Question 1 of 1

Step 1

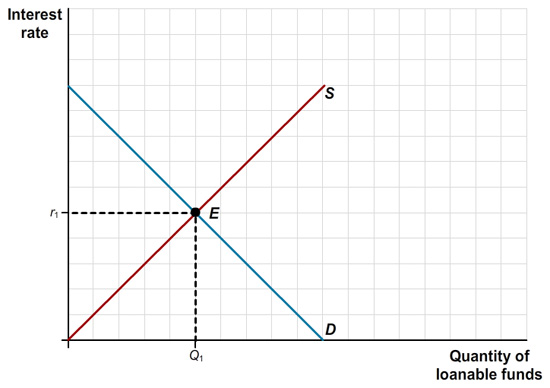

Use the market for loanable funds shown in the accompanying diagram to explain what happens to private savings, private investment spending, and the interest rate if each of the following events occur. Assume that there are no capital inflows or outflows.

a. If the government reduces the size of its deficit to zero there will be a(n) in the of loanable funds. Reducing deficits to zero will cause interest rates to .

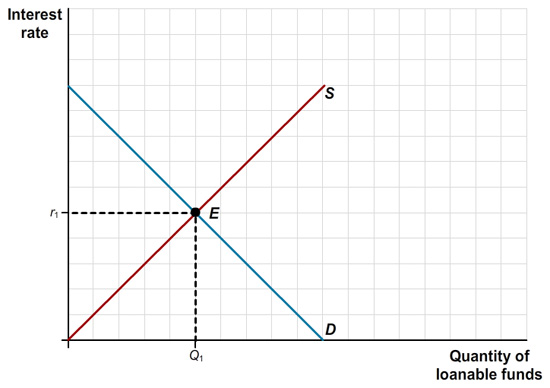

Use the market for loanable funds shown in the accompanying diagram to explain what happens to private savings, private investment spending, and the interest rate if each of the following events occur. Assume that there are no capital inflows or outflows.

b. At any given interest rate, if consumers decide to save more and the government budget remains unchanged there will be a(n) in the of loanable funds. This will cause the interest rate to .

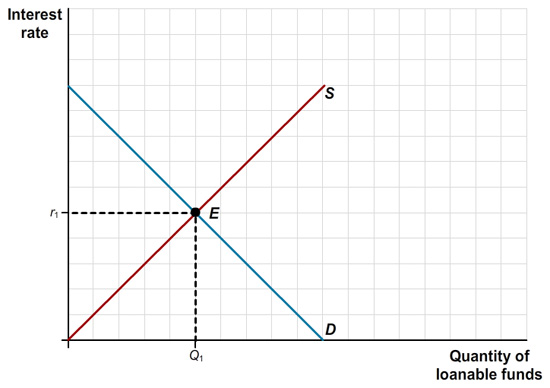

Use the market for loanable funds shown in the accompanying diagram to explain what happens to private savings, private investment spending, and the interest rate if each of the following events occur. Assume that there are no capital inflows or outflows.

c. At any given interest rate, if businesses become very optimistic about the future profitability of investment spending and the government budget remains unchanged then the of loanable funds will . This will cause interest rates to .