Questions and Problems

Check Your Understanding

Question

uEufEtQR+JcktAnQLKn0QRz27Qhe/9DE/cpToxXS0JPXY6dcMeYS+Vn+CT0LzDqmEvzuvhZ3+9ZzlEx65lWbMwfszQxT5LSvLrnkHaU/3b3Df+p1/xI2OoGbzWzQoKUZProb 5 1. How are business cycles defined? Describe the four phases of business cycles.Question

EuVuHk/BlEyolxRae8TNImfSa8WpeqYppufdxyN3ViHPhyAhI5qfNDm3zWPtY4+aaCFKY1lq0mRgeJDsHlzBafeSwUmFcfRdWciC87CS+NY8pq315LPW8r0AES0=Prob 5 2. What is a key problem with the way the NBER dates recessions and recoveries?Question

mqXVqGtKbgNM3eljCR70OOsem0JlmERDl5qgday7PdLV+L5Rt/ibo3xd/x5wOPfGFtyeaN5tPDC+B6DHeM5q9mFpw2CGahluBywJqhNclCucwDUeGoowwEhtjyILcRVfh85xrGPjqdw=Prob 5 3. Describe the circular flow diagram. Why must all income equal spending in the economy?Question

0sDzdsDP/Uv+jQOWq10iw/pxiNf0VqWAPLg/YBUEsgWTim4GLz/tziBd46vBKGxzU2g7DnB23JI59O3jRoAHfm/9racAz8PKvVfheTTywsJWqeHGUC3a4uAWBkp4X6Ogv2tC9AYwqwI/s0Fkuf2o7z5bfkAd7Kuq4xLBl5s3zNsvOC0EE52z6a6HVpLsqsdD/tgHqNV6VA2MMHMNLSnz9fM03AFjRBvVProb 5 4. Why does GDP accounting include only the final value of goods and services produced? What would be the problem if intermediate products were included?Question

6Cyt4mI3fU5bPvuI7KS63MrPa+oImSCUu5p5lAf/bHOq68uqRfpYITFpkGf6vJMuVhwHrlvuJq9emcj5Mg40xYqGr+IJo/RGQf17ROHF7bh5bV0c45uVQA==Prob 5 5. Describe why GDP can be computed using either expenditures or income.Question

ECRVfQSRpaaZbvUIfC2fBUz+r6FbkdWzxQpkk/tINLliLbqhHqLYoVuYnioI1/UDRGsu7wXVBGIBEfsAtXuJZ8zxUyZEgIAHfeByj3qMKi+5gaBIvX4LujVcBVPnb9MLYDe6s1W5jNOQF6K52n8KE9fdXH0wtfR4JisSKGzlgxcT614MUJvZGm0dTVg=Prob 5 6. What does GDP per capita measure? Why is it not a precise measure of a typical person’s standard of living in a country?

Apply the Concepts

Question

IRrKPdRX0j8rTPtgb2HiTj854uqJyoYhX/nrOnt98QfYfzPOm2jMNKVEA/VH/O7X2jd5Wynw1V1HQEaYZwguLmpaFXwqIcZq/pisRBCAbFbd85QgOaa+fdRfMBoURFoWTuJPY8dnWDYBAIy8Ywun930ZXKAeVRgERyLi6OtyPw8bmS9g96roJpkTufinVEJX6/lolIlA2A9xvzc604Z4cTB8ri+TeEO7T7t7WYoEAFhJVvzEhxLXJQHK0VffV5KKtK3wEDoUorp2k9Bbs67/SzLF/i8KmLaBProb 5 7. Explain how it is possible for an economy in the recovery phase of the business cycle to have a lower GDP and a higher unemployment rate than when it was in the recession phase of the business cycle.Question

Z95tZ8O+fm87rDAYwr/q7AN/60XNEmHq4AcaPp64cQ4Sc5w/785j2GNI4hpWT0W9zw4OHjiocmSox7yhhdpczeOkcHIOvtMC59igY6Kq7vS6o9qipN6vBIvQaLkSyNoN2jRGX8cOYYv4uHfAPmPNhFWVqIqsdW1o/y6q9AJ/3XeJHGUQYBwXeohyBxWOEzD7abxcTfdy80HEnBxtuvfqyZjMvLsymwa2tDJZUnVu4rv0Fv4asT2QU/dAvrsc02twHV6BecMUtqCC5+WtEHyqT/f8tGMvZy0923rujycnATdx/WC40qxXoZ/XvOyjN9qEbrths+rPa0axz0ru1vZANW472TrnSpg/k8/iHHoAGRE9IeYCq31sstuOFkoM9QX3el9/BUjob4dRg29CAJMIAEOMpd2M+uoH8O1wyBcxryDCoA9JGxbmQm1stQqqBeZnXqdgJMh+vb1viEh+IZZKhgPaal6zOIAvchNVjUiAnbyBKLSJDur89jb4BElxSozKfp4NUaZ1hg77nR2iHwzqZQbzwmLFRtqGMqLFMogWExk+RHeBNVYIq2DxUmFefHmO2ZxbcOyavWGoDRjJProb 5 8. Assume the federal government runs huge budget deficits today to finance, say, Social Security, Medicare, and other programs for the elderly, and finances these deficits by selling bonds, which raises interest rates. Because businesses often borrow money to invest, and interest is the cost of borrowing, these higher interest rates will reduce investment. Describe why this scenario is likely to be bad for the macroeconomy.Question

roooDh0SIRIOuTOg+9kzEwOMH8+1515n+LhUdOkrEsGZq4/X/1ZoTjNFilwocSvBpZE/en+HxFhfr8oBhKNV5QGa2QB1Q8IrDy+dafHOIWF8Jg5TG/nbxfSNA9lg9879agVWIAAAUM6WvL+MKRD70qVInf0QkaqhMOEQYDrjyImvIJByaHJoOAfpO7ROkBqLgCDKGyQm/fGBPDF29R8ZoLPz5elpcvGTuzxz899o5jeYXwGZfvNyjE/qBp+VCkkWBTRTjM7sS1dp69Txr2WkmBljDncOD2jIslEbIYo1iyNoXmUOFP7l8GLlC2/ynmHub66jfkxPNfGvuVFpqVLcbpjalTmxzl8bK+TF8D4pSZ64XSrQavSFQFudlEEN2b1SPq6fchUdxpMsHQyK0d5lzMaeoYGfeR8rR9yDqBYIXyMmb5GZrmctXPrejHCyCEsF9mWorHQGUXtMIE/63taY432Fm//fjkB592B5iZMpNxLFhO3vwF9m1Vyc5jXwX40ALAMCCLFbTx0+Z6XSHY1pxOnfIb+ujuRMM9a9Qj12lz0l3Whur7KSEd9z5ks=Prob 5 9. Critics argue that the NIPA are outdated and fail to account for “intangibles” in our new knowledge economy. For example, many firms create copyrighted materials (movies, books, etc.) that when completed are much more valuable than just the value of the marketplace inputs that went into their production. What might be some of the problems associated with trying to include these intangibles in the NIPA?Question

T+6GStlgQ2RklqSEPUz9UpcIFq8/VavlUbJM1g27aqwU3bmoUHLB9r9xNHemo8XL3lHH7mczJ8VcFngQh2RnVmVNj4cXhMR2dsg/7FL/KTGkrTlxRlKeL2g1lW0R6ySK95707LGKz3CpgaOj2RvikvNq5YoMsNHBt8Z5bJbsPF2dZtdC2HtaWl0qSefIYuUf21mE28seJGXXpxw350JuZfjjuhwcig+/Zw7UV24l+yN2JQx0u2elon0qxrVr8uKt8bvwtppaXq3lY7omh0N9tVWUYtM1lN36SMDkEC0eYLWlAE3x4RRqTwEskQCZ2UtCt7j0ddngjDOLZMJ1z1UGaegQcnIiEAYnTC/Go/do9aYYmIHMdvNAUz0y4+pCJ1yq7n/9OJrZGfkmKgaUProb 5 10. Gross domestic product and its related statistics are published quarterly and are often revised in the following quarter. Do you think quarterly publication and revision in the next quarter would present problems for policymakers trying to control the business cycle? Why or why not?Question

Yto1oHP+VHtEm7U4Kvj6XqqnDpno0SnYVAbY7DlNuKqrwMEFB8l+K7uuktWjaSnHJqDeFE1acyJyBTuLcGP7E2mLjo7BMcsYO6P0aGmsgMHQQKXFDmI1LwIiUvXqce+erUUlp7cHemiY9AibwpnMYFor3knzffFbvFjgOGANS8gQR+Rz9lWbPd0XciMQa3wlcpK+IIWA45jNynEXkAHkFGgJOfabGY7Ca0F7BfD4ErMwxwWbgaUFYAB5oUd+vtDZ5KGymekQYvVKBcrqSdBEIpH4UdjydkHGj12CAg2PNhL2bMIbjkXDqzLmftGTWX7RE56fFRSLQRUwYSfRsOJGpKwyrQPCkV9WaGL9KsjouLxf4GJ9Prob 5 11. Gross private domestic investment (GPDI) includes new residential construction as investment. Why is new housing included? Isn’t this just another consumer purchase of housing services? How would the sale of an existing house be treated in the GDP accounts?Question

Dz40ArP+/ciPP81grN5PNlHZBIWgie8B64ptnnqDbbCkTOPAJipX3jfyWSOvwkJ1tWM6LKifikpg7jXjzkxL4Mnwk9pUgBUhuzcBEpS5B8eRhHfwCpFx/JNO/+Vd0skE8c4jtZkLyNzB1Dr5B/1LO3KFlABHODUXFs2j9FtiF4TwNLrz8/bY6fM+0XrfXFIM1T10+BI1P8WjVJknxMed2puPDOPWM7RxAGRPMbrOngc4KHFGTfAhVzUdTdolVn8Sp0jhPzLsIaLR7IoLw01zTkbuBQr+o7DkDFjoYg+EDX0G0sy3gwFqsNe8+qC9dwLkvfi9QypumbB9VMqybRHT6Q==Prob 5 12. Assume that we are able to account for environmental degradation in the NIPA accurately. Rank the following countries by the percent reduction to their GDP (from least to most percentage reduction): the United States, China, and Norway.

125

In the News

Question

w7qFEP/dlqpLC0OjXVa1C7JRkSqiV3vIcUKhSBFlLafv7w/+8uVTgkS81KJ/ojZp9gdNTUWvPWzmRhI52MP1qqsu+EDrhOsMN8Zc4hwdWZVr/rRNgHXEiqxOJrTCTyXaeUUHvDMTi6rKbHDBJCLQlUoFC9NHX32ZezvM/FvTgUESk5t4ze8tRW7d5JQ1lDBPfhm20YBeSntxMdb6hLmmpjSj+0U+VMGJ5wKb4cTI0fo5tc5furOh1mgDYIh/TDmtVKxf9Gx/ED8A2SApcboX8nZOJyDejDtxOL7MWVUrgtzddnlRycUBShEgH9ZFev5SDuVosm5yM3iS91FNFmw42QV4bhHU7MeU2hjTrsatV4P8dUSx1JIgRKEB2yschqlurOhbhyzQ1WqawqybofH2bDeGnScku/ZZ3cACySIfnFpWN4EK8tDpNXzn3+VJVH5DbIWpec3K2vcDu9ZD3W4uzwMjtYKoXfS/r0WA1lGOjgGuB/5KPopvqWWgvwCRcGue5tWZoo2L+tK90hxgMIHWwa0AiZbM5zZq/dX2Q9+hkvzem81qProb 5 13. A headline in the January 27, 2012, USA Today read “Economists See Growth Slowing, Recession Risk Falling,” highlighting government statistics that showed economic growth slowing to a 2.2% rate for the year, below previous estimates. If economic growth is slowing, wouldn’t this suggest that another recession is likely to occur soon? Explain why the headline would suggest the opposite.Question

5UvdbPQ6sG/t8Zl/npHNXZY1ywpTynTkjLQuPixUktsMTcY4GeCS9PV7ZIu9YLZDayRstyhNmm6s9HM7ktc+n1aJu1Gnr3/7O+l9A4V0L0hVTj8jqGP8QPIBptXl31PQga1etL0psXAmPAfuzkSAY7LMmNs4xvtojSwIv9F6Rcea0ZVOITSpFqXNtCrMn6IFgXyGY5Trx1cLxcWytNo14Kw9JCXsmUHBA8m0W+oQJHwi35Aovi6w0zoh++G0upDLccRTaRoYzModDx3OetoECW8FrOSulaZQ71cVzwDm94qsj5vwAE/1FOCoRrucJAxI/2X1I2Ephxh5S98dXsxrpJZ9H42lNvJ4zghnA3QF3R3bTc1gACznNmONYkRDfOfx1rQrTZo7GbRn8QPTKhJwQ+yD4UVeptJJRiCNuUgbUIgGnmbD80AQI6fE9tSiws1uQuQHtYyqgcboShSsuulgfWHpAek/y8VhUfhC5O2ftxuOJrJSs32n+vn6NGyBMYsUzeUXrsxNFUGOAOS4KYiWDm0JL8+4FXY4iKBbtyOWNONlI1hkUAwPF/YTgZG5CWiCPBY78yLso4mu/I90BRpd88Xu084nztaLJEzRI70KzxL/mhXnNAzlzkXzI9rVEDOHl5E8tmQAk+nfR/HC0/2VWYiALz+7apZQUqMODYyAMrNXUZoCjSNKG9z13jBub3Kwb8r59PbHhffwQG1aipblCcoT/4Yv6WFgTau527nC3ZDHgEt8nrT4ATfMLNzwsz76geHE3ipSlShWvKZ4KLhnWu2qZcPGZ1Clk28m3QHGH/AOwaxP6fVkPqO91ao1W+AehopXoz3N4u5BBqOiCmLv0xP9/7PLLoFB557mRPsfmSMHuXek/jgfLgheGBLr9T6hfXjLo28Hkppz6VbNhTjdlp/fEoAEaOjAiDNStDSPsRnOQDQnfQJ2eA4r6evR/rs1eS6yFnSjdn9N4/HFbyK0C1aPvAD2hK87Nt+TpXyHVZT5l30PhWfwyZvCOL6Xp18PS/RIoA==Prob 5 14. According to the Happy Planet Index, an annual survey conducted by the New Economics Foundation, Costa Rica ranks as the happiest country on Earth (“Take a Trip to the Happiest Country on Earth,” Forbes, October 1, 2012). The index takes into account a number of factors including the quality of life and life expectancy, but most important the index values the sustainability of the environment, which it argues “establishes an undeniable link between happiness and the environment or nature.” The World Bank estimates that Costa Rica’s GDP per capita in 2012 was approximately $8,800, about one-fifth that of the United States. Explain why GDP per capita does not always correlate well with a country’s standard of living.

Solving Problems

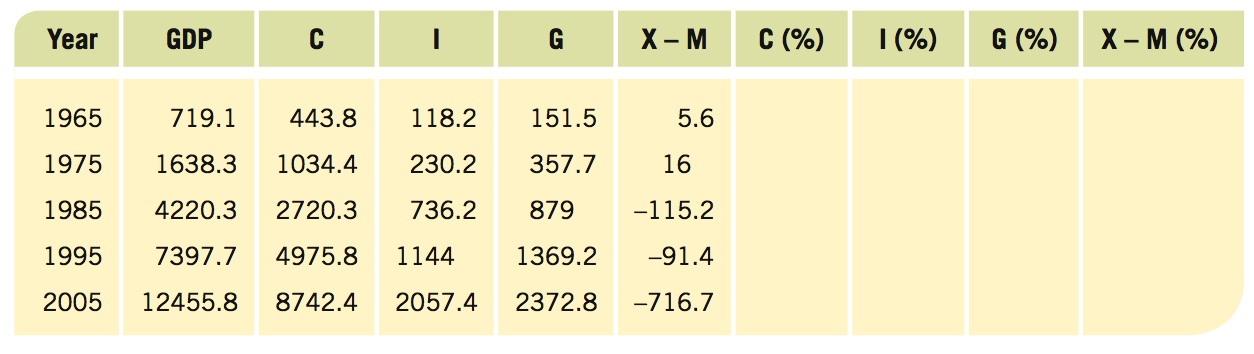

- The table below lists gross domestic product (GDP), consumption (C), gross private domestic investment (I), government spending (G), and net exports (X – M). Compute each as a percent of GDP for the five years presented.

Question

qXNZOkR0seN4ojbyBlvp8zk3IhgnC1v3DNijZdi8pkQ0PULcEg8T65LrhPQKWK3225carOIjeXfNt6g8pf5Re1caG0ck7fB14AK454I+YSZv5rwXP7SE/IK8nMVlWRWkcVFVg8wTBhwGeGv1WcgZRNCjLMKsZV4xTf8vjY35ds31sV5CC+VXrB48A/yriKxQ5mr90taO8mvis8OcNE3s453LeGGfQVvJsUX81WEKwN6LjoyDWZ0t+g==Prob 3 15a. Which component of GDP is the most stable? Look for the smallest change from the year with the smallest contribution to GDP to the year with the largest contribution.Question

Q1ijroBFGbysVy+NFDUQ5kHlglJyhB1Nc4co5LmqLa4lI4UG8wZ87gCTJmIB6UohyXDJQg6+vdg4exaXvsM2cg==Prob 3 15b. Which is the most volatile as a percent of GDP?Question

KryGF2BFfMQzRIWcrPja4Tog57ZBQwHGoUQiFRRYomDfhVJeK90srV8VpQqT/USftcE4Um6Sj8yiRvCA1+fNqmDj7dgKbPJv8rbljAXZu4Ot5g7bUvrttfS3ip+vMk5nvTO6Fi7eqx2D8o4nProb 3 15c. Ignoring net exports, which component has grown the fastest as a percent of GDP since 1965?

Question

2DCJPXk2tN3UOs3Fx+K6mJkGvT5Kv50VJxxGXmOFqzEvaSrAXtblhl+mNQRrvnmRsO62kRjBM84PM/NLQWHVbXhNDKkP+tcy/MyzAJvLu1YsREPTnY8iaotx2Q2ZCAtvtcFAdKlylp/tsHqKYt1bKpYRqyf8LjPa25qMJA9vLfrtUzwAzjJw2KdWpiQjKJVfArxmpolLbKJnhQRjnIRLvcaRJb9i9/mYo0uFNq0aSrzbJrgeqWrnTcPCxy2bB5IIPIJvmWHE+2cCbJq91p1KevzC+Q5OhWBawD1keRS9W309dI65M0DZNRIQGiEZS+OwK6bILhjIrxLVOjOzlCtXWMH9OUpFpHh/Df85xbxGonHW/jwHy2tV+kIypOc06Bld2G8fFxjU+R6JRst+61k52FcjUmViKNpBbCJwQi7cPy87hElZHj6Vz0G2KkNlfsox2QdK+zsKMCFp6q1sVVLzJYDvF8hEic+kDP8FRbFeMMPdqsI2HYVkB+k8ZjCbUTFl5sf5lGKS8NHxlBeuG2E+ta+2b7UagU7rjFM9E2GsCj1ejrulumeyBCNblhNiV1BVYj+Nn4SluYKit+I+mM50aFCLExoULTQAPiwEqRcUgz+FyNPS3xI8GR+jQsiVDWnAngD4k8GVsP2TqfxLnMcLQ6ZOwDHsAiXSAVlt/nLwnZo=Prob 5 16. Using the data below (given in millions of $U.S.), compute GDP, national income, and net domestic product.

126

Question

UWBuVEJSR2Vcoduf4uQRUW9IkAS2rIP8z+TupHNwfzCqGH+X9nGJ4OYB429kHsHs7VhK+NBIPwmQAaNaa3LQa9mPWsLL3vU9IQ6XzReXRrkdbYGiR+6fTnhE561dj+wrQ8H+ApjVhfINX17oRsTVASIRovYBhC2/L+YKvM552vDmXjjWS/BQd4OYdyNeigZvnr1qk+NVgCBa1dePdauL5w4SiUCCeaeEWAYsQJdv6/v6ILldooUcxTIFk8S04BP/KP7lfuGGRjJSmyXSsgdQ6kygGmIE+gl/0dVuIg9LnXDD//skProb 5 17. According to By the Numbers, in what year since 2005 was the difference between the unemployment rate and the real GDP growth rate the largest? What phase of the business cycle would this year best represent?Question

GnVxmGVKPW1Ye3JxQjlfV1TkZ9HRpt342VlxPk++CJabd8S2s45E8CR1Jzoez54fIHp2gAlUi1LigEghZOlaGZ5AebyST2zWhnjM4lXtidmFQ02Mwy5G5/7/oa3PQIlgoloa9oW1H/tkF5crR6ssmCwWqCbDcWGBg+GqhzMT7F3VmUOu6PEkrYrgdHvCZc7bRJuQLGTdFPzowEkZOramRaVyEuAylyW2Kt49Vw==Prob 5 18. According to By the Numbers, has the personal savings rate trended upward or downward during the last five economic recessions? Why does this trend occur?