A Price Is a Signal Wrapped Up in an Incentive

How is order produced from freedom of choice? That is a scientific mystery, and prices are the biggest clue to the solution. Prices do much more than tell people how much they must shell out for a burger and fries. Prices are incentives, prices are signals, prices are predictions. To understand the market, you need to better understand prices.

When the price of oil rises, all users of oil are encouraged to economize—perhaps by simply using less but also by thinking about substitutes: everything from electric cars to moving flower cultivation overseas. An increase in the price of oil is also a signal to suppliers to invest more in exploration, to look for alternatives like ethanol, and to increase recycling. Do you know the most recycled product in America? It’s asphalt.9

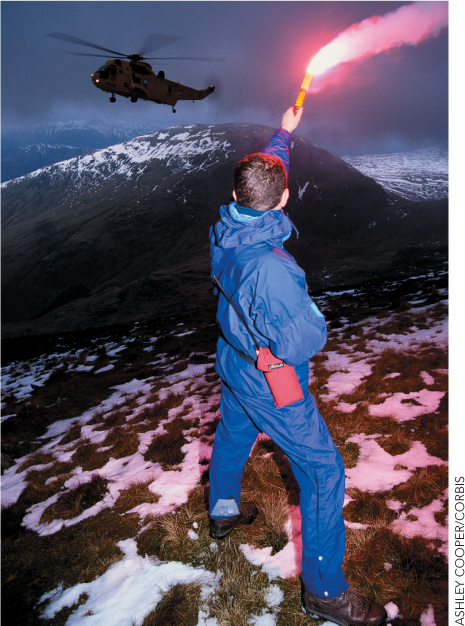

Politicians and consumers sometime fail to understand the signaling role of prices. After a hurricane, the prices of ice, generators, and chainsaws often skyrocket. Consumers complain of price gouging, and politicians call for price controls. That’s understandable, because it can seem doubly harsh to be hit by a hurricane and high prices. But the price system is just doing its job. A sky rocketing price is like a flare being shot into the night sky that shouts—bring ice here! A price control eliminates the signal to bring ice into the devastated area as quickly as possible.

121

CHECK YOURSELF

Question 7.5

Imagine that whenever the supply of oil rose or fell, the government sent text messages to every user of oil asking them to use more or less oil as the case warranted. Suppose that the messaging system worked very well. Is such a messaging system likely to allocate resources as well as prices? Why or why not? What is the difference between the message system and the price system?

Imagine that whenever the supply of oil rose or fell, the government sent text messages to every user of oil asking them to use more or less oil as the case warranted. Suppose that the messaging system worked very well. Is such a messaging system likely to allocate resources as well as prices? Why or why not? What is the difference between the message system and the price system?

Question 7.6

Firms in the old Soviet Union never went bankrupt. How do you think this influenced the rate of innovation and economic growth?

Firms in the old Soviet Union never went bankrupt. How do you think this influenced the rate of innovation and economic growth?

The high price of ice in a hurricane-devastated area signals a profit opportunity for ice suppliers. Buy ice where the price is low and deliver it to where the price is high. As the supply of ice in the hurricane-devastated area increases, the price will fall. More generally, price signals and the accompanying profits and losses tell entrepreneurs what areas of the economy consumers want expanded and what areas they want contracted. If consumers want more computers, prices and profits in the computer industry will increase and the industry will expand.

Losses may be an even more important signal than profits. Entrepreneurs who fail to compete with lower costs and better products take losses and their businesses contract or even go bankrupt. Bankruptcy is bad for a business but can be good for capitalism. Ever heard of Smith Corona, Polaroid, Pan Am, or Hechingers? At one point, each of these companies led its industry, but today all are either bankrupt or much smaller than at their peak. In a free market, no firm is so powerful that it does not daily face the market test. As a result, in a successful economy there will be many unsuccessful firms.