QUESTIONS AND PROBLEMS

Check Your Understanding

Question 9.1

1. Are McDonald’s and Starbucks monopolies? Why or why not?

Question 9.2

2. Explain why MR < P for the monopolist, but MR = P for perfectly competitive firms.

Question 9.3

3. What do economists mean when they call monopolies inefficient? What is the deadweight loss of monopoly?

Question 9.4

4. Why are monopoly firms able to earn long-

Question 9.5

5. Under what market conditions would a firm find it easier to engage in price discrimination?

Question 9.6

6. What is a natural monopoly and why is such a monopoly often regulated by government?

Apply the Concepts

Question 9.7

7. How important is the existence of a significant barrier to entry to maintaining a monopoly? What would be the result if a monopoly market could easily be entered? Why might a monopoly in a high-

Question 9.8

8. One can typically find a high-

Question 9.9

9. The taxi industry in many large cities spends millions of dollars lobbying local policymakers not to build rail links connecting airports to the city center, even if such mass transportation infrastructure would benefit many consumers traveling to and from the airport. Explain why such actions by the taxi industry are taken. Then, explain why taxi owners in cities without airport rail links are less likely to invest in fuel-

Question 9.10

10. If the Miami Heat can sell five courtside seats for $2,000 each or six courtside seats if it reduces the price to $1,600 each, what is the marginal revenue of the sixth seat? Should the owner make this sixth seat available? If all six seats can be sold for $1,800 each, would this make the sixth seat worth selling? (Hint: What costs are involved with selling the sixth seat?)

246

Question 9.11

11. Sally owns the only cake shop in town (she is a monopolist). At a quantity of five, the marginal cost of producing one more cake is $12, while the marginal revenue from selling one more cake is $10. In order for Sally to maximize profits, should she increase or decrease output? Should she increase or decrease prices? Explain.

Question 9.12

12. Airlines that compete against one another have at times merged with each other to create a larger airline. What are some factors that would determine whether such a merger would constitute an uncompetitive environment according to antitrust law?

In the News

Question 9.13

13. In December 2014 United Airlines and Orbitz Travel sued a 22-

Question 9.14

14. In November 2015 Marriott Hotels announced that it would acquire its rival, Starwood Hotels, creating the world’s largest hotel chain. Look at each hotel chain’s Web site and list all of the specific hotel brands operated by Marriott and Starwood that would now be managed by this merged company. Given that so many hotel brands are involved, why would this merger be allowed? Wouldn’t it create a near monopoly in the hotel market? What other types of lodging compete against hotels?

Solving Problems

WORK IT OUT  | interactive activity

| interactive activity

Question 9.15

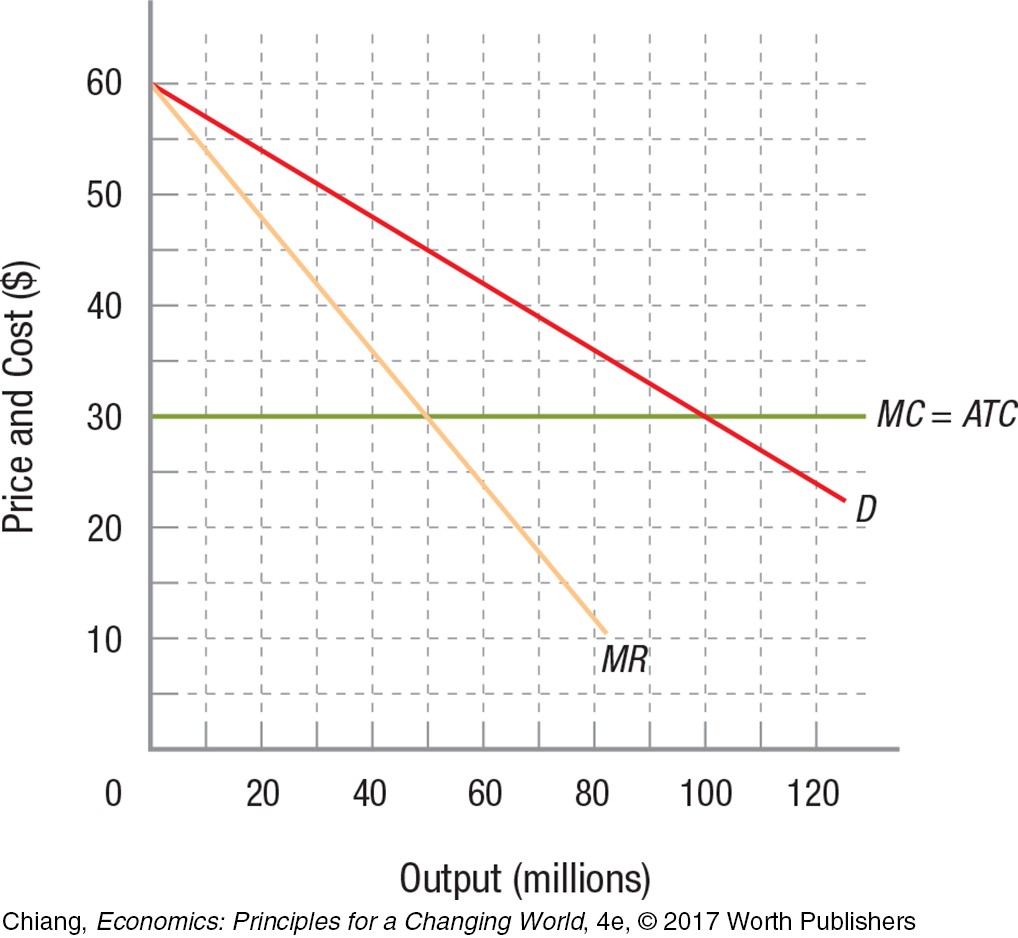

15. Using the accompanying figure for a monopoly firm, answer the following questions.

What will be the monopoly price, output, and profit for this firm?

If this monopolist could perfectly price discriminate, what would profit equal?

If this industry were competitive, what would be the price, output, and profit?

How large (in dollars) is the deadweight loss from this monopolist?

247

Question 9.16

16. The following table represents the sales figures for the eight largest firms in the auto industry in the United States in 2014:

| Company | Sales (billions of dollars) |

| General Motors | 84.1 |

| Ford | 67.0 |

| Toyota | 66.1 |

| Fiat Chrysler | 59.2 |

| Honda | 42.0 |

| Nissan | 35.9 |

| Hyundai | 33.7 |

| Volkswagen | 17.6 |

| Total | 405.6 |

Compute the four-

firm concentration ratio for the industry. Compute the HHI for the industry (assuming the industry contains just these eight firms).

Assuming the industry is represented by these eight firms, if Ford and Toyota wanted to merge, and you were the head of the Department of Justice, would you permit the merger? Why or why not? (Hint: Calculate the new values from parts a and b assuming the merger takes place.) How about if Nissan and Hyundai wanted to merge?

USING THE NUMBERS

USING THE NUMBERS

Question 9.17

17. According to By the Numbers, assuming that the number of viewers for each of the five games in the 2015 NBA Finals were the same, approximately how many more people watched the 2015 Super Bowl than the final game of the 2015 NBA Finals?

Question 9.18

18. According to By the Numbers, the annual growth in demand for electricity has fallen over the past half-