable. What type of good is it? Without government involvement, would the quantity provided be efficient, inefficiently low, or inefficiently high?

Street signs

Via rail service

Regulations limiting pollution

A congested highway without tolls

A lighthouse on the coast

Question 17.11

An economist gives the following advice to a museum director: “You should introduce ‘peak pricing.’ At times when the museum has few visitors, you should admit visitors for free. And at times when the museum has many visitors, you should charge a higher admission fee.”

When the museum is quiet, is it rival or nonrival in consumption? Is it excludable or nonexcludable? What type of good is the museum at those times? What would be the efficient price to charge visitors during that time, and why?

When the museum is busy, is it rival or nonrival in consumption? Is it excludable or nonexcludable? What type of good is the museum at those times? What would be the efficient price to charge visitors during that time, and why?

Question 17.12

In many planned communities, various aspects of community living are subject to regulation by a homeowners’ association. These rules can regulate house architecture; require snow removal from sidewalks; exclude outdoor equipment, such as backyard swimming pools; require appropriate conduct in shared spaces such as the community clubhouse; and so on. Suppose there has been some conflict in one such community because some homeowners feel that some of the regulations mentioned above are overly intrusive. You have been called in to mediate. Using what you have learned about public goods and common resources, how would you decide what types of regulations are warranted and what types are not?

Question 17.13

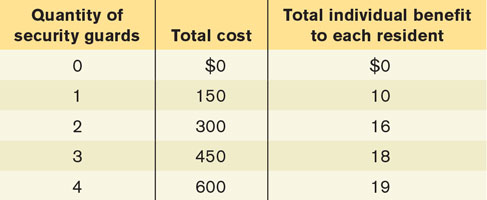

A residential community has 100 residents who are concerned about security. The accompanying table gives the total cost of hiring a 24-hour security service as well as each individual resident’s total benefit.

Explain why the security service is a public good for the residents of the community.

Calculate the marginal cost, the individual marginal benefit for each resident, and the marginal social benefit.

If an individual resident were to decide about hiring and paying for security guards on his or her own, how many guards would that resident hire?

If the residents act together, how many security guards will they hire?

Question 17.14

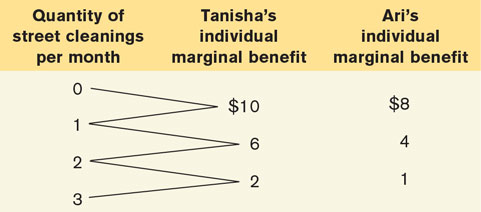

The accompanying table shows Tanisha’s and Ari’s individual marginal benefit of different amounts of street cleanings per month. Suppose that the marginal cost of street cleanings is constant at $9 each.

If Tanisha had to pay for street cleaning on her own, how many street cleanings would there be?

Calculate the marginal social benefit of street cleaning. What is the optimal number of street cleanings?

Consider the optimal number of street cleanings. The last street cleaning of that number costs $9. Is Tanisha willing to pay for that last cleaning on her own? Is Ari willing to pay for that last cleaning on his own?

Question 17.15

Anyone with a radio receiver can listen to public radio, which is funded largely by donations.

Is public radio excludable or nonexcludable? Is it rival in consumption or nonrival? What type of good is it?

Should the government support public radio? Explain your reasoning.

In order to finance itself, public radio decides to transmit only to satellite radios, for which users have to pay a fee. What type of good is public radio then? Will the quantity of radio listening be efficient? Why or why not?

Question 17.16

Your economics professor assigns a group project for the course. Describe the free-

Question 17.17

The village of Upper Bigglesworth has a village “commons,” a piece of land on which each villager, by law, is free to graze his or her cows. Use of the commons is measured in units of the number of cows grazing on it. Assume that the marginal private cost curve of cow-

Is the commons excludable or nonexcludable? Is it rival in consumption or nonrival? What kind of good is the commons?

Draw a diagram showing the marginal social cost, marginal private cost, and the marginal private benefit of cow-

grazing on the commons, with the quantity of cows that graze on the commons on the horizontal axis. How does the quantity of cows grazing in the absence of government intervention compare to the efficient quantity? Show both in your diagram. The villagers hire you to tell them how to achieve an efficient use of the commons. You tell them that there are three possibilities: a Pigouvian tax, the assignment of property rights over the commons, and a system of tradable licences for the right to graze a cow. Explain how each one of these options would lead to an efficient use of the commons. In the assignment of property rights, assume that one person is assigned the rights to the commons and the rights to all the cows. Draw a diagram that shows the Pigouvian tax.

Question 17.18

Prior to 2003, the city of London, England was often one big parking lot. Traffic jams were common, and it could take hours to travel a few kilometres. Each additional commuter contributed to the congestion, which can be measured by the total number of cars on London roads. Although each commuter suffered by spending valuable time in traffic, none of them paid for the inconvenience they caused others. The total cost of travel includes the opportunity cost of time spent in traffic and any fees levied by London authorities.

Draw a graph illustrating the overuse of London roads, assuming that there is no fee to enter London in a vehicle and that roads are a common resource. Put the cost of travel on the vertical axis and the quantity of cars on the horizontal axis. Draw typical demand, individual marginal cost (MC), and marginal social cost (MSC) curves and label the equilibrium point. (Hint: The marginal cost takes into account the opportunity cost of spending time on the road for individual drivers but not the inconvenience they cause to others.)

In February 2003, the city of London began charging a £5 congestion fee on all vehicles travelling in London. Illustrate the effects of this congestion charge on your graph and label the new equilibrium point. Assume the new equilibrium point is not optimally set (that is, assume that the £5 charge is too low relative to what would be efficient).

The congestion fee was raised to £9 in January 2011. Illustrate the new equilibrium point on your graph, assuming the new charge is now optimally set.

Question 17.19

The accompanying table shows six consumers’ willingness to pay (his or her individual marginal benefit) for one MP3 file copy of a Hedley album. The marginal cost of making the file accessible to one additional consumer is constant, at zero.

What would be the efficient price to charge for a download of the file?

All six consumers are able to download the file for free from a file-

sharing service, Pantster. Which consumers will download the file? What will be the total consumer surplus to those consumers? Pantster is shut down for copyright law infringement. In order to download the file, consumers now have to pay $4.99 at a commercial music site. Which consumers will download the file? What will be the total consumer surplus to those consumers? How much producer surplus accrues to the commercial music site? What is the total surplus? What is the deadweight loss from the new pricing policy?

Question 17.20

Butchart Gardens is a very large garden in Victoria, British Columbia, renowned for its beautiful plants. It is so large that it could hold many times more visitors than currently visit it. The garden charges an admission fee of approximately $30. At this price, 1000 people visit the garden each day. If admission were free, 2000 people would visit each day.

Are visits to Butchart Gardens excludable or nonexcludable? Are they rival in consumption or nonrival? What type of good is it?

In a diagram, illustrate the demand curve for visits to Butchart Gardens. Indicate the situation when Butchart Gardens charges an admission fee of $30. Also indicate the situation when Butchart Gardens charges no admission fee.

Illustrate the deadweight loss from charging a $30 admission fee. Explain why charging a $30 admission fee is inefficient.

Question 17.21

Software has historically been an artificially scarce good—

Discuss the free-

rider problem that might exist in the development of open- source software. What effect might this have on quality? Why does this problem not exist for proprietary software, such as the products of a company like Microsoft or Adobe? Some argue that open-

source software serves an unsatisfied market demand that proprietary software ignores. Draw a typical diagram that illustrates how proprietary software may be underproduced. Put the price and marginal cost of software on the vertical axis and the quantity of software on the horizontal axis. Draw a typical demand curve and a marginal cost curve (MC) that is always equal to zero. Assume that the software company charges a positive price, P, for the software. Label the equilibrium point and the efficient point.

Question 17.22

In developing a vaccine for the SARS virus, a pharmaceutical company incurs a very high fixed cost. The marginal cost of delivering the vaccine to patients, however, is negligible (consider it to be equal to zero). The pharmaceutical company holds the exclusive patent to the vaccine. You are a regulator who must decide what price the pharmaceutical company is allowed to charge.

Draw a diagram that shows the price for the vaccine that would arise if the company is unregulated, and label it PM. What is the efficient price for the vaccine? Show the deadweight loss that arises from the price PM.

On another diagram, show the lowest price that the regulator can enforce that would still induce the pharmaceutical company to develop the vaccine. Label it P*. Show the deadweight loss that arises from this price. How does it compare to the deadweight loss that arises from the price PM?

Suppose you have accurate information about the pharmaceutical company’s fixed cost. How could you use price regulation of the pharmaceutical company, combined with a subsidy to the company, to have the efficient quantity of the vaccine provided at the lowest cost to the government?