613

Banks and the Federal Reserve

Banks create money by accepting deposits and making loans. This process is aided by the Federal Reserve, which influences interest rates and sets reserve requirements for member banks.

Nikita Waller/Shutterstock

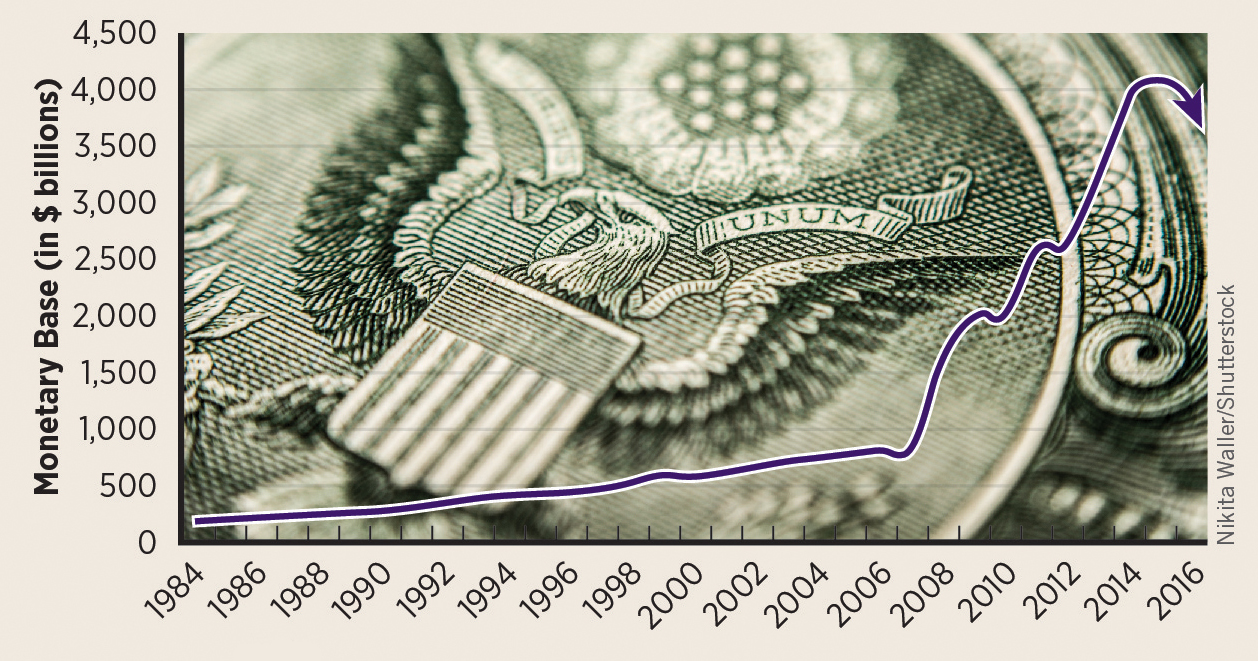

The monetary base is the sum of all currency in circulation and reserves held by banks. It grew steadily until the recent financial crisis, when aggressive action by the Federal Reserve caused the monetary base to skyrocket.

Robert Giroux/Getty Images

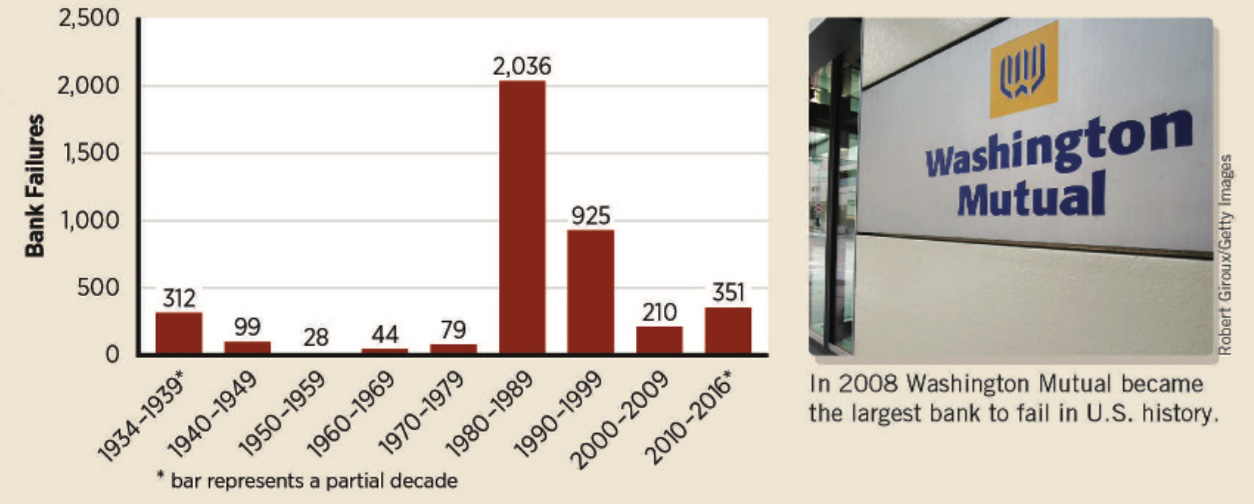

Bank failures were a major problem during the Great Depression in the 1930s, during the savings and loan crisis of the 1980s, and again during the most recent financial crisis. In fact, more banks failed in 2010 and 2011 than during the 40-

Zhang Jun/Corbis

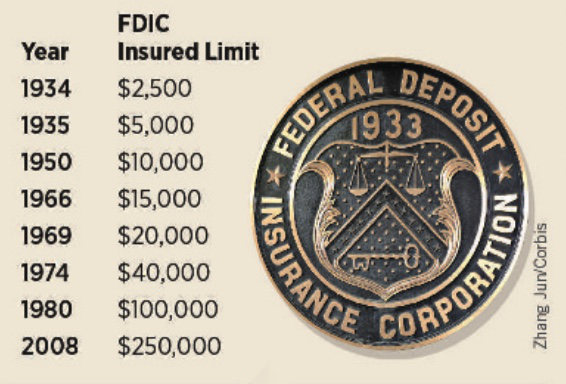

Individual bank accounts are protected against bank failure by the Federal Deposit insurance Corporation (FDIC). No FDIC insured deposit has ever been lost in its history.

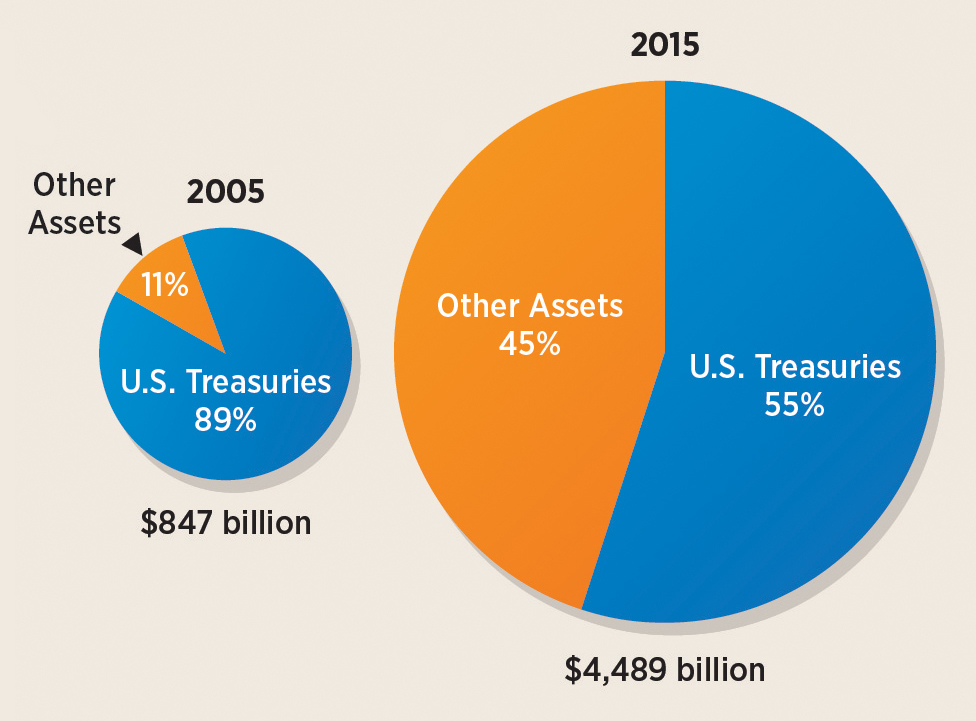

The Federal Reserve intervened heavily during the 2008 financial crisis by increasing its purchases of underperforming assets from struggling banks. By doing so, the Fed altered its balance sheet in both its overall size and composition of assets.