Chapter Summary

Chapter Summary

Section 1: How Banks Create Money

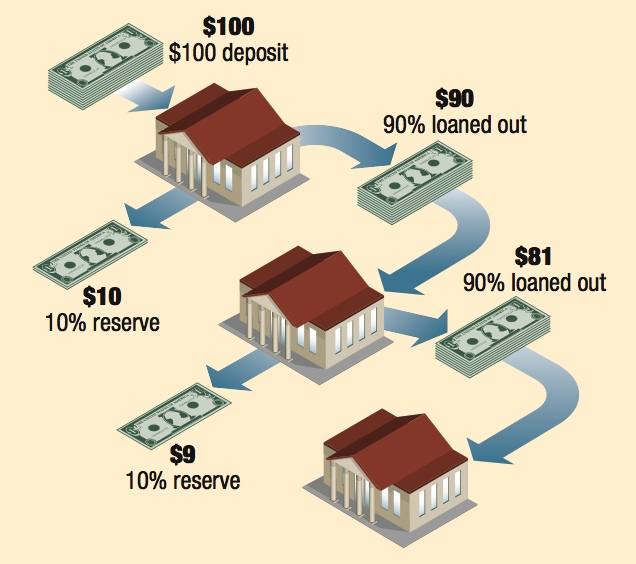

Money is created when banks make loans that eventually get deposited back into the system, generating checkable deposits. Part of these deposits are held as new reserves while the rest is again loaned out, creating even more money as it gets deposited back into the system.

In a fractional reserve banking system, banks accept deposits and hold only a certain portion in reserves, loaning out the rest.

T-Accounts and Reserve Ratios

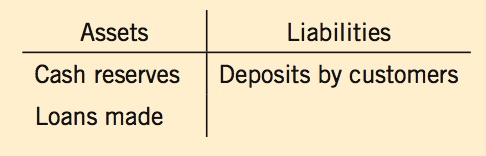

A T-account is a simple balance sheet showing a bank’s assets (money the bank claims) on the left side and liabilities (money the bank owes) on the right side.

A bank can continue to make loans as long as its reserve ratio, calculated as its reserves as a percentage of its total customer deposits, is equal to or higher than the reserve requirement.

Reserve ratio = Reserves/Customer Deposits

Section 2: The Money Multiplier and Its Leakages

The money multiplier is the maximum amount the money supply can increase (or decrease) when a dollar of new deposits enter (or exit) the system.

Money Multiplier = 1/Reserve Requirement

Examples:

If the reserve requirement is 25%, the money multiplier = 1/0.25 = 4

If the reserve requirement is 15%, the money multiplier = 1/0.15 = 6.67

A leakage-adjusted money multiplier takes into account the excess reserves and cash holdings that reduce the loans made and therefore reduces the actual money multiplier.

The actual money multiplier found in the economy is often lower than the potential money multiplier due to leakages caused by:

- Banks choosing to hold excess reserves by not lending out the maximum amount allowed.

- Individuals and businesses holding money in cash rather than in a bank.

Stashing cash under the mattress creates a leakage in the money supply because this money cannot be loaned out to another borrower.

309

Section 3: The Federal Reserve System

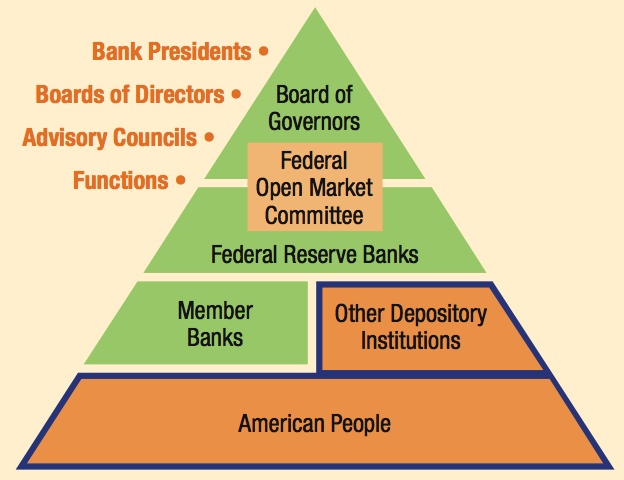

The Federal Reserve System is the central bank of the United States. It was established by the Federal Reserve Act of 1913 and is required by law to promote economic growth accompanied by full employment, stable prices, and moderate long-term interest rates.

The Federal Reserve is the Guarantor of the Financial System

Its actions are not subject to executive branch oversight, although the entire Federal Reserve System is subject to oversight by Congress.

The Fed is composed of a seven-member Board of Governors and twelve regional Federal Reserve Banks. The regional banks and their branches conduct the following services:

- Provide a nationwide payments system.

- Distribute coins and currency.

- Regulate and supervise member banks.

- Serve as the banker for the U.S. Treasury.

Section 4: The Federal Reserve at Work: Tools, Targets, and Policy Lags

The Fed uses three major tools to conduct monetary policy:

- Reserve requirements: Establishing the minimum level of reserves banks must hold.

- Discount rate: Setting the interest rate at which banks can borrow from the Fed.

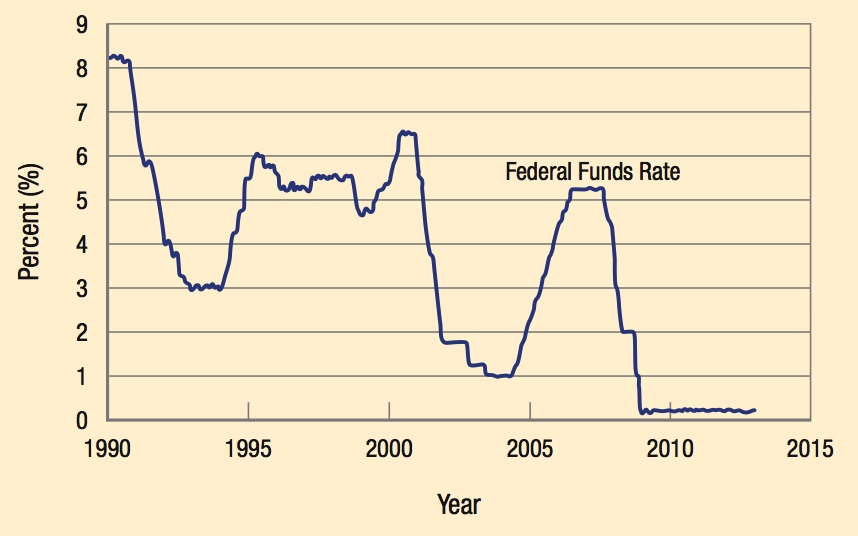

- Open market operations: Buying and selling government securities to target the federal funds rate.

The Fed targets the federal funds rate, an interest rate that influences nearly all other interest rates. The federal funds rate has been near 0% for the past few years.

Monetary policy is subject to lags:

- Information lag: The time it takes for economic data to become available.

- Recognition lag: The time before a trend in the data is certain enough to warrant a change in policy.

- Decision lag: The time it takes for the Federal Reserve Board to meet and make policy decisions.

- Implementation lag: The time it takes for banks and financial markets to react to the policy change.

Compared to fiscal policy lags, monetary policy lags, especially decision lags, are often shorter because decisions do not require the cooperation of Congress and the president.

310