19.1 The Economy’s Factors of Production

You may recall that we defined a factor of production in Chapter 2 in the context of the circular-

What are these factors of production, and why do factor prices matter?

The Factors of Production

As we learned in Chapter 2, economists divide factors of production into four principal classes: land, labour, physical capital, and human capital. Land is a resource provided by nature; labour is the work done by human beings.

Physical capital—often referred to simply as “capital”—consists of manufactured productive resources such as equipment, buildings, tools, and machines.

In Chapter 9 we defined capital: it is the value of the assets that are used by a firm in producing its output. There are two broad types of capital. Physical capital—often referred to simply as “capital”—consists of manufactured resources such as equipment, buildings, tools, and machines.

Human capital is the improvement in labour created by education and knowledge that is embodied in the workforce.

In the modern economy, human capital, the improvement in labour created by education and knowledge, and embodied in the workforce, is at least equally significant. The importance of human capital has been greatly increased by the progress of technology, which has made a high level of technical sophistication essential to many jobs—

Why Factor Prices Matter: The Allocation of Resources

Factor markets and factor prices play a key role in one of the most important processes that must take place in any economy: the allocation of resources among producers.

Consider the exploration, extraction, and processing of petroleum and natural gas in Alberta and Newfoundland and Labrador, part of Canada’s booming resource sector. These provinces have a considerable need for workers in the engineering and natural science trades—

What ensured that those needed workers actually came? The factor market: the high demand for workers drove up wages. From 1997 to 2014, the average Canadian hourly wage grew at an annual rate of around 2.7%. But in Alberta and Newfoundland and Labrador, the average hourly wage grew by 3.9% and 3.7%, respectively. The average hourly wage in Alberta went from $0.80 below the national average to the highest in the country. Over time, these higher wages led large numbers of workers with the right skills to move to these provinces to do the work. In other words, the market for a factor of production—

In this sense factor markets are similar to goods markets, which allocate goods among consumers. But there are two features that make factor markets special. Unlike in a goods market, demand in a factor market is what we call derived demand. That is, demand for the factor is derived from the firm’s output choice. The second feature is that factor markets are where most of us get the largest shares of our income (government transfers being the next largest source of income in the economy).

WHAT IS A FACTOR, ANYWAY?

Imagine a business that produces shirts. The business will make use of workers and machines—

The key distinction is that a factor of production earns income from the selling of its services over and over again but an input cannot. For example, a worker earns income over time from repeatedly selling his or her efforts; the owner of a machine earns income over time from repeatedly selling the use of that machine.

So a factor of production, such as labour and capital, represents an enduring source of income. An input like electricity or cloth, however, is used up in the production process. Once exhausted, it cannot be a source of future income for its owner.

Factor Incomes and the Distribution of Income

Most Canadian families get most of their income in the form of wages and salaries—

The factor distribution of income is the division of total income among labour, land, and capital.

Obviously, then, the prices of factors of production have a major impact on how the economic “pie” is sliced among different groups. For example, a higher wage rate, other things equal, means that a larger proportion of the total income in the economy goes to people who derive their income from labour, and less goes to those who derive their income from capital or land. Economists refer to how the economic pie is sliced as the “distribution of income.” Specifically, factor prices determine the factor distribution of income—how the total income of the economy is divided among labour, land, and capital.

As the following Economics in Action explains, the factor distribution of income in Canada has been quite stable over the past few decades. In other times and places, however, large changes have taken place in the factor distribution. One notable example: during the Industrial Revolution, the share of total income earned by landowners fell sharply, while the share earned by capital owners rose. As explained in the following For Inquiring Minds, this shift had a profound effect on society.

THE FACTOR DISTRIBUTION OF INCOME AND SOCIAL CHANGE IN THE INDUSTRIAL REVOLUTION

Have you read any novels by Jane Austen? How about Charles Dickens? If you’ve read both, you probably noticed that they seem to be describing quite different societies. Austen’s novels, set in England around 1800, describe a world in which the leaders of society are land-

This literary shift reflects a dramatic transformation in the factor distribution of income. The Industrial Revolution, which took place between the late eighteenth century and the middle of the nineteenth century, changed England from a mainly agricultural country, in which land earned a fairly substantial share of income, to an urbanized and industrial one, in which land rents were dwarfed by capital income. Recent estimates by the economist Nancy Stokey show that between 1780 and 1850 the share of national income represented by land fell from 20% to 9%, but the share represented by capital rose from 35% to 44%. That shift changed everything—

(Nancy Stokey, A Quantitative Model of the British Industrial Revolution, 1780-1850. Carnegie-

THE FACTOR DISTRIBUTION OF INCOME IN CANADA

When we talk about the factor distribution of income, what are we talking about in practice?

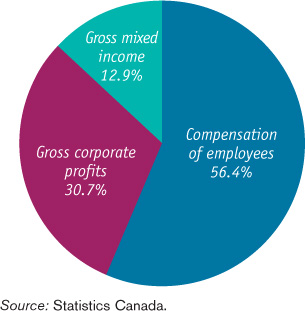

In Canada, as in all advanced economies, payments to labour account for most of the economy’s total income. Figure 19-1 shows the factor distribution of income in Canada in 2012: in that year, 56% of total income in the economy took the form of “compensation of employees”—a number that includes both wages and benefits, that is, employers’ social contributions to programs such as health insurance. This number was just slightly below the 58% average value for the previous thirty years.

However, measured wages and benefits don’t capture the full income of “labour” because a significant fraction of total income in Canada is “proprietors’ income”—the earnings of people who own their own businesses. The “gross mixed income” category includes gross operating income from unincorporated businesses, farms, and rentals. So part of that income should be considered wages these business owners pay themselves. So the true share of labour in the economy is probably a few percentage points higher than the reported “compensation of employees” share.

But much of what we call compensation of employees is really a return on human capital. A surgeon isn’t just supplying the services of a pair of ordinary hands (at least the patient hopes not!): that individual is also supplying the result of many years and hundreds of thousands of dollars invested in training and experience. We can’t directly measure what fraction of wages is really a payment for education and training, but many economists believe that human capital has become the most important factor of production in modern economies.

Quick Review

Economists usually divide the economy’s factors of production into four principal categories: labour, land, physical capital, and human capital.

The demand for a factor is a derived demand. Factor prices, which are set in factor markets, determine the factor distribution of income. Labour receives the bulk—

56% in 2012—of the income in the modern Canadian economy. Although the exact share is not directly measurable, much of what is called compensation of employees is a return to human capital.

Check Your Understanding 19-1

CHECK YOUR UNDERSTANDING 19-1

Question 19.1

Suppose that the government places price controls on the market for university professors, imposing a wage that is lower than the market wage. Describe the effect of this policy on the production of university degrees. What sectors of the economy do you think will be adversely affected by this policy? What sectors of the economy might benefit?

Many university professors will depart for other lines of work if the government imposes a wage that is lower than the market wage. Fewer professors will result in fewer courses taught and therefore fewer university degrees produced. It will adversely affect sectors of the economy that depend directly on universities, such as the local shopkeepers who sell goods and services to students and faculty, university textbook publishers, and so on. It will also adversely affect firms that use the “output” produced by universities: new university graduates. Firms that need to hire new employees with university degrees will be hurt as a smaller supply results in a higher market wage for university graduates. Ultimately, the reduced supply of university-