Chapter Introduction

189

190

After studying this chapter you should be able to:

- Name the primary market structures and describe their characteristics.

- Define a perfectly competitive market and the assumptions that underlie it.

- Distinguish the differences between perfectly competitive markets in the short run and the long run.

- Analyze the conditions for profit maximization, loss minimization, and plant shutdown for a firm.

- Derive the firm’s short-run supply curve.

- Use the short-run competitive model to determine long-run equilibrium.

- Describe why competition is in the public interest.

Visit your local farmer’s market on a weekend morning, and you’ll find dozens of individual stands offering the freshest fruits and vegetables, many of which are grown locally and delivered to the market directly by the grower. As you meander through the market you notice that the prices for any one type of fruit or vegetable are virtually the same from one stand to another. Further, the prices at the farmer’s market often aren’t much different from those that you might find in your grocery store’s produce section.

With prices being nearly identical, shoppers are then left with the challenge of selecting the fruits and vegetables that look, feel, smell—and sometimes taste, if samples are available—the best, which for a food connoisseur is one of the pleasures of visiting a farmer’s market. The rest of us, who do not have the skill to select the juiciest watermelon or peach, are often left to rely on our instincts. Even so, the difference in quality of the fruit across the various sellers is likely to be so small (because all are grown in the same area with the same climate) that typically one need not worry about making a bad choice.

This is the essence of a purely competitive market—the quality of a product is mostly indistinguishable, and hence the prices tend to be the same across sellers. In fact, each individual seller, being just one among thousands of sellers of fruit and vegetables, has little control over prices, another characteristic of a highly competitive market which forces sellers to be efficient. It’s an example of the classic “survival of the fittest” problem—either produce high-quality produce at the lowest prices, or be sent packing.

The nature of intense competition extends well beyond farming, of course. Much of the goods we consume each day are produced in massive factories, often in Asia, where thousands of workers toil diligently in an often dreary environment to provide what we desire at the lowest cost. Before we debate the merits of whether this is good or bad for the factory workers, let’s look at why many companies are using this form of production to stay competitive.

A firm’s production function describes the manner in which inputs (resources such as labor and capital) are turned into outputs (goods). Since the cost of a set amount of inputs is fixed, being able to manufacture more with those inputs reduces the cost of production and increases productivity.

How does a firm increase productivity? First, it can hire better workers or offer training to make each worker more productive. Second, it can utilize better machinery (capital). And third, it can design the factory in a way to maximize the production given the workers and capital available. Choosing the production method by which inputs such as labor and capital are used is critical to productivity and the success of a firm. This is the role of the manager. If a firm uses inputs inefficiently, more efficient firms will drive it out of business.

The goal of any firm is to maximize profits given the market structure in which it exists. This is easier in some markets than in others. For example, if a company is the industry leader and has few competitors, earning profits is easier than it is for a struggling company facing intense competition.

This chapter focuses on market structure and the purest form of competition, which we call perfect competition. We explore some of the implications competition has for markets and consider why the competitive market structure is so central to the thinking of economists. When Adam Smith wrote his classic book, The Wealth of Nations, he wrote of a “hidden hand” that guides businesses in their pursuit of self-interest, or profits, allowing only the efficient to survive. Some observers have noted similarities between Smith’s work, written in 1776, and Charles Darwin’s Origin of Species, published in 1872. The late biologist and zoologist Stephen Jay Gould commented that “the theory of natural selection is, in essence, Adam Smith’s economics transferred to nature.”1 Clearly, the notions of competition and the competitive market have played a prominent role in the history of ideas.

In this and the next two chapters, keep in mind the profitability equation developed in the previous chapter. Profits equal total revenues minus total costs. Total revenues equal price times quantity sold. Keep in mind the three items that determine profitability: price, quantity, and cost. We will see how firms try to control each one of these. What you learn in this chapter will give you a benchmark to use when we consider the other market structures in the following chapters.

191

Perfect Competition and Efficiency

Cost efficiency plays an important role in the survival of firms in perfectly competitive industries. Because each firm represents just one of many firms in the market, the actions of one firm do not affect any other firm.

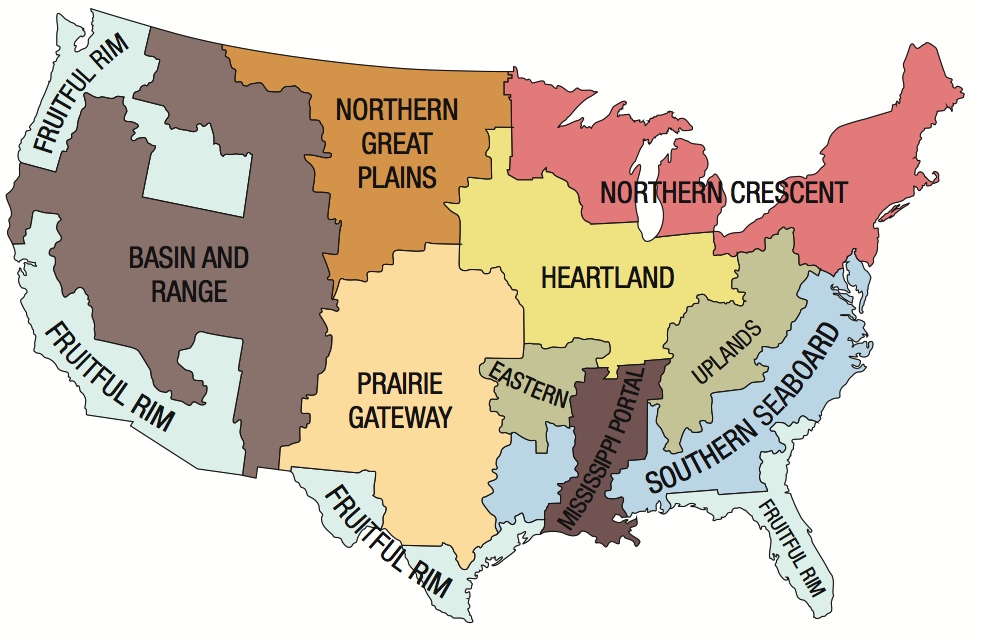

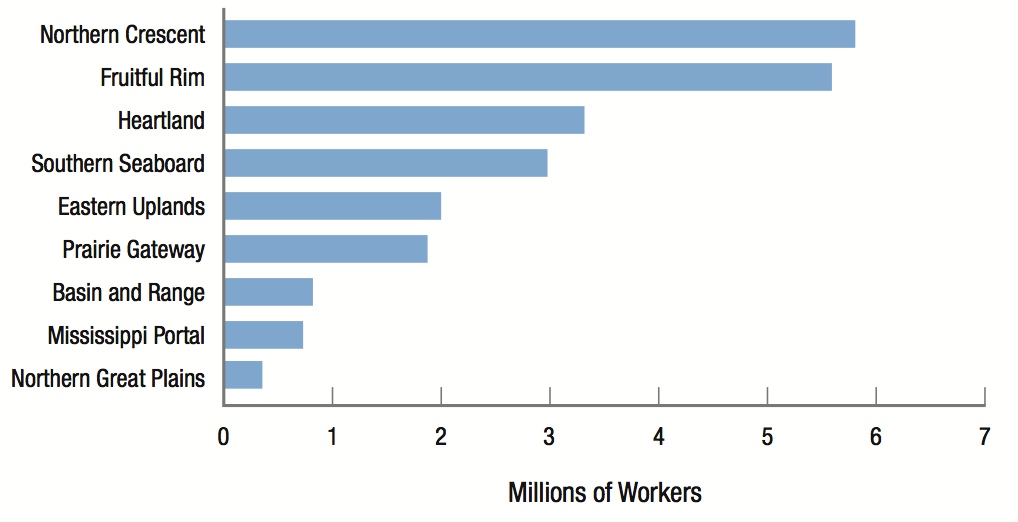

The United States Department of Agriculture divides the nation into regions for agricultural economic analysis. The number of farm workers varies significantly by region.

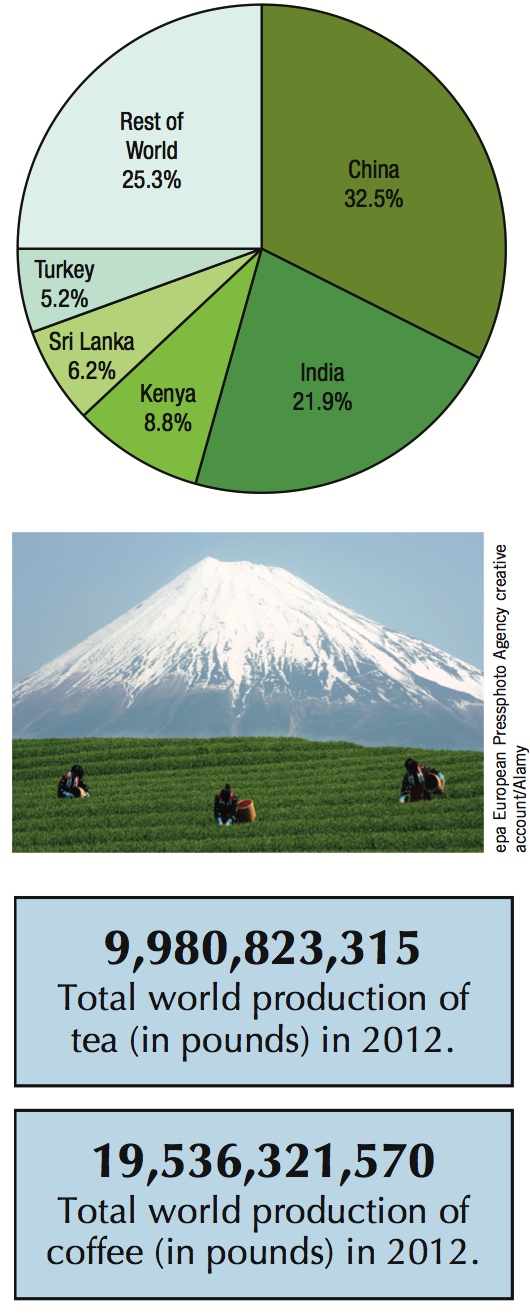

The world's top tea producers

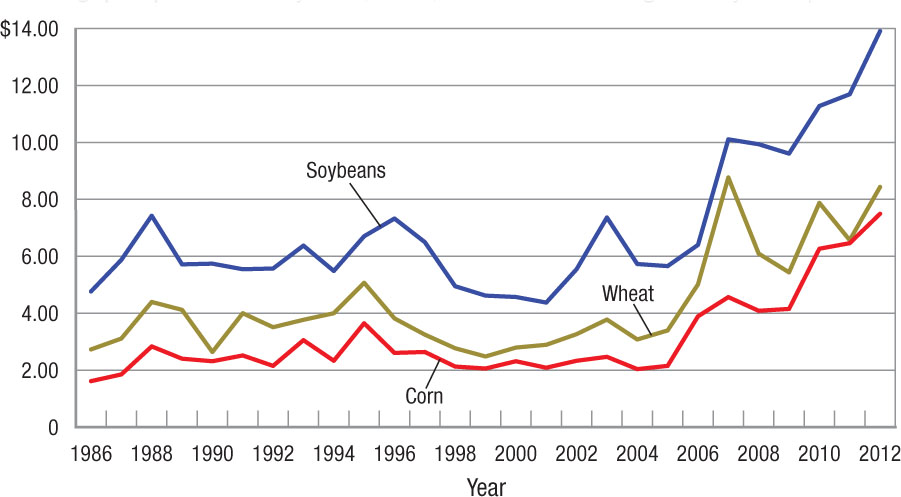

The average price per bushel of soybeans, wheat, and corn increased significantly in the past decade.

The legalization of marijuana in certain states has dramatically increased the number of growers in a highly competitive market, despite risk of federal prosecution.

192