Monopolistic Competition

monopolistic competition A market structure with a large number of firms producing differentiated products. This differentiation is either real or imagined by consumers and involves innovations, advertising, location, or other ways of making one firm’s product different from that of its competitors.

Until the 1920s, competition and monopoly were the only models of market structure that economists had in their toolbox. As consumerism expanded and more varieties of goods and services became available, economists found that these two models were inadequate to explain the vast markets for many goods. In other words, some markets were considered imperfect, or not fitting the mold of the traditional competitive structure. This led to the study of imperfect markets, which included monopolistic competition and oligopoly.

Monopolistic competition is nearer to the competitive end of the spectrum and is defined by the following:

- A large number of small firms. Similar to perfect competition, each firm has a very small share of the overall market. They and their competitors cannot appreciably affect the market and, therefore, mostly ignore the reactions of their rivals.

- Entry and exit are easy.

- Unlike perfect competition, products are different. Each firm produces a product that is different from its competitors or is perceived to be different by consumers. What distinguishes monopolistic competition from perfectly competitive markets is product differentiation.

Product Differentiation and the Firm’s Demand Curve

Most firms sell products that are in some way differentiated from their competitors. For example, this differentiation can take the form of a superior location. Your local dry cleaner, restaurant, grocery, and gas station can have slightly higher prices, but you will not abandon them altogether. Other companies have branded products that give them some ability to increase price without losing all of their customers, as would happen under perfect competition.

249

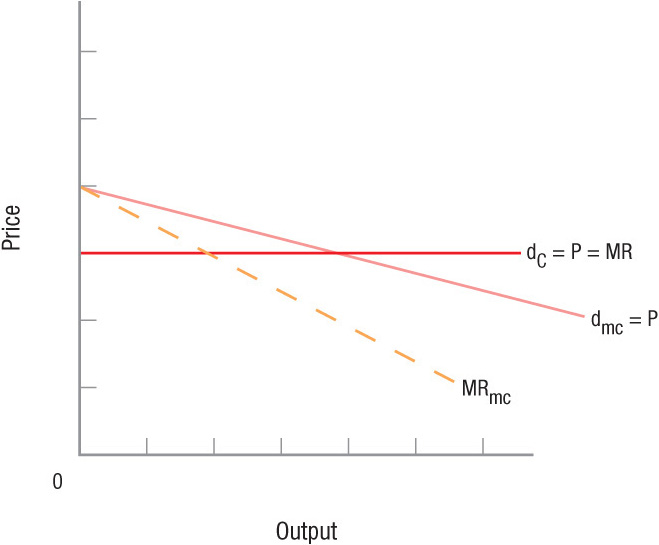

Product differentiation gives the firm some (however modest) control over prices (market power). This is illustrated in Figure 1. Demand curve dc is the competitive demand curve, and dmc is the demand faced by a monopolistic competitor. This is similar to the monopolist’s demand, but the demand curve is considerably more elastic. Because a monopolistic competitor is small relative to the market, there are still a lot of substitutes. Thus, any increase in price is accompanied by a substantial decrease in output demanded. But unlike the perfectly competitive firm that faces a horizontal demand curve with no power to raise price, a monopolistically competitive firm has some market power with its not quite horizontal demand curve.

product differentiation One firm’s product is distinguished from another’s through advertising, innovation, location, and so on.

Like a monopolist, the monopolistically competitive firm faces a downward sloping marginal revenue curve, shown in Figure 1 as MRmc.

Product differentiation can be the result of a superior product, a better location, superior service, clever packaging, or advertising. All of these factors are intended to increase demand or reduce the elasticity of demand and generate loyalty to the product or service. Therefore, the demand curve for monopolistically competitive firms can vary. Although demand curves tend to be elastic (flat), firms that are able to differentiate their products the most can achieve greater market power, which makes their demand curves steeper, allowing them to charge higher prices.

The Role of Advertising An important way to differentiate products is through advertising. Economists generally classify advertising in two ways: informational and persuasive. The informational aspects of advertising let consumers know about products and reduce search costs. Advertising is a relatively inexpensive way to let customers know about the quality and price of a company’s products. It can also enhance competition by making consumers aware of substitute or competitive products. Advertising also has the potential to reduce average costs by increasing sales, bringing about economies of scale.

But advertising does have a negative side as well. Because so much of advertising is persuasive (ads containing little informational content but designed to shift buyers among competitors of similar products), the result is that the cost of advertising drives up the price of many products. With all the advertising we see, a significant portion probably cancels each other out.

Advertising is another area in which technology has transformed the medium: Digital video recorders permit ad-skipping and have significantly reduced the impact of TV ads. A lot of advertising dollars are shifting away from conventional media (newspapers, magazines, and television) and moving to the Internet, where consumers can be targeted more inexpensively and efficiently.

250

Do Brands Really Represent Pricing Power?

What is a brand? All of us know brands through their names and logos. Nike has the swoosh, Intel has a logo and the four-note jingle that sounds whenever its processors are advertised, Coca-Cola has a distinctive way of spelling its name. Names and logos are communication devices, but brands are more than this. They are a promise of performance. A branded product or service raises expectations in a consumer’s mind. If these expectations are met, consumers pay a price premium. If expectations are not met, the value of the brand falls as consumers seek alternatives.

Brand names start with the company that makes the product or provides the service. In the past, this meant that brand names came from a limited number of sources. Some companies were named after their founders, such as Walt Disney; some companies were named after what they supplied, such as IBM (International Business Machines); and some have also been named by their main product, such as the Coca-Cola Company. Sometimes the company name has a tenuous link with the product but is strong nevertheless, such as the Starbucks name for coffee products: Master Starbuck was first mate to Captain Ahab in Moby-Dick and did drink coffee in the book, but who remembers that?

Whatever their origins, these brands have recognizable brand names, and they command price premiums. According to the annual BrandZ study by Millward Brown, Apple was the most valuable brand in 2012, valued at nearly $182 billion, followed by IBM, Google, McDonald’s, and Microsoft. Nine of the top ten brands were American, with the only non-American brand being China Mobile, coming in at number ten and worth $47 billion. Brands this valuable must convey some considerable pricing power, or what we called market power in the previous chapter. Market power is what companies want.

In the auto industry, Toyota was knocked out of its position as the highest valued brand by BMW, whose brand is worth $25 billion. This was not the result of a lack of an efficient production system by Toyota, but rather a case of bad luck in recent years. First, in 2010, Toyota recalled over 7 million cars due to an accelerator issue that ultimately was determined to have been caused by driver error. Then, in 2011, an earthquake and tsunami in Japan caused severe supply disruptions to car manufacturers, which caused further deterioration of Toyota’s reputation. Despite these setbacks, Toyota maintained its concentration on consistent high quality, a commitment to customer service, and continuous improvement of the product line.

The Toyota brand has cachet: At the California plant that until 2009 Toyota shared with General Motors, identical cars came off the production line. Some were branded as GM cars, others Toyotas. When the cars were traded in, the Toyotas had a much higher trade-in value. The Toyota brand conveys quality, which gives Toyota its pricing power. As Toyota rebuilds its reputation from the recent setbacks, it may potentially re-emerge as the top auto brand.

Sources: BrandZ Top 100 Most Valuable Global Brands 2012, Millward Brown, WPP Companies.

All of these ways to differentiate their products give monopolistically competitive firms some control over price. This market power means that their profit maximizing decisions will be a little different from those of perfectly competitive firms.

Price and Output Under Monopolistic Competition

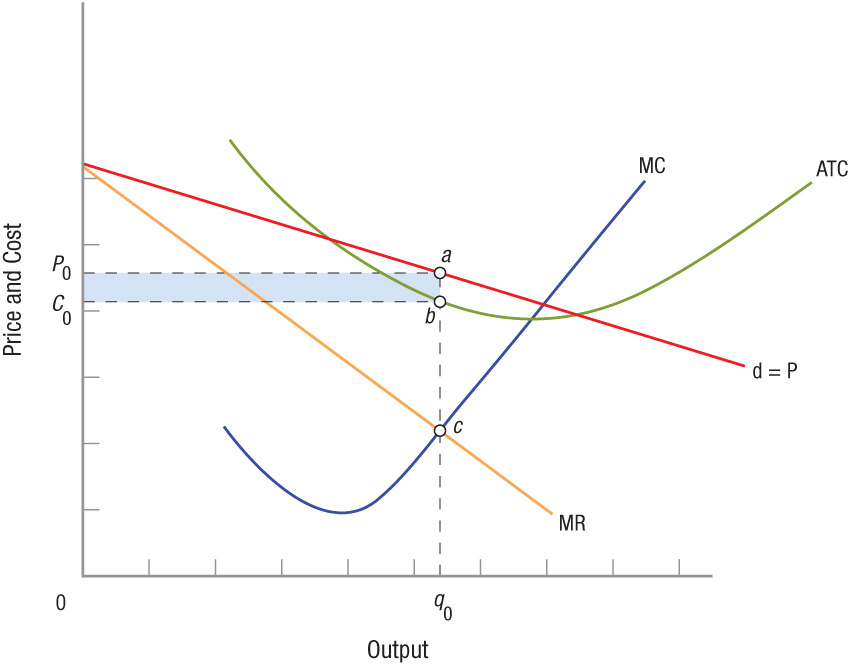

Profit maximization in the short run for the monopolistically competitive firm is a lot like that for a monopolist, but given the firm’s size, profit will tend to be less. Short-run profit maximizing behavior is shown in Figure 2. The firm maximizes profit where MR = MC (point c) by selling output q0 for a price of P0. Total profits are the shaded area C0P0ab. All of this should look very familiar from the last chapter (review the five-step approach to maximizing profit). The difference is that the monopolistically competitive demand curve is quite elastic, and economic profits are diminished. The level of profits is dependent on the strength of demand, but in any event will be considerably lower than that of a monopolist.

This does not mean that profits are trivial. Many huge global firms sell their products in even larger global markets, and their profits are significant. They are large firms, but do not have significant market power. Many companies—such as Armani, Nike, and Sony—are all quite large but relative to their markets face daunting competition.

251

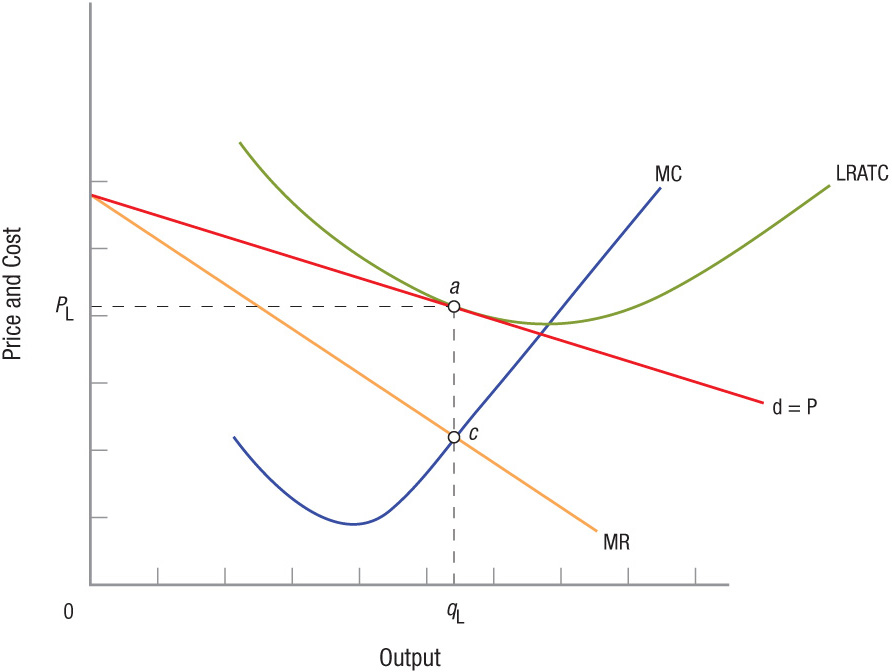

If firms in the industry are earning economic profits like those of the firm shown in Figure 2, new firms will want to enter. Since there are no restrictions on entry or exit, new firms will enter, soaking up some industry demand and reducing the demand to each firm in the market. Demand will continue to decline as long as economic profits exist. At equilibrium in the long run, the typical firm in the industry will look like the one shown in Figure 3.

252

Notice that the demand curve is just tangent to the long-run average total cost (LRATC) curve, resulting in the firm earning normal profits in the long run. The firm produces and sells qL output at a price of PL (point a). Note that price PL is not at the minimum point of the LRATC, which shows that prices in monopolistically competitive markets are higher than prices in perfectly competitive markets. Once the typical firm reaches this point, there is no longer any incentive for other firms to enter the industry. Like perfectly competitive firms, monopolistically competitive firms earn normal profits in the long run.

Comparing Monopolistic Competition to Competition

How does allocative efficiency compare for the two market structures? Because firms in both earn normal profits, you might think that both market structures are equally efficient. Unfortunately, this is not the case. Differentiated products create minimarkets within each industry. For example, Wrangler and True Religion are both brands of blue jeans, but each caters to a different set of customers, allowing True Religion to charge more than Wrangler. By differentiating products, economies of scale for monopolistically competitive firms are likely to be smaller compared to a perfectly competitive firm whose product is essentially identical, resulting in slightly higher prices and lower output.

These relatively small differences in price and output represent the costs we pay for product differentiation and innovation. To the extent that these differences are real, the costs are justified. When advertising provides accurate information that helps us select products, or if the products are sufficiently distinct that they provide real choices, then the additional costs can be worth it. Plus, competitive pressures will keep prices significantly lower than if a monopoly emerges in the market.

Firms differentiate their products through style and features that matter. Coca-Cola offers Cherry, Vanilla, and Black Cherry Vanilla Coke, as well as diet versions. Watches offer everything from the time and date to temperature, stopwatch capabilities, Global Positioning System (GPS) capability, altitude, and, most recently, Internet access. Product differentiation is important and for most of us valuable, but not free.

From this discussion, you might get some sense of the pressures firms face to differentiate their products. The more they can move away from the competitive model, the better chance they have of using their market power to make more profit. But because market power evaporates over the long run for monopolistically competitive firms, these firms have to try to sustain the value in the differentiated product. This is hard to do. The price premium charged by Hollister will not be paid when Hollister becomes less fashionable, or more like everyone else. Yet, it is in the firm’s interest to product differentiate as long as it can. When you see firms trying to differentiate their products, ask yourself if the products really are so different after all.

MONOPOLISTIC COMPETITION

- Monopolistically competitive firms look like perfectly competitive firms (large number of small firms in a market in which entry and exit is unrestricted) but have differentiated products.

- Monopolistically competitive firms have downward-sloping demand curves and elastic demands.

- Short-run equilibrium output for the monopolistic competitor (like the monopolist) is at an output where MR = MC, and can result in positive or negative profits.

- In the long run, easy entry and exit result in monopolistically competitive firms earning only normal profits.

- Output is lower and price is higher for monopolistically competitive firms when compared to price and output for perfectly competitive firms. Monopolistically competitive firms have some market power.

QUESTION: At Disney World in Florida, you can stay at the Disney Grand Floridian Resort for $350/night or at the Disney All-Star Resort for $125/night. Both hotels are located within the park boundaries and are owned by Disney. How does product differentiation explain the significant price difference? Search and browse the hotels’ Web sites to provide examples of product differentiation between the hotels.

Although both hotels are located on Disney property, the Grand Floridian Resort is much closer to the theme parks, and is located on the Monorail for easy transportation throughout the park. Also, the Grand Floridian is an upscale hotel with many fine restaurants and shops, and offers luxurious room amenities. The All-Star Resort, on the other hand, caters to budget conscious families that are willing to forgo some convenience and amenities in exchange for significant savings. Disney differentiates its hotels to cater to different groups of customers with varying willingness-to-pay. The result is a significant price difference between the two hotels.