4.7 PROBLEMS

Question 4.12

Determine the amount of consumer surplus generated in each of the following situations.

Leon is willing to pay up to $10 for a new T-

shirt. He picks out one he likes with a price tag of exactly $10. When he is paying for it, he learns that the T- shirt has been discounted by 50%. Alberto goes to a store hoping to find a used copy of The Tragically Hip’s Yer Favourites for up to $10. The store has one copy selling for $10, which he buys.

After soccer practice, Stacey is willing to pay $2 for a bottle of mineral water. The 7-Eleven sells mineral water for $2.25 per bottle, so she declines to purchase it.

Question 4.13

Determine the amount of producer surplus generated in each of the following situations.

Gordon lists his old Lionel electric trains on eBay. He sets a minimum acceptable price, known as his reserve price, of $75. After five days of bidding, the final high bid is exactly $75. He accepts the bid.

So-

Hee advertises her car for sale in the used- car section of the student newspaper for $2000, but she is willing to sell the car for any price higher than $1500. The best offer she gets is $1200, which she declines. Sanjay likes his job so much that he would be willing to do it for free. However, his annual salary is $80 000.

Question 4.14

There are six potential consumers of computer games, each willing to buy only one game. Consumer 1 is willing to pay $40 for a computer game, consumer 2 is willing to pay $35, consumer 3 is willing to pay $30, consumer 4 is willing to pay $25, consumer 5 is willing to pay $20, and consumer 6 is willing to pay $15.

Suppose the market price is $29. What is the total consumer surplus?

The market price decreases to $19. What is the total consumer surplus now?

When the price falls from $29 to $19, how much does each consumer’s individual consumer surplus change? How does total consumer surplus change?

Question 4.15

In an auction, potential buyers compete for a good by submitting bids. Adam Galinsky, a social psychologist at Northwestern University, compared eBay auctions in which the same good was sold. He found that, on average, the larger the number of bidders, the higher the sales price. For example, in two auctions of identical iPods, the one with the larger number of bidders brought a higher selling price. According to Galinsky, this explains why smart sellers on eBay set absurdly low opening prices (the lowest price that the seller will accept), such as 1 cent for a new iPod. Use the concepts of consumer and producer surplus to explain Galinsky’s reasoning.

You are considering selling your vintage 1969 convertible Volkswagen Beetle. If the car is in good condition, it is worth a lot; if it is in poor condition, it is useful only as scrap. Assume that your car is in excellent condition but that it costs a potential buyer $500 for an inspection to learn the car’s condition. Use what you learned in part (a) to explain whether or not you should pay for an inspection and share the results with all interested buyers.

Question 4.16

According to Statistics Canada, due to an increase in demand, the average domestic airline fare increased from $182.18 in 2010 to $190.92 in 2011, an increase of $8.74. The number of passenger tickets sold in 2010 was 65.8 million. Assume that over the same period, the airlines’ costs remained roughly the same (in reality they did not: the price of jet fuel rose from $0.57 per litre in January 2010 to $0.78 per litre in December 2011, and airline pilots’ salaries rose 2%).

Can you determine precisely by how much producer surplus increased as a result of the $8.74 increase in the average fare? If you cannot be precise, can you determine whether it was less than, or more than, a specific amount?

Question 4.17

Hollywood screenwriters negotiate a new agreement with movie producers stipulating that they will receive 10% of the revenue from every video rental of a movie they authored. They have no such agreement for movies shown on on-

When the new writers’ agreement comes into effect, what will happen in the market for video rentals—

that is, will supply or demand shift, and how? As a result, how will consumer surplus in the market for video rentals change? Illustrate with a diagram. Do you think the writers’ agreement will be popular with consumers who rent videos? Consumers consider video rentals and on-

demand movies substitutable to some extent. When the new writers’ agreement comes into effect, what will happen in the market for on- demand movies— that is, will supply or demand shift, and how? As a result, how will producer surplus in the market for on- demand movies change? Illustrate with a diagram. Do you think the writers’ agreement will be popular with cable television companies that show on- demand movies?

Question 4.18

The accompanying table shows the supply and demand schedules for used copies of the first edition of this textbook. The supply schedule is derived from offers at Amazon.com. The demand schedule is hypothetical.

Calculate consumer and producer surplus at the equilibrium in this market.

Now the second edition of this textbook becomes available. As a result, the willingness to pay of each potential buyer for a second-

hand copy of the first edition falls by $20. In a table, show the new demand schedule and again calculate consumer and producer surplus at the new equilibrium.

Question 4.19

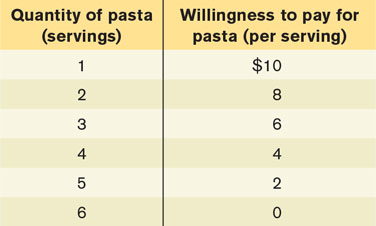

On Thursday nights, a local restaurant has a pasta special. Ari likes the restaurant’s pasta, and his willingness to pay for each serving is shown in the accompanying table.

If the price of a serving of pasta is $4, how many servings will Ari buy? How much consumer surplus does he receive?

The following week, Ari is back at the restaurant again, but now the price of a serving of pasta is $6. By how much does his consumer surplus decrease compared to the previous week?

One week later, he goes to the restaurant again. He discovers that the restaurant is offering an “all-

you- can- eat” special for $25. How much pasta will Ari eat, and how much consumer surplus does he receive now? Suppose you own the restaurant and Ari is a typical customer. What is the highest price you can charge for the “all-

you- can- eat” special and still attract customers?

Question 4.20

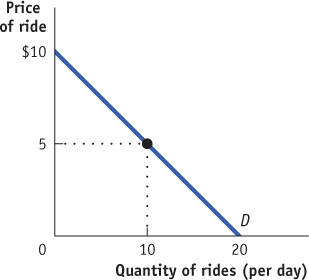

You are the manager of Fun World, a small amusement park. The accompanying diagram shows the demand curve of a typical customer at Fun World.

Suppose that the price of each ride is $5. At that price, how much consumer surplus does an individual consumer get? (Recall that the area of a right triangle is 1/2 × the height of the triangle × the base of the triangle.)

Suppose that Fun World considers charging an admission fee, even though it maintains the price of each ride at $5. What is the maximum admission fee consumers would be willing to pay? (Assume that all potential customers have enough money to pay the fee.)

Suppose that Fun World lowered the price of each ride to zero. How much consumer surplus does an individual consumer get? What is the maximum admission fee consumers would be willing to pay?

Question 4.21

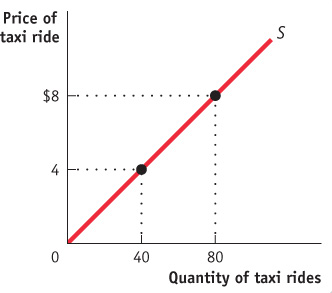

The accompanying diagram illustrates a taxi driver’s individual supply curve (assume that each taxi ride is the same distance).

Suppose the city sets the price of taxi rides at $4 per ride, and at $4 the taxi driver is able to sell as many taxi rides as he desires. What is this taxi driver’s producer surplus? (Recall that the area of a right triangle is 1/2 × the height of the triangle × the base of the triangle.)

Suppose that the city keeps the price of a taxi ride set at $4, but it decides to charge taxi drivers a “licensing fee.” What is the maximum licensing fee the city could extract from this taxi driver?

Suppose that the city allowed the price of taxi rides to increase to $8 per ride. Again assume that, at this price, the taxi driver sells as many rides as he is willing to offer. How much producer surplus does an individual taxi driver now get? What is the maximum licensing fee the city could charge this taxi driver?

Question 4.22

On May 10, 2010, a judge ruled in a copyright infringement lawsuit against the popular file-

If everyone obtained music and video content for free from websites such as LimeWire, instead of paying the record companies, what would the record companies’ producer surplus be from music sales? What are the implications for record companies’ incentive to produce music content in the future?

If the record companies had lost the lawsuit and music could be freely downloaded from the Internet, what do you think would happen to mutually beneficial transactions (the producing and buying of music) in the future?