ELASTICITY OF SUPPLY

So far, we have looked at the consumer when we studied the elasticity of demand. Now let us turn our attention to the producer, and analyze elasticity of supply.

price elasticity of supply A measure of the responsiveness of quantity supplied to changes in price. Elastic supply has elasticity greater than 1, whereas inelastic supply has elasticity less than 1. Time is the most important determinant of the elasticity of supply.

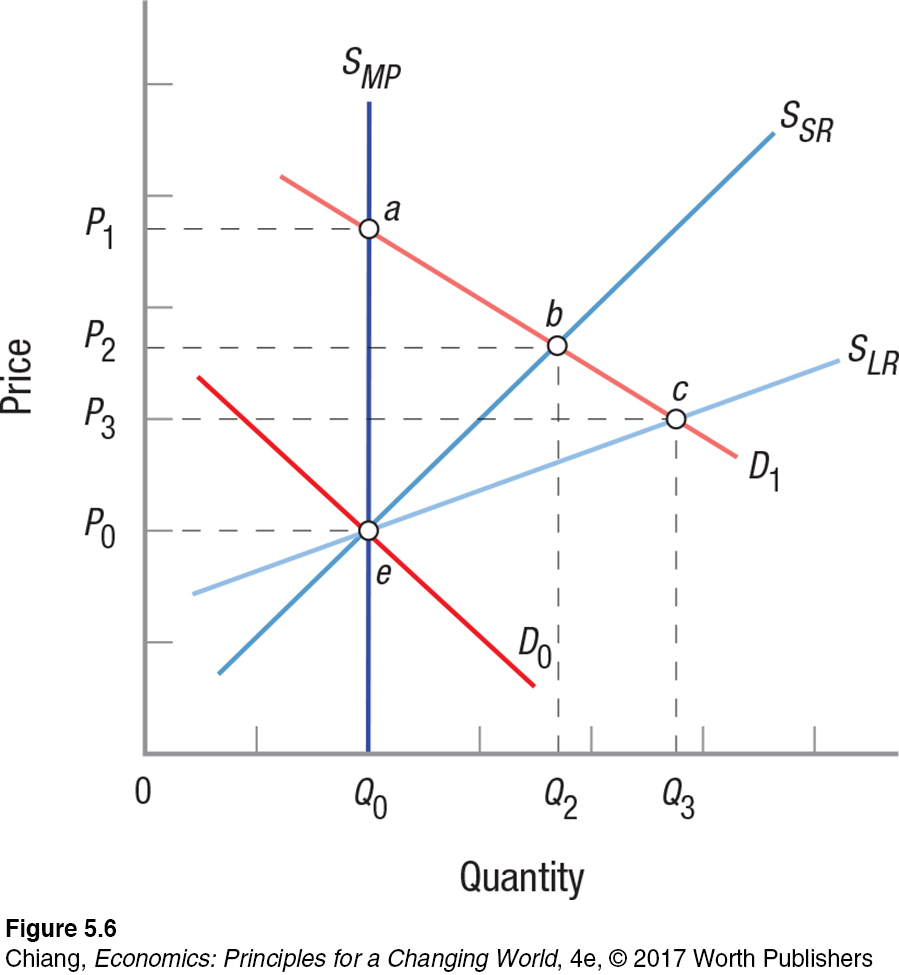

Price elasticity of supply (Es) measures the responsiveness of quantity supplied to changes in the price of the product. Price elasticity of supply is defined as

Note that because the slope of the supply curve is positive, the price elasticity of supply will always be a positive number. Economists classify price elasticity of supply in the same way that they classify price elasticity of demand. Classification is based on whether the percentage change in quantity supplied is greater than, less than, or equal to the percentage change in price. When price rises just a little and quantity increases by much more, supply is elastic, and vice versa. The output of many commodities such as gold and seasonal vegetables cannot be quickly increased if their price increases, so they are inelastic. In summary,

elastic supply Price elasticity of supply is greater than 1. The percentage change in quantity supplied is greater than the percentage change in price.

elastic supply: Es > 1

inelastic supply Price elasticity of supply is less than 1. The percentage change in quantity supplied is less than the percentage change in price.

Inelastic supply: Es < 1

unitary elastic supply Price elasticity of supply is equal to 1. The percentage change in quantity supplied is equal to the percentage change in price.

Unitary elastic supply: Es = 1

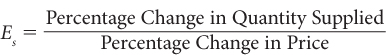

Looking at the three supply curves in Figure 5, we can easily determine which curve is inelastic, which is elastic, and which is unitary elastic. First, note that all three curves go through point a. As we increase the price from P0 to P1, we see that the response in quantity supplied is different for all three curves. Consider supply curve S1 first. When price changes to P1 (point b), the change in output (Q0 to Q1) is the smallest for the three curves. Most important, the percentage change in quantity supplied is smaller than the percentage change in price; therefore, S1 is an inelastic supply curve.

Contrast this with S3. In this case, when price rises to P1 (point d), output climbs from Q0 all the way to Q3. Because the percentage change in output is larger than the percentage change in price, S3 is elastic. And finally, curve S2 is a unitary elastic curve because the percentage change in output is the same as the percentage change in price.

120

Here is a simple rule of thumb. When the supply curve is linear, like those shown in Figure 5, you can always determine if the supply curve is elastic, inelastic, or unitary elastic by extending the curve to the axis and applying the following rules:

Elastic supply curves always cross the price axis, as does curve S3.

Inelastic supply curves always cross the quantity axis, as does curve S1.

Unitary elastic supply curves always cross through the origin, as does curve S2.

Time and Price Elasticity of Supply

The primary determinant of price elasticity of supply is time. To adjust output in response to changes in market prices, firms require time. Firms have both variable inputs, such as labor, and fixed inputs, such as plant capacity. To increase their labor force, firms must recruit, interview, and hire more workers. This can take as little time as a few hours—

market period The time period so short that the output and the number of firms are fixed. Agricultural products at harvest time face market periods. Products that unexpectedly become instant hits face market periods (there is a lag between when the firm realizes it has a hit on its hands and when inventory can be replaced).

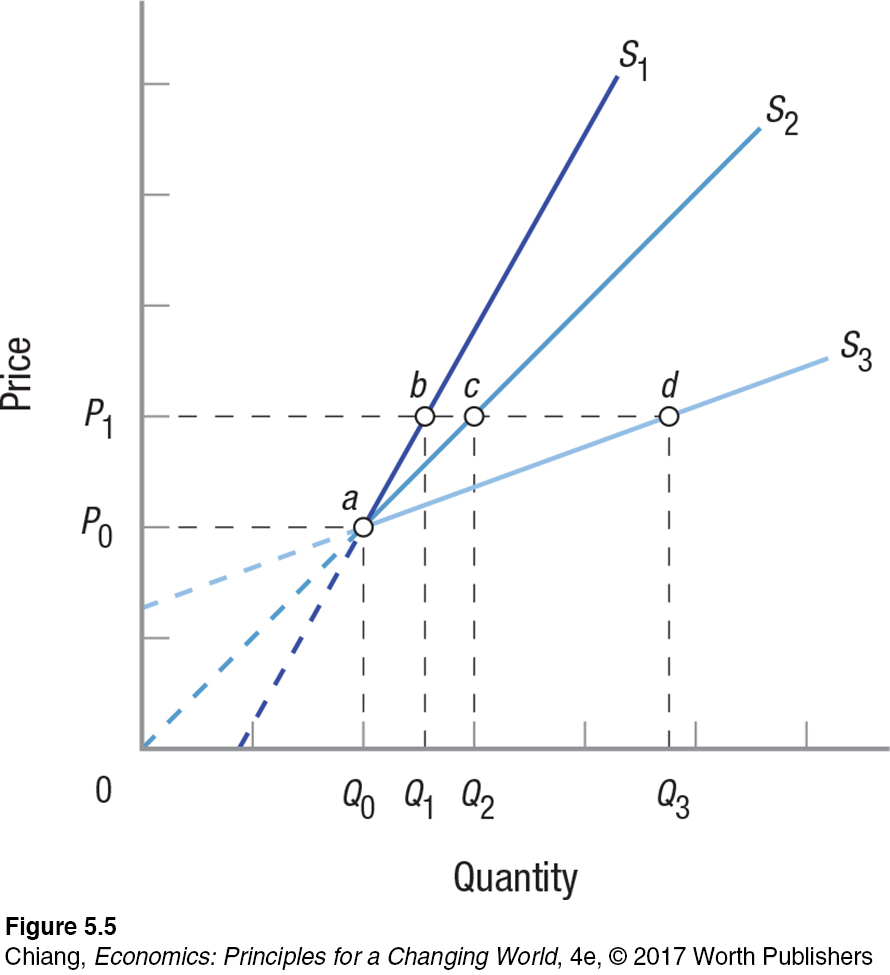

The Market Period The market period is so short that the output and the number of firms in an industry are fixed; firms have no time to change their production levels in response to changes in product price. Consider a raspberry market in the summer. Even if consumers flock to the market, their tastes having shifted in favor of fresh raspberries, farmers can do little to increase the supply of raspberries until two years later. Figure 6 shows a market period supply curve (SMP) for agricultural products such as raspberries. During the market period, the quantity of product available to the market is fixed at Q0. If demand changes (shifting from D0 to D1), the only impact is on the price of the product. In Figure 6, price moves from P0 (point e) to P1 (point a). In summary, if demand grows over the market period, price will rise, and vice versa.

121

Changes in demand over the market period can be devastating for firms selling perishable goods. If demand falls, cantaloupes cannot be kept until demand grows; they must either be sold at a discount or trashed.

short run The time period when plant capacity and the number of firms in the industry cannot change. Firms can employ more people, have existing employees work overtime, or hire part-

The Short Run The short run is defined as a period of time during which plant capacity and the number of firms in the industry cannot change. Firms can, however, change the amount of labor, raw materials, and other variable inputs they employ in the short run to adjust their output to changes in the market. Note that the short run does not imply a specific number of weeks, months, or years. It simply means a period short enough that firms cannot adjust their plant capacity, but long enough for them to hire more labor to increase their production. A restaurant with an outdoor seating area can hire additional staff and open this area in a relatively short timeframe when the weather gets warm, but manufacturing firms usually need more time to hire and train new people for their production lines. Clearly, the time associated with the short run differs depending on the industry.

This also is illustrated in Figure 6. The short-

long run The time period long enough for firms to alter their plant capacities and for the number of firms in the industry to change. Existing firms can expand or build new plants, or firms can enter or exit the industry.

The Long Run Economists define the long run as a period of time long enough for firms to alter their plant capacity and for the number of firms in the industry to change. In the long run, some firms may decide to leave the industry if they think the market will be unfavorable. Alternatively, new firms may enter the market, or existing firms can alter their production capacity. Because all these conceivable changes are possible in the long run, the long-

In giving the long-

122

Some industries may not face added costs as they expand. Fast-

At this point, we have seen how elasticity measures the responsiveness of demand to a change in price and how total revenue is affected by different demand elasticities. We have also seen that supply elasticities are mainly a function of the time needed to adjust to price changes. Next, let’s apply our findings about elasticity to a subject that concerns all of us: taxes.

CHECKPOINT

ELASTICITY OF SUPPLY

Elasticity of supply measures the responsiveness of quantity supplied to changes in price.

Elastic supply is very responsive to price changes. With inelastic supply, quantity supplied is not very responsive to changing prices.

Supply is highly inelastic in the market period, but can expand (become more elastic) in the short run because firms can hire additional resources to raise output levels.

In the long run, supply is relatively elastic because firms can enter or exit the industry, and existing firms can expand their plant capacity.

QUESTION: A number of products are made in preparation for the annual flu season, although the types of goods vary in terms of their elasticity of supply. Rank the following goods from most elastic to least elastic: (a) over-

Answers to the Checkpoint questions can be found at the end of this chapter.

Although these rankings can be subjective, the most likely rank from most elastic to least elastic is: chicken soup, boxes of tissue, over-