5.7 PROBLEMS

Question 5.11

Suppose it is decided that rent control in a city will be abolished and that market rents will now prevail. Assume that all rental units are identical and so are offered at the same rent. To address the plight of residents who may be unable to pay the market rent, an income supplement will be paid to all low-

Use a diagram to show the effect on the rental market of the elimination of rent control. What will happen to the quality and quantity of rental housing supplied?

Use a second diagram to show the additional effect of the income-

supplement policy on the market. What effect does it have on the market rent and quantity of rental housing supplied in comparison to your answers to part (a)? Are tenants better or worse off as a result of these policies? Are landlords better or worse off?

From a political standpoint, why do you think cities have been more likely to resort to rent control rather than a policy of income supplements to help low-

income people pay for housing?

Question 5.12

In order to ingratiate himself with voters, the mayor of Gotham City decides to lower the price of taxi rides. Assume, for simplicity, that all taxi rides are the same distance and therefore cost the same. The accompanying table shows the demand and supply schedules for taxi rides.

Assume that there are no restrictions on the number of taxi rides that can be supplied (there is no licensing system). Find the equilibrium price and quantity.

Suppose that the mayor sets a price ceiling at $5.50. How large is the shortage of rides? Illustrate with a diagram. Who loses and who benefits from this policy?

Suppose that the stock market crashes and, as a result, people in Gotham City are poorer. This reduces the quantity of taxi rides demanded by 6 million rides per year at any given price. What effect will the mayor’s new policy have now? Illustrate with a diagram.

Suppose that the stock market rises and the demand for taxi rides returns to normal (that is, returns to the demand schedule given in the table). The mayor now decides to ingratiate himself with taxi drivers. He announces a policy in which operating licences are given to existing taxi drivers; the number of licences is restricted such that only 10 million rides per year can be given. Illustrate the effect of this policy on the market, and indicate the resulting price and quantity transacted. What is the quota rent per ride?

Question 5.13

In the mid-

Draw a diagram showing the effect of the policy. Did the policy act as a price ceiling or a price floor?

What kinds of inefficiencies were likely to have arisen when the controlled price of bread was below the market price? Explain in detail.

Suppose that one year during this period, a large wheat harvest caused a rightward shift in the supply of bread and therefore a decrease in its free market price. Bakers found that, as a result, the controlled price of bread was above the free market price.

Draw a diagram showing the effect of the price control on the market for bread during this one-

year period. Did the policy act as a price ceiling or a price floor? What kinds of inefficiencies do you think occurred during this period? Explain in detail.

Question 5.14

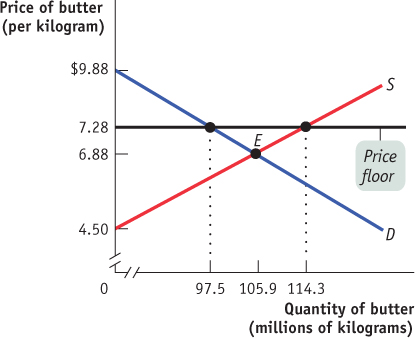

The Canadian Dairy Commission (CDC) administers the price floor for butter, which was set at $7.28 per kilogram in 2012. At that price, according to data from the CDC, the quantity of butter supplied in 2012 was 114.3 million kilograms, and the quantity demanded was 97.5 million kilograms. To support the price of butter at the price floor, the CDC therefore had to buy up 16.8 million kilograms of butter. The accompanying diagram shows supply and demand curves illustrating the market for butter.

In the absence of a price floor, how much consumer surplus is created? How much producer surplus? What is the total surplus?

With the price floor at $7.28/kg of butter, consumers buy 97.5 million kilograms of butter. How much consumer surplus is created now?

With the price floor at $7.28/kg of butter, producers sell 114.3 million kilograms of butter (some to consumers and some to the CDC). How much producer surplus is created now?

How much money does the CDC spend on buying up surplus butter?

Suppose the federal government covers the cost of surplus butter using tax revenue, as they do in the United States.4 As a result, total surplus (producer plus consumer) is reduced by the amount the CDC spent on buying surplus butter. Using your answers for parts (b)–(d), what is the total surplus when there is a price floor? How does this compare to the total surplus without a price floor from part (a)?

Question 5.15

The accompanying table shows hypothetical demand and supply schedules for milk per year. The Canadian government decides that the incomes of dairy farmers should be maintained at a level that allows the traditional family dairy farm to survive. So it implements a price floor of $1 per litre by buying surplus milk until the market price is $1 per litre.

In a diagram, show the deadweight loss from the inefficiently low quantity bought and sold.

How much surplus milk will be produced as a result of this policy?

What will be the cost to the government of this policy?

Since milk is an important source of protein and calcium, the government decides to provide the surplus milk it purchases to elementary schools at a price of only $0.60 per litre. Assume that schools will buy any amount of milk available at this low price. But parents now reduce their purchases of milk at any price by 50 million litres per year because they know their children are getting milk at school. How much will the dairy program now cost the government?

Explain how inefficiencies in the form of inefficient allocation of sales among sellers and wasted resources arise from this policy.

Question 5.16

European governments tend to make greater use of price controls than does the Canadian government. For example, the French government sets minimum starting yearly wages for new hires who have completed le bac, certification roughly equivalent to a high school diploma. The demand schedule for new hires with le bac and the supply schedule for similarly credentialed new jobseekers are given in the accompanying table. The price here—

In the absence of government interference, what are the equilibrium wage and number of graduates hired per year? Illustrate with a diagram. Will there be anyone seeking a job at the equilibrium wage who is unable to find one—

that is, will there be anyone who is involuntarily unemployed? Suppose the French government sets a minimum yearly wage of €35 000. Is there any involuntary unemployment at this wage? If so, how much? Illustrate with a diagram. What if the minimum wage is set at €40 000? Also illustrate with a diagram.

Given your answer to part (b) and the information in the table, what do you think is the relationship between the level of involuntary unemployment and the level of the minimum wage? Who benefits from such a policy? Who loses? What is the missed opportunity here?

Question 5.17

Until recently, the standard number of hours worked per week for a full-

Question 5.18

For the last 70 years the Canadian government has used price supports to provide income assistance to Canadian farmers. To implement these price supports, at times the government has used price floors, which it maintains by buying up the surplus farm products. At other times, it has used target prices, a policy by which the government gives the farmer an amount equal to the difference between the market price and the target price for each unit sold. Consider the market for corn depicted in the accompanying diagram.

If the government sets a price floor of $5 per bushel, how many bushels of corn are produced? How many are purchased by consumers? By the government? How much does the program cost the government? How much revenue do corn farmers receive?

Suppose the government sets a target price of $5 per bushel for any quantity supplied up to 1000 bushels. How many bushels of corn are purchased by consumers and at what price? By the government? How much does the program cost the government? How much revenue do corn farmers receive?

Which of these programs (in parts (a) and (b)) costs corn consumers more? Which program costs the government more? Explain.

Is one of these policies less inefficient than the other? Explain.

Question 5.19

The waters off the North Atlantic coast were once teeming with fish, but because of overfishing by the commercial fishing industry, the stocks of fish became seriously depleted. In 1991, the International Commission for the Conservation of Atlantic Tunas (ICCAT) implemented an international set of quotas to allow Atlantic tuna and swordfish stocks to recover. The quota limited the amount of swordfish caught per year by all Canadian-

Use a diagram to show the effect of the quota on the market for swordfish in 1991. In your diagram, illustrate the deadweight loss from inefficiently low quantity transacted.

How do you think fishers changed how they fished in response to this policy?

Question 5.20

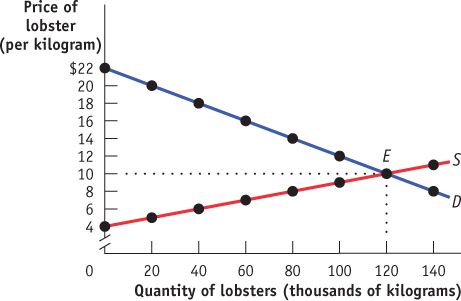

In the Atlantic provinces and Quebec, you must have a licence to harvest lobster commercially; these licences are issued yearly. Suppose the federal Department of Fisheries and Oceans is concerned about the dwindling supplies of lobsters. This department decides to place a yearly quota of 80 000 kg of lobsters harvested in all Canadian waters. It also decides to give licences this year only to those fishers who had licences last year. The accompanying diagram shows the demand and supply curves for Canadian lobsters.

In the absence of government restrictions, what are the equilibrium price and quantity?

What is the demand price at which consumers wish to purchase 80 000 kg of lobsters?

What is the supply price at which suppliers are willing to supply 80 000 kg of lobsters?

What is the quota rent per kilogram of lobster when 80 000 kg are sold? Illustrate the quota rent and the deadweight loss on the diagram.

Explain a transaction that benefits both buyer and seller but is prevented by the quota restriction.

Question 5.21

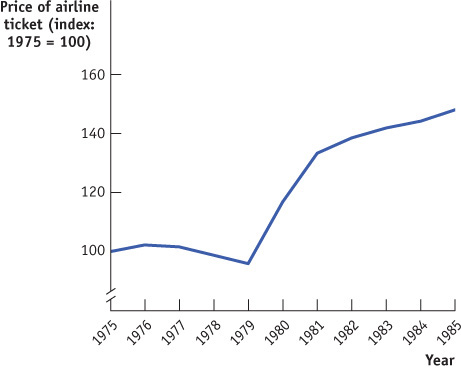

The accompanying diagram shows data from the U.S. Bureau of Labor Statistics on the average price of an airline ticket in the United States from 1975 until 1985, adjusted to eliminate the effect of inflation (the general increase in the prices of all goods over time). In 1978, the United States Airline Deregulation Act removed the price floor on airline fares, and it also allowed the airlines greater flexibility to offer new routes. (Note: Canada experienced similar airline deregulation in 1978.)

Looking at the data on airline ticket prices in the diagram, do you think the price floor that existed before 1978 was binding or non-

binding? That is, do you think it was set above or below the equilibrium price? Draw a supply and demand diagram, showing where the price floor that existed before 1978 was in relation to the equilibrium price. Most economists agree that the average airline ticket price per mile travelled actually fell as a result of the Airline Deregulation Act. How might you reconcile that view with what you see in the diagram?

Question 5.22

In Canada, all provinces except Alberta have a minimum legal retail price for beer (a price floor). Part of the rationale for this policy is to discourage immoderate consumption of alcohol.

Suppose the fictitious province of Beerlandia has the following annual demand and supply schedule for beer (sold in cases of 24 bottles).

Find the equilibrium price and quantity of cases of beer in Beerlandia. Draw a diagram representing the market for beer in the province of Beerlandia. Clearly label the price paid by consumers, the quantity of beer exchanged, and the price received by suppliers in equilibrium.

Suppose the provincial government of Beerlandia decides to impose a legal minimum price of $28.00 per case of 24 bottles of beer. Briefly describe the winners and losers of this minimum price law.

Suppose the majority of the residents of Beerlandia live close to the border and have access to beer at a lower price either in another province or in the United States. What do you expect to occur? What does this imply about the ability of the provincial government of Beerlandia to independently set their tax and alcohol/beer pricing policy? Which jurisdiction is likely to be more problematic, other Canadian provinces or U.S. states?

Question 5.23

This question uses the algebraic method of determining equilibrium from Appendix 3A. In Canada, producers of milk, poultry, and eggs are protected by government-

Suppose, for simplicity, the Canadian market for turkeys is described by the following demand and supply curves.

where Q represents the monthly quantity of turkey in thousands of kilograms and the price P is the price per kilogram.

Suppose Canada does not have any supply management for turkey farmers. Derive the equilibrium price and quantity of turkey. Draw a diagram representing the market for turkey. Clearly label the equilibium price and quantity.

Suppose, to support the incomes of farmers who raise turkeys, the government imposes a price floor for turkeys at $9.00 per kilogram. Determine the resulting price paid by consumers, quantity of turkeys exchanged, and the price received by suppliers in equilibrium. Sketch this into your diagram from part (a).

Briefly explain how this price floor supports the income of farmers.

Why might the government need to also impose limitations on the quantity of turkeys imported? Explain.

Show that the imposition of a production quota of 168 000 kg of turkey per month results in the same price paid by consumers as the price floor in part (b). What are the resulting demand price, supply price, and quota rent?

Would the government (or a supply management authority) need to have the means to impose penalties for violating the price floor and/or the supply quota? Explain why or why not.

Would farmers who were unable to get a turkey production quota licence be pleased by this supply management system? Explain why or why not. Suppose, if they wish, these farmers could rent a production quota licence from another farmer who was awarded one. Would this make these other farmers extremely happy? Explain why or why not.