Prediction Markets

A prediction market is a speculative market designed so that prices can be interpreted as probabilities and used to make predictions.

If markets are good at predicting the future even though they evolved to do something else, imagine how useful they might be if they were designed to predict. Beginning in the late 1980s, economic engineers began to design prediction markets, speculative markets designed so that prices can be interpreted as probabilities and used to make predictions.11

The best known prediction market is the Iowa Electronic Markets. The Iowa market lets traders use real money to buy and sell “shares” of political candidates. During the 2008 election, for example, traders on the Iowa Electronic Markets could buy shares in John McCain and Barack Obama. A share in Barack Obama, for example, would pay $1 if Barack Obama won the election and nothing otherwise. Suppose that the market price of an Obama share is 75 cents. What does this market price suggest about the probability of Barack Obama winning the election?

To answer this question, think about each share as a bit like a lottery ticket. The ticket pays $1 if Obama wins and nothing if he loses. How much would you be willing to pay for this lottery ticket if Obama has a 20% chance of winning? How much would you be willing to pay for this lottery ticket if Obama has a 75% chance of winning? If Obama has a 20% chance of winning, then a lottery ticket that pays $1 if he wins, and nothing otherwise, is worth about 20 cents on average (0.2 × $1). If Obama has a 75% chance of winning, then the lottery ticket is worth about 75 cents (0.75 × $1). Thus, working backward, if we see that people are willing to pay 75 cents for an Obama lottery ticket, we can infer that they think that Obama has about a 75% probability of winning the election. In this way, we can use market prices to predict elections!

The Iowa markets correctly predicted the Obama win in 2008 and they were very close about Obama’s vote share as well. The future can never be predicted perfectly, but in some 20 years of predicting U.S. and foreign elections, primaries, and other political events, the Iowa markets have proven to be more accurate than alternative institutions such as polls.12 In tight elections, professional bond traders—who often have millions of dollars riding on postelection economic policies—monitor the Iowa markets for clues about future events.

126

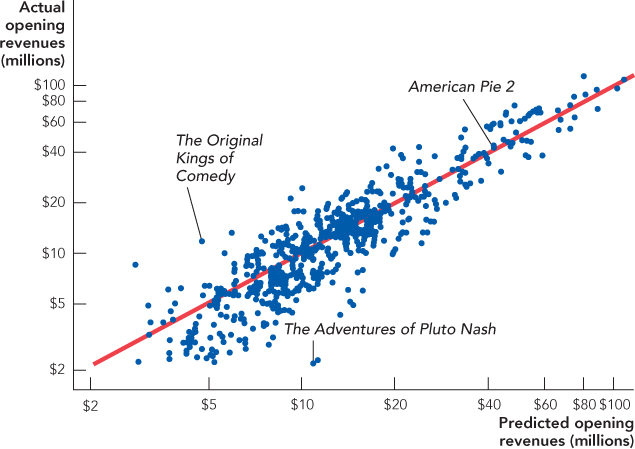

The Hollywood Stock Exchange (http://www.HSX.com) is also proving that the innovative use of markets can be profitable. The Hollywood Exchange lets traders buy and sell shares and options in movies, music, and Oscar contenders. Trading on the Hollywood Exchange is conducted in make-believe “Hollywood Dollars,” but the goal of the HSX—which is owned by a subsidiary of the Wall Street firm Cantor Fitzgerald—is profit. Some 800,000 people trading on HSX for fun have proven that HSX prices are reliable predictors of future film profits. Figure 7.3 graphs market predictions of opening revenues on the x-axis against actual opening revenues on the vertical axis. If all predictions were perfect, then predicted revenues would be exactly equal to actual revenues and all the observations would lie on the 45-degree red line. No one can predict the future perfectly, of course. Movies above the red line did better than predicted and movies below the red line did worse than predicted. The market predicted that The Adventures of Pluto Nash, a 2002 movie starring Eddie Murphy, would take in opening weekend revenues of over $10 million. In fact, The Adventures was the biggest financial bomb of all time with costs of $100 million and revenues of $4.41 million, just over half of that generated on the opening weekend before word of mouth sent it straight to the reject pile. Director Spike Lee’s The Original Kings of Comedy, however, was an unexpected hit with actual opening revenues of nearly $12 million compared to predicted revenues of just $4.7 million. Although market predictions are sometimes a little high and sometimes a little low, they are centered around the 45-degree line, which means that they are correct on average. The market, for example, predicted that American Pie 2 would have opening revenues of $45.1 million and actual revenues were $45.3 million. Perhaps the biggest sign of the accuracy of the HSX market is that HSX sells its data to Hollywood studios eager to improve their predictions about future blockbusters.

127

The use of prediction markets is expanding rapidly, but what’s important for our purposes is that prediction markets help to illustrate how all markets work. Market prices are signals that convey valuable information. Buyers and sellers have an incentive to pay attention to and respond to prices and in so doing they direct resources to their highest-value uses. That means everyone can make the most out of limited resources.